Introduction

Organisations are expected to promote corporate social responsibility (CSR) to reflect their focus on the interests of society. The Football Association of Ireland (FAI) was organised in 1921, and its CSR policy was updated seven years ago, in 2013 (FAI, 2016). This aspect indicates the necessity of revising the CSR strategy of the FAI, and the purpose of this report is to critique the relationship between business and the FAI’s social responsibility performance and to examine the link between CSR and financial performance.

Relationships between Business and Social Responsibility

The FAI’s Sustainability and Goals

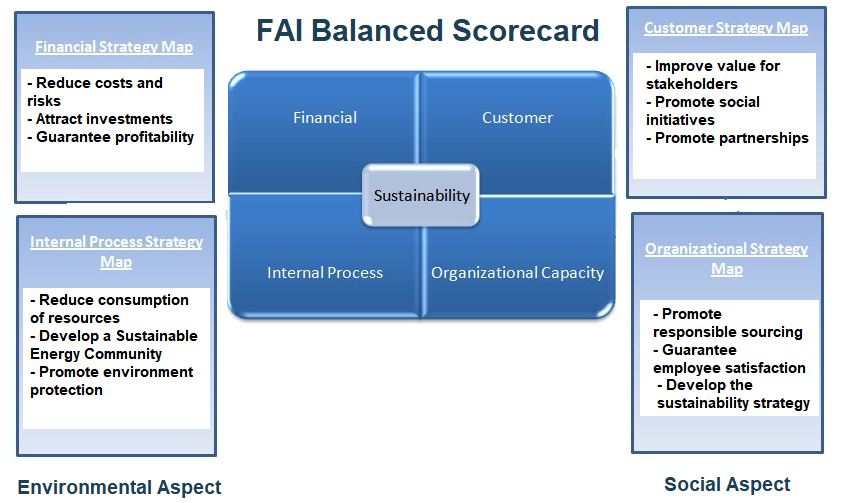

CSR should be viewed as a specific business approach associated with adding the sustainable growth of an organisation to its specific strategic business model. This approach involves a variety of social, economic, and environmental issues (Wang and Sarkis, 2017). The FAI’s sustainability development and goals can be represented with the help of its balanced scorecard which is created referring to the information from the organisation’s reports (Figure 1). This sustainability balanced scorecard demonstrates the priorities of the FAI regarding the key four aspects (financial, customer, internal processes, and organisational capacity), and additional environmental and social aspects are added to reflect the organisation’s focus on sustainability (Hansen and Schaltegger, 2016). These aspects are also correlated with the four pillars of CSR: ethical, legal, economic, and philanthropic ones.

In the context of finances, the FAI sets the following goals: to reduce costs and financial risks for the organisation and to guarantee its profitability. It is recommended to add the goal of attracting more investments from the partners to be able to address the community’s needs and the company’s financial crisis (Horgan-Jones and Malone, 2019). As the FAI’s CSR policy is based on addressing Community, Responsible Sourcing, Environment, and Our People, these areas are also reflected in the organisation’s sustainability goals (FAI, 2016). The goals are to improve the value for stakeholders while continuing to address disabled people, ethnic and cultural minorities, act against racism and promote such social initiatives as grassroots and educational programmes (Late Night Leagues, Kick Start, and the Football for All) (Governance review group report for the FAI Board and Sport Ireland, 2019). The goal formulated for the revised version of the CSR policy is to promote further partnerships with the Union of European Football Associations (UEFA), the Fédération Internationale de Football Association (FIFA) and the United Nations Children’s Fund is a United Nations (UNICEF).

Internal process and environmental goals require most revision as they are ineffectively formulated in the current version. It is necessary to reduce the consumption of resources and the carbon footprint, as well as improve waste management (Hill, 2020). The change will be observed with focusing on the Sustainable Energy Community and organising green garden and green school programmes (Heaslip, Costello and Lohan, 2016). The most effectively formulated goals are related to employees (responsible sourcing and the focus on Our People) (FAI, 2016). The goals include guaranteeing employee satisfaction through applying non-discriminatory, ethical, safety-oriented and flexibility-oriented policies.

Stakeholder Engagement

It is important to note that the business activities of the FAI directly depend on different levels of stakeholder engagement that guarantees the realisation of the organisation’s social responsibility performance. Strong relations with stakeholders are critical for sports organisations, and the FAI works to promote different social initiatives and programmes to ensure stakeholders’ engagement in the organisation’s struggle with racism or promotion of diversity or a healthy lifestyle (Foley, 2019). In the literature on stakeholder theories and sustainability, it is stated that effective stakeholder engagement is essential for aligning business processes, the organisation’s performance and stakeholders’ interests (Martinez, Peattie and Vazquez‐Brust, 2019). Collaboration and partnerships with local stakeholders are important to contribute to making organisations like the FAI more socially responsible and transparent, being sensitive to community representatives’ needs (Aras, 2016; Wang and Sarkis, 2017).

