In today’s fast-thriving economic environment, annual reports and accounts constitute some of the most important factors for assessing the success of a company. However, the importance of this annual ritual has been widely debated. Annual reports can be used for understanding a company’s market, productive, and financial performance. Annual reports must be perfectly designed with an ideally selected content, focused on the right audience and add value to the company performance (Casteel 2002).

Annual report and accounts of BAE Systems plc are used as an extended example for discussion. BAE Systems is a global defence and security company headquartered in the UK. The company’s range of activities includes design, development, and manufacturing of some specific products connected with defence. The company deals with equipment preparation and support aimed at border and transport security, cyber security, and high technology electronic systems.

Market Performance

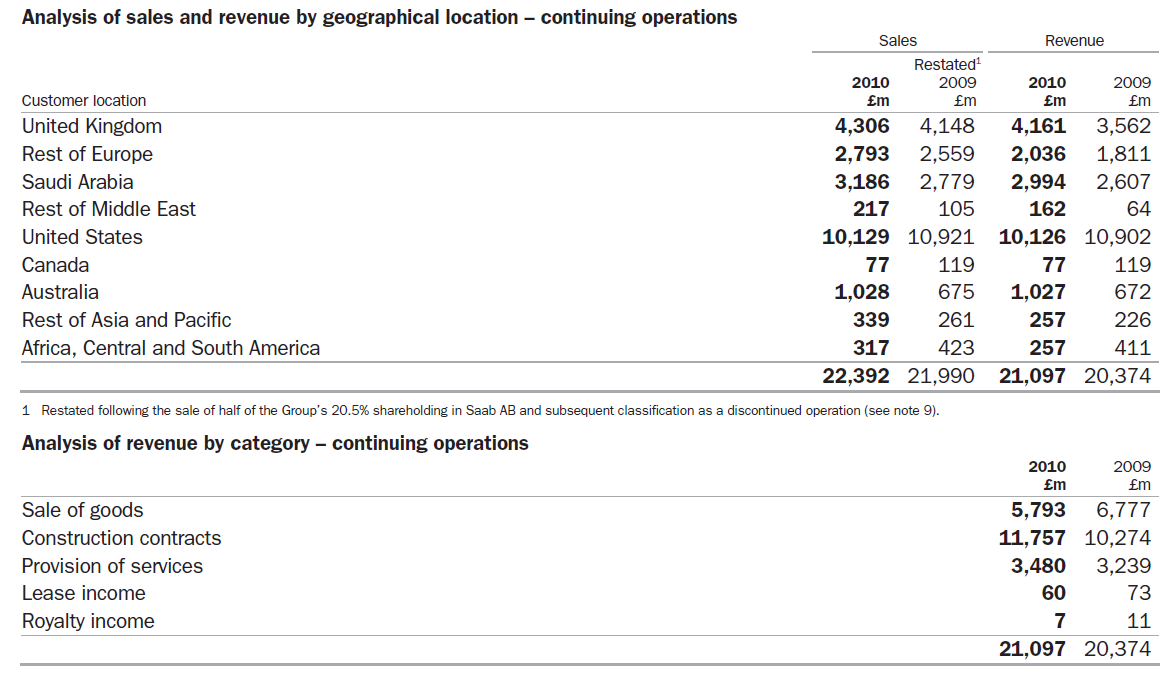

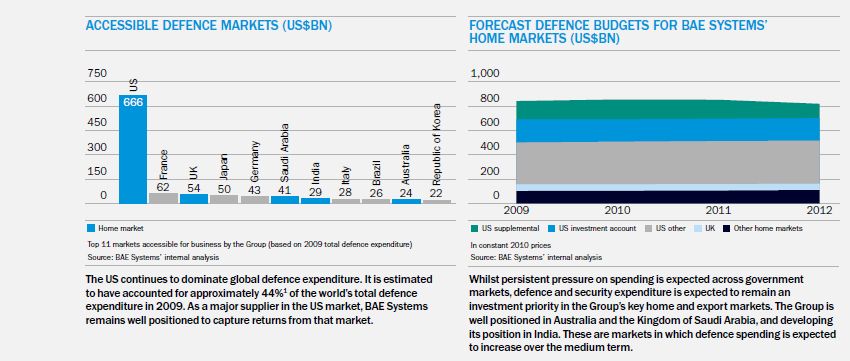

Annual reports include a strategy section that provides a detailed analysis of the environment to help consumers understand the markets. BAE Systems’ annual report contains a forecast of defence budgets for its customers and it can also be used as a vital prediction for market size.

