Major Sources of Cash

- Operating activities: net income, depreciation and amortization, and accounts payable.

- Investing activities: proceeds from sales of marketable securities and proceeds from maturities of marketable securities.

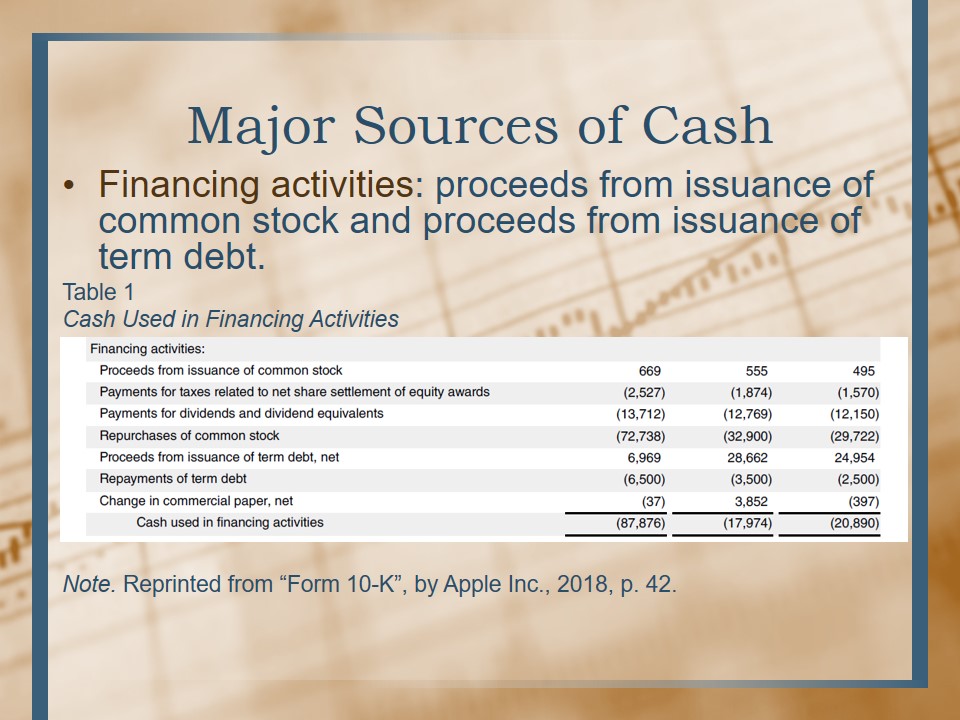

- Financing activities: proceeds from issuance of common stock and proceeds from issuance of term debt.

Apple’s most significant sources of cash from operating activities in 2016-2018 are net income, depreciation and amortization, and accounts payable. Net income for the year 2018 is greater by 23% than net income for the year 2017.

Apple’s most significant sources of cash from investing activities in 2016-2018 are proceeds from sales of marketable securities and proceeds from maturities of marketable securities.

The only positive sources of cash from financing activities are proceeds from issuance of term debt and proceeds from issuance of common stock.

Major Uses of Cash

- Operating activities: accounts receivable and vendor non-trade receivables.

- Investing activities: purchases of marketable securities and payments for acquisition of property, plant, and equipment.

- Financing activities: repurchases of common stock, payments for dividends and dividend equivalents.

For all the three years, the percentage of total cash flow from operating activities is greater than 100% because several items, such as accounts receivable and vendor non-trade receivables, used cash rather than provided it.

Approximately 444% of cash from investing activities was spent on purchases of marketable securities in 2018, as compared to 343% in 2017. 83% of cash from investing activities was spent on payments for acquisition of property, plant, and equipment in 2018, as compared to 27% in 2017.

The greatest portion of cash in financing activities section was used on repurchases of common stock and payments for dividends and dividend equivalents. In 2018, there was a significant increase in repurchases of common stock, as compared to the previous years.

