Introduction

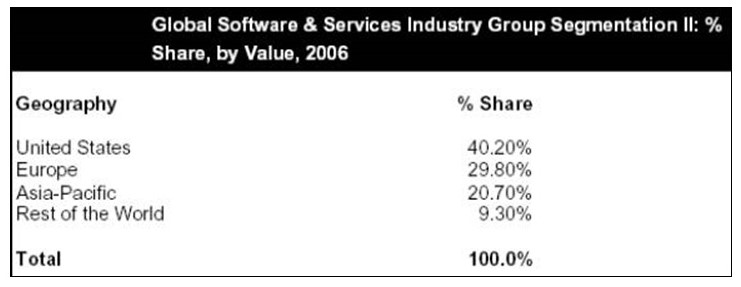

According to a report by Datamonitor. (March 2007), the global software and services industry group grew by 10.8% in 2006 to reach a value of $1,350.8 billion. In 2011, the global software and services industry group is forecast to have a value of $2,219.5 billion, an increase of 64.3% since 2006. IT Services account for 53% of the global software & services industry group’s value. 40.2% of the industry group’s value is produced in the United States. Clearly, IT and software has increased its presence and offers a strong growth area and the growth would be sustained for quite a long time. This paper analyzes various forces that drive and shape the software industry.

Social, Cultural and Demographic Forces

Various social, cultural and demographic forces are at work in shaping the software industry. This chapter provides a discussion on these forces and how they serve to act as drivers for the industry.

Software Demographics differences

Band (July 2007) has suggested that there are clear demographic differentiators in the software industry and they are the software developer and the software vendor. Software developers are the companies that take up outsourced IT application work for other companies while software vendors are the companies that sell packaged software. The author has stated that that all the global 10 leading software vendors have off shore software development centers in India while a few of them have offices in China, Taiwan and other Asian countries. The leading software vendor companies are Microsoft, Oracle, SAP, Sungard Data Systems, Computer Associates, Symantec, Intuit, Amdocs, Misys and BMC Software. The leading software services companies are based in India and include Infosys, Tata Consultancy Services, Patni Computers, Mastek Ltd. and a few others. The software services providers also provide BPO services and call center services and Band says that there is a marked demographical preference for Asian developers, mainly from India while China is also racing forward.

Importance of cultural differences in software industry

Victoria Furness. (2007) has highlighted the cultural differences in the software industry, especially in the Asia-Pacific regions and countries such as China, India, Japan and others. According to the author, India has a specific advantage over the countries with its liberalized education system and the overall higher level of intelligence of students in the country. Countries such as Korea, Taiwan and China are next in the line while Japan is regarded more as a consumer of software products and services. The author has argued that since a long time, Indian citizens from prestigious institutions such as IIT and other engineering colleges have emigrated to US and Europe, settled and prospered there. Many set up their own businesses and were welcomed by the host countries since Indians were regarded more as intelligent workers who were ready to work for lesser wages than their counterparts. Moreover, technology transfer to India had happened quite often and there were many US multinational companies in India who had set shop decades ago and had prospered. So when the IT boom began in the late 1980’s, India formed a ready resource of talented IT professionals who had a high acceptance level in US and Europe. The author has explained that cultural gaps in the Chinese and Korean counterparts were so great that people from these countries could not readily bridge the gap.

Language

According to a report published by Datamonitor (India, December 2006), one of the main reasons for India emerging as a leading software services provider is the fact that English is very common in the country and a majority of the literate people speaks the language effectively. India was a commonwealth country and one of the legacies that the British left was a rich learning and educational system where English was the primary language. In many government offices in India, English language is used since there are many different languages in the country and English is the most accepted language. Almost all the private enterprises and large companies use English as the main mode of communication and English is the main medium used in colleges and schools. Such widespread use of English made it very easy for ordinary Indians to quickly gain acceptance in US and Europe. The report argues that this was not the case with other countries such as China and Korea where fewer people speak English and the medium of education still remains their native language.

How social differences effect software industry

Datamonitor (India, December 2006) report suggests that social differences have effected the way in which people fid employment in the software industry. The study reported that the Asian countries have an advantage when compared with their western countries since the economic conditions are lower here and skilled labor can be found for much lower costs. The author suggests that while US software engineers would cost around 100 $ per hour, equally skilled Indian engineers can be hired for as low as 10 $ per hour. The cost and the wage differential has helped the software industry in these countries to grow at a very rapid rate.

