Introduction

Launching a business abroad is always a challenging task, because the launcher should pay attention to a number of factors that do not pose serious concerns if a domestic business is in question (Thompson, 2005, pp. 11 – 12). These factors are best formulated in the so-called framework for PESTEL analysis, i. e. the examination of political, economic, socio-cultural, technological, environmental, and legal peculiarities of conducting business activities in various countries (Thompson, 2005, p. 168).

The attentive consideration of all, or some, of the above listed factors allows, as Thompson (2005) argues, forecasting the challenges a business might face in a certain country. Further on, a proper analysis of these factors allows assuming the relative fitting of a country’s market for a certain business. Thus, recommendations of launching, or not launching, a business in a particular country can be presented on the basis of a detailed examination of PESTEL analysis’ components.

Background on India

So, since the focus of the current paper is the analysis of India as a business environment for developing Australian businesses and investments, it is necessary to first of all provide a general background on this country, its political system, legislation, economic environment, and overall attractiveness for overseas investors. Thus, India is characterized as one of the fastest-developing economies in the world, only behind China, whose trade operations are expected to amount to 10% of the global trade by 2020 (Bhuva, 2008, p. 14; Mishra, 2010, 2010a). The quickly growing population, currently amounting to over 1 billion of people, and governmental focus on economic and social developmental directions allows assuming that the future of this country is rather promising.

PESTEL Analysis

Political Sphere

Data

Thus, the first and the basic element of the current analysis is the examination of the political peculiarities that characterize the business environment in India. The political situation in the country can be referred to as “dynamic democracy” (Khan, 2006, p. 58), which is still two-fold in its nature. In more detail, one aspect of Indian political development is openness towards international communication and cooperation (Khan, 2006, p. 234). Another aspect of Indian politics of today is the greatest value attributed to the national identity, cultural and traditional development, and integration of these ideas into the picture of international functioning of India (Khan, 2006, p. 238).

Thus, the openness of India to foreign investors can be best illustrated by the degree of governmental intervention to the countries business market. According to Vasanthi (2002), this intervention is rather considerable, as about 60% of enterprises in India are governmentally controlled, but still rather favorable for foreign companies. In particular, the tax policy in India welcomes foreign investments and businesses by setting comparatively liberal conditions for them.

For instance, in the early 2000s, India reduced corporate taxes for foreign entities from 50 to 48%, while the long-term capital gains tax was reduced to 10% level. In addition, income tax for foreign institutional investors is set at 20%, and the short-term capital gains require only 30% tax, which is a rather competitive policy, especially for Asian countries (Vasanthi, 2002, pp. 121 – 122).

Implications

Accordingly, the Australian companies have considerable positive implications for investing into and launching businesses in India if their choice is based on the tax climate observed in the country. Moreover, the current development of the political environment in India is even more promising for foreign, and in particular Australian, investors. According to The World Bank (2010) reports, after years of developing as a close and protectionist economy, India is now governmentally led to international integration. The signs of this fact include:

- Decrease of average industry tariffs for foreign investors from 200% to 15% and less;

- Increase of Indian foreign trade to GDP ratio to the level of 35% (after formerly observed 15%);

- Signing of regional and bilateral trade agreements with over 40 countries, including Australia;

- Involvement of the World Bank into the political development and economic regulation of the country (The World Bank, 2010).

At the same time, anti-dumping policies and tariff increases that the Indian government carries out in cases of necessity (often rising tariff from 15% to 45% as in agriculture) serve as protective means against the uncontrollable expansion of foreign businesses (The World Bank, 2010). Accordingly, Australian companies have all grounds to invest in Indian economy, as far as the considerable governmental interventions into it are encouraging for foreign investments.

Legal Sphere

Data

The second important aspect of launching an international business in India is the legal environment in the country’s market, i. e. the set of legislative acts that regulate the ways in which an international organization, or an individual, can launch and operate a business or invest in India. So, as far as the Indian legislation is in its essence rather close to the British one, the principles of Common Law and the Indian Constitution adopted in 1950 are basic for all spheres of law, including the business legislation. The major areas of activity regulated by the Indian common law include discrimination, employment and labor, and health and safety laws. The relations in them are developed in accordance with the respective Acts of the Indian government.

For instance, the discrimination law is regulated by the Child Labour (Prohibition & Regulation) Act 1986, Equal Remuneration Act 1976, and Minimum Wages Act 1948 (IPTU, 2010). Child Labour (Prohibition & Regulation) Act 1986 prohibits the employment of children under 14, Equal Remuneration Act 1976 outlaws the employment and wage discrimination on sexual basis, while Minimum Wages Act 1948 establishes the current minimum wage at 6,500 Rupees (IPTU, 2010).

