Marketing Issue

Australian company manufacturing alcoholic products seeks to enter the Ireland market.

Ireland

Ireland got its independence in 1921 after a great struggle and was followed by a brief civil war, which ended in 1923. It established its constitution in 1937 and was declared a republic in 1949. It joined the European Economic Community (EEC, now the EU) in 1973. The monetary policy of the country is determined by the European Central bank whereas the fiscal policy is determined by the domestic government. Currently, the microeconomic environment remains pro-business (The Economist, 2007). The economic policy of Ireland revolves around keeping Ireland an attractive destination for FDI. However, there needs to be more improvement in public services such as transport and health. The basic statistical data for Ireland is seen in the following table:

Table 1. Statistical data for Ireland.

Foreign Trade in Ireland

Ireland is a small country, that holds a great deal of potential for exporters from developed countries like the US. Since the mid-1990’s, the CelticTiger’s economy has boomed. The availability of a highly educated workforce along with strong government fiscal policy has attracted good foreign direct investment. Transportation and other infrastructure are good in Ireland. There are now over 550 U.S. companies with branches in Ireland (Hanley, 2001). Consumer demand for more diverse, quality foods from overseas markets has resulted in niche market opportunities for exporters from the United States and else-where, according to Thomas Hamby, U.S. Minister Counselor for Agricultural Affairs at the American Embassy in London (Hanley, 2001).

Ireland has traditionally been a liberal country when it came to consumption of alcoholic drinks and people often met at the pub. More recently, the consumption of alchol by adults is declining. One of the major threats to the alcoholic drinks industry in Ireland is the increase in the number of coffee shops on the high street. These coffee shops are positioned as meeting points and as places to relax in and hence compete with the alcoholic drinks market (The Economist, 2007).

In 2006 merchandise exports amounted to US$104.7bn and imports to US$72.8bn. Thus Ireland has a big trade surplus. Despite the large trade surplus, the current account registered a deficit of US$9.1bn, or 4.2% of GDP, reflecting the large deficits on the services and income account (The Economist, 2007). As a member of the European Union, Ireland it does not have authority to negotiate directly with non-EU countries. The export- import data for Ireland are as follows:

The above trade data shows that Ireland is interested in importing products from developed countries such as UK, US and Germany.

EU Common Commercial Policy

Ireland’s international trade policies are based on the evolving EU Common Commercial Policy (CCP). The EU negotiates as a single entity at the World Trade Organisation and the EU Common Commercial Policy Section represents Ireland’s interests at other EU trade committees, including those dealing with Anti-Dumping measures, the Generalised System of Preferences (GSP) for developing countries, Commodity Agreements and Rules of Origin.

However, every country in the European Union (EU) has its own laws and other policies.

In Ireland, according to 2006 reports, the beverages’ sector, soft drinks, wines and spirits notably, pursue their 2005 upward trend with high growth rates (CIAA, 2006). Higher on-trade prices and stricter legislation drive the ‘cocooning’ trend. It has been found that wine is especially popular in Ireland whereas Eastern European immigrants have increased the demand for vodka products in Ireland. The culture in Ireland for the present is that younger consumers are choosing to experiment.

Global Alcoholic Drinks Industry

There are a lot of changes in the global alcoholic drinks market which is causing transformations in the way alcoholic products are developed, produced and marketed. The consumers today are well informed regarding quality choose to purchase better quality products while at the same time, they are moderate in consumption due to growing health concerns. But, changes in demographics are also opening up new markets for alcoholic drinks manufacturers. It is significant to note that the greatest share of new alcoholic products were introduced in Europe in 2006. This is mainly because of developments in the wine category. New kinds of wines were introduced so much so the wine category occupied a share of 58% of all new product introductions in Europe (Business Wire, 2007). The popularity of wine is due to the fact that people considered it beneficial to health.

Some important facts unearthed by Research and Markets are:

- The value of the European and US alcoholic drinks market combined is increasing and is expected to reach $745.1bn by 2010.

- Premiumization is the major trend defining the alcoholic drinks market. Value and volume sales projections to 2010 show that this trend is set to continue in both mature and emerging markets.

