Executive summary

The purpose of this report is to discuss the market of a biscuit company in Australia. This paper will consider Arnotts Ltd for broader discussion. In order to formulate this study, this report will consider external and internal environment of the company, market size, growth, and market share of Arnotts Ltd. To assess the present market position of Arnotts, this paper will concentrate more on external factors like economic aspects, political situation, governmental regulations, technological improvement, and socio-cultural factors.

Introduction

The author of this report has selected Arnotts Ltd to examine the market of a biscuit company in Australia.

Background of the Company

Arnotts had actually started its operation in 1875 as a small homemade biscuit manufacturing company in Australia (Cohen, 2004). The company believes that it is a symbol of national history. It is one of the prime food companies in Australia as well as Asia pacific zone. It has more than 4,900 employees among them 2,600 employees are Australian and it generated about $5.2 billion sales revenue. Arnotts Ltd offers number of products for the customers, such as, Tim Tam, Arnott’s Mint slice, family chocolate, Vita-weat crackers with whole grain goodness, sweet biscuits like Assortments, Kingstone Creams, Lemon Crisp, Raspberry shortcake, Tiny Teddy and Snack right, Shapes and so on (Arnott’s, 2010). However, Campbell Soup Company is the wholly owned parent company of Arnotts Ltd, as a result, Arnott’s financial information has integrated with baking, and snacking segment of the Campbell consolidated financial report.

Market growth

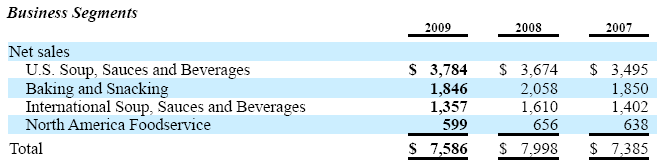

The following table shows that its sales growth decreased from 2007 and 2008 fiscal years due to financial crisis and implementation of divestiture strategy. However, since 1997, it has invested about $27m for expansion in South Australia, $19m for growth in South Wales and $9.4m for development in Queensland market (Arnott’s, 2010).

Table 2: – Key statistics of Arnotts Ltd. Source: – Self generated Campbell Soup Co (2009, p. 53-55).

Historical Background

William Arnott, in 1875, established a bakery house in Australia and started a factory in Newcastle; in 1956, the business combined with Morrow, Metteram Menz, Mills & Ware, and Brockhoff and appeared as Australian Biscuit Company, which floated in the Australian Stock Exchange in 1970. The Campbell Soup Company obtained a small share of the company in 1985, and by 1997, it got the complete control of Arnott’s.

Mission Statement

The mission of Arnotts is to provide the best quality biscuits, chocolates, cookies and other related food items to the target customers and hold the market leading position forever by satisfying them.

Market size

Arnotts Ltd had applied acquisition and restructuring strategies and it is a subsidiary company of Campbell. In this context, it is difficult to current market size of the company, but it supplied 70% of total biscuit products before acquisition (Arnott’s, 2010).

Market Share

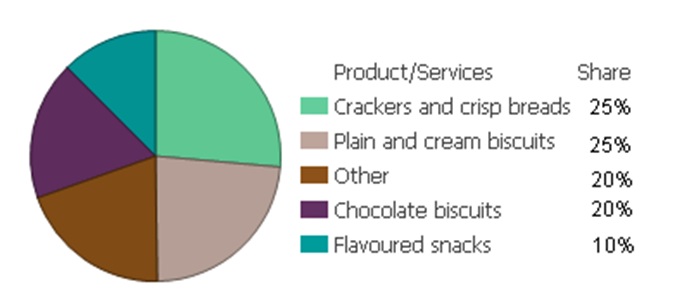

However, the following figure demonstrates its market share considering product and service range

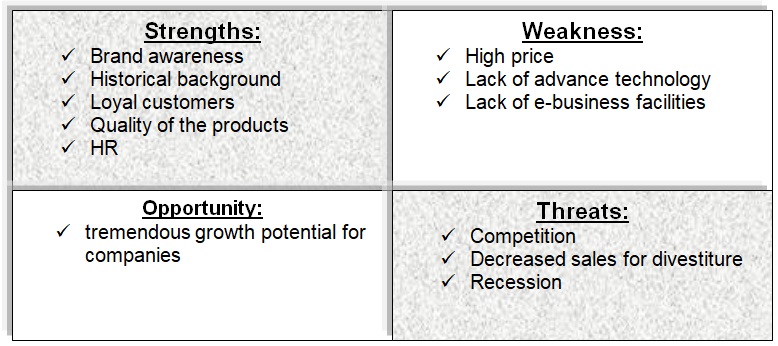

SWOT analysis Arnotts Ltd

Strengths

- Arnotts Ltd has outstanding brand awareness and historical background;

- Despite economic downturn, it delivered solid business performance;

- It has lots of loyal customers in the market;

- Arnott’s donated more than 232,468 kilograms of biscuits to Food bank in 2008

- It offers fresh and quality food items for the consumer;

- It has more than 2,600 skilled, dynamic and efficient employees, who are come from different countries of Asia;

- It has some uniqueness in producing biscuit and other related products, which also helps the company to hold strong position in the market;

- Now it is wholly owned subsidiary of Campbell Soup Company, which gives the company a new dimension of its operation.