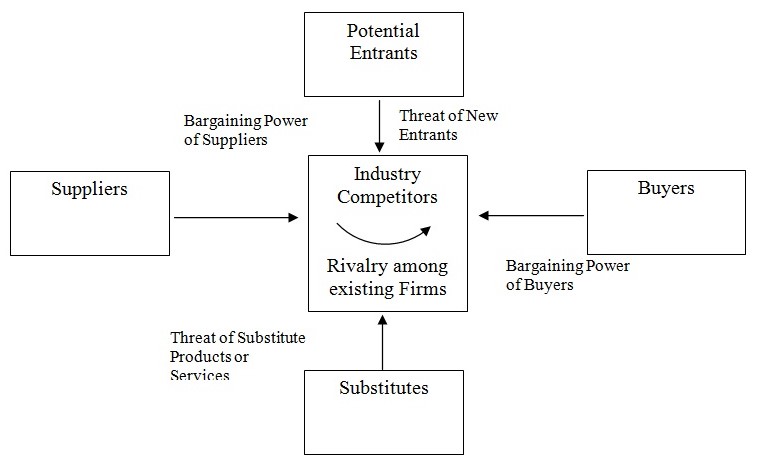

Porter’s 5 Forces Effect on Software Industry

Porters five-force analysis provides an analysis of the micro environment in which the company operates. The study will explain the five forces: Industry Competitors, Suppliers, Potential Entrants, Buyers and Suppliers that influence the software industry. Please refer to Figure 1. Porters Five Forces Analysis for an illustration of the tool. Each force is analyzed in detail in this section.

Forse #1 Potential new entrants

According to the report by Datamonitor (Global Software, December 2006), barriers for potential entrants in the field is low and the barriers operate in specific segments, verticals and horizontals. While literally anyone can open a company, it is getting business and sustaining themselves that really matters. The global software & services industry group is composed of the software industry, IT services industry, and Internet software & services market. The global software industry consists of the global application software, systems software, and home entertainment software markets. The global IT services industry is composed of the global data processing and outsourcing market, and the global IT consulting and other services market. The data processing & outsourcing market measures providers of commercial electronic data processing and/or business process outsourcing services. The IT consulting and services market covers providers of information technology and systems integration services. It also includes information technology consulting and information management services. The market values are calculated as revenue generated from such services. The global Internet software and services market consists of companies developing and marketing internet software and/or providing Internet services including online databases and interactive services, web address registration services, database construction and Internet design services. Market values reflect receipts from Internet service providers and web search portals.

Force #2 Empowered buyers

Furness Victoria. (2006) has reported that the power of buyers is increasing day by day as new products and technologies appear and are available at lower costs. The author has suggested that even well established companies who are virtual legends in the software such as Microsoft face the empowered buyers. Availability of alternative products at cheaper prices and the advent of open source software such as OpenOffice have threatened well-established products such as MS Office. Even Oracle has faced competition from other database products such as Sybase. So buyers have the power to quickly change over to a new vendor and new service provider.

Force #3 Substitute products or services

A Datamonitor report titled Software in China. (December 2006) suggests that the threat or software piracy and substitute products have severely threatened the software industry. According to the report, there is a parallel market of pirated and spurious software products and the more popular a product is, the more easily it is available. In addition to the piracy threat, there are a number of alternative products and products from the open source resources that are free. While major applications and companies may prefer to use Windows or Oracle, other small and medium companies have started using products such as Tomcat, Linux and Java servers. It is the open source software’s that are a major source of worry for the software companies.

Force #4 Rivalry among industry firms

Berezai (2006) has reported that while the rivalry between Microsoft and Sun Systems and Apple caused widespread interest, the majority of the software industry players have a healthy competition where products are launched and each company tries to prove that its product is the best.

