Introduction

The Best Buy Company has been in existence for over half a century in America. In the recent past, the electronics retail chain has expanded its market niche to Canada and at present own over 900 stores across America and Canada. The company has grown over the years until the 2005 when the growth begun to decline following the introduction of the customer Centricity marketing by the company CEO.

The poor performance of the customer Centricity strategy has been attributed to serious competition from Circuit Cirt, Wal Mart,Costco among others who seem to have copied the company’s strategies and have successfully in implemented them. Specifically, these competitors are poaching the company’s best sales persons and are away ahead in offering customized services to their clients.

Currently, the market share of the company in the US and Canada is 20%. Though the customer Centricity strategy is healthy, the implementation process was poorly organized and hurriedly integrated in the marketing structure despite the sentiments of the sales staff.

Besides, the CEO’s proposal on customer Centricity did not include finer details of implementation modules and success reporting in the face of other business dynamics that did not have anything to do with the customer’s demands. For instance, the expansion strategies adopted in the year 2005 were poorly informed since proper research on their viability had not been done.

Coupled with the market economic climate swings, the company is facing the fear of possible breakdown from stiff competition. Due to competition and customer changed preferences, the current financial performance in terms of sales is very dismal.

In addition, the poor communication system between policy makers and implementers have affected the marketing strategies for the company as the sales support team seems uninformed on the scope and requirements of successful sales. Due to the customer Centricity strategy, the sales support team are given little attention to contribute creative input to the complete scientific management system of the company.

Analysis of financial strengths and weaknesses

Financial records provide a potential investor with a narrow insight into the financial strengths and weaknesses of the company because reported values do not give an in depth description of the performance of an entity. Financial analysis breaks down the financial data into various components for better understanding. The ratios will focus on the profitability, liquidity, efficiency, and gearing of the company from 2002 to 2004.

The analysis will also entail coming up with graphs to show the trend of performance over the five year period (Eugene and Michael 176; Atrill 56). The table below summarizes the financial highlights of the company between 2002 and 2004.

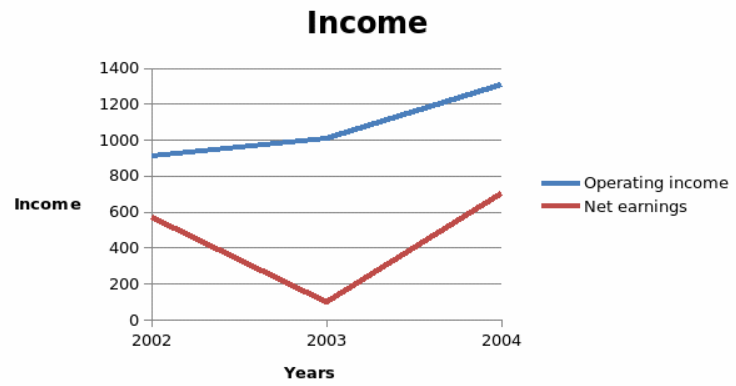

The financial highlights above indicate that the company’s sales increased over the period of review. This represents an increase of 35.46% from 2002 to 2004. However, operating income and net earnings had an erratic trend during the three year period. This can be attributed to massive investment undertaken by the company. The graph below shows the trend of operating income and net earnings.

Share prices and dividends

The table below shows the average year end share prices of the company for the three year period.

From the table, the average share prices of company range between 35.37 and 44.13. The share prices declined between 2002 and 2003 by 4.26%. This could be attributed to declining profitability in that period. Thereafter, the share prices increased by 24.75%.

It is evident that the profitability of the company affects share prices though the share prices is less responsive to changes in profitability that is, profitability declined by 82.63% while share prices declined by only 4.26%. This implies that other factors such as news of the company performance affects the share prices of the company more than profitability.

From the financial records, it is also evident that the company did no pay dividends in 2002 and 2003. This can be attributed to lower profitability. In 2004, the company paid an annual cash dividend of $0.4 (Haber 32).

Liquidity ratios

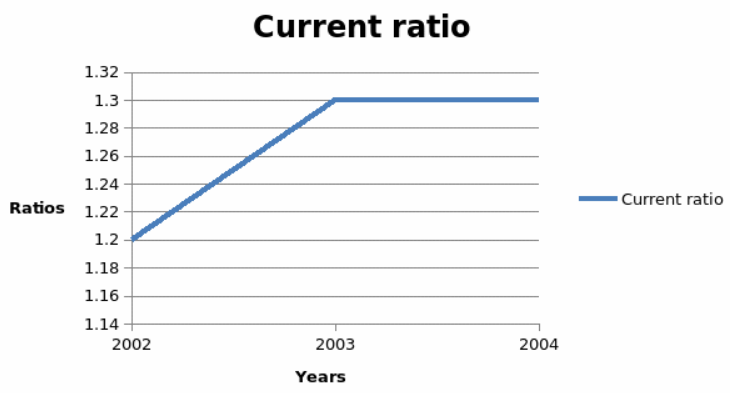

Analysis of liquidity is necessary as it establishes the ability of the organization to maintain positive cash flow while satisfying immediate obligations, that is, the availability of cash to pay current debt. The common ratios used to analyze liquidity are current and quick ratio (Haber 26; Brigham and Joel 27). It is necessary to maintain optimal liquidity ratios since either low or very high ratios are not favorable.

