Executive Summary

Bridgeton Industries’ cost position has deteriorated over the years due basically from external environment because of increased competition and from internal environment as a result of management’s decision to write down some assets from the books ahead of the expiration of their expected life. The increased competition included those from foreign sources in production particularly from Japan.

The increase in the number of competitors resulted in more players and therefore lower prices for the products in the industry. Lower price means higher cost in relation to price and therefore less profitability for the players of the industry including Bridgeton.

Another external factor was the oil crisis in the 1970’s. The crisis has affected much of the industry since the crisis means increased gas or oil prices and therefore lower demand for cars. This is based on the economic theory for complimentary products where an increase in the price of oil would mean fewer people who will drive new cars. Thus, competition was heightened causing less production contracts for car parts.

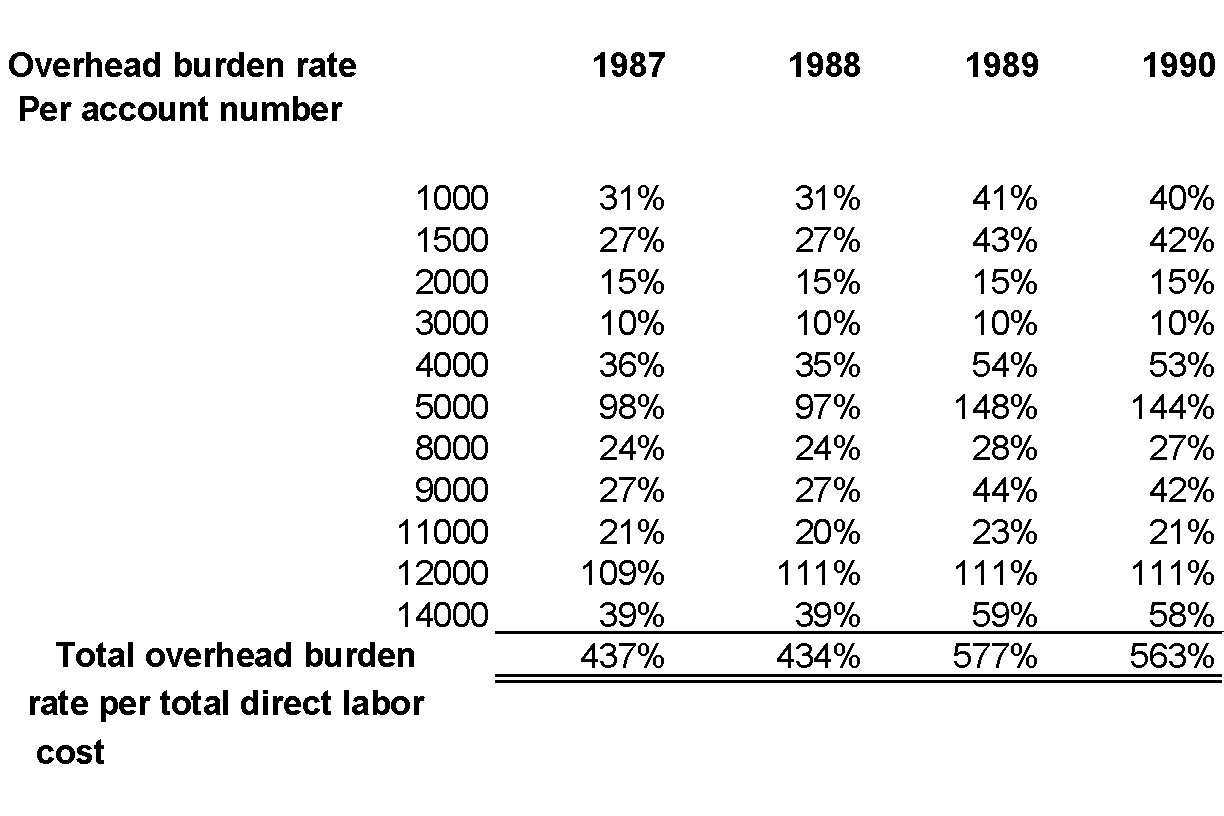

Computed overhead burden rate for each of the model years 1987, 1988, 1989, and 1990 was used as a basis as the most reasonable factor that influenced a change in factory overhead in relation to direct labor cost as other factors of production. It is desirable to have a correct overburden rate for the purpose of costing the products in relation to competition since any error would result in either overpricing or underpricing of the resulting product that may cause erroneous decisions for the company.