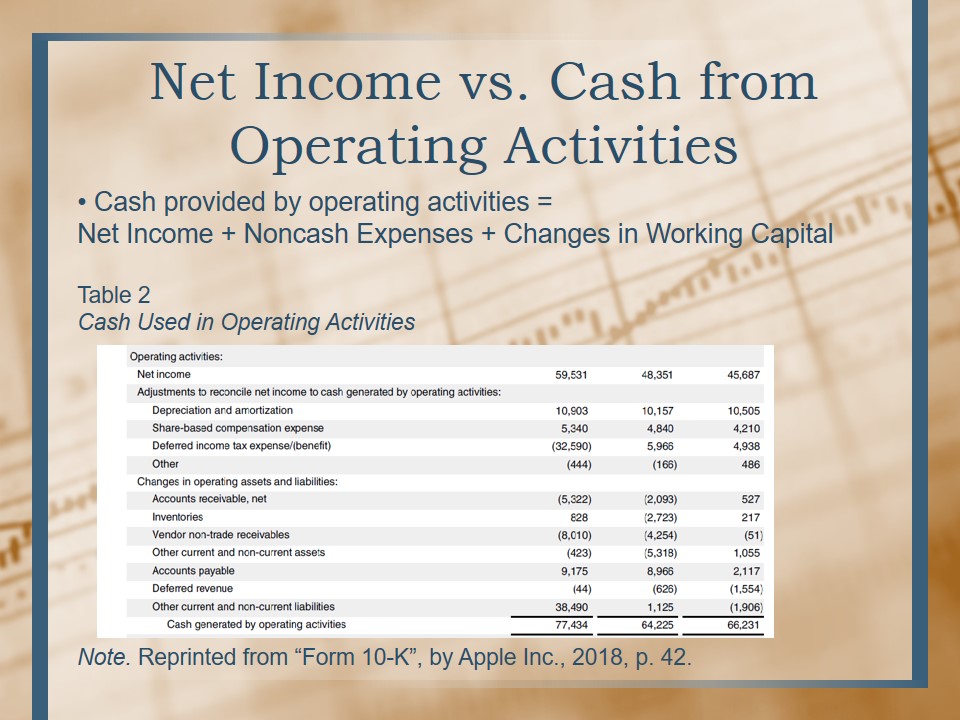

Net Income vs. Cash from Operating Activities

Cash provided by operating activities = Net Income + Noncash Expenses + Changes in Working Capital.

In 2018, net income of Apple was equal to $59,531, whereas the cash provided by operating activities was equal to $77,434. Such a major difference of $17,903 may be explained by the presence of noncash expenses and changes in working capital (Apple Inc., 2018, p. 42). In 2017 and 2016, this difference was equal to $15,87 and $20,544 respectively.Net income is calculated by subtracting expenses, taxes, and costs of goods sold from the total revenue, whereas operating cash measures cash going in and out from the company’s day-to-day operating activities. Therefore, it is assumed that operating cash flow is a better indicator of a company’s financial health than its net income.

Cash generated by operating activities is calculated by adding the net income to adjustments to reconcile net income to cash generated by operating activities and to changes in operating assets and liabilities. Despite the fact that there are major uses of cash which have been mentioned before, there are also major sources of cash that significantly added to the value of cash generated by operating activities. The difference between cash flow from operating activities and net income may be attributable to a time lag between documented sales and real payments (Froeb, McCann, Shor, & Ward, 2015). For example, if customers postpone their payments further, the difference between net income and cash provided by operating activities will be greater.

Financial Strengths of the Business

- A good ability to pay and increase dividends and service debt payments.

- Generation of positive cash flows.

- Wise management of securities.

- Heavy investments in long-term assets.

- Stock repurchasing to reduce the tax rate and avoid ownership dilution.

The company is able to generate positive cash flows from its daily business operations. With the total cash generated by operating activities being equal to $77,434 in 2018, $64,225 in 2017, and $66,231 in 2016, it is possible to state that the true profitability of Apple is high and on the rise. The company has strong operating cash flows as it collected more money from customers than spent on normal recurring operating expenses. Thus, Apple has a good ability to pay and increase dividends and service debt payments that mature within a year and be less susceptible to changes in the industry (Hancock, Bazley, & Robinson, 2015). From this perspective, it may be expected that the company will experience continued success since it has enough financial resources for that.

Apple is expanding its business by investing in new assets, such as property, plants, and equipments. The company has also heavily invested in purchases of marketable securities and generated a large profit from selling them (Apple Inc., 2018, p. 42). This means that Apple can successfully manage its securities to generate profit. Since both the cash generated by investing activities and the cash generated by operating activities are positive, the company is expected to be successful in the next couple of years and possibly expand its business.

The negative value of cash used in financing activities for all the three years indicates that more money is flowing out of the company than into it. However, healthy business often shows negative cash used in financing activities as they pay dividends (Atrill & McLaney, 2017). Given that Apple repurchases its stock, it is possible to suggest that such a policy may be viewed as the company’s strength. This is because by repurchasing its shares, Apple can reduce its tax rate. This will allow for funneling money to stockholders and avoiding the dilution of the ownership of existing shareholders.

Financial Weaknesses of the Business

- It is possible that Apple is delaying paying its suppliers.

- The high price of a stock repurchase.

- Loss of investment income due to a stock repurchase.

However, there are several weaknesses of the business that should be taken into account. Even though the figure of the cash generated by operating activities is positive, there is an increase in accounts payable in 2018, as compared to 2017 and 2016 (Apple Inc., 2018, p. 42). This may imply that Apple delays paying its suppliers to improve its cash flow position. Repurchasing stock may have certain disadvantages, including the high price of share repurchase and a loss of investment income. Still, it is not expected that Apple will experience continued challenges in these areas since the pros of such strategy outweigh the cons.

In summary, even though Apple has mainly a strong cash position, unpredictable implications of its stock repurchase may be regarded as the company’s weakness.

References

Apple Inc. (2018). Form 10-K. Web.

Atrill, P., & McLaney, E. J. (2017). Accounting and finance for non-specialists (10th ed.). Harlow, UK: Pearson Education.

Froeb, L. M., McCann, B. T., Shor, M., & Ward, M. R. (2015). Managerial economics: A problem solving approach (4th ed.). Boston, MA: Cengage Learning.

Hancock, P., Bazley, M. E., & Robinson, P. (2015). Contemporary accounting: A strategic approach for users (9th ed.). South Melbourne, Australia: Cengage Learning Australia.