The table below summarizes the liquidity ratios for the Group.

From the table above, both current ratios are greater than one. This implies that the company is in a financial position to meet current obligations as they fall due using current assets. The trend of current ratio is shown in the graph below.

Profitability ratios

Profitability denotes the ability of an entity to earn income after excluding cost of running a business. It shows how an organization uses assets to generate sales in the organization. Various ratios are used to analyze profitability such as, gross profit margin, operating profit margin, net profit margin, the return on assets (ROA) ratio, and the return on equity (ROE) ratio.

Profitability ratios are the main concern of most stakeholders in the organization. High profitability ratios are favorable. The table below shows various profitability ratios over the five year period.

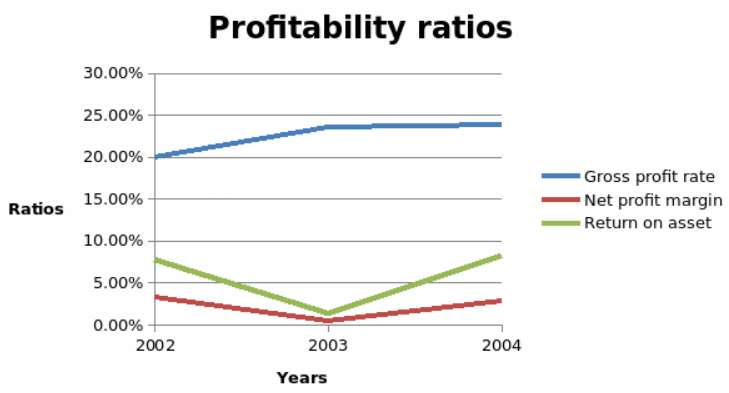

Four ratios are computed to show the profitability of the company. Gross profit margin shows how well a company manages its costs of sales and pricing so as to generate profit. The ratios are below 50% for the three year period which is unfavorable even though they are increasing. The net profit margin shows how the company manages the total cost of running the business.

The ratios for the organization are low and declining. It is an indication of dismal performance and inability to manage the cost of the organization. Return on assets shows how well a company uses assets to generate profits. Return on assets for the company is low with a declining trend between 2002 and 2003. Return on equity shows how well the company uses shareholders’ funds to generate profit.

High ratios are favorable since it indicates that the shareholders obtain high returns from their investment. Profitability ratios for the company are low. This shows an overall low profitability of the company. This can be as a result of high operating cost. The graph below shows the erratic trend of the profitability ratios.

Leverage ratios

A company’s leverage is explained by the amount of debt financing it holds in the capital structure in relation to the amount of equity financing. The ratios are vital since they show an investor the extent of exposure of equity financing (Holmes &Sugden 28). Further, the leverage ratios give more information to debt providers on the ability of the organization to settle the debt on time. Commonly used ratios are the interest coverage ratio and debt to equity ratios.

The table below shows leverages ratios for the company.

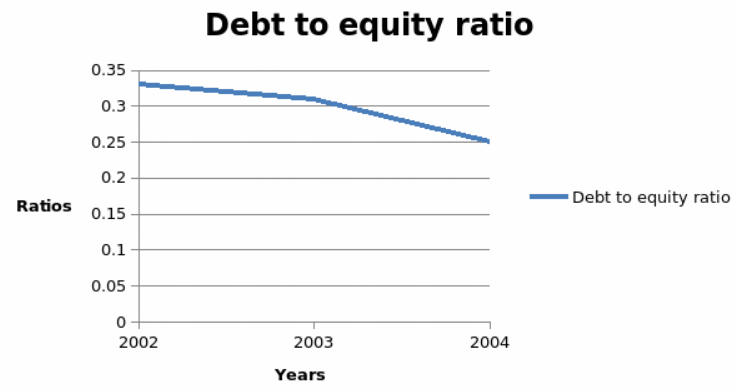

A high debt to equity ratio implies that the company has a very large amount of debt financing in relation to equity financing. It indicates high leverage. This implies that shareholder wealth is at risk. Besides, a high ratio may limit the company from getting additional debt. Low debt to equity ratio is favorable.

However, extremely low ratios are also not suitable since it implies that the company is not willing to exploit the potential of the business. Debt to equity ratio for the company ranges between 0.25 and 0.33. Even though the ratios are low, they are not suitable since they indicate that the company has not fully exploited its potential.

Besides, they are declining further over the three years. The company should strive to maintain a suitable optimal debt structure. The graph below shows the trend of debt to equity ratio over the three year period.

Summary

From the ratio analysis above, it is evident that the company’s liquidity position is favorable, that is, they are able to meet current obligations using current assets. Further, profitability of the company is quite dismal and it shows that the company is not attractive enough to invest in.

