Abstract

This report aims to provide a reflection on a Business Strategy Game (BSG) that occurred among students during the previous semester. First, we will examine the major decisions made over the years during the simulation game, the reasons behind them, and the outcomes of these choices. The second part will examine some theoretical frameworks applicable to the BSG, and the final part will focus on some of the emerging technologies the company can adopt.

Introduction

The Business Strategy Game (BSG) is an engaging approach to understanding the major business decisions made in organizations and how numerous external and internal variables often influence these choices. The BSG virtual game enables students to test various decisions and observe the outcomes in real-time. The game involves students organized into different groups, each representing a location within the game.

The focus is on running a footwear company and then taking turns in making decisions regarding the company, which operates worldwide, including in Latin America, the Asia-Pacific region, North America, Europe, and Africa. The diverse geographic regions enable students to make informed choices about the footwear company and observe how their influence on strategy affects the company’s productivity and profits. The competitive game against other students allows participants to make decisions that depend on their intellect and experience, giving each one a chance to see the results based on a real-life scenario.

Our company, Flexy Shoes, specializes in innovative products created through high-tech processes, positioning us at the leading edge of the market. We focus on producing high-quality products that can withstand the test of time and are durable in various scenarios, whether for sports, fashion, leisure, or official applications. The buyer can choose from custom colors, shapes, or sizes, making our shoes the perfect fit for a wide range of individuals.

Mission: To provide high-quality shoes while maintaining quality materials and a friendly price.

Vision: To launch unique footwear, which is recognizable, timeless, and suitable for all age groups.

Values:

- Innovation,

- Responsibility

- Diversity

- Loyalty.

Corporate Objectives:

- S-Specific- Increased EPS, Net revenue, ROE, and market share; Improved credit and image ratings.

- M-Measurable– yearly rise in EPS by 20%, Net revenue by 5%, and ROE by 5%. Credit rating goal ‘A’ OR ‘A+’ and image rating 72 or more. Market shares increase by a minimum of 2%.

- A-Achievable– Increase in EPS, Revenue, and ROE to be achieved with more models available, new production facilities built in Europe, Africa, and Latin America regions, and increased production capacity, reduction of production costs/economies of scale/.

- R-Relevant- Attracting more customers via brand advertising, SEA, celebrity endorsement contracts, and offering higher retailer support, improving CSRC by adding various initiatives.

- T-Time-bound– Every year.

Overall, the corporate objective of Flexy is to meet the annual investors’ KPIs expectations.

Reflection on the Experience of the BSG

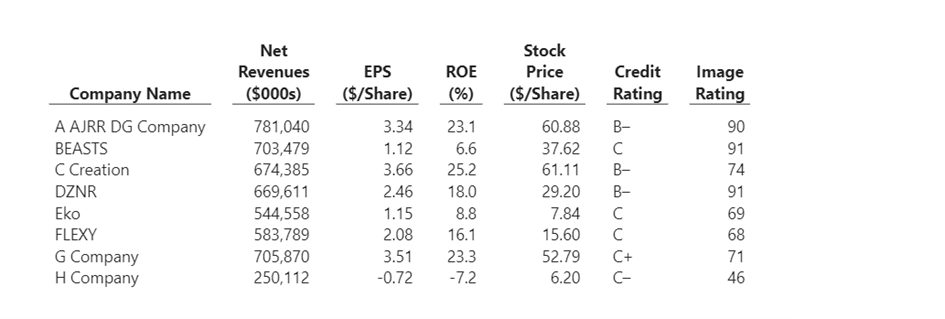

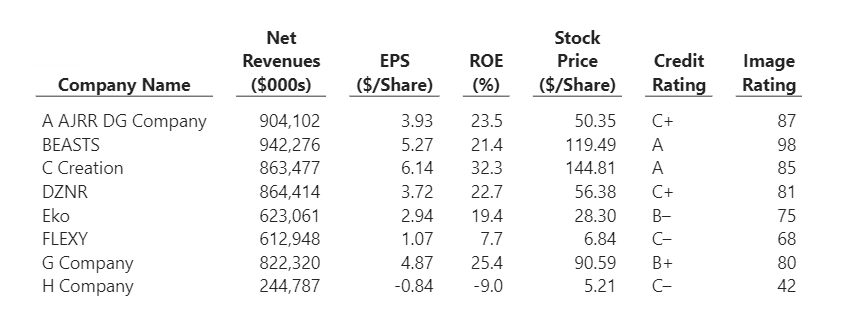

At the beginning of Year 11, investors held the following expectations regarding KPIs.