However, it is necessary to state that for the FAI, the current level of stakeholder engagement is not the most efficient one, and more attention should be paid to organising business processes and performance for the purpose of developing the relationship between the FAI, Club, and society to contribute to the community. The focus on partnerships is an effective strategy in this context, but these partnerships need to be expanded to involve more stakeholders (Foley, 2019). Furthermore, it is also important to guarantee that the highest level of stakeholder engagement can be achieved by providing the community with the opportunity to participate in decision-making (Hill, 2020; Martinez, Peattie and Vazquez‐Brust, 2019). The current approach to the collaboration of the FAI with community schools needs to be revised to ensure that the FAI promotes green initiatives and contributes to training and educating the youth, supporting their health and well-being.

Socially Responsible Investment in the FAI

Socially responsible investing (SRI) is associated with contributing to organisations or business processes that allows for receiving not only financial benefits but also social and environmental ones. While perceiving customers as potential socially responsible investors, it is important to note that they usually choose to promote practices and procedures that guarantee social benefits for the community, employee safety, the protection of human rights, the protection of the environment, and the promotion of diversity in the organisation (Demirbag et al., 2017). From this perspective, in spite of some weaknesses in the CSR strategy of the FAI, this organisation can be regarded as potentially attractive to customers as socially responsible investors.

Customers and other stakeholders will invest in the FAI because of its orientation towards the key components of the CSR policy: Community, Responsible Sourcing, Environment, and Our People. If customers will invest in the FAI, they will add to the development of their community and support the protection of the environment, as well as the people progress (FAI, 2016). In this case, such investing can be regarded as socially responsible and ethical. Focusing more on the major aspects of the FAI’s CSR policy, it is important to note that the organisation contributes to the community via the promotion of FAI schools, Late Night League, the FAI/HSE Kickstart 2 Recovery Mental Health programme, and the Football for All programme (FAI, 2016; Governance review group report for the FAI Board and Sport Ireland, 2019). These programmes, charitable partnerships, and the cooperation with the John Giles Foundation lead to addressing the most urgent social issues affecting the community, and more investment is required to support this area.

The focus on responsible sourcing is also attractive because working hours are standardised, employees are not discriminated, and competitive wages are paid. These approaches contribute to creating effective workplaces in the community (Aras, 2016). The focus is on the idea of supporting Our People that is associated with guaranteeing that all employees and Club members are treated equally and effectively (Foley, 2019). Furthermore, the focus on protecting the environment and minimising energy consumption and waste are also discussed by potential investors as important areas for supporting.

Attracting Capital Markets to the FAI

Capital markets unite stock and credit markets, as well as any equities and organisations that can impact the financial position of an organisation like the FAI. Before selecting the company for investing, capital markets focus on assessing the CSR and sustainability goals and progress of the firm (Kim, 2019). The following features can be regarded as effective for attracting capital markets: effective strategic goals and procedures to achieve them, a strong CSR policy, the focus on sustainability covering social, economic, and environmental needs, stable partnerships guaranteeing the organisation’s profitability (Hill, 2020; Wang and Sarkis, 2017). While evaluating the current state of the FAI in the context of its attractiveness to capital markets, it is possible to state that the FAI is not attractive enough presently.

Today, the FAI’s financial performance is not efficient, and the CSR policy is not developed successfully to address stakeholders’ interests (Horgan-Jones and Malone, 2019). To be able to attract capital markets to the FAI, the organisation needs to concentrate on completing the following goals and tasks. The first goal is to develop partnerships with different types of social and football organisations to improve its financial situation (Foley, 2019; Martinez, Peattie and Vazquez‐Brust, 2019). The second goal is to promote partnerships in the context of community programmes (green schools, League of Ireland (LOI) clubs in association with the Sustainable Energy Authority of Ireland (SEAI).

The third goal is to gain funding with the help of focusing on the Sustainable Energy Community (SEC) scheme and system. Furthermore, the final goal and action to take is to revise and improve the CSR policy (Governance review group report for the FAI Board and Sport Ireland, 2019). These steps are important to ensure that investors will feel comfortable cooperating with the FAI. The problem is that the current financial crisis observed in the FAI prevents sponsors from discussing the FAI as a partner (Horgan-Jones and Malone, 2019). Therefore, the FAI needs to declare its honesty, transparency, and sustainability to overcome this crisis.

CSR and Financial Performance

ESG Criteria

In the context of SRI and capital markets’ interests in certain organisations, companies’ performance and the potential for investing in their business are assessed according to environmental, social and governance (ESG) criteria (Jagannathan, Ravikumar, and Sammon 2017). These ESG criteria are used as specific standards and measures in order to be able to evaluate the quality of an organisation’s strategies and operations (Muñoz‐Torres et al., 2019). In the context of the FAI, specific ESG criteria can be determined that are used by investors to screen the FAI’s performance in the areas of addressing environmental, social and governance concerns.