Weaknesses

- It has no online purchasing facilities;

- Arnott’s Ltd offers more price for its products than local competitors;

- The promotional strategies is one of major problems of the company;

Opportunities

- Arnott’s has enough resources to expand its business and it has already invested $350 million for expansion in Australia;

- it has capacity to supply biscuits all over the world by its retail customers;

- As Arnott’s is aware about its loophole, it has opportunity to reshape the company by removing hindrance;

- It has all ingredients to provide home delivery services;

- Increased customer interest on diversified biscuit products;

Threats

- Arnott’s has to compete with many national and international players, for example, Associated British Foods PLC, Morinaga Milk Industry, Cadbury, Nabisco Biscuit, United Biscuits, Yamazaki Baking, Goodman Fielder, Nabisco and so on;

- Though the company was not severely affected by the global financial crisis, but it may become a great threat for the company;

- According to the annual report of Campbell (2009), its sales decreased because of the divestiture of certain salty snack food brands in 2008.

PESTEL Factors of Arnotts Ltd

Political factors

Being a brand of the Campbell Soup Company in Australia, the political features of the country can adversely affect Arnott’s operations, which may include unfriendly alterations in legal and regulatory requirements, taxation policy, trade restrictions, political uncertainty, environmental catastrophes, and terror attacks. The Australian market is free from political ambiguity, environmental disasters, terror attacks, and the taxation policy and legal requirements are business friendly as well.

Economic factors

Due to the global economic downturn, the Australian food industry has faced several economic inconveniences, which has in turn affected Arnott’s business performance. Moreover, fiscal and credit market disturbance can lower down Arnott’s capability to deal with regular business relations with the consumers, providers and creditors; apart from that, the exchange rates, taxation policy, interest rate, and inflation rate of the Australian economy can have huge impact over the company’s operations.

Social factors

The company efforts constant care to ensure a healthy nutrition of the customers especially for those who are below twelve; Arnott’s has promised promotional interactions to children less than twelve encouraging healthy nutritional options which will not promote foodstuffs to kids in media unless those are nutritious and are with recognized scientific or Australian government standards. Arnott’s Foundation is serving Aussie families and is intending to generate an advanced standard of living for them; its proposal consists ensuring safe driving, constructing gardens for kids in hospital, and serving welfare organizations; it has contributed over 232,468 kg of cookies to Foodbank in 2008, and has aided over 1,500 families who have babies suffering from cancer (Arnott’s, 2010).

Technological factors

The company has insufficient IT facilities and if it cannot employ necessary resources and technical infrastructure to improve its technological sector and to maintain computerized and manual control procedures, its business could be unfavourably affected. Most importantly, the company lacks an e-commerce site that would facilitate the customers of Arnotts to buy things at home and perform so many other operations as well. Some of its competitors are gaining competitive advantage over Arnott for having advanced technological facilities.

Environmental factors

Arnott’s ecological policy mirrors its pledge to do business in a way, which safeguards the atmosphere; it is determined to lower down the discharge of polluted material in rivers or in air, and so it works together with authorities such as Sydney Water for lowering water wastage. Whilst, in 2001, Arnott’s Smithfield facility used 850,000 litres of water a day, by 2004, this reduced to below 500,000 litres a day; Arnott’s Marleston bakery has brought major development in lessening water usage by setting up a $390,000 wastewater treatment plant. Arnott’s strategy has definite aims to diminish the application of wrapping stuffs, and increase the application recyclable stuffs for their products; it has renewed above 1,000 tonnes of wafer packs every year from non-recyclable polystyrene to recyclable PET. It is now to producing 5,000 tonnes of carton plank every year from 100 per cent recycled plank and has shortened yearly consumption of tin plate by over 40 tonnes (Arnott’s, 2010)

Legal factors

The Campbell Soup Company has operations in several countries across the world. In different countries, it needs to comply with the legal and regulatory requirements of that country. In operating in Australia, Arnott’s conforms to all its environmental, labour, and other corporate laws (Kotler & Keller, 2006).

Reference List

Arnott’s. (2010) About us: Corporate Profile. Web.

Arnott’s. (2010) Campbell Arnotts Action Plan. Web.

Arnott’s. (2010) Environmental factors of Arnott’s. Web.

Arnott’s. (2010) Products of Arnott’s. Web.

Campbell Soup Co. (2009) Annual report 2009 of Campbell Soup Company. Web.

Cohen, M. L. (2004) Arnott’s Ltd. Web.

Hitt, M. A., Ireland, R. D., & Hoskisson, R. E. (2001) Strategic Management. 4th ed. South-Western Thomson Learning.

IBISWorld. (2009) Biscuit Manufacturing in Australia: Australian Industry Report. Web.

Kotler, P., & Armstrong, G. (2006) Principles of Marketing. 11th ed. Prentice-Hall of India Private Limited.

Kotler, P., & Keller, K. L. (2006) Marketing Management. 11th ed. New Delhi: Prentice Hall.