Table 1: Projected Year 11 Performance

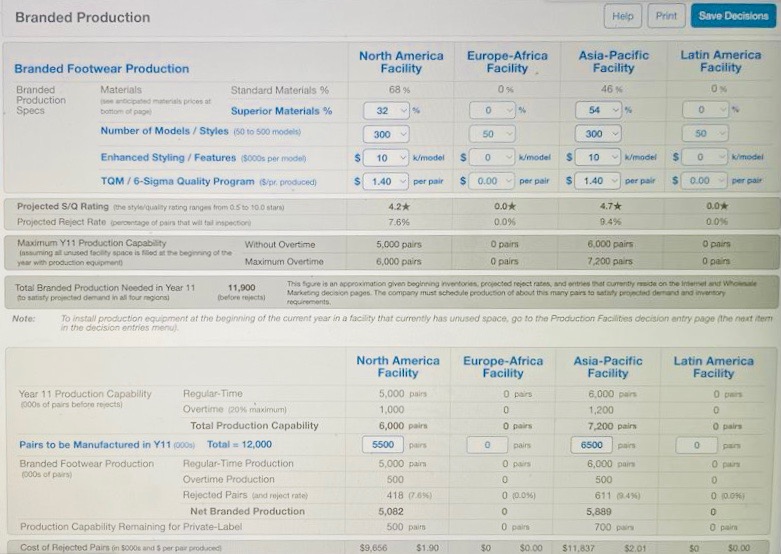

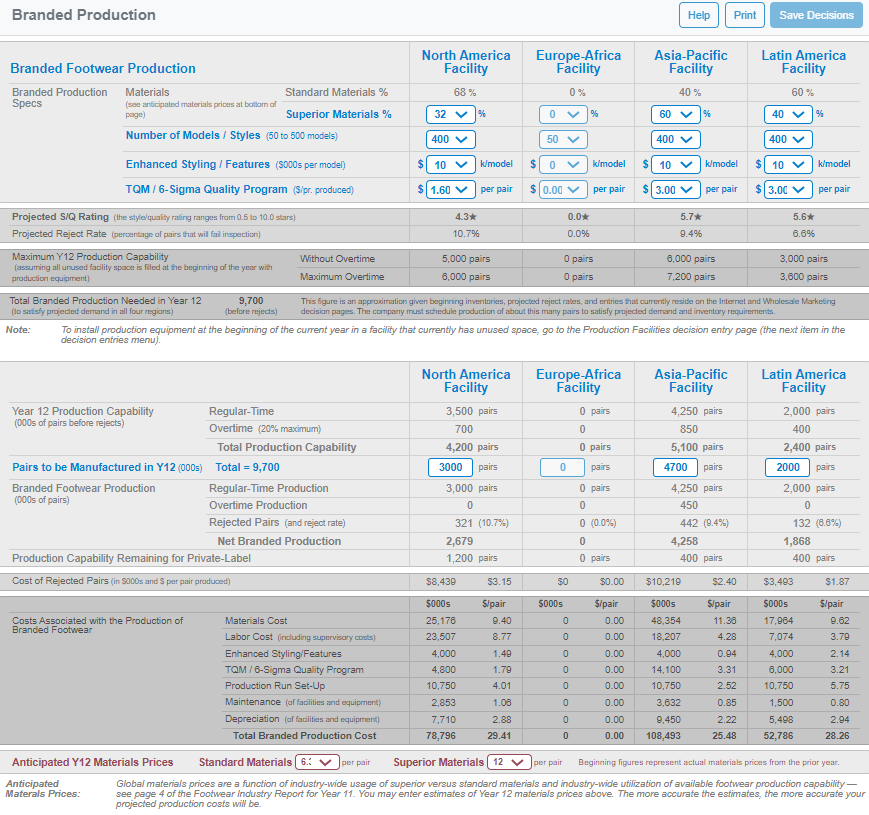

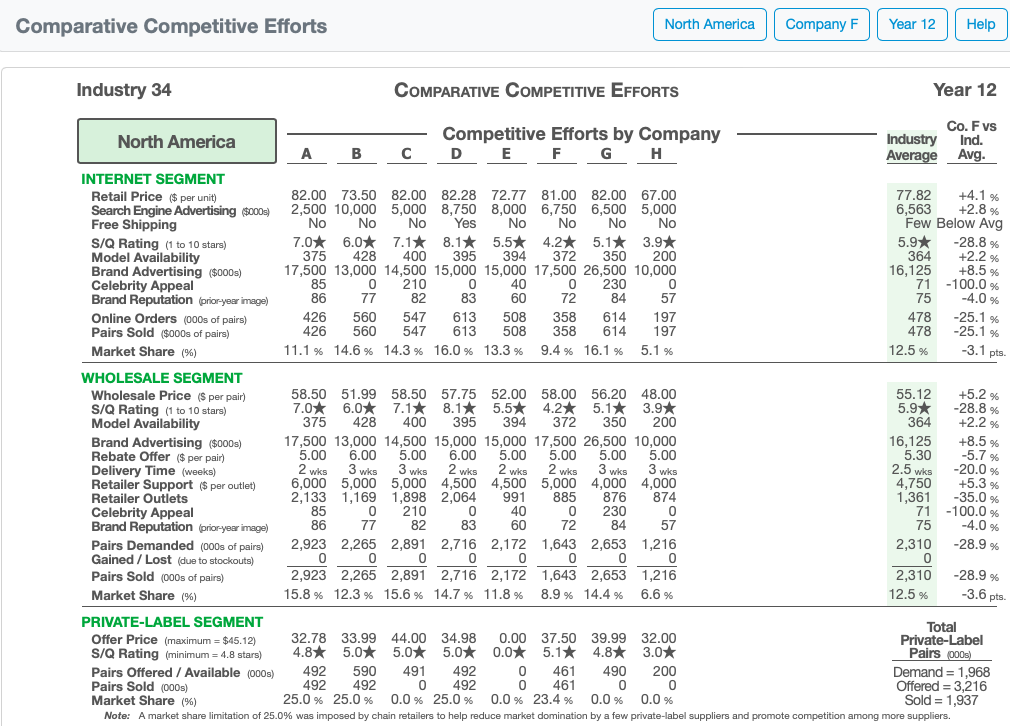

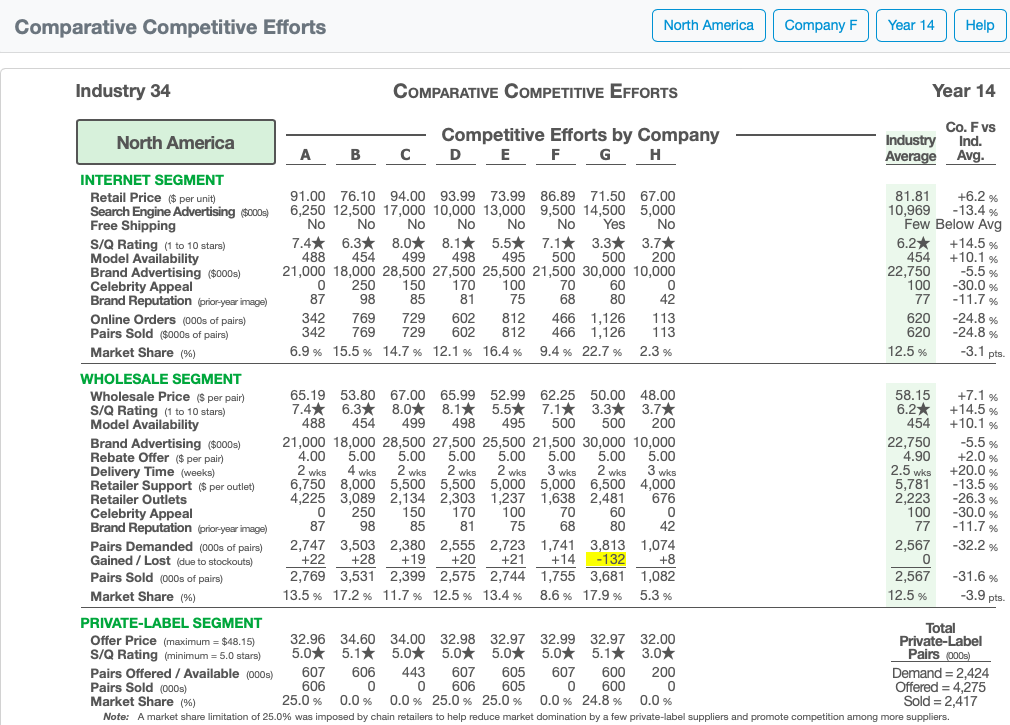

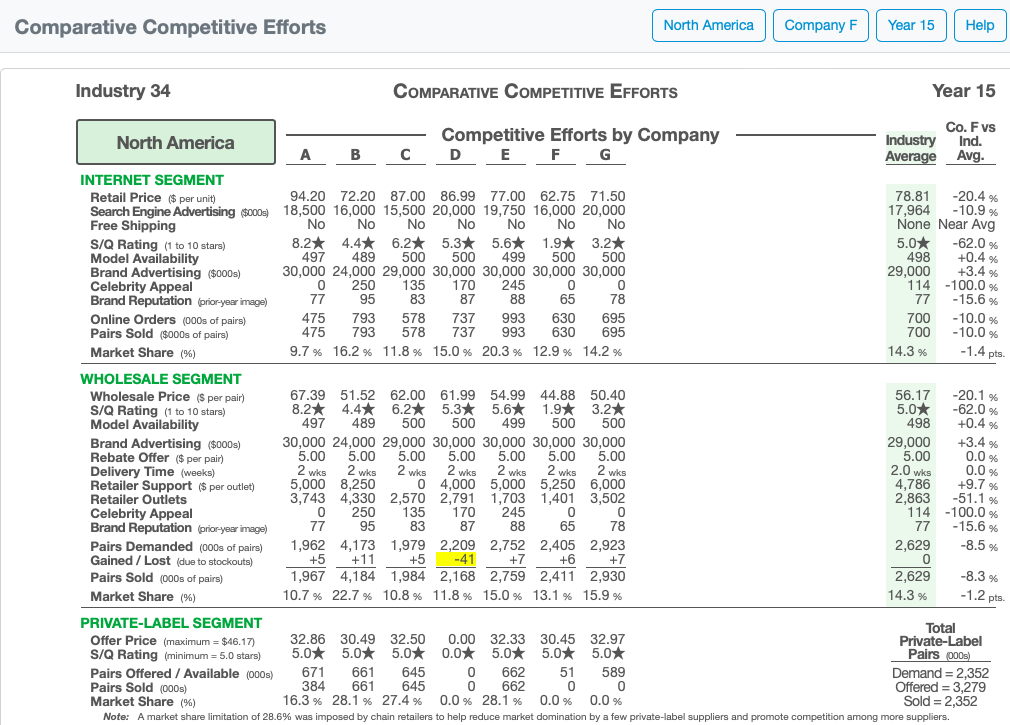

During the first year of operation, we increased the base wage by 2% to enhance productivity. We decided on a product differentiation strategy, increasing the number of models manufactured from 200 to 300 to improve the company’s competitive advantage (Figure 1).

However, the rejection rate also increased as the number of models increased. We then chose to increase the SIGMA/TQM to reduce rejection rates, improve image rating, and boost sales, even though we have a problem with insufficient brand advertising funds.

