Industry description

The US office supply and paper distribution industry is composed of wholesale firms which deal with the supply of various products. Some of these products include office stationeries such as pencils, pens, staplers, carbon paper, marking devices, inked ribbon paper and other office papers (Research and Markets para. 4).

Firms in this industry also supply other products such as breakroom supplies, cleaning supplies and office furniture. Additionally, the industry players also deal with various technological products such as computer accessories, shredders and phones. Some of the major players in this industry include Unisource, and United Stationers Incorporation.

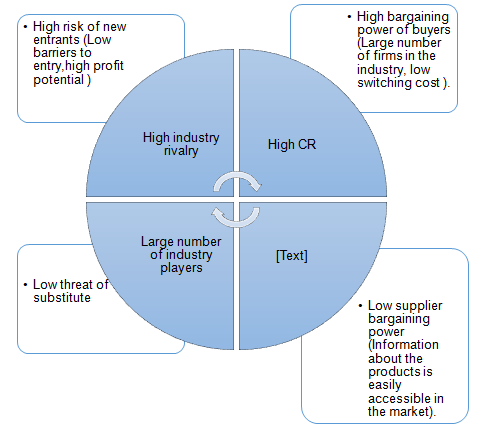

Industry analysis. Porters Five Forces

Industry rivalry

The United States office supply and paper distribution industry is characterized by a high degree of rivalry. This is made evident by the large number of local and multinational companies. Currently, the industry has approximately 6000 establishments. Additionally, the degree of rivalry is illustrated by the industry’s high Concentration Ratio (CR).

According to Bard (50), CR is an indicator of the % of market share held by 4 of the largest players with regard to the 8, 25 and 50 firms in the industry. An industry with a high CR indicates that the largest firms in the industry hold the largest market share.

The US office supply and paper distribution industry is highly concentrated. For example, 60% of the total market revenue goes to the 50 largest firms. This means that small and medium size firms are faced with intense competition.

In addition, industry rivalry is increased by the fact that demand in the industry is dependent on efficiency of a firm in its operation. According to Hill and Jones (59), increase in industry demand leads to a reduction in industry rivalry. However, profitability of firms in this industry is dependent on a firm’s efficiency in aspects such as merchandising and its delivery system.

Threat of substitute

The industry is characterized by a low threat of substitute. However, considering the high rate of technological innovation, there is a high probability of some of the products facing threat of substitutes. For example, emergence of e-commerce means that some of the buyers would incorporate technology in their operation.

One of the ways through which they can achieve this is by incorporating paperless operation. As a result, demand for papers will decline. This may take a substantial duration of time before all firms incorporate e-commerce.

Buyers bargaining power

Hill and Jones (60) define buyer power as the ability of buyers to negotiate/bargain down the price of a commodity. Alternatively, bargaining power may arise if buyers can demand high quality products and services from suppliers thus pushing their production cost up. Buyers in the office supply and paper distribution industry have a high bargaining power.

Their bargaining power results from the large number of firms within the industry. Buyers can shift from one supplier to another and incur minimal switching cost. This means that the industry is characterized by a high threat of backward integration. In addition, the large number of firms in this industry is advantageous to the customer. This arises from the fact that they can force suppliers to lower the price of their supplies.

Bargaining power of suppliers

Bard (49) defines supplier bargaining power as the ability of a firm to push price up so as to make profit. Some of the factors which contribute to high supplier power include presence of large number of suppliers compared to buyers, minimal product information, and high product differentiation.

Supplier power within this industry is low. For example, the success of a firm in this industry is dependent on the effectiveness with which it differentiates its products. Most of the successful firms in this industry have standardized their products.

In addition, information about the firms’ products is easily accessible in the market. Therefore, for an entrant to survive in this industry, it is vital that it incorporates product differentiation through various strategies such as customization.

Threat of new entrant

Despite the large number of firms in the industry, the industry is characterized by a high profit potential. This means that there is a high probability of new firms venturing the industry in an effort to maximize their profits. For example, the annual average revenue for the local SMEs and multinational corporations operating in the industry amounts to $40 billion.

Therefore, successful penetration into the industry means that a firm can acquire a share of the revenue. The average revenue for every employee is estimated to be $525, 000 (First Research para. 3).One of the major barriers to entry in this industry is its capital-intensive characteristic.

However, considering the long –term benefits, it s worth venturing the industry. Entry by new firms would result into a decline in the industry’s profitability. To deal with this risk, it is vital for new firms to develop their competitive advantage.

Chart showing a summary of the industry analysis using Porters Five Forces.

Other industries which affect the industry

Firms in this industry are affected by other manufacturing industries. Some of these industries which affect this industry directly include firms which deal with the manufacture of office stationeries.

On the other hand, the industry is affected by firms which specialize in the manufacture of technological products such as computer accessories and furniture products. The success of these firms means that there is a high probability of industry players also succeeding.

In summary, it is relatively easy to enter into the US office supply and paper distribution industry. This is due to the fact that there are minimal barriers to entry. IN addition, the industry is characterized by a high profit potential. However, new entrants have to consider developing a high competitive advantage so as to attain an optimal market position.

Works Cited

Bard, Timothy. Venture basics 101: ebook. London: Venture Basics 101. 2010. Print.

First Research. Office supply and paper distribution industry profile. New York: Hoovers Incorporation. 2010. Web.

Hill, Charles and Jones, Gareth. Essentials of strategic management. New York. Cengage Learning, 2008. Print.

Research and Markets. Office supply and paper distribution. 1st March 2011. 1 April 2011. Web.