Introduction

The Blue Ocean Strategy Simulation (BOSS) is a strategic tool that allows users to comprehend and practice the core ideas of the Blue Ocean Strategy, a framework for company strategy that emphasizes the creation of recognized market space and eliminating competition. However, this strategy is divided into two rounds: red and blue. Both rounds are distributed in years; for example, the red round includes the current offering for three years of competitive strategy tools. This report will elaborate on the project’s outcomes and recommendations for improvement.

Analysis

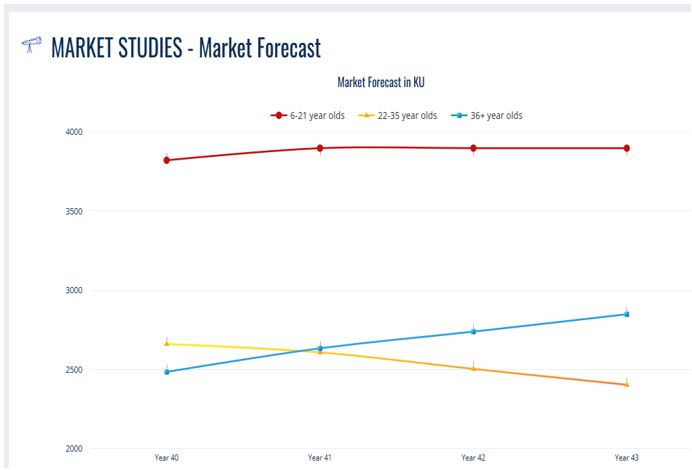

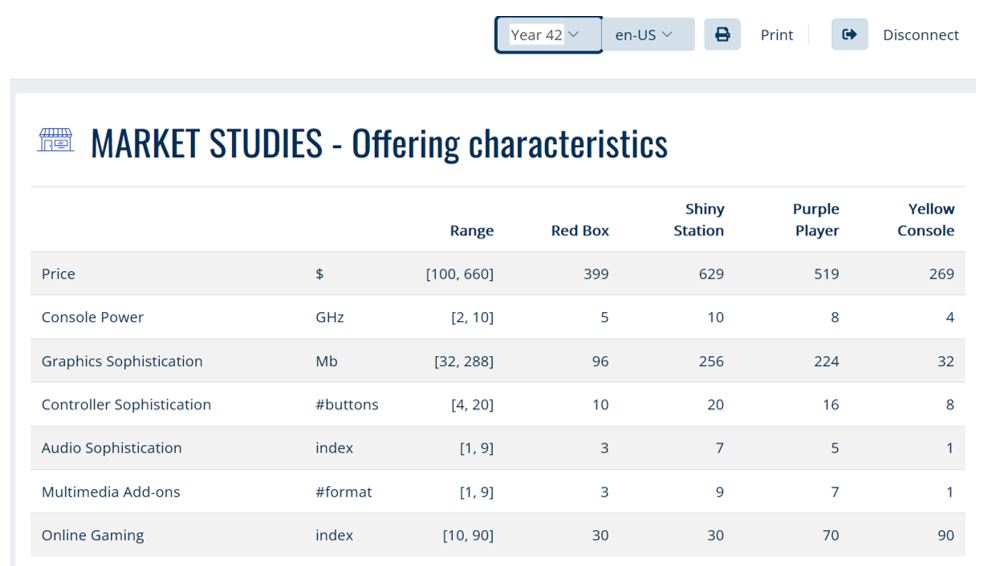

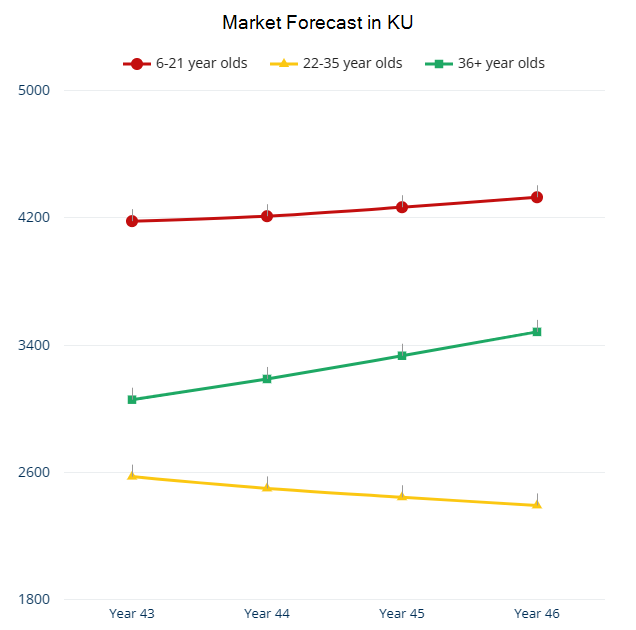

Firstly, as the red round requires, we will compete in the existing market with several existing players. This round necessitates following the low-cost strategy, exploiting the current demand, and trying to beat the competition. Figure 1 includes the market forecast, which helped us decide to focus on the 36+ age group as our targeted segment, as they are going to increase in the upcoming years.