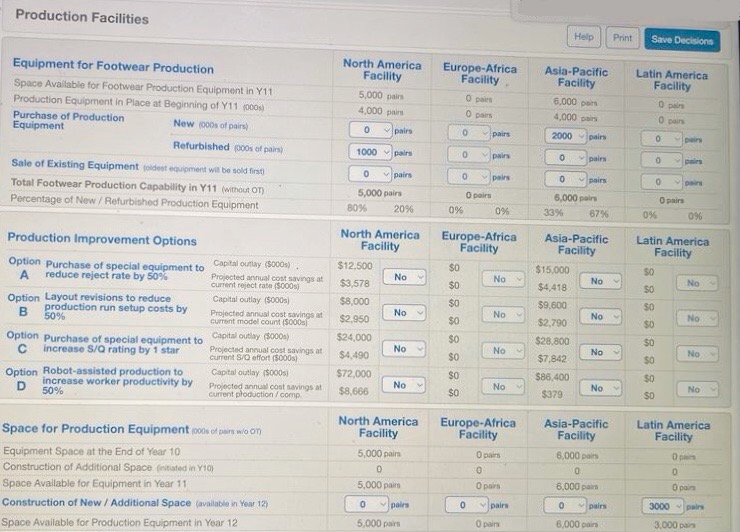

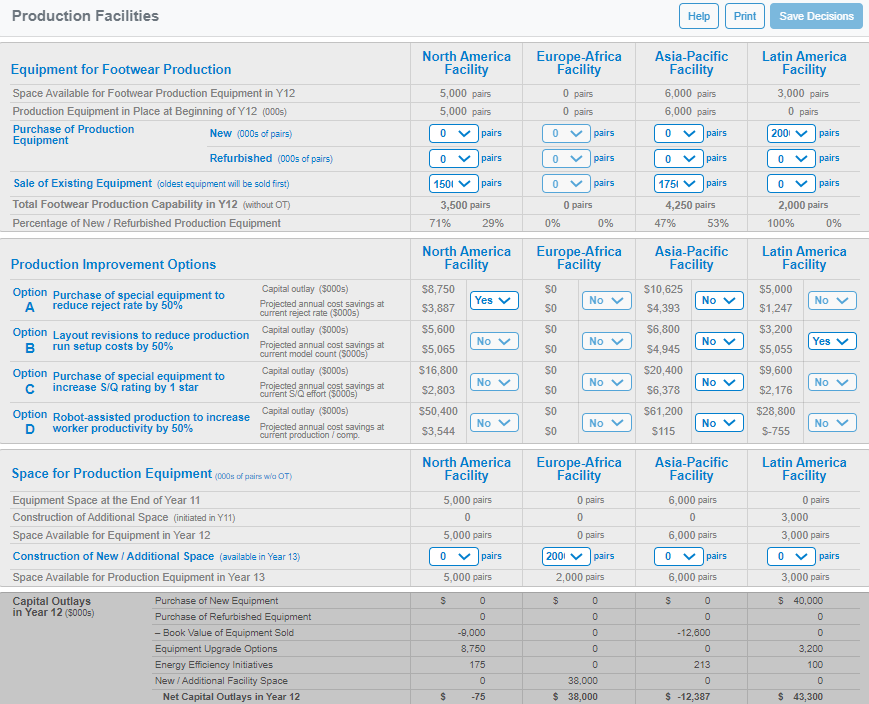

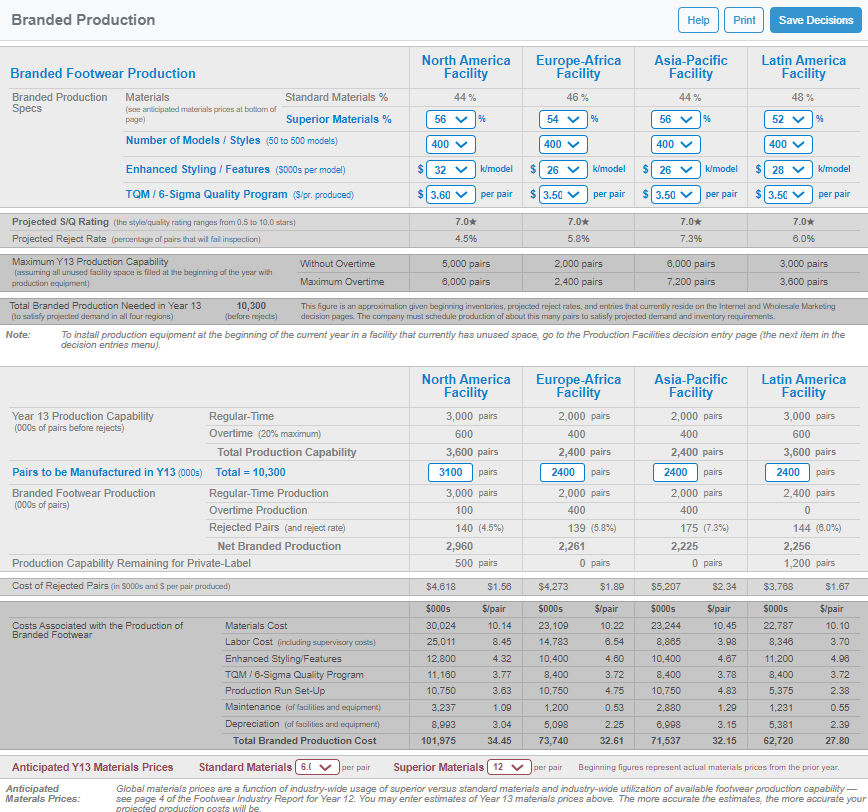

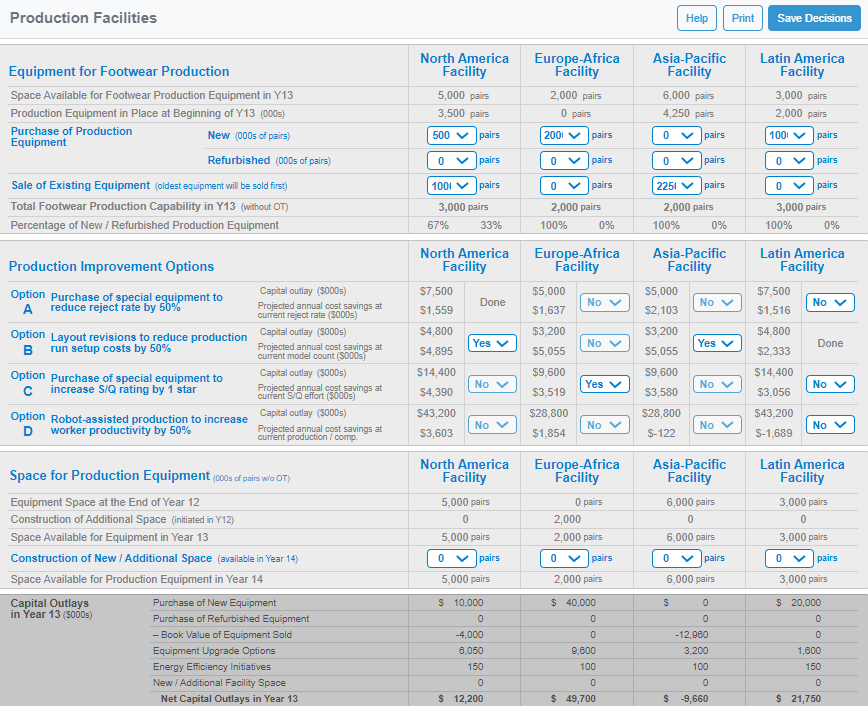

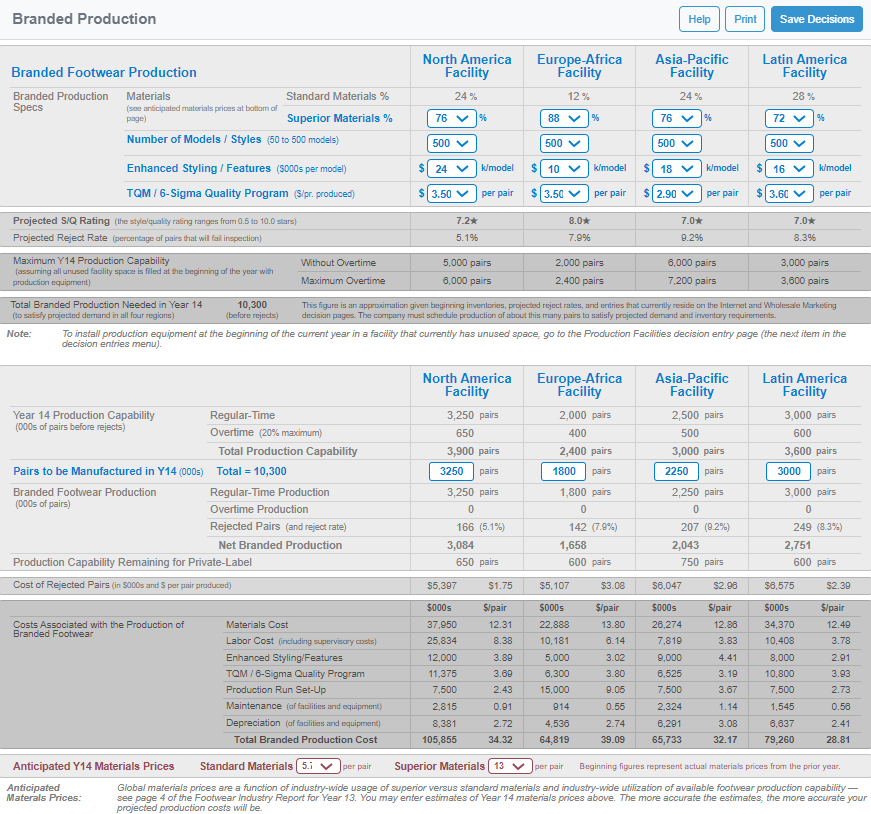

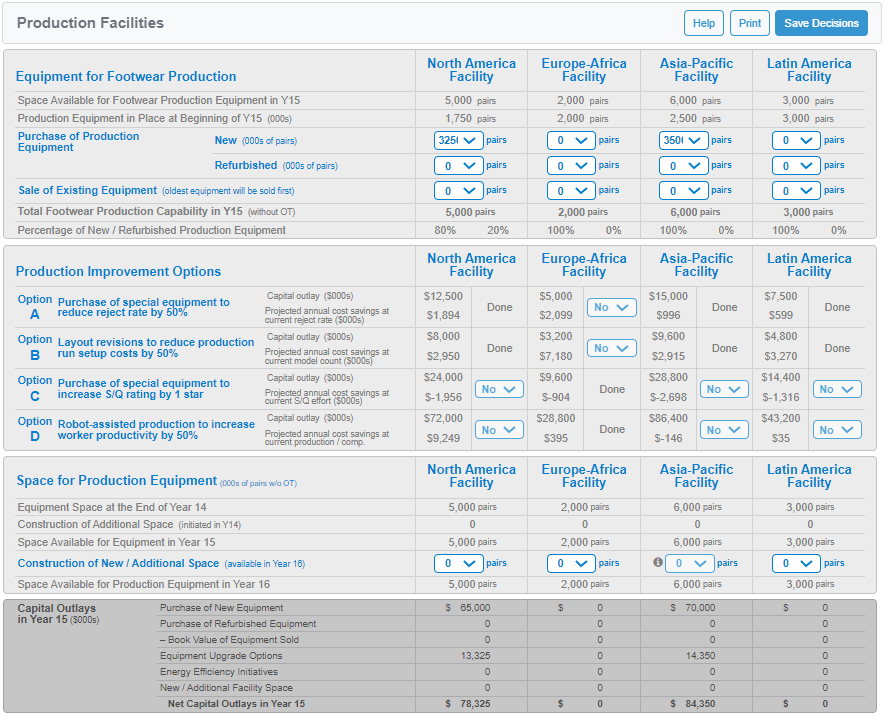

Another decision was the construction of production facilities in Latin America for 3,000, as the region has been experiencing a rising demand for shoes. With low labor costs and proximity to other regions, it has very low shipping costs. Moreover, we have invested in new and refurbished equipment to increase production (Figure 3).

