A short history of Best Buy

‘Best Buy’ is an American company started by Richard Schulz and James Wheeler. The company was initially called ‘Sound of Music’ and dealt with stereos. By 1980, the company realized that selling audio parts/products was not a profitable business and as such started trading video products as well.

The name ‘Best Buy’ was recommended as the company name by the board of directors of the company when one of their sale events, named Best Buy, was a huge success. Gradually, Best Buy launched a website to sell compact discs and DVDs. Soon more consumer products were added to the list. In the year 2002, Best Buy acquired Geek Squad that was into the repair and maintenance of electronic items.

Best Buy extended this facility to all of its stores. Later on, the company introduced ‘big box’ stocking system that included high-end electronic items and home appliances. But unfortunately, this did not click and Best Buy had to shut down 50 stores due to a reported loss of $1.7 billion.

Later the company started 100 smaller version stores and also dismissed 400 employees. Today, Best Buy is at the eleventh place amongst the retail websites and has 170,000 employees. The company runs not less than 1400 stores with annual revenue of US$50 billion (Best Buy).

Since inception, Best Buy had always relied on a competitive price policy. But during the recent years, online selling has caught up with the customers. Moreover, such online selling companies don’t have much of overhead expenses and as such can sell at very competitive prices with marginal profits.

This situation has posed a great threat to America’s largest retailer of electronic products. The main competitors of Best Buy were Highland Superstores, Silo Holdings, and Circuit City. Amazon.com has proved to be one of the biggest competitors (online) of Best Buy.

Best Buy entering Chinese market

Due to all these competitions, the management of Best Buy thought it wise to venture in other countries and they chose China as the potential destination. In order to gain some initial clientele and establish a strong foothold in China, Best Buy acquired Five Star, one of the biggest electronics retailers in China during that time. This happened in the year 2006; it is worth mentioning that only 75% of the shares were acquired.

Due to the prevailing socio-economic factors in China during that period, it was supposed to be an intelligent move by Best Buy. A plus point for Best Buy was that it had some infrastructure already in place owing to its purchasing activities. The acquisition of Five Star provided Best Buy with a well established and strong management lineup that had complete knowledge of the market trends and customers.

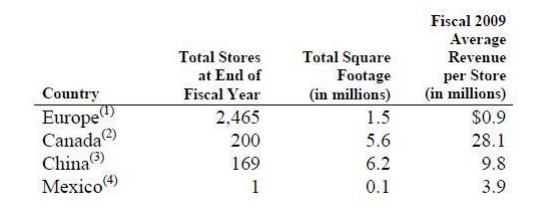

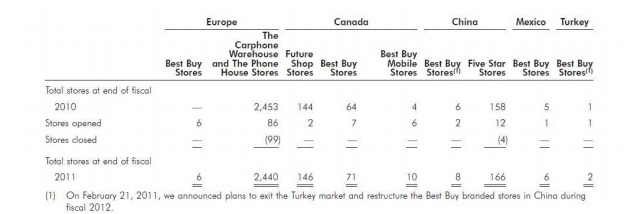

The company did very good business during the next 2-3 years and acquired considerable properties for stores. In 2009 Best Buy acquired the remaining 25% shares of Five Star and became the sole owner. Before the start of 2012, Best Buy had under it 169 Five Star stores and 8 Best Buy stores. Appendix 1 shows the details of Best Buy stores in 2009 and Appendix 2 shows the number of stores operated by Best Buy in 2011.

The main competitors of Best Buy in China’s electronic retail market were Gome (at number one position) and Suning (at number two position). Both these companies were household names whereas Best Buy was never heard of in China before it acquired Five Star. This proved to be the most contributing aspect in Best Buy’s establishing brand equity (Hodgson).

Business tactics adopted by Best Buy in China that failed to click

The tactics adopted by Best Buy in China was more consumer-centric. The company wanted to be on a different platform than its competitors. The company hired qualified and well mannered and such sales personnel who were objective rather than subjective.

They were paid handsomely so that they don’t have to worry about the commissions. It is worth mentioning here that in most of the Chinese companies the compensation given to the sales personnel is based more on performance and commissions.

Unlike in North America where Best Buy opened stores in urban areas considering the ease of parking, in China the company opened its stores (8 numbers) in urban area of Shanghai. The parking consideration was not given much importance because the management thought that probably Chinese households have less number of cars. But the decision was actually wrong.

In fact the traffic congestion is so much in China that people prefer to purchase things from stores that are nearer to their homes (Rein). Moreover, most of the stores of Best Buy were not situated at convenient locations. Like for example, one of the company’s stores was located amidst two metro stations. Many people complained about this on the company’s blog and other forums.

As mentioned earlier, the sales personnel of Best Buy in China were not given any commission on their sales. Initially it was OK but gradually the absence of commission started irking the sales personnel. Even the biggest consumer product retailers like GOME and Suning pay commissions to their sales personnel.

Commissions actually act as motivating catalyst for them. On the contrary, in a fixed salary system no compensation is given for more work. The point to be noted here is that since Best Buy paid higher salaries, its overhead costs were high and hence it could not compete in the price sensitive Chinese market.