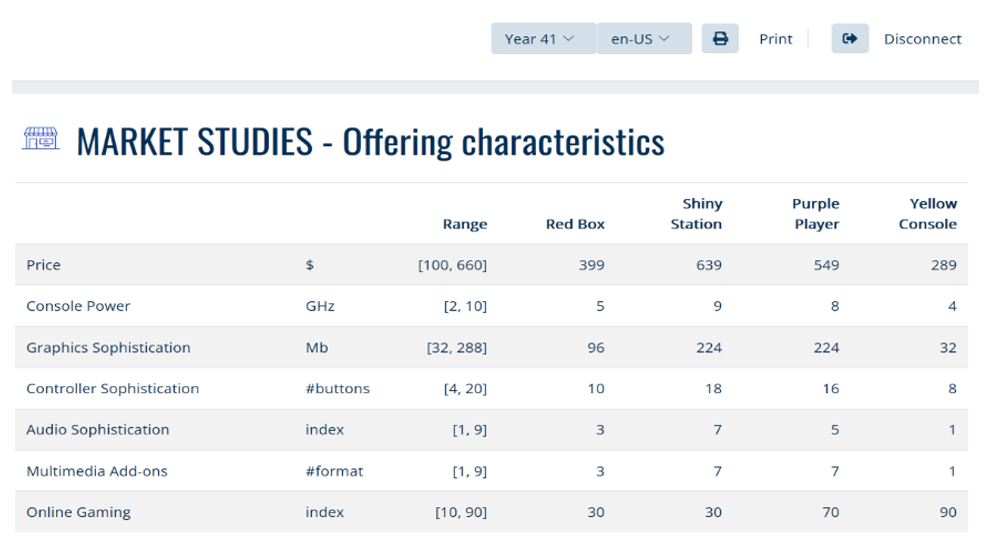

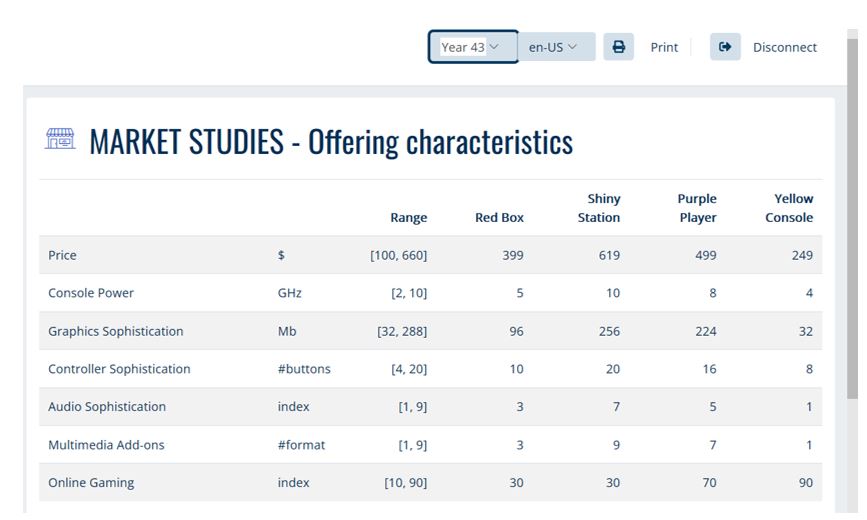

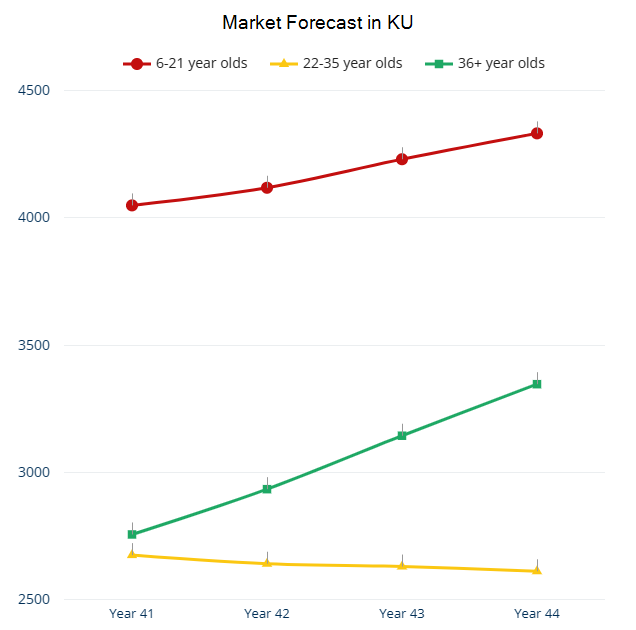

Hence, to understand more about the essential characteristics that need to be part of our product, we tried to track the shiny station’s features, as they have the largest market share for the group age we planned to target. This allowed us to point out the characteristics and features we need to include in our product, as shown in Figure 2.

In addition, for this red round, our strategy focused on increasing the attributes that 36+-year-old people value, as we will target them. Thus, we plan not to reduce many characteristics in the product since the option of creating and eliminating new characteristics was not enabled for the current (red round).

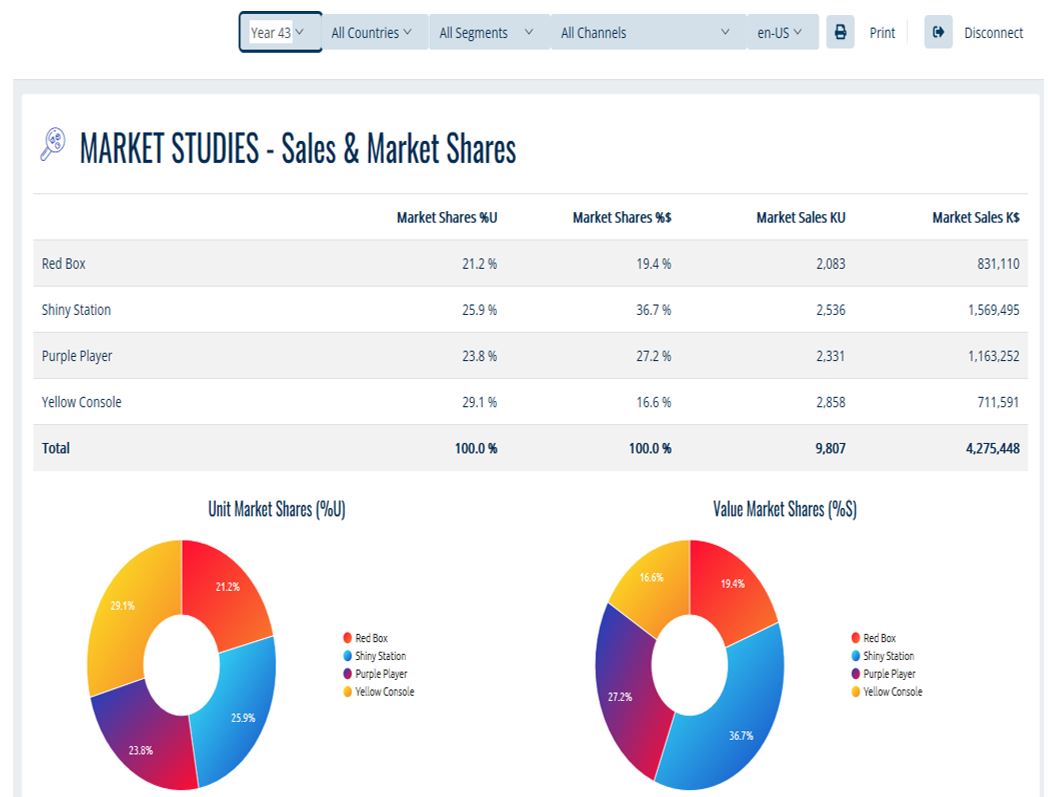