- In Europe, the Eastern European markets are expected to grow the best over the next five years.

- Wine products launches represent 46.1% of all alcoholic drinks launches, growing from 32.2% in 2004 and the most new product launches were within red wine.

- Private label sales of alcoholic drinks are projected to rise by 28% in Europe over the next 5 years. However, industry executives predict that consumers are likely to choose premium branded products and promote their sales growth. According to the Research and Markets Report, it has been found that the organic product tag was one of the few to increase in use on alcoholic drinks, increasing from 2.1% in 2004 to 4.0% in 2006. This shows that the health trend is likely to continue. The report suggests that the organic trend will be increasingly important from the point of view of alcoholic product manufacturers for moving forward especially within the European market. Asahi Honnama Aqua Blue is a beer product formulated to appeal to a more health conscious consumer (Business Wire, 2007). It was launched in January 2006 and is said to be made with pure barley extract and water from deep waters in the oceans. It is said to contain DNA and seaweed extract that is rich in minerals with 30% less carbohydrate. Thus Asahi Breweries has positioned this beer product as a healthier alternative to regular beer (Business Wire, 2007).

- The report also points out that vodka will constitute the single largest opportunity in the spirits market and holds that the younger generation can be the target market for ready-to-drink vodka cocktails. Moreover, it has been found that there is great marketing opportunity at the premium end of the market. Connoisseurs are increasingly willing to pay premium prices for purity of product and Vodka 14 is an example of how the pure positioning is being sold to consumers.

Ireland and Alcoholic Drinks

Ireland was generally considered to be a liberal country in its attitudes to alcohol and was a favorite destination for stag parties and hen parties. Ireland’s per capita litre consumption has increased from 7.0 in 1970 to 14.5 in 2001 according to the World Health Organization and 13.5 in 2004. This compares with 20.4 in France in 1970 down to 13.0 in 2004 (Finfacts Ireland, 2007).

Alcoholic consumption declined in 2004 due to increased legislation and rising prices. Factors such as high excise duty, a ban on ‘happy hours’ (2003) and smoking in public places (2004) and the reorganisation of outdated Irish drinking laws under the Liquor Licensing Bill (2005) (Euromonitor International, 2003). Drinking became a luxury in Ireland due to increased living costs and busier lifestyles. There was a steady shift of alcoholic drinks volume sales from the on-trade channel to the off-trade channel. The change in drinking culture, which was evident throughout Ireland in 2006, is commonly described as ‘cocooning’ – the desire among consumers to do the bulk of their socialising in the comfort of their own homes (Euromonitor, 2003). However, it should be noted that while total alcoholic drinks volume sales showed persistent declines over 2001 – 2005, the per capita consumption rate in Ireland remained one of the highest in the world in 2006 (Euromonitor, 2007). Accordingly, the country’s alcoholic drinks market is still very much attractive and challenging.

As a direct outcome of the ‘cocooning’ total wine sales showed strong growth in volume and current value terms in 2006 and was the real bright spot in an otherwise depressed market (Euromonitor, 2007). Wine products are predicted to do well in the future as well. Moreover, it has been found that alcoholic drinks consumption among Irish women is rising steadily and wine seems to be their favorite drink. A recent Drinks Industry Group of Ireland report estimated that 70 per cent of alcohol in Ireland is bought in pubs and restaurants. This is a substantially higher proportion than our European counterparts, largely due to the greater propensity for Irish people to drink in pubs and restaurants rather than at home.

The recent national accounts from the Central Statistics Office show that expenditure on alcohol in Ireland is 8.6 per cent of total personal expenditure, which has declined from 10.8 per cent in the mid-1990s (Finfacts Ireland, 2007). The recent EU-funded report claims that Ireland spends three times more than any other country on alcohol. The trend over the last decade was for actual alcohol consumed to rise as income levels increased significantly, but at the same time the proportion of expenditure on alcohol declined. A number of factors led to the increase in alcohol consumed, particularly the huge growth in the numbers of people in the 18-25 age group and increased inward migration of adults (Finfacts Ireland, 2007). In 2003, 80% of alcohol consumed in Ireland was beer followed by wine at 8% cuder at 6% and spirits at 3%. Eurostat 2003 index figures show that Ireland is the most expensive country in the EU15 for alcholic drinks (CSG, 2007). The higher prices are due to four factors:

- Excise duties combined with a 21% VAT rate are a major component of the price of alcohol – up to 40% for beer and 55 per cent for spirits in 2003.