Overhead costs as categorized in Exhibit 3 are reviewed for their behavior if a decision is taken to outsource manifold manufacturing. Classifications were made whether some costs are relevant to the outsourcing decision. Relevant costs refer to variable costs and they should be considered to be eliminated or adjusted if the decision to outsource manifold is made.

However, some costs are fixed costs and they will still be incurred even if the outsourcing of manifold is done or not. The result of this finding is evident in the prepared estimated model budget for the 1991 model year, assuming that no additional products are dropped and assuming that manifolds are dropped using suitable assumptions. It was necessary to change some of the assumptions as used by the consultant as there is a need only to emphasize the importance of relevant costs that must vary in case a product is dropped or outsourced.

To recommend outsourcing for manifold manufacturing in 1991 is not proper because of a net advantage of manufacturing the same instead of allowing an outsider to do it. Comparing the competitive cost position of the company in relation to competitors may be ideal. However, it is still necessary to consider whether the continued operation would still be more advantageous to the company by comparing the total variable costs with the expected revenues that may be had from the sale of the manifold. Forcing the company immediately to be operating just like those in Japan may not be necessarily good because a positive contribution margin could still be realized if manifold manufacturing is not outsourced justified in 1991.

Introduction

This paper seeks to clarify why the cost position of Bridgeton Industries has evolved as it has by taking into account the situation externally as well as within the company itself. In addition, this will calculate the overhead burden rate for each of the model years 1987, 1988, 1989, and 1990 for the company and review the overhead costs categorized in Exhibit 3 to assess how they will behave if a decision is taken to outsource manifold manufacturing.

Furthermore, the paper will prepare, with suitable assumptions, an estimated model budget for the 1991 model year, assuming that no additional products are dropped and assuming that manifolds are dropped. Before the final conclusion, this paper will also recommend, with justifications, whether manifold manufacturing should be outsourced in 1991.

Analysis and Discussion

Company’s Cost Position

The cost position of the company has in fact evolved by declining over the years because of the different factors that drove the cost of production to become high. One factor is that prior to the decline in cost position, all of the ACF’s production of Bridgeton Industries was sold to Big-Three domestic automobile manufacturers and that competition was primarily from local suppliers and other Bridgeton plants.

The conditions required to sustain the company’s position then included the continued growth and domination by the U.S. automobile manufacturers. But such could not hold longer because market forces had driven customers to seek the better value of their money and this meant wider selection from more choices.

Foreign competition particularly from the Japanese came as a result to provide more choices. This development necessarily affected the supply and demand for car engines since instead of serving mainly the US big three manufacturers, other products from other countries were allowed to join the market. The decreased supply of gasoline as a result of the oil crisis in the 1980s also contributed to the loss of market share as the scarcity of the supply of gasoline has also driven prices up. Higher prices necessarily contributed to the loss of market for the company since foreign cars were selling at lower prices.

The company’s plant original plant site called ACF necessary found itself competing with lower production contracts. The yearly periods covering the 1980s were marked with a cutback in its production has caused greater competition except at the latter part starting on September 1, 1989, when the model year 1990 caught management’s attention as the ACF could still be considered critical to company success.

The decline in the company’s cost position may be asserted to have suffered much in 1985 when the effects of domestic loss of market share were strongly felt after the company failed to sell more diesel-powered cars when expected growth in the market did not materialize. The company had actually built two plants to manufacture fuel-efficient diesel engines in anticipation as a reaction to the first oil crunch in the mid-1970s. The loss of market share, therefore, caused the shutdown of one of the engine plant operations in the ACF.

The combined events triggered the need to have special studies about the relative costs of the two plants, and the ACF’s facility was the one selected for closing. After having been informed that the ACF facility’s cost position was not competitive, production workers responded to reduce the production cost within a few differences of the competing benchmark for cost yet management still decided to close the facility.

Although ACF’s engine plant was closed in 1986 model year, with the elimination of all the related production jobs, the company retained tradespeople with unique skills that were needed in other plant areas that were allowed to continue operating. This had resulted in a sudden increase in cost that in turn had magnified the level of depreciation because of the decision to write down and take off from the books the cost of the physical machinery, equipment, and building. The effect of these write down is to close the unamortized assets cost balances to expense, thus it surely has affected the cost position of the company then compared with other years.