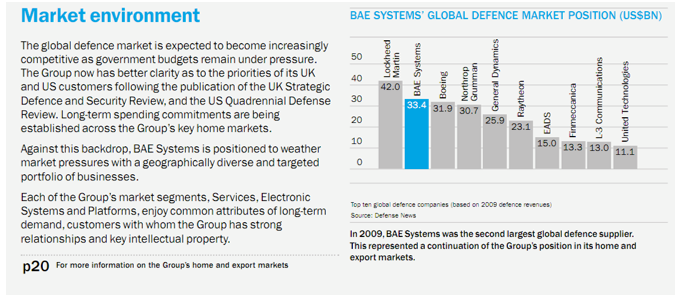

This chart from BAE Systems’ annual report shows the relative position of BAE among its competitors at the global markets, including Australia, India, Saudi Arabia, the UK, and the US. The market concentration, the function of the number of firms, and their respective shares of the total production in the market, can also be judged and analysed for a better understanding of the company’s overall performance and the degree of competition at the market. As Figure 1 shows, BAE Systems is positioned at the market as the second largest global defence supplier.

The strategy section of the accounts provides a breakdown of regional market conditions. For example, the annual report also shows that the US dominates global defence expenditure. Such information provides potential investors with a comprehensive understanding of the company with regard to global market share (see Figure 3).

However, criticism has arisen concerning annual reports’ market analysis (Laidler & Donaghy 1998) There is an opinion that publishing an annual report the company is unable to express an independent opinion; it may be too optimistic, perhaps resulting in an increase in share prices. Therefore, annual reports may be the only source of information for such non-profit companies, which are accountable before stakeholders and government (Lee 2004).

Productive Performance

To understand the productive performance of a company, the annual report provides its segmental review. There are two ways of measuring productive performance: physical and financial. However, host shareholders require financial information for understand how the company develops (Cook & Sutton 1995).

Physical measure

Table 1 shows relation between the revenue and the number of BAE Systems’ employees. This can be a good indicator of the company ratio of revenue per employee.

Table 1. Company ratio of revenue per employee (BAE System 2010).

The annual report provides information regarding cost reduction and cost recovery, while a stakeholder analysis shows the general characteristics of the business peculiarities and product specifics. Productive performance can be analyzed in a number of ways. On the one hand, the amount of physical input against output may be considered. On the other hand, sales per employees may be accessed because of the difficulty in obtaining output figures for the group.

Looking at Table 1, we can see that sales per employee have increased greatly over the period 2006 – 2010. The table also demonstrates that BAE can produce a greater number of products/services with less number of employees.

An annual report also provides the number of orders taken in relation to the size of the bookings (e.g. unfulfilled orders) which are vital indicators of the company’s future production. The accounts and reports also provide innovations for potential new product development and R&D investments (Vergoossen 1993).

The revenue-per-employee analysis in Table 1 does not indicate the impact of technological innovations on business over the last 5-6 years. Technology substitutes a vast number of the jobs once done by employees at BAE Systems, as the company has shifted to automated services, robotic arms, and capital-intensive production capacity. Although the annual reports are useful, they may not go far enough in providing readers with the information how the company has achieved the greater success.

Different companies have various requirements for presenting data in annual reports. That is why it may be difficult to compare and contrast the results and achievements of different companies (Dagiliene 2010). For example, it would be difficult and not very useful to compare BAE’s output per employee to Tesco’s one.

Financial measure

Another method for analysis the productive performance of the company is the value added per employee apart from sales per employee activity. Using information from annual reports, we are able to calculate the value added for BAE Systems. Value added is primarily a measure of internal conversion costs, but it also measures value added to bought-in components.

Value added is essentially the difference between the sales and the production cost. Consequently, the calculated value-added amount for 2010 is £1,336M (£21,097-£19,761). Table 2 shows total value added and value added per employee for the past five years.

Table 2. Total value added and value added per employee for the past five years (BAE System 2010).