- The Liquor licensing laws in place since 1902 control retailer entry into the market and at present no licence can be issued without another being extinguished. Licences are issued through courts and Revenue commissioners. With almost 80% of alcohol being sold on-trade this restrictive practice has done little to encourage innovation in the pub sector which in turn places little pressure on the supply chain.

- The current alcohol licensing system specifies that to transfer a licence to a new pub, the owner must make a case that the new pub will not affect the viability of existing pubs in the area.

- There is a concentration in the draught beer supply market with three large suppliers dominating (Diageo, Heineken and Beamish and Crawford). An increase in competition at retail level would lead to increased competition among suppliers.

Ireland and Alcohol – Social and cultural environment

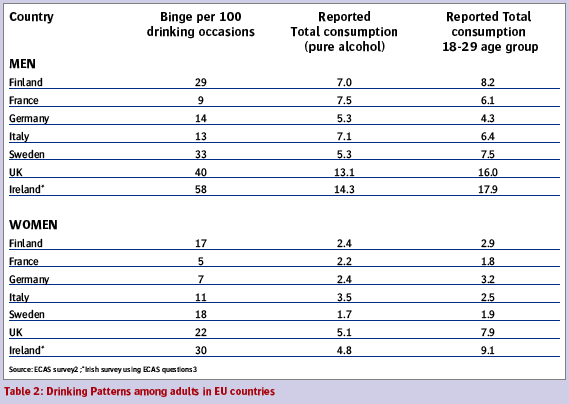

Irish society has experienced tremendous progress in the last decade with rapid econmic growth. Along with this progress, there has been a major rise in alcohol consumption. Ireland has become one of the highest consumers of alcohol in the world. Between 1990 and 2002, alcohol consumption per capita increased by 41 per cent, the highest rate of increase in Europe. During this period, the number of alcohol related deaths also increased. A recent study showed that adults in Ireland had the highest reported consumption per drinker, the highest level of binge drinking and experienced more harm than other European countries. Binge drinking is the norm among Irish men, in that out of every 100 drinking occasions, 58 end up in binge drinking for men and 30 for women (Hope, 2004). In 2002, fewer children under 15 years, reported experimenting with alcohol, drinking on a regular basis or getting drunk compared to 1998 (Hope, 2004). Among 16 year olds, one in three were regular binge drinkers and one in four reported being drunk ten or more times in the last year.

In 2002, alcopops was the most popular drink among girls while beer continued to be the most popular drink among boys. It has been found that alcohol sport sponsorship, linking alcohol, masculinity and sport, attracts young males, the groups mostly likely to be high risk and heavy drinkers. The introductionof alcopops in 1995, with a strong sweet taste, disguising the taste of alcohol, attracted many young people into alcohol. The more recent new alcohol products with high alcohol content provide for a quick and easy ‘fix’ of alcohol for those who are interested in getting drunk fast. In Ireland, alcohol advertising is governed by voluntary codes or self-regulation.

In Ireland alcohol is easy to access, as there are at least 13,000 outlets that sell alcohol (Hope, 2004). Since the 1980s, alcohol has become more available by increases in the number of exemptions (later opening) and in the number of outlets (restaurants and clubs, off-licenses). Excise duty was increased on cider and spirits by Government in December 2001 and 2002 respectively. In 2002, cider sales decreased by -11.3 per cent, while wine and spirits increased and beer remained relatively stable. In 2003 following the tax increase on spirit products, spirits sales decreased by 20 per cent while wine sales increased (+8 per cent) and both beer (-2.5 per cent) and cider (+1 per cent) showed marginal changes.