Not surprisingly because of sudden cost the company hired consultants to analyze the company’s product cost for the purpose of classifying products by degree of cost competitiveness. Class I is allotted for world-class products as they have costs equal to or lower than competitors’ manufacturing costs and these products would be retained as they are considered competitive.

Class II is for those products that have the potential to become world-class or have costs 5% to 15% higher than those of competitors’ costs and which were required to be watched for deterioration or improvement. Class III is for products that have cost more than 15% higher than the major competitor and would be considered for outsourcing. And so the consultant classified fuel thanks as belonging to Class I; manifolds, front and rear doors as Class II, and Muffler-exhaust system and oil pans as Class III.

It could therefore be asserted that the deterioration in cost position was caused externally by increased competition and internally by management’s decision to write off unamortized cost ahead of the expected life of the assets and a result to management’s decision as advised by a consultant to classify the cost in relation to competitors and considering those that are higher than competitors to be not competitive.

The Overhead Burden Rate for the Model Years 1987, 1988, 1989, and 1990

The overhead burden rates for each of the model years 1987, 1988, 1989, and 1990 are computed as a percentage of total direct labor cost and the results are shown in Table A below. The overhead burden rate may consist of variable and fixed costs as will be explained in the next subsection 2.3 but using the basis of preparation of overhead as shown in Exhibit 2 of the case facts, it can only be inferred that all overhead costs were assumed variable costs.

The Overhead Costs Categorized in Exhibit 3 and Their Behave

Each of the overhead costs categorized in Exhibit 3 will behave separately if a decision to outsource manifold manufacturing happens. Costs could either be variable or fixed. Variable costs are therefore those that will vary and are considered relevant if outsourcing is pursued. Fixed do not change and they will still be incurred whether the decision to outsource is pursued or not.

Some of the company’s overhead is variable overhead costs as their share in manifold manufacturing will be eliminated if outsourcing of the same is pursued. First to consider as variable cost is Account number 1000 for wages and benefits of non-skilled personnel such as janitors and truck drivers since it may be eliminated when manifold manufacturing is outsourced.

Second is Account 1500 for all plant salaried personnel expenses, including benefits, except industrial engineers included in account number 11000 which will be eliminated since such cost will also be eliminated in case of outsourcing. Other variable costs are Account number 20000 for production suppliers such as gloves, safety goggles, and packing material; Account number 4000 for all purchased utilities, including coal and compressed gas and Account number 5000 for wages for non-production employees with specialized skill classification used for plant maintenance and rearrangement where the benefits associated with these wages are in class 14000 below.

Still considered relevant costs that would change in relation to outsourcing include Account number 12000 for benefits overtime premium hourly workers, including COLA, state unemployment, and pension, and Account number 14000 for benefits for skilled hourly workers similar to those production workers. The basis for classifying the above overhead costs as variable costs is on the nature of these costs since outsourcing manifold will result in not incurring them.

The following are considered the fixed costs and will be expected to remain whether or not outsourcing is pursued: Account number 3000 for small wearing tools such as grinding wheels, hammers, and screwdrivers; Account number 8000 for depreciation on a straight-line basis and proper taxes; Account number 9000 for various relatively constant personnel-related expenses, including items such as training, travel and union representation; and Account number 11000 for project expense for one-time and some rearrangement of new equipment and machinery. The basis for classifying the above overhead costs as fixed costs are on the nature of these costs since outsourcing manifold will result to still incurring them.