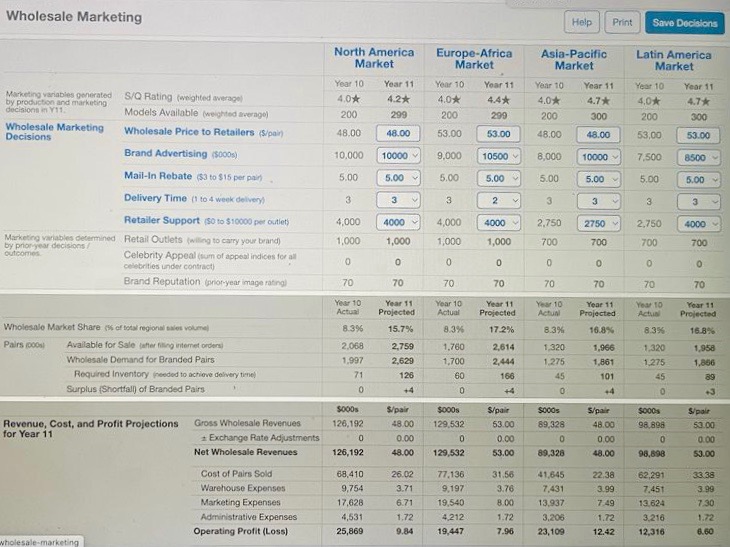

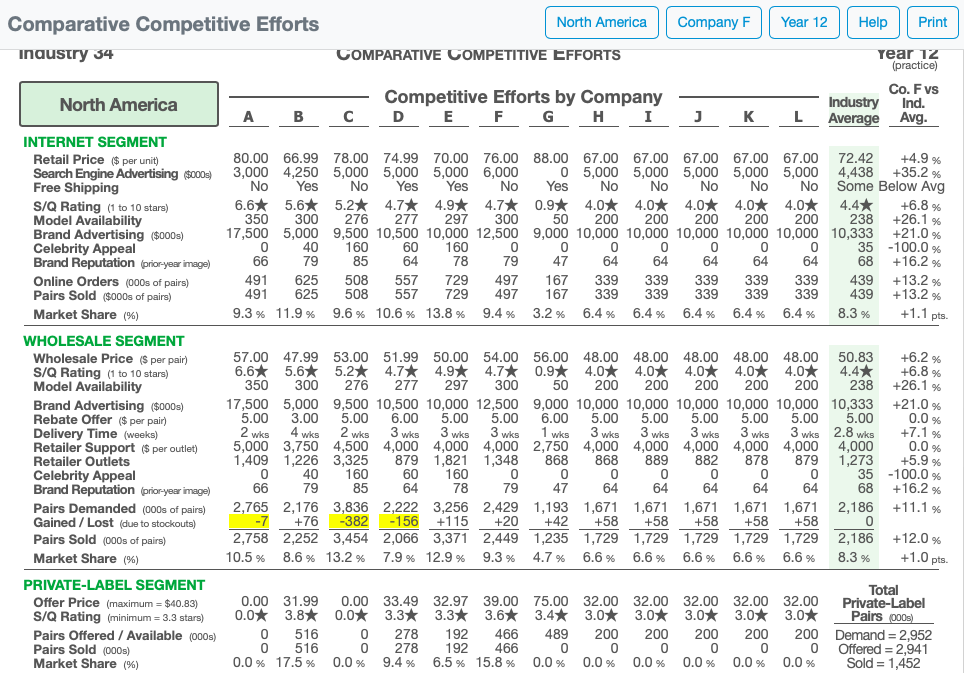

We also chose to increase prices due to the increased number of models and to generate profit to cover expenses incurred. However, a significant problem is that our price was higher compared to that of our competitors, while the quality of our products was significantly lower.

Moreover, the Year 11 Industrial Report placed the company in position 6 out of 8 and did not achieve investors’ expectations across all KPIs.

Inventory was a significant issue by Year 12, which had a major impact on finances, credit rating, and image rating. Since the stocks from Year 11 were unclear, we began year 12 with excess inventory at a high price.

Moreover, we made a fatal mistake by building a facility in Europe, despite struggling to sell our products, and while the company had sufficient production capacity to meet demand (Figure 6).

The decision should have been made to utilize the existing facility to its full capacity, thereby lowering the production and selling price costs, rather than investing in the construction of a new facility, given the company’s financial crisis.

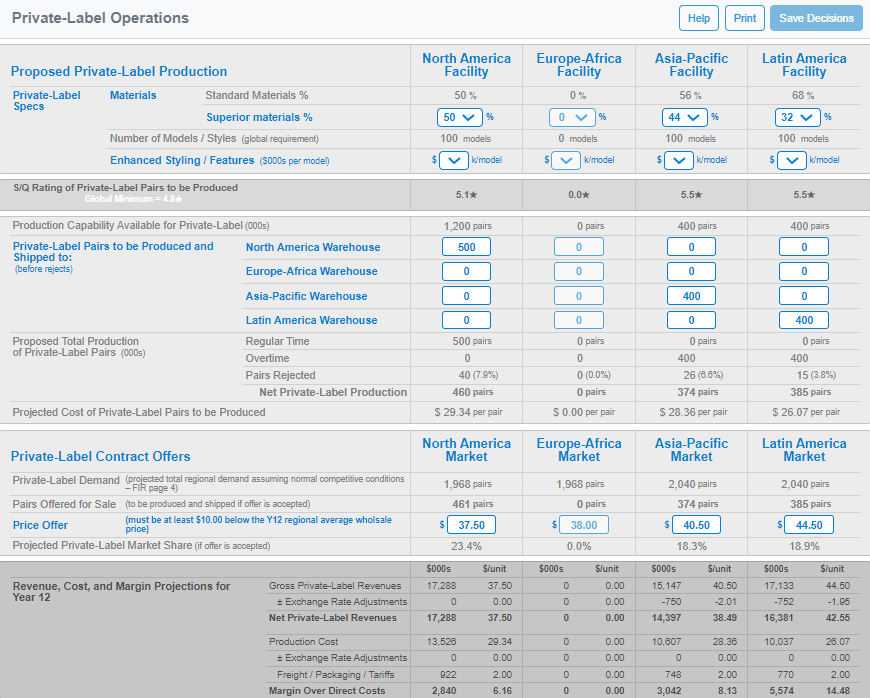

However, we made a successful decision in the private label segment to raise prices and improve the quality of materials used, allowing us to increase prices and generate higher profits, considering that production costs have increased.