In spite of its strategies, Best Buy was not able to maintain its profit rate. As a compensating measure the company decided to decrease its costs throughout. But even then the results were not as per the company’s expectations. The main reason for the low profit was found to be more sales of lower margin products. Ultimately, by the end of the year 2011, all the eight stores of Best Buy were closed.

China being an oligopolistic market, most of the electronic market is controlled by Gome and Suning; oligopolistic market is a market where the supply of any particular product is controlled by a limited number of producers/traders and these producers/traders can control the prices).

As discussed earlier, Best Buy’s prices were not competitive and even though it was considered to be a foreign brand, people did not prefer buying from them. Moreover, Best Buy had a no-bargaining or a fixed price policy. On the contrary, Chinese companies relied on bargaining for making sales.

Another problem was the price of the repair and maintenance services offered by Best Buy. The rates of service were very high and there was no bargaining. It has already been discussed that the Chinese population is accustomed to bargaining. Moreover, there was nothing special or extra in the services of Best Buy. People could get the same service at lesser price around the corner (Young).

The products of Best Buy were not different from those of its competitors but there a substantial price gap. Best Buy products were costly. In order to justify the price difference, Best Buy had a special feature that no other store had. The customers could try the products at the store itself before purchasing it.

Best Buy thought this as an advantage. But this idea was copied by other retailers and Best Buy was left with nothing to promote as being different and classy. In fact Best Buy, likewise IBM, Mercedes, etc, should have offered services and/or products that could not have been copied or replicated.

The proximity to competitors’ stores added to the worries of Best Buy. Actually the plus point with Best Buy was the trying out of the products. The plus point with the competitors was the price. Customers are very smart now-a-days. They would go into Best Buy store, try-out the product and then go the competitors’ stores and buy the product. This went on for about 4 years before Best Buy realized.

Best Buy stores in China were designed according to the Western style. The interior was not according to the taste of Chinese customers. Chinese want ease of navigation that was not present in Best Buy stores. Being modern doesn’t mean being difficult. Best Buy should have respected the taste and culture of the Chinese and designed its stores accordingly.

Issues affecting international business

Entering an international market means to explore new business. Both of these need a thorough investigation, arrangements and preparations. But somehow, there are instances where companies fail to perform at the global platform. Factors that influence the performance of companies may be categorized by PESTEL analysis.

PESTEL Analysis

Political factors: China is a Communist country. As such, the rules are very stringent. “A country’s political climate is an important factor to consider in global business ventures. Political uncertainties, such as a change in national policy, can lead to political unrest, terrorism and even war” (Zoldak).

The Communist Party of China (CPC) has a strong hold over the country population and as such, the government is stable. This stability enhances the chances of businesses to flourish. Best Buy also got a good chance of investment and doing business in China but unfortunately, it could not avail the various benefits offered by the government.

Economic factors: Any country’s fiscal policies have a great effect on the exchange rates. The exchange rates have a major role to play when the expenses such as wages, purchasing, and other overheads are accounted for. There are certain ‘hidden fees and/or complicated taxes that have an impact on the cost.

Social factors: It is considered the duty of business houses to respect the social factors of the area where they do business. They should have some social responsibility and humanity factor in their dealings.

The business of business should not be about money, it should be about responsibility. It should be about public good, not private greed. As mentioned earlier, Best Buy failed to respect the culture and feelings of the Chinese population and as such could not survive.

Technological factors: “Companies conducting business in emerging markets might find technological differences that will add to the cost of products manufactured or to a business’s communication costs. Access to needed bandwidth or the internet in some markets can affect global competitiveness” (Zoldak).

Chinese technology is known worldwide. China is a huge and fast developing country and as such, the modern technological inventions are being used in all spheres of life. But at the same time, copying is also done in a very perfect manner. Even though Best Buy had started a totally different concept of trying out the products prior to buying, the same was copied by the competitors who took the advantage.

Environmental factors: these actors relate to the pollution aspect. There are companies that spread pollution through their products. But since Best Buy’s products were not hazardous, the company didn’t have to worry about such causes.

Legal factors: A company should respect the laws of the country where it is doing business. China, being a communist country, the law of the land is very stringent.

In addition to the aforementioned factors there are certain other factors that may have an impact on the performance of a company at global platform:

- When there is no specific plan for the global market.

- When there is lack of dedication from the employees

- When local competitors come up with better deals and offers.

- When other global projects of the company suffer cut backs due to failure in any particular country.

- When the international market scenario is thought to be similar to that in the home country.

- When total faith is put on the overseas partner.

Works Cited

Best Buy. 2012. About Best Buy Co. Inc. Web.

Hodgson, An. 2007. China’s Middle Class Reaches 80 Million. Web.

Rein, Shaun. 2011. Why Nest Buy Failed in China. Web.

Young, Esther. 2011. Cracking the Chinese Retail Market. Web.

Zoldak, Anastasia. 2012. Factors for Global Business Failure. Web.

Appendix

Appendix 1

Total stores of Best Buy in 2009 (international)

Source: Best Buy’s 2009 Annual Report

Appendix 2

Total stores at the end of 2011 fiscal year (international)

Source: Best Buy’s 2011 Annual Report