Model Budget for the 1991 Model Year

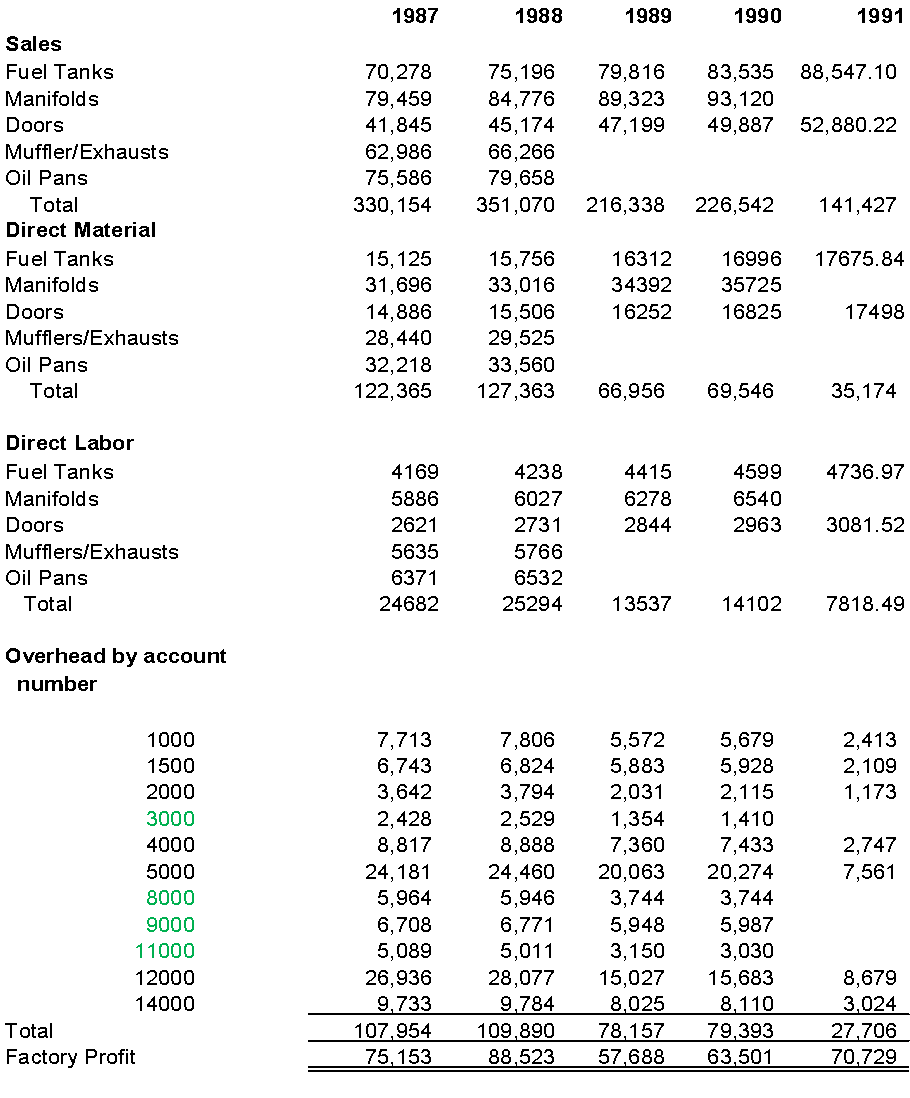

The estimated budget model for the 1991 model year will appear as shown in Table B below, assuming that no additional products are dropped and that manifolds are dropped.

Sales revenues and various expenses are expected in relation to average changes for the years 1988 through 1990. Thus 1991 revenues for those not to be dropped are expected to increase by 6% for both fuel tanks and doors. The related direct materials of the remaining products are also expected to increase in 1991 from 1990 using the average for the last three years from 1988 through 1990 at 4% for both fuel tanks and doors. For direct labor, an increase of 3% is expected in 1991 for fuel tanks and for 4% in the case of doors.

Given the changes that would be effected in the treatment of other overhead costs as compared to what was previously done for model years 1987 through 1990, the following overhead costs are considered variable costs and they are the only cost that should vary with direct labor cost as the base: Account number 1000, Account 1500, Account number 20000, Account number 4000, Account number 12000 and Account number 14000. Thus only these variable costs will change in relation to the decision to outsource manifold in the model year 1991.

The computed variable overhead costs used the ratio of each overhead item to the total direct labor cost in 2008. As the total direct labor costs decrease because of outsourcing so is the resulting variable overhead costs. The rest of the overhead costs are expected to be fixed and therefore the 1988 model figures are carried over in 1991. See Table B below. These fixed overhead costs include Account number 3000, Account number 8000, Account number 9000, and Account number 11000 which are colored green in Table B below.