Competition in the Alcoholic Drinks Market in Ireland

Diageo Ireland Ltd and Heineken Ireland are rival domestic companies in the alcoholic drinks market of Ireland. Diageo Ireland Ltd is the dominating company with maximum volume sales in 2005. This was because it supplied illustrious brands such as Smirnoff Red, Baileys Irish Cream, Smirnoff Ice and Guinness. The company also dominated beer and RTDs/High-strength premixes and finished second in spirits and cider/perry. It also offered a number of wine brands, most notably Blossom Hill (Euromonitor International, 2003). The company is predicted to sell of Guinness brand as part of a wider effort to rationalise its portfolio.

This is seen as the time when large multinationals can buy local brands to complete their portfolios. But it is expected that there will be continuous shifting from the on-trade to the off-trade channel, making Ireland more in sync with the rest of its European Union neighbors. The off-trade distribution value share of specialists outlets will probably drop because lower prices often lead to consumers buying alcoholic drinks products at convenience stores, supermarkets and discounters outlets. There is also the probability that the government may introduce new regulations to curb excessive drinking.

Currently US is the main wine exporter to Ireland and holds about 12-percent share of the country’s imports and continue to grow.The success of U.S. wines in sustaining such a market shows that Ireland is still a good market for alcoholic drinks. According to Peter Dunne, director of Mitchell and Sons, one of the oldest wine stores in Dublin, Irish wine consumers, are be-coming more and more sophisticated and often seek out small U.S. boutique wines. Import and excise duties account for almost half of the retail price (Hanley, 2001).

Irish consumers are generally offered a wide choice of wines as they are always eager to try something new and different. Hence it is difficult to maintain brand loyalty or low price (Hanley, 2001). From the viewpoint of Australia, the main competition will be from the EU, US and New Zealand. Strong marketing by Chile and even more so by South Africa during the past few years have increased their market shares (Wetzel, 2004). In fact, Irish beer distributors continue to seek out new brands, especially those aimed at niche markets. Potential exists for microbreweries to enter the market–and there is also interest in low-alcohol and non-alcoholic beers (Hanley, 2001).

Grocery retailing in Ireland has for years been structured around major supermarket chains in major cities, with smaller groceries in villages and neighborhoods. With modernization, many of the retail markets are under the control of supermarket chains and independent stores, operating under a franchise group name. Retailers generally use an importer to bring the world to their customers. Strong marketing by Chilean and especially South African labels during the past few years resulted in increased market shares for these wines. Exporters should also note that as excise duties are quite high in Ireland, an inexpensive wine at winery level might in fact become relatively expensive when it reaches retail level. Currently, as a result of a relatively low price and high income elasticities of demand for alcoholic beverages, the high level of taxation of alcohol in Ireland has resulted in an exceptionally large proportion of income being devoted to purchasing them rather than to a fall in their consumption.

Marketing Mix

Marketing can be viewed as a set of functions that include product development, packaging, pricing, advertising, selling, distribution and customer service. This process can be studied under two phases: a strategic and a tactical phase. The strategic phase has three components: segmentation, targeting, and positioning. The tactical phase is the one that includes designing and implementing various tactics to achieve the formulated strategy. These tactics are also referred to as the “4Ps”: product, place, promotion, and price. (Kotler, 2003). A comprehensive marketing strategy is one that addresses all components of the “Marketing Mix”.

In order to market any product in any market, a marketing strategy is implemented through decisions regarding the elements of the marketing mix that are also known as ‘controlled variables’ of marketing. The product refers to the physical product or the service offered to the consumer. Marketers can strategically adjust certain product characteristics such as the taste, effect, quality, appearance, packaging and brand. The second variable, price, deals with financial considerations such as profit margin, competitor pricing, and discounts. Place variable deals with channels of distribution including the supply chain, market coverage and various service levels (Novak, 2004). Promotion decisions includes advertising, personal selling, media, public relations and budget. In the alcoholic beverages industry, a mature and highly competitive market, companies need to offer the appropriate marketing mix based on the country and its unique set of characteristics.