Environmental criteria for the FAI include the assessment of the organisation’s use of different resources, including water and energy; the organisation’s approach to reducing environmental pollution, and waste management procedures. Furthermore, socially responsible investors are also interested in assessing the potential risks of the FAI’s operations for the environment in the context of assessing the Club’s and football activities for the environment (Governance review group report for the FAI Board and Sport Ireland, 2019; Muñoz‐Torres et al., 2019). Social criteria include the analysis of the organisation’s relationships with the community, employees, suppliers, and partners. It is important to guarantee that the organisation develops sustainable and positive business and cooperative relationships with stakeholders (FAI, 2016). Much attention is paid to assessing the following factors: a) charity; b) social initiatives, projects, and programmes; c) working conditions for community members; d) safety of employees and guarantees for them.

Governance criteria cover such areas as internal processes and controls, leadership, and addressing shareholders’ interests. In the context of the FAI, much attention should be paid to analysing how internal controls help to regulate ethical and effective relationships of the organisation with its stakeholders (Governance review group report for the FAI Board and Sport Ireland, 2019). Furthermore, the organisation’s leadership is also assessed in terms of addressing strategic goals and making the FAI profitable and stable, guaranteeing the long-term success for this organisation (Foley, 2019). For SRI, it is important to be sure that the organisation follows effective transparent methods of accounting, and their financial operations are accurate.

The reason for focusing on and discussing only some of the ESG criteria for the FAI is that not all of the criteria can be applied to all the types of companies. For the potential investors of the FAI, the primary interest and concern are in environmental and governance criteria (Jagannathan, Ravikumar, and Sammon, 2017). The organisation’s profitability, efficiency, and liquidity are the areas of concern today, and the FAI is focused on finding the ways of attracting more investments in order to finance its operations and the development of the Club (FAI, 2016). Effective governance plays a key role in this aspect, and it is also critical for supporting the realisation of a variety of social and environmental programmes that can contribute to stakeholder engagement (Muñoz‐Torres et al., 2019). Therefore, the determined ESG criteria should be discussed as most applicable to the case of the FAI.

Attaining ESG Criteria

The identified ESG criteria can be attained with the help of focusing on three paths: a) the development of partnerships within and outside the community, b) the development of the Sustainable Energy Community, and c) the promotion of the CSR policy and principles. The development of the FAI’s partnerships with the LOI clubs and the SEAI, and the promotion of the green schools programme (Healthy Ireland) are extremely important (Foley, 2019). The reason is that sports organisations are expected to contribute to the social development of the community, attracting more investments and resources to support the youth, their education, health, and development (Governance review group report for the FAI Board and Sport Ireland, 2019). The cooperation with the LOI and the SEAI is the possibility for the FAI to receive much support and investment to add to the development of communities because of accessing more capital markets through partnerships (FAI, 2016). The focus on strong and effective partnerships is the FAI’s key to financial stability and receiving enough resources for the further growth.

The attainment of the criteria associated with the environmental aspect is correlated with one of the FAI’s sustainability goals: the development of the Sustainable Energy Community, Being present in many cities of Ireland, the FAI should guarantee it effectively utilises resources, minimises waste and pollution, and controls energy consumption (Heaslip, Costello and Lohan, 2016). It is promising for the FAI to participate in projects associated with using alternative sources of energy, recycling, and completing energy audits (Hill, 2020). All these steps are necessary in order to make sure that the stadiums in different cities of Ireland are environmentally efficient and sustainable.

The promotion of the CSR policy and principles is associated with attaining the ESG criteria related to the social and governance spheres. The problem is that the current CSR policy of the FAI requires significant revisions to make it more clear and efficient from the perspective of stakeholders. In this context, it is important to guarantee that the FAI will involve its stakeholders in the decision-making process to cover their needs with the help of its activities (Foley, 2019). This action is essential to represent that the FAI is interested in addressing the needs of the community members. The promotion of the CSR policies and steps made by the FAI to address the community’s demands is also critical to accentuate the effectiveness and usefulness of the FAI for society (Martinez, Peattie and Vazquez‐Brust, 2019). The public needs to be informed regarding the FAI’s social contribution and its plans for further sustainable development. The key step on this path is the focus on supporting the children’s involvement in sports activities in Ireland with the help of the FAI’s clubs, teams, and initiatives for students.

