Introduction

Income statements are essential components of financial reports, which are helpful for business analysis and its overall health. By analyzing the constituents of the statement, one can see the changes in revenue, net income, expenses, and EBITDA and see whether the company experiences any growth or becomes more burdened with expenses and taxes. Although other reports, such as a balance sheet and a cash flow statement, are usually complementary in the analysis, catching a glimpse of one can also be crucial.

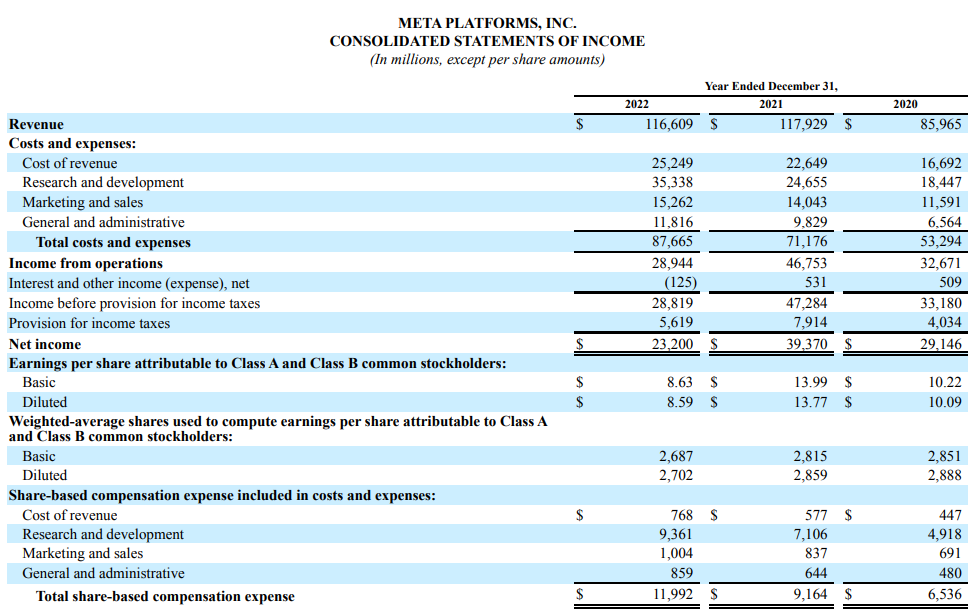

In the case of Meta Platforms Inc., one can see in the Appendix that the investments are made toward innovations, with the corporation gradually increasing its expenses while not demonstrating any significant changes in net income. In general, after considering the news and official reports made by the corporation, it becomes evident that unsuccessful investments in additional company divisions are canceled out by an increasing presence and demand for the company’s services.

Trends

Revenue

An evaluation of the income statement should start at the top, where one can observe revenue. According to Parrino and colleagues (2018), “A firm’s revenues (sales) arise from the products and services it creates through its business operations” (p.184). In the case of Meta, the primary sources of sales are Facebook, Instagram, and Messenger services provided to customers.