However, according to the Year 12 industry report, we could have maintained the quality at a global minimum instead of increasing the number of models to avoid unnecessary costs, as private label customers prefer low prices over models. In year 12, the number of models and styles in branded production increased to attract more customers.

Despite the increased number of models to 400 in Year 12 (Figure 7), the higher prices were not attractive to customers, as the quality of the product had decreased.

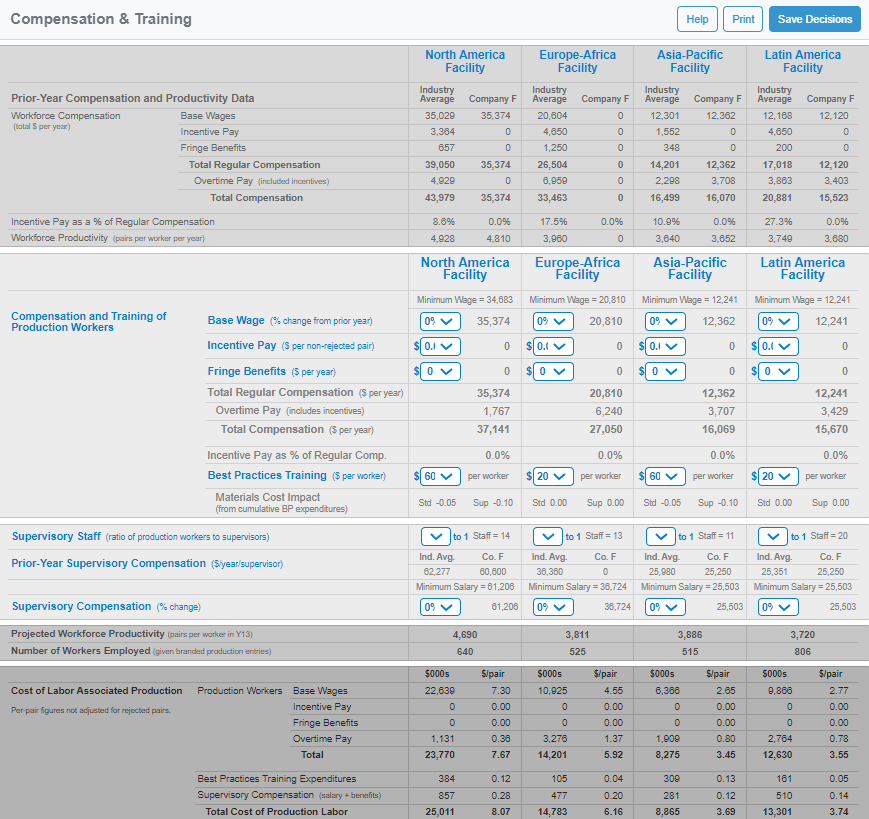

In year 13, a significant decision was made regarding compensation and training. To reduce production costs, we cut training expenses and halted increases to the compensation base wage (see Figure 8).

However, we increased the use of superior materials in North America and added 400 models in Europe for branded production.

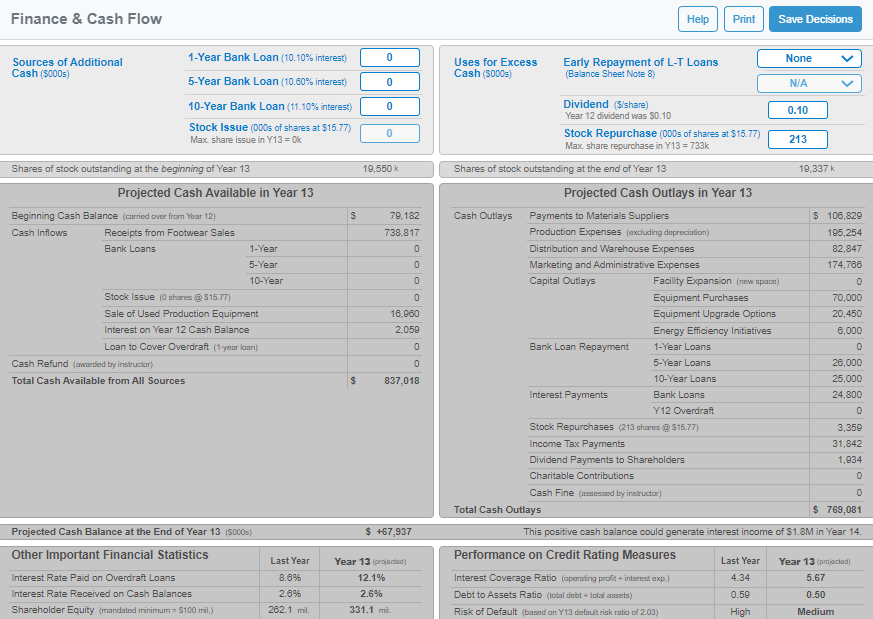

We also purchased new equipment to replace the sold equipment before it was thoroughly scrapped, and invested in an option to reduce setup costs.