The employment and health and safety relations are regulated by Industrial Disputes Act 1947, Weekly Holidays Act 1942, The Workmen’s Compensation Act 1923, and IS 18001:2000 Occupational Health and Safety Management Systems developed by the Bureau of Indian Standards (IPTU, 2010). Industrial Disputes Act 1947 requires an employer to request governmental allowance for employee firing, Weekly Holidays Act 1942 grants the legal right to the employees for legislatively established holidays, while The Workmen’s Compensation Act 1923 obliges the employer to compensate an employee for any injury or trauma suffered at the workplace.

Finally, IS 18001:2000 Occupational Health and Safety Management Systems require the employers to provide a safe and healthy working environment for all employees or request official consent to take risks and obtain remuneration for it (IPTU, 2010).

Implications

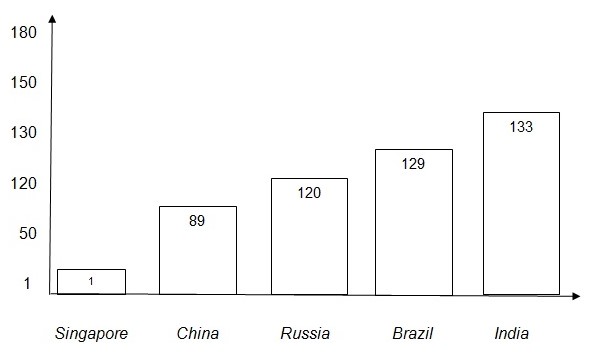

Thus, the implications of the legal factors of Indian business environment are favorable for Australian investors. More specifically, Indian laws are rather demanding, but still they allow having a clear picture of what is required of a foreign investor in this country, and this will allow Australian investors to be better prepared for doing business in India. For example, an Australian company in India will have the clearly defined salary levels for its employees, employment policies forbidding any discrimination, as well as standards of healthy and safe work for all staff members. Due to the above discussed legal requirements, according to IFC (2009) data, the ease of launching a business in India for a foreign company is assessed as 133 out of 180 economies analyzed (with 1 being the easiest procedure of business launching and 180 marking the most complicated process) (IFC, 2009), and this fact should be an object of scrutiny for Australian businesses that plan on expansion to such a promising economy as Indian one:

So, drawing from the above presented data, operating in India is quite possible but still rather complicated for Australian companies.

Economic Sphere

Data

So, the consideration of the economic sphere in India is one of the most important aspects of the current analysis. Concerning the Indian economy, it has been on the rise in 2010 compared to the three-year falling trend conditioned by the global economic recession. This trend is illustrated by the country’s GDP (gross domestic product) and CPI (consumer price index) dynamics between 2007 and 2010 (Mishra, 2010):

Fig. 2 Indian GDP and CPI, 2007 – 2010

At the same time, the picture of the public state debt of India is not as promising as the GDP dynamics. If compared at similar points in 2008 and 2009 (3rd quarter of the year), the debt has increased for about ¼ and amounted to over 50% of India’s GDP, which is a rather threatening figure for such a quickly developing but still rather unstable economy. Accordingly, increase of debt results in decrease of funding of various spheres of activity, including business (Mishra, 2010):

Fig. 3Indian Public Debt, 2008 and 2009 (in millions of U.S. dollars)

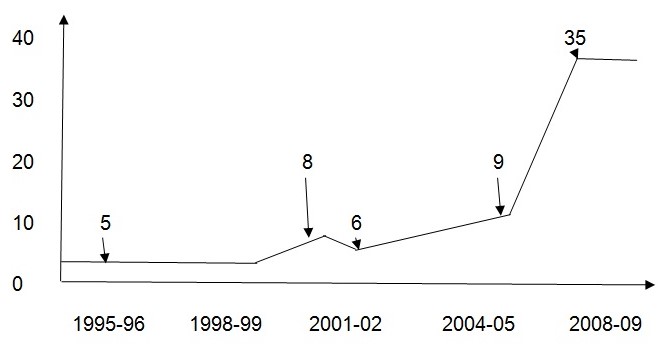

However, the dynamics of foreign direct investment into the Indian economy still preserves the growth trends, which is one of the positive signs for international businesses:

Interest rates have also been recently increased in India (from about 5% to uniformly 6.5% or 7%), which is also a favorable condition for international investors (One Mint, 2009). The higher interest rates, properly used by the companies, can increase the cost of their capital and thus increase the efficiency of their performance in India.

The similar importance can be attributed to the exchange rates of Indian Rupee and Australian Dollar. The point is that an Australian company will have to export goods or raw material to India, and the higher the exchange rate is, the higher the price is for those goods. Given the fact that over 1/5 of the Indian population lives in poverty, such a situation is not rather favorable for Australian companies, as far as for April 17, 2010 the exchange rate of the two counties’ currencies was 41.0858 Rupees for 1 Australian Dollar (X-Rates, 2010). Such an exchange rate makes it difficult to adjust the goods’ prices to the averagely low income levels and labor force costs in India.

