Examining the Poor Results in the Australian Economy

The Australian economy has not been doing well and hence the poor economic results. However, the effect has not been much compared to other economies that have witnessed worse economic growth and stabilities over the past few years. Several factors have attributed to the poor results in the Australian economy.

Global uncertainty and the decline asset prices have been some of the factors why the economy of Australia has not been doing well. These two factors have seen less investment in the stock market as investors feared that it would crash. The economic crunch in Europe and the debt crisis in Greece, Portugal and Italy have also had an effect on the Australian dollar (Forex Blog 2011).

The AUD has risen by more than 40% against the US dollar making, it a risk affair. Being seen as a market currency, many investors are now using the AUD to pay the euro debts. Selling the AUD to a weaker currency has affected its value as it is being transferred to another economy.

Fig 1: Australia GDP Growth Rate (Forex Blog 2011).

From figure 1 above, we can see that the Australian economy has not been doing well as the GDP has not been stable since the last quarter of 2007. It has dropped until it sunk in 2009, rose and dropped in the send quarter of 2011.

This has been caused by the economic contraction of 1.2% as a result of the economic uncertainty, increase in interest rates as well as the decline in asset prices. This drop was the largest in the Australian economy in 20 years leading to corporate bankruptcies and losses that have had a negative impact on the economy.

Net International Investment Position and the Balance of Payment

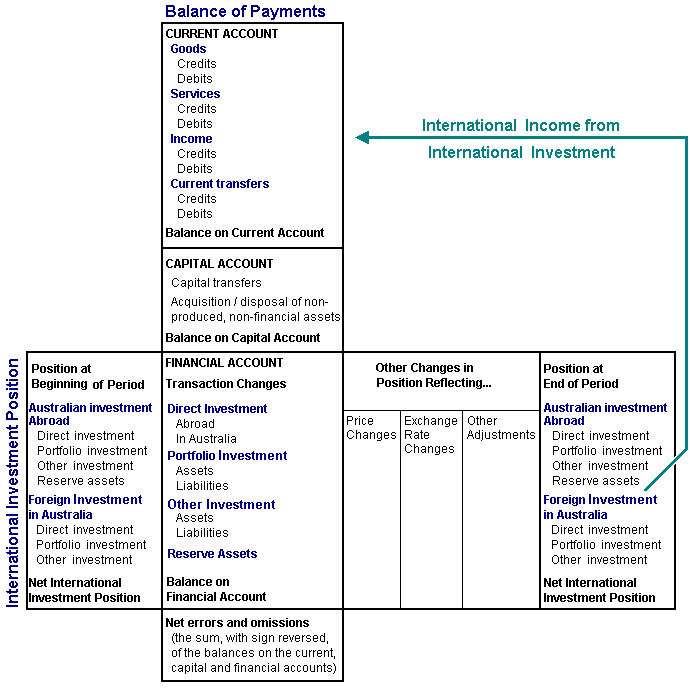

According to the Australian Bureau of Statistics (2006) there exists a close relationship between the Australian balance of payment statistics and the net international investment position. This has been necessitated by the stronger performance and the high investment levels in the Australian economy especially the mining sector.

Each period is a pointer to assets positions and the initial foreign financial liability, and increased liabilities and assets, among other factors (Australian Bureau of statistics 2006). On the other hand, the balance of payments is used to measure transactions in the Australian economic transactions with the rest of the world (Australian Bureau of Statistics 2008).

The closer relations between the two arise because a comparison is done on the level of transaction and the level of investment in Australia and abroad.

The differences between the Australian stocks based on the “foreign financial assets and liabilities at a particular date” (Australian Bureau of Statistics 2008), is used to represent the net international investment position. The relationship between the balance of payment and the net international investment position is captured in diagram below.

Fig 2: Relationship between the Balance of Payments and International Investment Position

(Source: Australian Bureau of Statistics 2008)

The Australian economy has been on the decline for the past years although it has not been hit hard like in the case with major currencies in Europe and the U.S. This is due to an increase in interest rates, a decline in the price of assets and the global uncertainty, leading to low level of investment by domestic and foreign investors.

This has been the most negative effect on the Australian economy in 20 years. The relationship between the balance of payments and the net international investment position is very narrow.

Works Cited

Australian Bureau of Statistics. 5362.0.55.001 – A Guide to Australian Balance of Payments and International Investment Position Statistics, 2001. 22 Sep. 2008 Web. <https://www.abs.gov.au/ausstats/[email protected]/0/90EC36DAF9522644CA256A17002691F5?OpenDocument>

Australian Bureau of Statistics. 5363.0 – Balance of Payments and International Investment Position, Australia, 1999-2000. 8 Dec. 2006. Web. <https://www.abs.gov.au/AUSSTATS/[email protected]/0/5FBBFDFAFB4BF439CA2568E9001874A4?OpenDocument>.

Forex Blog. Tide is turning for the Ausie. 29 Jun. 2011. Web. <http://www.forexblog.org/category/australian-dollar>.