Recommendation

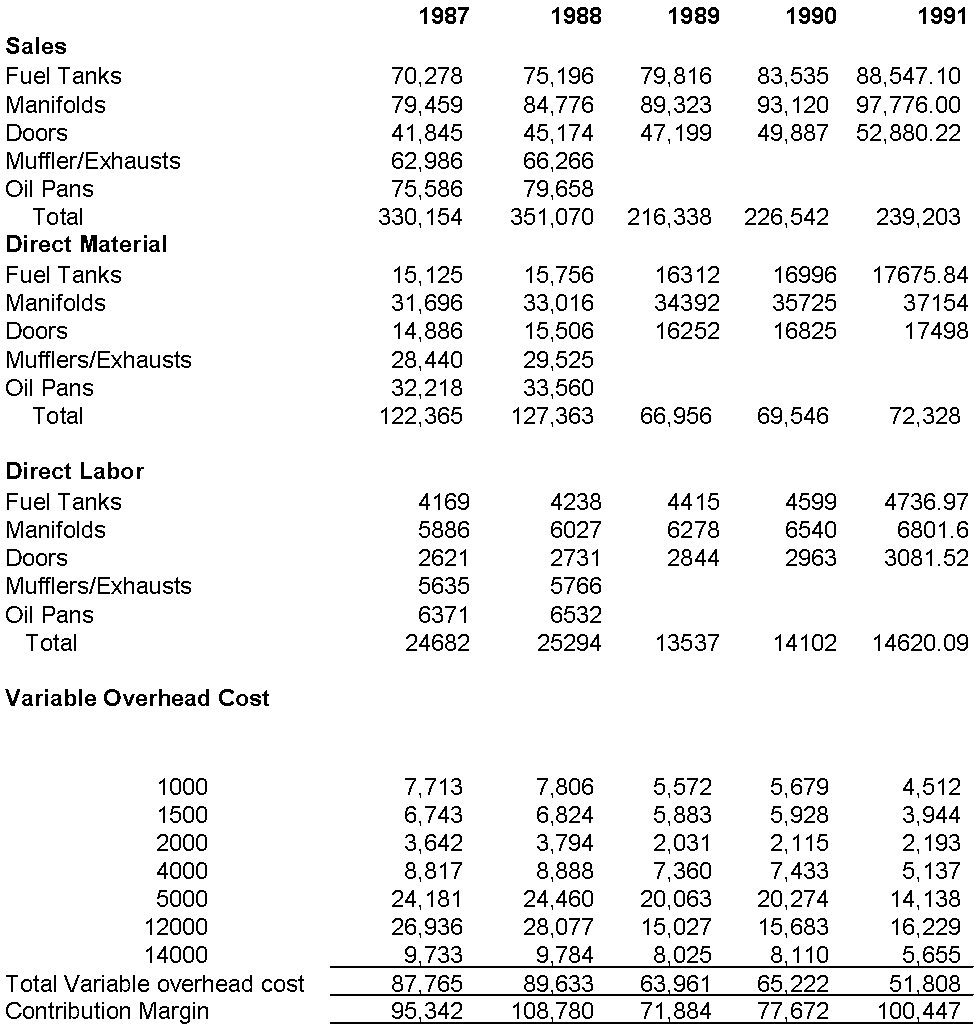

This paper does not recommend outsourcing of manifold manufacturing in 1991 because there is still a net advantage of manufacturing the same instead of allowing an outsider to do it. Although there is a need to compare the competitive cost position of the company in relation to Japanese and other competitors, it is still necessary to consider whether the continued operation would still be more advantageous to Bridgeton Industries by comparing its total variable costs with the expected revenues that may be had from the sale of the manifold.

As found, there is still a positive contribution margin that will have to be realized if manifold manufacturing is not outsourced. The expected revenues for 1991 are however assumed to continue from the 1990 level and that company will maintain the same market share as in 1990.

It is to be noted that the previous outsourcing of Class III products has done well for the company. Case facts provide that at the end of the 1988 model year, oil pans and muffler-exhaust systems were outsourced by the company from the ACF which resulted in a loss of 60 direct labor (production) jobs and 30 indirect (skilled) jobs.

The union of the company was very concerned with the loss of the jobs caused by outsourcing so that the 90 affected people were transferred to a retraining job pool, which was administered and paid by the union. Case facts provide that the job pool cost was not part of plant burden costs since there was no cash outlay from the company. But the fact that the union did show concern for its employees must be something that is worth looking into by the company. It is said that problems create opportunities and so the management and union were challenged to increase productivity.