Considering Table 2, we can deduce that although total value added has fluctuated throughout the past five years, the value added per employee is still growing, except for 2009 (because of exceptional circumstances, which involved a lower number of working days due to injuries, cost, and efficiency action planning).

Annual reports mostly display the statistical information which examine either the strategies or the production which have led to one of the financial outcomes, poor of good one. The information in annual reports just offer the general information which require additional consideration, research and manipulation. Additionally, annual reports determine the successfulness of the company, the break-even point and the cash flow, which can be obtained or interpreted from annual reports (Stittle 2003).

Annual reports and accounts also measure the use of assets through the balance sheet, in which fixed assets and current assets are identified (Lehavy, Feng, & Merkley 2011).

Table 3. Measurement of assets through the balance sheet (BAE System 2010).

Financial Performance

When evaluating the financial performance of a company, the main factors to consider are as follows:

- The income statement, which indicates revenue generation and profits,

- The balance sheet, which indicates the assets and liabilities and helps in understanding the size of the firm,

- The cash flow statement, which indicates cash generation, showing the net incomes and increases/decreases of cash over time, and helps to identify viability and liquidity (Miller, Vandome & McBrewster 2010).

The annual report also shows the key performance indicators:

- Sales by operating groups and the earnings before interest, tax depreciation, and amortisation (EBITDA).

- Earnings per share (EPS), which play a vital role in determining the company’s share price (Hope, Southworth, Kirkham & Arnold 1994).

Those who consider financial information useful, express the following ideas. First, all of the financial figures are retrospective, meaning they look backwards in time. Therefore, if we say that these numbers help us to analyze and understand future financial performance, we must assume that the company’s finances will perform as they have in the past. However, by the example of BAE Systems, dramatic changes may occur, for example, in defence spending or in new competition for BAE, such as from India and Brazil, which are both rising competitors in terms of defence companies. Therefore, using a financial report for projections is limited. For a full understanding of a company’s performance, we require knowledge and information beyond that provided by financial reports and accounts.

Second, despite the negative aspects of using accounts in judging financial performance, comparability is possible between companies. For example, BAE can be compared with one of its competitors, Lockheed Martin. The financial report can also provide us with a better understanding and appreciation of BAE in the long term.

As noted above, the importance of annual reports and accounts has been widely disputed. Companies may choose whether to provide some of the information or not. Many companies do choose to present information beyond the minimum required by law. The annual reports and accounts are regarded as a good opportunity for companies to inform a large number of people about their activities. Companies want to keep in touch with potential shareholders and other prospective investors by providing a comprehensive picture of their past performance and insight into their future development.

References

BAE System 2010, Annual Report 2010. Web.

Casteel, L 2002, ‘Investing in an effective annual report’, Public Relations Tactics, vol. 9, no. 11, p. 10-11.

Cook, J, & Sutton, M 1995, ‘Summary annual reporting: A cure for information overload’, Financial Executive, vol. 11, no. 1, pp. 12-15.

Dagiliene, L 2010, ‘The research of corporate social responsibility disclosures in annual reports’, Engineering Economics, vol. 21, no. 2, pp. 197-204.

Hope, T, Southworth, A, Kirkham, L, & Arnold, J 1994.,Financial Accounting, Prentice Hall, New Jersey.

Laidler, J, & Donaghy, P 1998, Understanding UK Annual Reports and Accounts: A Case Study, International Thomsen Business Press, London.

Lee, M 2004, ‘Public reporting: A neglected aspect of nonprofit accountability’, Nonprofit Management & Leadership, 15, 2, pp. 169-185.

Lehavy, R, Feng, L, & Merkley, K 2011, ‘The Effect of Annual Report Readability on Analyst Following and the Properties of Their Earnings Forecasts’, Accounting Review, vol. 86, no. 3, pp. 1087-1115.

Miller, FP, Vandome, AF, & McBrewster, J 2010, Market Concentration. VDM Publishing House Ltd, Saarbrücken.

Stittle, J 2003, Delivering Your Corporate Message to Stakeholders, Gower Publishing, Aldershot.

Vergoossen, RA 1993, ‘The use and perceived importance of annual reports by investment analysts in the Netherlands’, European Accounting Review, vol. 2, no. 2, pp. 219-243.