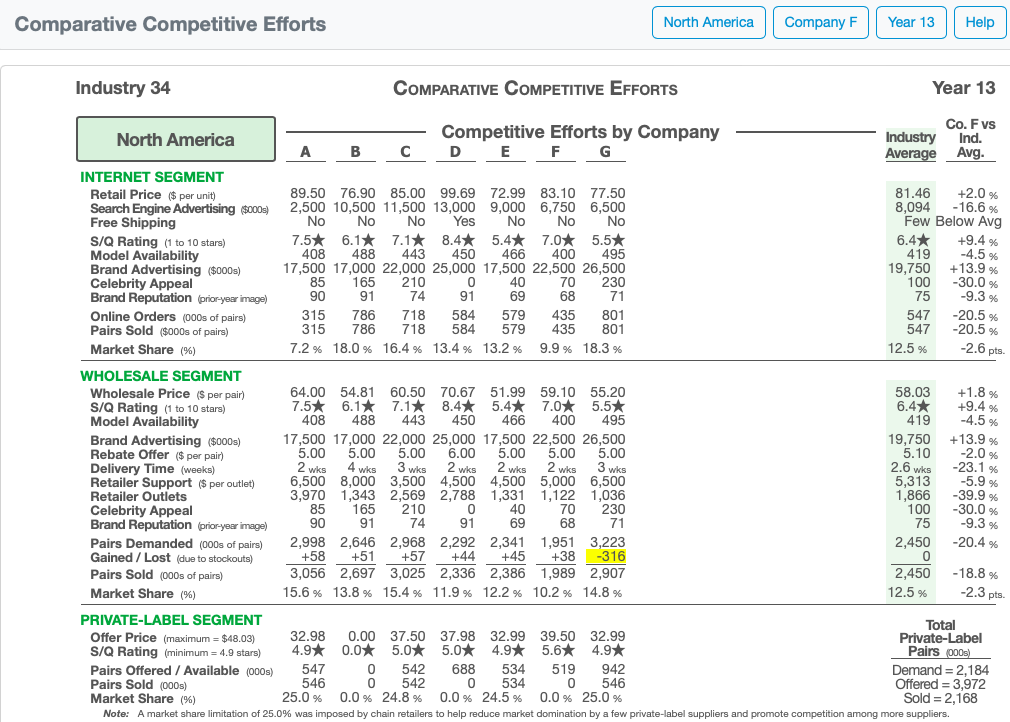

We also increased search advertising this year, in addition to leveraging celebrity appeal. However, despite an increased market share compared to prior years, the company’s net revenue remained low, and its ROE was only 7.7%. Consequently, we received one of the lowest credit ratings in the industry.

This is attributed to having fewer models and higher selling prices than rivals with more available models and better S/Q rating. Unnecessary investments in equipment and options also caused a cash shortage, resulting in a bank overdraft.

Moreover, the managers made a bad decision by paying dividends to shareholders while the company was not generating profit.

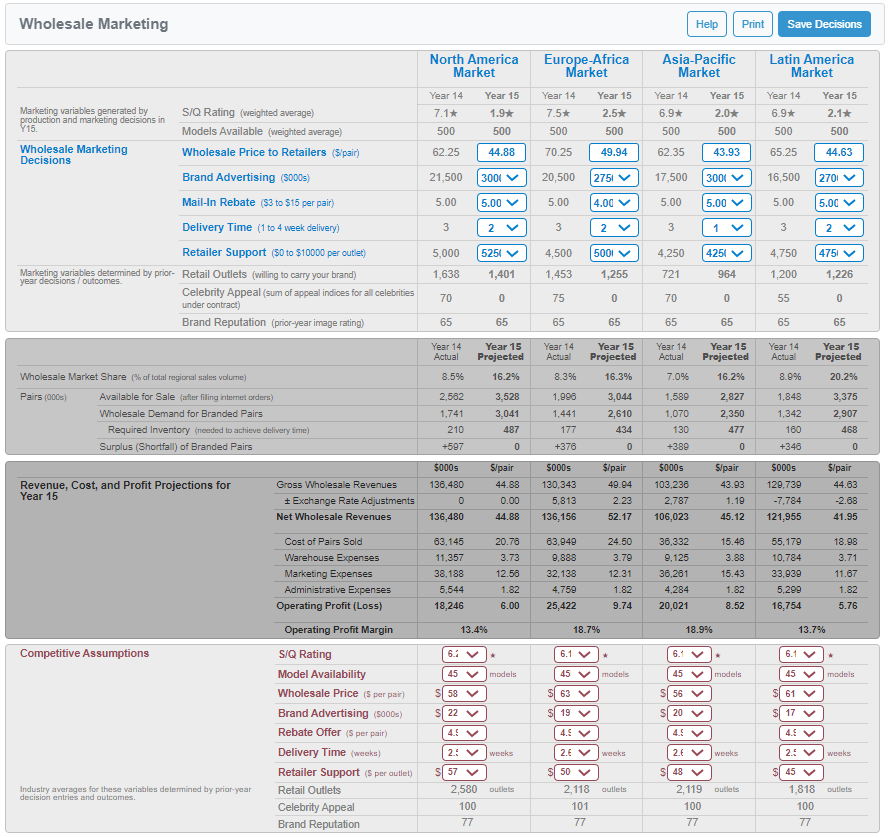

In Year 14, all the metrics failed to meet investor expectations and were declining year-on-year. We made major decisions in Year 14, such as increasing the number of superior models to be competitive, and decided to continue using a differentiation strategy.

However, as we had noticed that we did not have enough financial ability to continue increasing models and using more superior materials, we would have changed our strategy to low cost, as there were only a few competitors in the industry. It would have helped us minimize production costs and invest more in brand advertising to boost sales and improve our brand reputation. We took out loans several times over the years to cover the costs of building the facility, purchasing equipment, and other expenses. However, the outcome was that our credit image declined consistently, as we struggled to repay the loans.

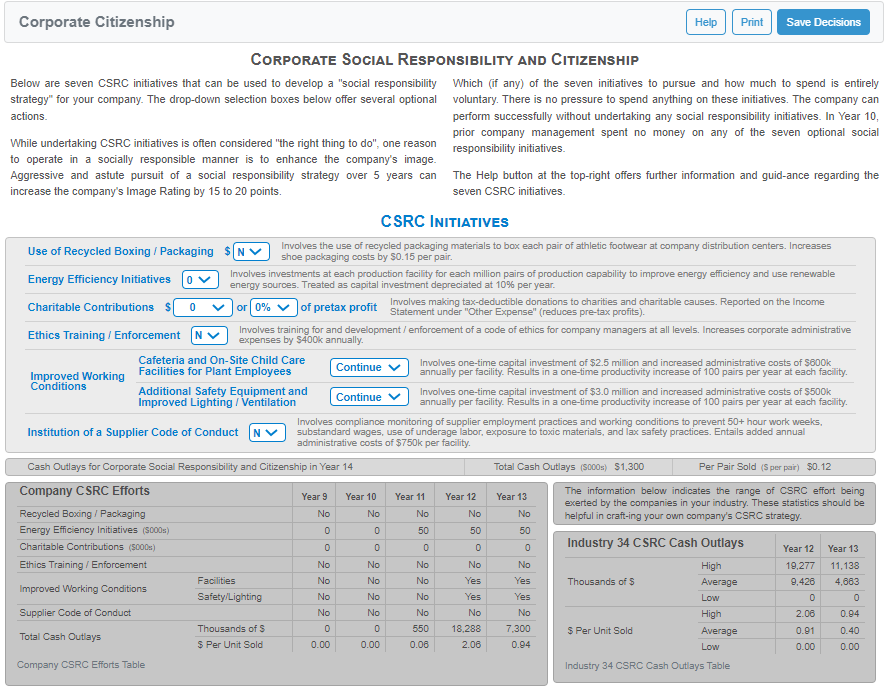

We also chose to end our corporate citizenship initiative, the energy efficiency initiative, to cut unnecessary costs. We also decided to borrow $85,000 and reduce our dividend payments.