Achieving Financial Investment from Stakeholders

For the FAI, macro-level stakeholders include the government and policy makers, multinational profit and non-profit organisations, UEFA, FIFA and UNICEF (FAI, 2016). Micro-level stakeholders include community organisations, suppliers, and other local leaders and organisations, the direct stakeholders of the FAI (Demirbag et al., 2017; Kim, 2019). As a result, the approaches to achieving financial investment from these two groups of stakeholders are different because these companies are interested in dissimilar levels of cooperation and promotion in the community.

In order to gain financial support from macro-level organisations, it is necessary for the FAI to ensure that the firm has formulated business goals in correlation with sustainability goals, these aspects are reflected in the revised CSR policy, and certain steps for the realisation of this policy are implemented. The FAI should demonstrate that its sustainability principles, the orientation towards the environment protection, and the support for children and youth are correlated with the goals of international organisations (Foley, 2019). In this context, certain changes in the area of the FAI’s leadership are also expected to ensure that the organisation will follow a strict and effective strategy for its socially responsible development (Wang and Sarkis, 2017). The key focus should also be on the value creation in order to demonstrate for potential partners and investors that the FAI collaborates with charity organisations and foundations and implements various education, youth sports and health initiatives.

The strategy to achieve the financial support of local organisations or micro-level stakeholders is related to generate investments and receive funding while supporting the nation-wide social and environmental initiatives. The shift of the FAI’s attention to promoting football and sports philosophies among children with the help of programmes for children will attract the resources of companies that support educational and child-oriented projects in the community (Governance review group report for the FAI Board and Sport Ireland, 2019). Furthermore, it is also necessary to accentuate the FAI’s position regarding diminishing negative effects on the environment by adopting SEC plan and principles for the realisation in the organisation (FAI, 2016).

These steps are necessary to make sure that the FAI operates to respond to the expectations of the community, and any financed activities with contribute to the development of a healthy nation with reference to supporting children’s interests in sports. The currently applied CSR policy of the FAI cannot contribute to strengthening its image among the public and potential sponsors because of the company’s partnership with SportPesa (SportPesa announced as new FAI partner, 2019). These aspects need to be taken into account when formulating an effective strategy for attracting investment from micro-level stakeholders.

Conclusion

The main purpose of this report was to analyse the relationship between business and the FAI’s social responsibility performance as well as to discuss the link between CSR and financial performance. The results of the analysis indicate that the FAI needs the revision of the currently followed CSR strategy and policy that are rather ineffective to address the organisation’s financial and social, as well as environmental, goals. The implementation of the revised CSR policy will lead to attracting more finances to support the FAI’s activities with the help of stakeholders’ resources.

Reference List

Aras, G. (2016) A handbook of corporate governance and social responsibility. London: CRC Press.

Demirbag, M. et al. (2017) ‘Varieties of CSR: Institutions and socially responsible behaviour’, International Business Review, 26(6), pp.1064-1074.

FAI (2016) Strategic plan 2016-2020. Web.

Foley, K. (2019) FAI review and analysis of football in Ireland: strategic, commercial, operational and governance review of football in Ireland. Web.

Governance review group report for the FAI Board and Sport Ireland (2019). Web.

Hansen, E.G. and Schaltegger, S. (2016) ‘The sustainability balanced scorecard: A systematic review of architectures’, Journal of Business Ethics, 133(2), pp.193-221.

Heaslip, E., Costello, G.J. and Lohan, J. (2016) ‘Assessing good-practice frameworks for the development of sustainable energy communities in Europe: Lessons from Denmark and Ireland’, Journal of Sustainable Development of Energy, Water and Environment Systems, 4(3), pp.307-319.

Hill, J. (2020) Environmental, Social, and Governance (ESG) investing: A balanced analysis of the theory and practice of a sustainable portfolio. London: Academic Press.

Horgan-Jones, J. and Malone, E. (2019) ‘FAI to publish new financial results with details of Delaney’s exit package’, The Irish Times, 2 December. Web.

Jagannathan, R., Ravikumar, A. and Sammon, M. (2017) Environmental, social, and governance criteria: why investors are paying attention. London: National Bureau of Economic Research.

Kim, C.S. (2019) ‘Can socially responsible investments be compatible with financial performance? A meta‐analysis’, Asia‐Pacific Journal of Financial Studies, 48(1), pp.30-64.

Martinez, F., Peattie, K. and Vazquez‐Brust, D. (2019) ‘Beyond win–win: A syncretic theory on corporate stakeholder engagement in sustainable development’, Business Strategy and the Environment, 28(5), pp.896-908.

Muñoz‐Torres, M.J. et al. (2019) ‘Can environmental, social, and governance rating agencies favor business models that promote a more sustainable development?’, Corporate Social Responsibility and Environmental Management, 26(2), pp.439-452.

SportPesa announced as new FAI partner (2019) Web.

Wang, Z. and Sarkis, J. (2017) Corporate social responsibility governance, outcomes, and financial performance. Journal of Cleaner Production, 162, pp.1607-1616.