Management of the company does not efficiently using resources available to generate sales. Finally, the company’s leverage is favorable though extremely conservative. The low performance recorded between 2002 and 2003 is attributed to the massive expansion program undertaken by the company (Bruner, Robert, Kenneth, and Schill 96).

Recommendations

Operational efficiency and market niche provide an indication of how well the company manages its resources, that is, how well it employs its assets to generate sales and income. It also shows the level of activity of the corporation as indicated by the turnover ratios. The level of activity for the Best Buy Company has remained relatively stable over the three year period despite threat of competition, and constant change of taste and preference.

In order to stay afloat, the company should adopt policies such as diversification, expansion, affordability, and quality in their chain of electronics. Properly designed online marketing and product distribution management facilitated the success and sustainability in online marketing since it operated within stipulated business laws.

To increase credibility and maintain professionalism, the company should remodel their online marketing channels to encompass processes and features that flawlessly facilitate a healthy and a lifetime relationship between the business and its clients. Among the new development elements that can be incorporated in this arrangement are trust, reliability, distribution, fair retribution process, and passing accurate information to target audience to restore confidence within their online marketing networks.

Essentially, success of brand and product management depends on a proper alignment of a functional idea into the creation of flexible, involuntary, and quantifiable measurement of perception among the target audience. Reflectively, this idea should have essential elements that can easily sway the mind, either positively or negatively (Baker and Timothy 11). Therefore, online advertisement is pronounced successful when it creates a reliable, informed, and passionate appeal to perception of the target.

The first dimension of marketing policy places the values of “flexibility, discretion, and dynamism at one end of the scale while stability, order, and control on the other. This indicates that some organizations values adaptation, change and organic processes while others are effective in emphasizing stable, predictable and mechanistic processes” (Tharp 21).

The second dimension looks at “internal orientation, integration and unity on one side while external orientation, differentiation and rivalry on the other end” (Tharp 22). Therefore, the company should consider franchising in the marketing policies aimed at expanding and improving its position without having to incur much cost. Franchising offers the parent company a faster and cheaper way to grow since the parent company does not need to incur the initial costs of starting up a business when venturing into new markets.

Cross platform franchising will enable the company to gain a strategic competitive advantage in a number of ways. First, established franchises will enable the company to carry out comprehensive market research across different territories. The results of such research allow the company to develop a marketing strategy for the regions they intend to open stores.

Further, it enables the company to reduce the risk of market flop that results from the failure to carry out adequate market research of the target market segment. In general, cross platform franchising promotes better understanding of the markets, lines of business, and customer needs. This increases the competitive advantage of the company.

Communication in organizations can be either formal or informal. These two forms of communication are distinct though they are used simultaneously in organizations. Formal communication is the proper and defined process of communication within an organization. Communication influences innovative and deviating period of organizational economic activities including increasing market demand, production and workflow, investment and trade patterns, and competition among the rival companies.

With the need to establish lean and efficient marketing team, the Best Buy Company should develop a discursive approach in explaining and exploring shared and coordinated actions on roles and channels through which organizational framework functions in the exchange of information formally (Tharp 31). This is of great essence towards understanding its organizational communication and passing new changes without causing confusion among the sales staff.

Though the customer centricity policy was necessary, the poor communication in piloting it made it flop. The company should adopt a highly structured and broad differentiation strategy in designing market segmentation policies. This strategy aims at establishing the broadest possible mechanism for optimizing returns by dwelling on specific features which make the product unique and appealing to target clients such as unique location, multiple branding strategy and consultative policy implementation.

The company should realize that promotion of its products is not merely an advertising function. It should come up with both advertising campaigns and promotional strategy that is defined by the nature of the market, the size of the market and the tastes as well as the preferences of the customers (Bert 67). In so doing, Best Buy Company should design on the promotional mix that address the element of price, product and market in a way customers will feel obliged to purchase its products amidst alternative products.

Works Cited

Atrill, Peter. Financial Management for Decision Makers.Harlow: Financial Times Prentice Hall, 2009. Print.

Baker, Jonathan and B. Timothy 2006, Economic evidence in antitrust: Defining markets and measuring market power. Web.

Bert, Ronald. Marketing Channels: A Management View, Sydney: Thompson South- Western, 2011. Print.

Bruner, Robert, Kenneth Eades, and M. Schill.Case Studies in Finance: Managing for Corporate Value Creation, USA: McGraw Hill, 2003. Print.

Collier, Paul.Accounting for managers, London:John Wiley & Sons Ltd, 2009. Print.

Eugene, Brigham, and F. Joel.Fundamentals Of Financial Management,USA: South- Western Cengage Learning, USA, 2009. Print.

Eugene, Brigham, and M. Ehrhardt.Financial Management: Theory and Practice, Mason: Thomson South-Western, 2008. Print.

Haber, Jeffry.Accounting Demystified, New York: American Management Association, 2004. Print.

Holmes, Geoffrey, andA. Sugden.Interpreting Company Reports, Harlow: Financial Times/Prentice Hall, 2008. Print.

Tharp, Bruce 2009, Organizational Culture White Paper. Web.