In the alcoholic drinks industry, the products need to be varied and cater to a wide range of people. There is a segment that desires vodka and another segment desiring the finest wines. While some people prefer low priced items there are also connoisseurs looking out for expensive brands. The trend in Ireland for the present is towards health promotion. Hence it is essential that the carbohydrate content of alcoholic products should be kept minimum. Regarding the place variable, alcoholic products are now sought as both low price items in supermarkets and as branded exclusive products from pubs. The fourth variable, Price again depends on the economy. Right now Ireland can deal with both low-price items and branded expensive items. When it comes to promotion, Ireland now has the most comprehensive pre-clearance system for all alcohol advertising, through the operation of Central Copy Clearance Ireland. This system assures that there is compliance with relevant codes for all drinks advertising. The print and broadcast media have also agreed to comply with CCCI (Ricard, 2007).

The government of Ireland has endorsed a set of voluntary codes in 2005. These codes compliment the ASAI content code and specifically address the placement and volume of alcohol advertising and sponsorship, with a view to limiting the exposure of young people to alcohol marketing. MEAS (Mature Enjoyment of Alcohol in Society) is another organization in Ireland formed in 2003 to ensure that the drinks industry acts with social responsibility (Ricard, 2007). Heineken as a brand is very successful in Ireland according to Graham Nolan, business development manager at McCann Erickson. Nolan feels that Irish agencies have a different way of looking at things and multinational brands need to promote their products creatively in order to be successful in marketing (Adworld, 2006).

Outstanding creative work for beer brands has included Carlsberg, through OwensDDB, a local advertising company in Ireland. Another Dutch beer brand DDFH&B also uses local advertisers who are familiar with Irish ironic humour. As Nolan puts it: ” Irish beer drinkers, in particularly like and welcome a different type of creative using a bit of wit and humour” (Adworld, 2006). Moreover, it is imperative that there should be increased sensitivity in implementing marketing strategies. Because of the restrictions, the marketing should be careful not to cross the line. According to an old-timer, the marketing must demonstrate that all you are trying to do is switch drinkers from one brand to another and not try to consume more of one brand or binge drink (Adworld, 2006).

Moreover, sports cannot be used for promoting alcoholic drinks in Ireland because sports are connected with young people who need to be shielded from such promotions of alcoholic products. Hence other media such as arts, music and film are being increasingly used to promote alcoholic products. Stella Artois has used film sponsorhip and Heineken has used music. A Stella Artois promotion, offered drinkers the chance to win tickets to see Alcatraz, the movie inside Alcatraz, the San Francisco prison (Adworld, 2006).

Ireland is a good place for marketing materials. The global marketing team for Baileys and its creative talent operate from Diageo in Dublin and the CSR campaign Don’t See A Good Night Wasted commercial, was also developed here. There are also plans to do a number of foreign language voiceovers and show it in other non-English speaking markets (Adworld, 2006).

Branding of Alcoholic Products

In concentrated industries such as the alcohol industry, marketing is best done through effective advertising rather than pricing. A highly concentrated industry is characterized by a small number of relatively large firms. Brand equity refers to the collective positive associations that individuals have about a brand. Firms with higher levels of brand equity will have higher sales because they provide consumers with higher levels of utility. The creation of a new brand involves three steps: market segmentation, the creation of a branded product and the creation of new advertising for the brand, with content targeted at the intended market segment. Market segmentation can be based on geography, demographics, behavior or psycho-graphics. In the case of Ireland, the market for alcoholic products should be segmented on the basis of demographics and psycho-graphics.

Mode of Entry

The different modes of entry into a market would include exporting, entering through turnkey projects, licensing, franchising, joint ventures, and through wholly owned subsidiaries. Exporting involves high transportation costs, ability to withstand competition from low cost manufacturers, high transportation costs, and tariff barriers. In case of turnkey projects, its important to take care that this does not mean loss of technology or imply selling of competitive advantage. Cross-border licensing involves legal barriers. Franchising needs a high degree of quality control. High costs and risks are associated with joint ventures and wholly own subsidiaries. Major entry barriers in Ireland include high capital requirements, economies of scale, patents, and licensing requirements, scarce locations, raw materials or distributors and reputation requirements. Big companies, by virtue of their high capital structure, are able to acquire patents and licenses, meet high investment costs in case of transport or raw materials or distribution costs, and by virtue of their reputation and superior branding infrastructure, are able to overcome these barriers to entry.