Force #5 Barriers to entry

According to the report published by Datamonitor (Asia-Pacific, December 2006), increased demand for fast, effective electronic business processes and a continual need to keep day-to-day costs to a minimum has meant that recent economic slowdown has had only a limited effect on the software and services industry group. The big names of IT consultancy have become aware of the threat from companies in other fields looking to diversify; smaller players within the industry, having gained entry to the industry group, have actually grown at a faster rate, as both government and commercial institutions increasingly turn to smaller players for expertise in specific areas. Although smaller operators are playing a more important role, IBM remains by far the biggest player in the industry group, acquiring Micromuse, Bowstreet, Iphrase and JBoss in 2005, in addition to undertaking various strategic alliances. The most significant development within the industry group was perhaps Oracle’s takeover of PeopleSoft in January 2005. Microsoft is still under pressure from a number of US courts which continue to investigate the company on the back of claims of unlawfully creating a monopoly and abusing its dominant position. As the major operators have diversified their services, providing a “one-stop shop”, smaller players have reacted by providing expertise in one specified, highly focused area. As they dictate demand for operating systems, PC sales continue to be the key factor in influencing industry group performance. Traditionally, as in any technology-based industry, research and development has been the key to growth. Innovative breakthroughs and product differentiation are fundamental to reaping the greatest profits. One significant R&D discovery, broadband, has significantly boosted online use and efficiency, providing much higher download speeds; developers are subsequently integrating more and more Internet-based options into their own programs. Microsoft spends around 15% of its total revenues on product R&D, and Oracle has recently been spending up to 13%. In addition, the trend toward shorter-duration contracts which has crept into the software industry poses further problems for companies, as reduced upfront costs and lesser payback time will give firms increased license to trim their renewal rate in the face of any economic downturn. Increasingly it is brands that are proving to be a company’s most valuable asset. Current leaders realize this and, in response, are investing more and more in marketing.

Capital Requirements

The Datamonitor report (India, December 2006) suggests that the capital requirements to set up a software unit are far lesser than compared to other manufacturing industries. Capital investment usually includes computers, servers and software and these can be purchased at vastly discounted rated directly from the vendors. The only fixed investment costs are the land and building and these can be leased or set up in software development at lower rates. Setting up manufacturing industries is much more expensive since costly machinery and equipment have to be purchased.

Switching Costs

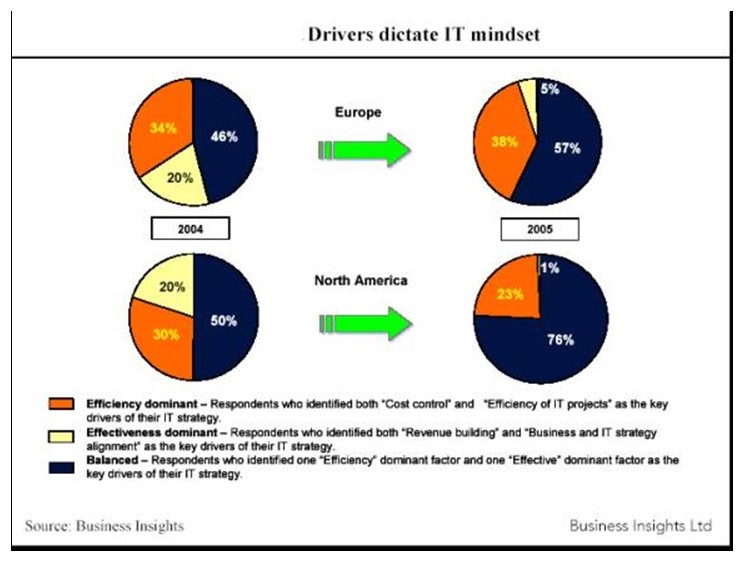

According to a report published by Datamonitor (US Software, December 2006), cost management has emerged as the dominant driver of IT strategy across the US and Canada, the region remains the stronger market for IT expenditure growth, with 59% of institutions indicating budgets will increase in 2008 (compared to 45% of European institutions) and with far fewer institutions planning outright budget reductions. This is likely a reflection of the business environment in the respective regions, with North American-based institutions and markets generally outperforming their European counterparts in earnings and premium growth, as well as the greater ability of US and Canadian insurers to manage and reduce their cost base over past few years. The report has estimated that with higher operating costs of development, companies find it much more profitable to get the work outsourced to the Asian countries where skilled labor is available at much lower costs.