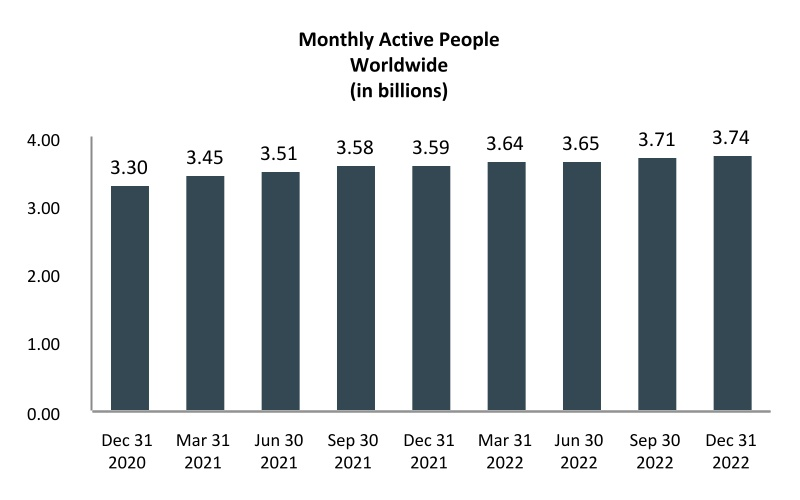

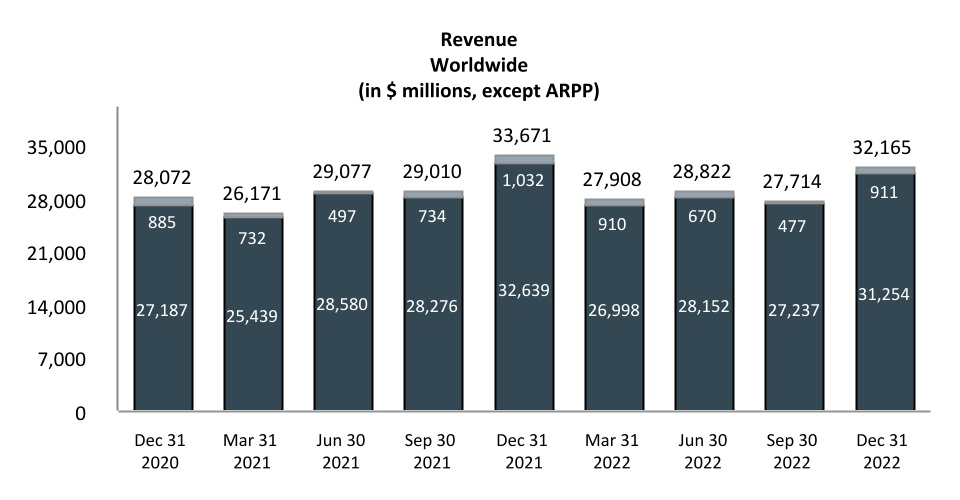

Table 1 shows that, with the baseline being 2020, the revenue was $85 billion, which grew by over 35% in 2022, demonstrating sales of $116 billion. There can be several explanations for such rapid growth. On the one hand, the popularity of social media during COVID-19 can help explain the growth. As seen in Figure 1, the number of active users worldwide has been increasing since 2020 and continues even now. As a result, such a growth in the use of platforms is reflected in the corporation’s revenues, outlined in Figure 2.

On the other hand, preference for specific services can additionally bring more revenue for the company. In 2022, ad income rose by 12%, exceeding Google’s 3% growth (Paul & Malik, 2023). Refinitiv analyst firm data reveal that adjusted earnings per share of $2.98 beat Wall Street projections of $2.91 (Paul & Malik, 2023). The mania around innovative artificial intelligence technology and an urge for efficiency that has seen it lay off nearly 21,000 people since last year have assisted in the social networking behemoth’s recovery from a difficult 2022 (Paul & Malik, 2023). Therefore, Meta Platforms has increased its revenue through advertisements despite economic hardship.

Table 1 – Revenue of Meta Platforms.

Source: SEC, 2022.

Spending

Another area that must be reviewed is expenses, which highlights how much the company spends on creating its services. According to Parrino and colleagues (2018), “Expenses are the various costs that the firm incurs to generate revenues” (p.184). As seen in Table 2, the operating expense of Meta Platforms has increased by over 70%, rising from $36 billion in 2020 to $62 billion in 2022. Such expenses can be seen as funds to create services and investments, both successful and unsuccessful.

In 2022, Reality Labs, a division of Meta, suffered an operating loss of $4.28 billion (Levy, 2023). As was reported, analysts anticipated Reality Labs would announce a quarterly operating loss of $4.36 billion on revenue of $715.1 million (Levy, 2023). Moreover, sales of VR headsets in the United States were down 2% from the previous year, according to information provided to CNBC by the statistical firm NPD Group (Levy, 2023). Therefore, unsuccessful investments by Meta Platforms can cause significant expenses and hurt net income.

Table 2 – Operating Expense of Meta Platforms.

Source: SEC, 2022.

Net Income

Net income is among the most crucial components. While revenue can mislead an investor by showing rapidly growing figures, the company might not even make any money. As a result, the firm’s net income is the line to look at since it “reflects its accomplishments (revenues) relative to its efforts (expenses) during a period” (Parrino et al., 2018, p.184). As seen in Table 3, the results of Meta Platforms have been poor in net income, demonstrated in a negative 20.4% change.