Furthermore, we have analyzed the offering characteristics of the product starting from year 41 and finishing with year 43. The testing has shown that some products’ prices have decreased, but their general characteristics have improved. We chose year 41 for the benchmarking because it became easier to calculate the beginning annual report to make further comparisons. The information included such indices as market share in two currencies: revenue and EBIT.

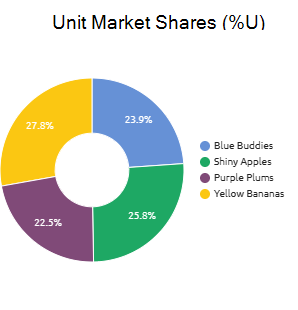

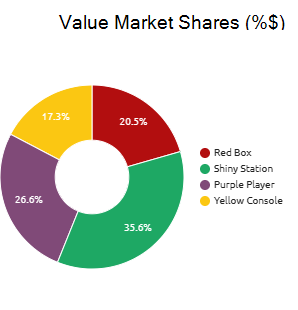

We chose to sell fruits to make it easier to understand how the estimations are made in real life. Table 1 shows that the market share for apples stays high over time, and this fruit is in high demand. Excel tools helped us make a round graph (Figure 3) from Table 1 to see the share of every analyzed fruit. We have conducted the same analyses for years 42 and 43 to visually represent the main changes.

