Trends in the Direct-Selling Industry

The direct-selling industry is undergoing significant changes because of the shift to online marketing as a major trend over the past decade. The key pressure of this trend on the cosmetics-focused company Avon relates to the further development of its website Avon.com to integrate the company’s representatives into its functioning and attract more clients.

For Avon, the challenge of moving from direct to online selling is related to the necessity of choosing an effective strategy for the growth of the company’s website, Avon.com, in terms of determining the role of representatives, selecting products, and promoting an online channel of distribution. While the trend toward providing retail services online may appear to be negatively affecting the direct-selling industry, it is at the same time offering cosmetics companies limitless opportunities to reach customers.

PEST Analysis

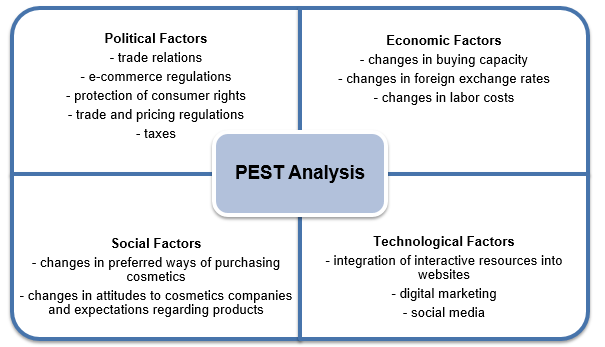

The political factors that influence Avon.com are associated with legal aspects, including the development of trade relations between the United Kingdom, the United States, and other countries along with the adoption of statutes regulating e-commerce and protecting consumer rights. Trade and pricing regulations, as well as taxes related to trading and selling online, also affect the company’s activities. Economic aspects include changes in the buying capacity, foreign exchange rates, and labor costs. Social factors are related to changes in preferred ways of purchasing cosmetics, alterations in attitudes to cosmetics companies, and expectations for their products. Technological factors include interactive resources integrated into websites, digital marketing, and the spread of social media (see fig.1).

Porter’s Five Forces

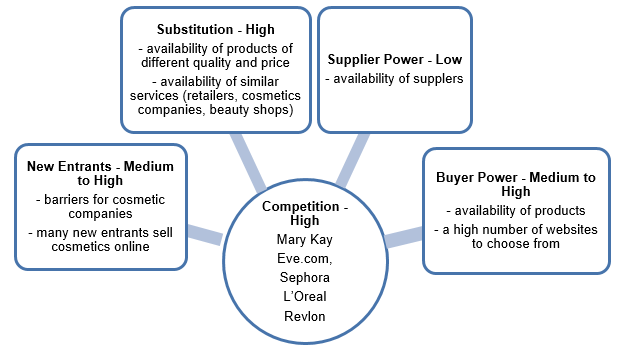

According to Porter’s Five Forces, the threat of substitution for Avon products and the services accessible through Avon.com is high because of the availability of a range of substitute products of differing levels of quality and price. Services offered through Avon.com may also be available from retailers, other cosmetics companies, and beauty shops. The supplier power is low because Avon can choose among a variety of suppliers that want to cooperate with the company. The buyer power is medium to high because customers can select the particular items they wish to buy and specific websites to choose from for online buying. The threat of new entrants is medium to high because of barriers for cosmetics companies, but many new entrants are selling cosmetics online (Godes 7-9). Overall competition in the industry can be described as intense since Mary Kay, Eve.com, Sephora, L’Oreal, and Revlon also sell products online (see fig. 2).

Financial Performance

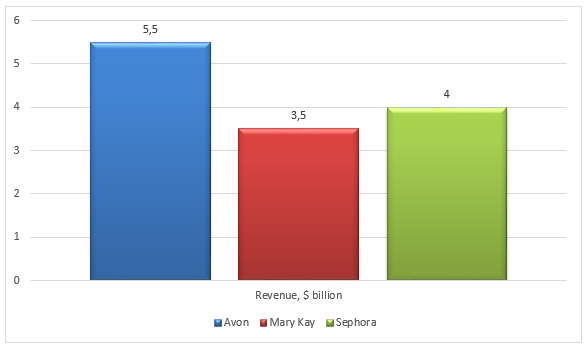

Avon’s direct-selling strategies and Avon.com are allowing the company to remain an industry leader and a strong competitor. In 2018, Avon gained a revenue of $5.5 billion, significantly higher than the industry’s benchmark by $2 billion (“Avon Reports Fourth-Quarter and Full-Year 2018 Results”). The company demonstrated maximum achievement among its rivals (see fig. 3). Regarding the near future, it is possible to predict further increases in revenues associated with developing marketing strategies for Avon.com to address customer expectations.

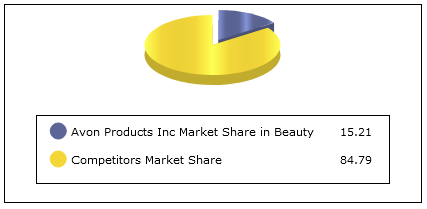

Besides, Avon’s revenue in the United States has grown by more than 80%, and its market share surpassed 15% (see fig. 4). The company holds the leading position in the direct selling industry (“Avon Reports Fourth-Quarter and Full-Year 2018 Results”). More attention should be paid to using Avon.com to increase the company’s market share related to selling cosmetics online to effectively compete with rivals in the industry and online retailers of products for women.

Works Cited

“Avon Reports Fourth-Quarter and Full-Year 2018 Results: Simpler, Leaner and More Agile Going Forward.” Avon Worldwide. 2019. Web.

Godes, David B. Avon.com (A). Harvard Business School Publishing, 2003.