While revenue highlights the company’s success, Table 3 shows some challenges that can be present. Indeed, Meta said that it would incur a $4.2 billion restructuring cost (Isaac, 2023). The cost of premature lease terminations for some workspace, redesigning some data center projects, and severance pay for workers let go last year were all reflected in the charge (Isaac, 2023). Additionally, Meta kept up its heavy spending on Mr. Zuckerberg’s transition to the so-called metaverse, with expenditures increasing 22% from a year earlier (Isaac, 2023). Consequently, net income could be affected by debt restructuring costs.

Table 3 – Net Income of Meta Platforms.

Source: SEC, 2022.

At the same time, it is necessary to look at the earnings before interest, taxes, depreciation, and amortization, also known as EBITDA. Table 4 demonstrates the results of Meta Platforms without such constituents, and one can still see unfavorable results. Being afflicted by unfavorable economic conditions in 2021, the company still did not recover in 2022, affected by a decrease in EBITDA. The overall change is negative 4.8%, which could indicate that the company is more focused on expansion and research and development. Experiencing rapid revenue growth and not being burdened by expenses, lower income results might not have a detrimental effect on the corporation in the short term.

Table 4 – EBITDA of Meta Platforms.

Source: SEC, 2022.

Recommendations

In terms of recommendations, the first one should incorporate appropriate risk assessment. After reviewing the case with Reality Labs, one can see that some projects can be riskier and require contingency plans and risk mitigation strategies. Without such a consideration, there can be significant challenges, and the corporation can continue to experience poor financial performance in terms of net income since sunk costs will drive it down.

Another recommendation is to focus on long-term strategic planning. As was highlighted earlier, Meta Platforms Inc. focuses on artificial intelligence and metaverse, investing many funds into such areas. Meanwhile, it would be beneficial to consider the near future trends and analyze market potential. The plan should align with the company’s vision and adapt to changing market dynamics.

At the same time, it is crucial to mention that net income conditions must improve for the company. This means that although costs associated with research and development are vital for market disruption and innovations, it is also necessary to consider how the possibilities of being burdened with debt are minimal. The corporation can focus on revenue optimization and operational efficiencies in this case.

These approaches will help Meta Platforms to remain financially healthy while not risking losing its market share or the loyalty of the customers. As was seen before, the business recently started implementing cost-cutting measures, such as the ones connected to leasing agreements, employees, and workspaces. Here, it is additionally crucial to not reduce costs too much in order not to curb progress and experience stagnation due to lowered efficiency.

Conclusion

Overall, after considering the news and official reports released by the corporation, it is clear that unsuccessful investments in the company’s extra divisions are offset by an expanding presence and demand for its services. With 2020 as the baseline, revenue was $85 billion. By 2022, sales had increased by more than 35% to $116 billion. In addition, Meta Platforms’ running expenditures have climbed by roughly 70%, from $36 billion in 2020 to $62 billion in 2022.

The results of Meta Platforms have been disappointing in terms of net income, as evidenced by a negative 20.4% drop. Lastly, Meta’s EBITDA has changed negatively by 4.8% from 2020 to 2022. The initial recommendation should be the incorporation of a suitable risk assessment. Another suggestion is to concentrate on long-term strategy planning because it should align with the company’s vision and be flexible enough to accommodate shifting market conditions. Additionally, it is critical to note that the company’s net income situation must improve so that it may concentrate on operational efficiency and revenue optimization.

References

Isaac, M. (2023). Meta posts $4.2 billion restructuring charge. The New York Times. Web.

Levy, A. (2023). Meta lost $13.7 billion on Reality Labs in 2022 as Zuckerberg’s metaverse bet gets pricier. CNBC. Web.

Parrino, R., Bates, T., Gillan, S. L., & Kidwell, D. S. (2018). Fundamentals of corporate finance (4th ed.). Wiley.

Paul, K., & Malik, Y. (2023). Facebook parent Meta sees advertising jump, tops Wall Street targets. Reuters. Web.

SEC. (2022). Form 10-K: Meta Platforms, Inc. Web.

Appendix