Table 1. Market share for every fruit

We have calculated the percentage of interest to ensure that the products are targeted according to the customers’ needs and wants. Clients’ preferences play a significant role in developing successful products and the right distribution (Roggeveen & Sethuraman, 2020). The results in year 41, year 42, and year 43 did not show a massive difference in the interest from diverse age groups, and while people from 6 to 21 years old like the yellow console more, those from 22 to 35 years old prefer the purple player. Moreover, people who are 36+ years old stay with the shiny station. Interestingly, customer interest has been growing every year.

Results

Year 41 – Red Round

For this year, we stuck to the characteristics offered by the other competitors in the market, as shown in Figure 4. This made us decide to reduce the number of consoles since there has been a drastic fall in the market regarding this feature; it seems that consumers are not interested in it. However, looking at the high demand in the market, we raised the following features: graphic sophistication, online gaming, controller sophistication, and price to please the customers of our target group and compete with our competitors.

Year 42 – Red Round

As this round restricted the options of eliminating and creating any features, the offered characteristics for Year 42 were rising graphic sophistication to aim a steady rise to reach the highest level at Year 43, price to indicate the increase in the number of characteristics, and quality of online support to be the finest in the market. However, we reduced some of the characteristics, such as online gaming and the number of consoles used, because of the decreased demand in the market. Our product delivers the best value that targets the age group of 36+. Figure 5 included all the characteristics of the market offering in Year 42.

Year 43 – Red Round

As it was the final year in the red round before entering the blue round, we decided to raise the price to reflect our product’s outstanding characteristics. In addition, by increasing the graphics sophistication and quality of online support, we can match our competitors and provide the highest value to our customers. Figure 6 mentions all the characteristics offered by the competitors in year 43.

We produced a similar graph for the red box, shiny station, purple player, and yellow console using Excel’s visual tool. Figure 7 shows that the share of the shiny station is higher in dollars compared to other currencies. In general, the market share of the red ocean strategy stays more elevated in the BOSS annual report, and it is vital to understand the company’s score to evaluate future performance and risks.

Discussion

Estimating the company’s future work is a crucial part of our research. With future predictions, making serious decisions and strategic plans becomes easier. Additionally, it helps mitigate risks and apply relevant solutions to problems in the early stages. The resources can also be easily allocated to understand what products are missing or should be improved. Graph 1 shows a massive gap between age groups, which may not be suitable for the business.

It is vital to maintain the interest of all target audience members, but in this case, only people aged 6 to 21 receive many benefits. Nevertheless, the statistics in the following years, 42 and 43, state that the problem is being solved, and the gap is becoming smaller, as shown in Graph 2.

Our strategy aimed to raise the characteristics ideal for the age group 36+ and follow the shiny station strategies as they have the maximum market shares. Since we did not want to be below the other console, we have not reduced many characteristics of the red round. We recognized that not only the 36+ age group will purchase our product, but also that other age groups may be interested in purchasing this product. During 41 to 43 years, we steadily improved the characteristics that our target group appreciated, concluding the red rounds with a product less expensive than the two top-end products aimed at those over 36: the shiny station and the purple player.

Finally, our team decided to manage our budget evenly so we did not spend more or less. In the years that we spent on a corporate budget, we did not raise many characteristics, and in the years that we spent a lot of budget on R&D, we did not spend on any corporate project to keep the budget in balance. For instance, in year 41, when we raised some of the characteristics, we did not invest in any corporate project. Moreover, we managed our expenditure by distributing it evenly over the years, by spending a huge budget. In this round, all our decisions were considered for the upcoming years, not only in the red round, but we were also trying to forecast the blue round.

Summary

The lesson we learned during the analysis is related to the increased production of new goods sold for a lower price. We should consider changing the pricing strategy to generate more revenue and ensure no negative indicators in the cash flow statement. Furthermore, we found out that the age gap is massive, and it causes most of the problems with sales and market shares. It is crucial to pay attention to the needs and wants of existing and potential customers to find the right selling and production strategy.

Reference

Roggeveen, A. L., & Sethuraman, R. (2020). Customer-interfacing retail technologies in 2020 & beyond: An integrative framework and research directions. Journal of Retailing, 96(3), 299-309. Web.