In the context of entering the alcoholic drinks industry in Ireland, its better to market the product through an existing domestic supplier who is more knowledgeable regarding promotions and distribution.

SWOT Analysis of Ireland Market for Alcoholic Products

Strengths

- Ireland has a rich tradition of good alcohol consumption.

- Currently, Ireland has a stable economy.

- New segments have opened up – such as teenagers and women – in the Irish market for Alcoholic products.

Weakness

- Ireland is a small country with a small population.

- It has companies that manufacture alcoholic products domestically.

- Irish people have a different viewpoint when it comes to advertising and relate best to ads that have a bit of Irish humor and wit alone.

Opportunities

- A huge demand for new varieties of alcoholic products especially with low carbohydrate content.

- Greater demand for wine varieties especially red wine.

- Domestic companies are giving up some of their products.

- Ireland has a history of trade with developed countries.

- Retailers generally use an importer to bring the world to their customers. This can be used to advantage.

Threats

- Increasing health awareness. Industry executives consider ‘increased health consciousness’ to be the greatest threat to alcoholic drinks over the next 5 years. Consumers are choosing to moderate their drinking, impacting volume sales projections to 2010 (Business Wire, 2007).

- Increasing regulations and codes for advertising alcoholic products. Restrictions on advertising are deemed by industry experts to be the second greatest threat to the industry between now and 2010 (Business Wire, 2007).

- Competition from local companies.

- International competition from US and New Zealand.

Recommendations

The following recommendations may be made to the Australian company seeking to enter the Ireland alcoholic drinks market.

- Extensive market research should be carried out before identifying target population groups and their favorite alcoholic products.

- The product should preferably be positioned as a healthy alternative to traditional alcoholic products.

- The products should be sold through off-trade markets.

- The pricing should be competitive.

- The focus should be on giving new varieties of alcoholic products with minimal alcohol content, carbohydrate content and good quality.

- A local company should be employed for promotion purposes.

- Building brand equity is very important to cater to the well-to-do population in Ireland.

- Marketing efforts of exporters should also include point of sale material, which helps consumers focus attention on labels. Many wineries also include marketing promotions such as competitions to gain a customer base especially for wines at the inexpensive sector of the market.

Conclusion

Ireland is the most expensive country in the EU15 for alcoholic beverages. Indirect taxes such as excise duty and VAT are major components of the final price of an alcoholic product and entry inot the on-trade market place is restricted by the Liquor Licensing Laws. Hence, there are many challenges to be met for an Australian company to break into the Ireland Alcoholic Drinks Market. The best option is to enter the off-trade market place and position the product as a healthy alternative to traditional alcoholic products. There is also competition among exporters the main competition coming from other EU countries, Chile, South Africa, US and New Zealand. Depending on the ability of the Australian company to meet the competition and counter the risks of entering the Alcoholic Drinks Market in Ireland, the company should make its decision.

Bibliography

Wetzel, Hayden (2004). Ireland Country Commercial Guide.

Euromonitor International (2006). Alcoholic Drinks in Ireland.

Adworld (2006). Fears for Beers: An Industry Strikes Back. Web.

Hope, Ann (2004). Alcohol Policy and Young People.

Revenue Commissioners, (2004). Personal Communication

Euromonitor (2007). Alcoholic Drinks in Ireland.

The Economist (2007). Factsheet: Ireland. The Economist Intelligence Unit, Country ViewsWire. Web.

Novak A. Julie (2004). Alcohol Promotion and the Marketing Industry: Trends, Tactics and Public Health.

CIAA (2006). Data and Trends of the European Food and Drinks Industry. Web.

Hanley, Mike (2001). Feeding the Celtic Tiger: Ireland’s Strong Economy Wants Imports.

CSG (2007). Make Consumers Count: A New Direction for Irish Consumers.

Ricard, Pernard (2007). Corporate Responsibility. Web.

Business Wire (2007). The Value of the European and US Alcoholic Drinks Market Combined is Expected to Reach $745.1bn by 2010. Web.

Finfacts Ireland (2007). World/Global Alcohol/Drink Consumption 2007. Web.