It is therefore provided per case facts that the second cutback has caused plant management and labor to move toward more cooperation and openness in efforts to retain the remaining business including the introduction of several programs to improve product quality and increase productivity which may be considered to have helped improve the cost position of the company in relation to competitors. Thus case facts revealed the power of management and workers cooperating with each other as both sides worked toward creative solutions to meet these challenges.

Productivity therefore improved when ACT required time change dies improved from 12 hours to 90 minutes, making the record the best in Bridgeton. However, the speed in changing dies was still below the record made by the Japanese at approximately 10 minutes for special plant lay-outs. Another productivity progress as a result of the events happened when the company was also able to improve uptime as a measurement of productivity from an average of 30% to 65%, making the best record in Bridgeton but still lower than the “world-class” record posted again by the Japanese at 80% uptime.

Management however appeared unperturbed by the improvements since such great efforts have not broken the record set by the Japanese. This, therefore, resulted to further designation manifolds being downgraded to Class III and making it a candidate for outsourcing.

However, for the failure of ACF to improve up to the level of the competitors’ cost position despite what has been done by management and the union, Class II products were further downgraded to Class III for possible outsourcing.

Given this positive and negative information about the past experience of outsourcing, there is still a need to decide whether indeed outsourcing for manifold is justified. As found in Table C below, there is reason to retain the manifold production because there is the net advantage of producing the same assuming the company could maintain the average increase or change in revenues and in the level of direct materials, direct labor in relation to expenses and level of overhead costs in relation to total direct labor. Moreover higher factory profit comes when Table C is compared with Table B wherein the latter manifold is assumed to be outsourced.

The case facts also mentioned the possibility of increased emission standards that would require new vehicles fitted with lighter-weight, more efficient manifolds. Management estimated that if such an expected event happened, there would be an expected increase in the demand for stainless steel manifolds such as those manufactured at the ACF. This could therefore still increase forecasted revenues and profits even higher than forecasted in the prepared budget for 1991.

Indeed Mr. Lewis was right in his reaction that the company cost position is still competitive so that there be should be a good reason not to outsource manifold production.

Conclusion

This paper found that why the company’s cost position has declined as it has evolved after taking account of the situation externally as well as within the company itself. In other words, its cost position became less competitive over the years due to different factors. One factor is the increased competition from foreign sources in production, particularly from Japan. More competitors could mean more players and therefore lower prices for the products in the industry. The lower price could mean a higher cost in relation to price and therefore less profitability.

Other factors included the oil crisis in the 1970s which has affected much of the industry since the increase in gas or oil would lower demand for cars as the increase in the price of oil would mean fewer people who will drive new cars. Heightened competition thereby had driven down the cost position of the company in relation to competitors.

Computation was made for overhead burden rate for each of the model years 1987, 1988, 1989, and 1990 using as a basis the most reasonable factor that would cause a change in factory overhead for the purpose of costing the products in relation to the competition. This paper has also reviewed the overhead costs categorized in Exhibit 3 and the behavior of each if a decision is taken to outsource manifold manufacturing. Some of the costs are variable and hence they should be considered as relevant in making the decision to outsource manifold and therefore they will be eliminated. However, some costs are fixed costs and they will still be incurred even if the outsourcing of manifold is done.

This paper has also prepared an estimated model budget for the 1991 model year, assuming that no additional products are dropped and assuming that manifolds are dropped using suitable assumptions. It was necessary to change some of the assumptions as used by the consultant as there is a need only to emphasize the importance of relevant costs.

Finally, outsourcing manifold manufacturing in 1991 is not being recommended because there is still a net advantage of manufacturing the same instead of allowing an outsider to do it. Although there is a need to compare the competitive cost position of the company in relation to competitors, it is still necessary to consider whether the continued operation would still be more favorable to the government by comparing the total variable costs with the expected revenues that may be had from the sale of the manifold.

As found, there is still a positive contribution margin that would have to be realized if manifold manufacturing is not outsourced. The expected revenues for 1991 are however assumed to continue from the 1990 level and that company will maintain the same market share as in 1990.

References

Case Study – Bridgeton Industries