Implications

Among economic factors there are both positive and negative ones for potential Australian investors. On the one hand, GDP and FDI growth, together with increased interest rates create a quite promising background for business launching and development. On the other hand, the state debt of India grows and this fact might limit economic development of this country, while the rather high exchange rate of Rupee to Australian Dollar might complicate the process of income retrieval from launching a business or investing into Indian business markets.

Socio-Cultural Sphere

Data

Finally, operating in a foreign market, every company should pay attention to its national socio-cultural peculiarities, and this statement concerns India even more than many other countries. The racial composition of India includes Indo-Aryan (72%), Dravidian (25%), and Mongoloid and other people (3%), although the diversity of minorities in India is reported to be the second richest in the world after the continent of Africa (Library of Congress, 2004). All these groups worship their own religions (over 20 kinds), speak different languages (114 languages subdivided into more than 200 dialects) (Library of Congress, 2004), and deserve respect and careful treatment by business companies who plan to retrieve their profit from these people. In addition, these differences are combined with the still practices cast system, which finds its traces in business as well (Bhuva, 2008, pp. 17 – 18).

Further on, population growth and educational levels of Indian people also affect the socio-cultural peculiarities of doing business in this country. The current population is about 1.17 billion people, with the median age being 25.1 years (IPTU, 2010). The literacy rate is about 80%, and the higher educational establishments prepare hundreds of thousands of qualified professionals. At the same time, India’s employment market offers a considerable cheap labor force consisting of semi-skilled or unskilled workers, while the unemployment rate is reported to be 7.8%, although actual figures are supposed to be higher (IPTU, 2010). The only serious problem seems to the reported proportion of rural population at the level of about 72% (IPTU, 2010), which is rather disadvantageous for Australian investors, who would need much time and funding to educate the rural workers and introduce them into the business process.

Implications

The implications of this point for Australian companies are quite clear. First, these companies should study the socio-cultural peculiarities of India in as much detail as possible to operate freely in every particular context with every particular social or racial group, religious unity or cast. Second, Australian companies that plan business in India should state diversity and inclusion as their basic values to avoid any potential issues connected with alleged discrimination of any groups constituting the Indian society of today.

Finally, Australian companies can count on the labor force of the perfect age for fulfilling the most complicated and effort-requiring working tasks. The high literacy rates and considerable educational potential are also rather promising factors for business launching and development in India. At the same time, quite high unemployment levels and the access to the cheap labor force also welcome foreign investment and business incentives, in particular from Australian companies.

Conclusion

So, the above presented analysis of the political, legal, economic, and socio-cultural elements of the PESTEL analysis for Indian business environment allows concluding that generally India is an attractive environment to launch businesses in and invest into.

The political factors considered reveal that the government intervenes in the business sector quite heavily, but this creates a favorable environment for foreign investments. The legal factors require considerable study and strict compliance of all foreign investors to the basic Indian business, employment, and discrimination laws. The economic factors are rather controversial for international businesses due to the variety of contradicting elements like exchange and interest rates observed. Finally, the socio-cultural factors of the Indian market seem to be rather promising and favorable for Australian investors.

At the same time, it should be noticed that specific recommendations for Australian companies regarding operation in India can be made only on the basis of specific data, i. e. context of business launching, planned time and location of the business, its specialization, target customers, and potential for development in India.

Reference

Bhuva, R. (2008) India has the framework within which to change the game. Outlook Business, 3(17), 14 – 19.

IFC. (2009) Doing Business 2010: India. IBRD. Web.

IPTU. (2010) Indian Employment Laws and Regulations. IPTU. [online] India Pakistan Trade Unit. Web.

Khan, A. (2006) Indian Political System. Anmol Publications PVT. LTD.

Library of Congress. (2004) County Profile: India. LCWEB. [online] Federal Research Division. Web.

Mishra, V. (2010) Indian Economy 2010 Overview: Development in the Global Economy Post Recession. Worldpress. Web.

Mishra, V. (2010a) Indian Economy In 2010: Indian Economy To Grow 10 per cent By The Year 2012 With High Interest Rates. Worldpress. Web.

One Mint. (2009) Bank Interest Rates: India. Investments. [online] Financial Decisions. Web.

The World Bank. (2010) India: Foreign Trade Policy. International Economies. [online] Trade in South Asia. Web.

Thompson, J. (2005) Strategic management: awareness and change. Cengage Learning EMEA.

Vasanthi, P. (2002) Tax Policy in India. Asian Journal of Public Administration, 24(1), 111 – 138.

X-Rates. (2010) Exchange Rates Table for Indian Rupee. FXCM. [online] X-Rates. Web.