Economies of scale

The economies of scale seem to favor the bigger companies since they are able to distribute their fixed costs. Pleshko (2007) has argued that medium to large companies frequently lose their perspective as they try to boost up production and this creates a situation where the per unit cost of production starts rising. When the costs rise and the marketing efforts do not generate sufficient revenue, companies tend to fold up overnight. This has been proved out by the large number of companies that underwent losses in the dotcom era. With huge overheads and little in the form of revenue generation, the companies fell down to the economies of scale.

Cost Disadvantages Independent of Scale

Pleshko (et all, 2007) has reported that small firms have certain advantages and disadvantages when it comes to operating in a competitive market and these are independent of the scale.. The advantages are that there are smaller layers for decision-making and decision are taken faster and implemented even quicker. The disadvantages are that they have a limited market and are not able to utilise their infrastructure to the maximum potential and thus never able to leverage the economies of scale. Since they do not have deep pockets and large amounts of money, they cannot wait for the market to develop and the demand to be created and this is something larger firms have. With large funding available, large firms can invest in expensive technology and bear the high fixed costs that occur during the gestation period. They have the means to deploy labour, procure raw materials, invest in marketing and research and be ready when the market opens. Since there are many departments in the organisation, even if one fails, the losses are not felt immediately.

Product Differentiation

Furness Victoria. (2006) has suggested that certain unique product differentiation helps companies to get an edge in the market share. The author has suggested that the brand quality and service and performance play a very important role in the product differentiation. Certain vertical segments such as enterprise planning solutions have a number of competitors such as SAP, BAAN, Peoplsoft, JD Edwards and so on. Over the years, SAP has created a unique identity and has been used by very large companies such as Nike, Tesco and others and it is the unique product differentiator that has helped the company to sustain itself.

Access to Distribution Channels

Berezai (2006) says that access to distribution channel which was a major issue and the main reason for a company to grow, the trend has been reversed. With the easy availability of high speed internet connection, customers can easily download the required software and this has reduced the need for distribution channels. But for large enterprise level applications, where customization of even off the shelf products is required, access to distribution channels becomes important.

Conclusion

The paper has examined the various factors that act on the global software industry. Forces such as demographic, cultural, language and social differences have played an important role in Asian countries such as India and China getting an edge. The paper has also examined the Porters Five Forces that act on the software industry and has examined forces such as Potential new entrants, Empowered buyers, Substitute products or services, Rivalry among industry firms and Barriers to entry. In addition, the paper has also discussed other issues such as Capital Requirements, Switching Costs, Economies of scale, Cost Disadvantages Independent of Scale, Product Differentiation and Access to Distribution Channels

References

Asia-Pacific. (2006). Software in Asia-Pacific. Datamonitor Publications, London.

Band John. (2007). The Top Ten Software Vendors Growth strategies, consolidation and convergence in the leading players. Publisher: Business Insights Ltd. London.

Berezai Piers. (2006). B2B on the Internet. Business Insights Ltd. London.

Carpenter Mason A. Sanders William Gerard. (2006). Strategic Management: A Dynamic Perspective, Concepts and Cases. Prentice Hall; US Ed edition.

China. (2007). Computer Software in China: A Market Analysis. Access Asia Limited Publication. London.

Software in China. (2006). Software in China: Industry Profile. Datamonitor Publications, London.

Datamonitor. (2007). Global Software & Services Industry Profile. Datamonitor Publications, London.

Furness Victoria. (2006). Best Practices in Financial Services Technology: Effective vendor strategies, opportunities and pitfalls. Business Insights Ltd. London.

Global Software. (2006). Global Software: Industry Profile. Datamonitor Publications, London.

India. (2006). Software in India: Industry Profile. Datamonitor Publications, London.

Mc Donald Malcom. (1996). Strategic Marketing and Planning. Cranfield Management Series.

Pleshko Larry, Nickerson Inge. (2007). Strategic comparison of very large firms to smaller firms. Journal of Academy of Strategic Management, Volume 6, pp: 105-117.

US Software. (2006). Software in the United States Industry Profile. Datamonitor Publications, London.

Victoria Furness. (2007). Emerging Security Trends and Market Opportunities: Competitive response to new threats and evolving technologies. Publisher: Business Insights Ltd. London.