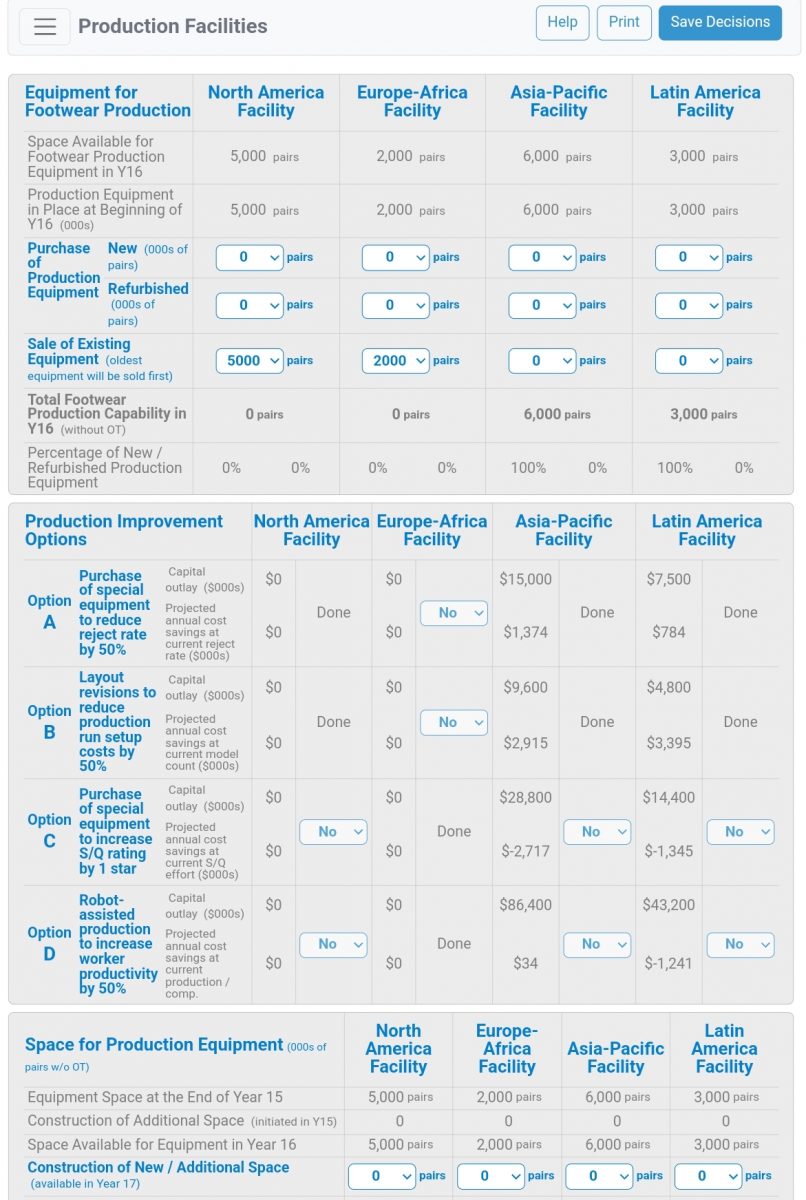

In year 15, we switched to a low-cost branded production strategy. Therefore, we purchased equipment to utilize the available space to its fullest extent. However, the company made a mistake by incurring this huge cost to produce maximum output and minimize the cost of production.

We used lower-quality materials, decreased features, lowered the selling price, and shortened the delivery time to 2 weeks.

However, by the end of the year, we had a surplus of stock comprising 5,800 pairs and failed to meet investor expectations in all metrics. This is due to excess production without considering regional demand, and the investment in retail outlets was insufficient.

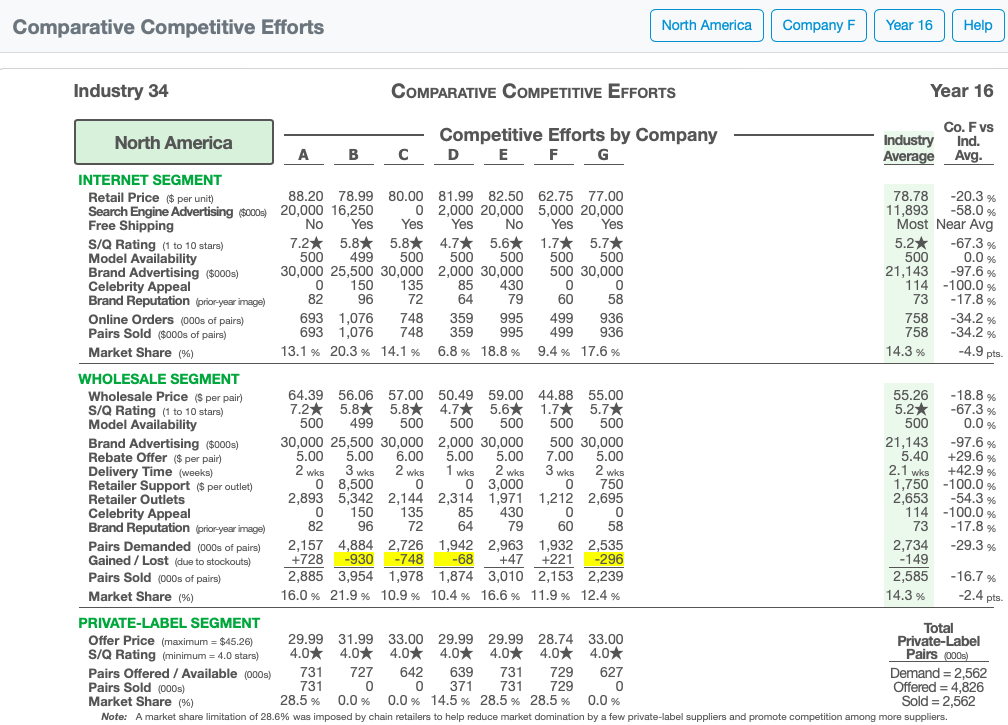

In year 16, we shut down production facilities in Europe and North America because the production costs were high, and we could no longer manage to run four facilities. This was a big mistake we had made initially.

We significantly reduced our brand advertising, which resulted in a decline in our market share as demand for the offered pairs decreased.

SWOT Analysis

SWOT analysis is the most common framework for understanding a business. The acronym stands for strengths, weaknesses, opportunities, and threats. The analysis focuses on the different aspects of the company to evaluate and understand them. It is best understood by considering both internal factors, such as strengths and weaknesses, and external factors, including threats and opportunities.

Strengths

The shoe company’s strength lies in the shoe market, despite the company not fully capitalizing on this positive market aspect. People of all ages continue to purchase shoes, and the company has experienced ongoing revenue losses over the years, making it more challenging to hire skilled employees and compensate them adequately (Zonyfar, 2020).

Weaknesses

One weakness of the company is its financial management. Most of the money has been invested in the business, and it does not have any liquid cash for other services when it needs urgent cash (Cheng, 2021). The company has been facing financial challenges that hamper its advertising efforts. The brand image has also been in decline, leading to a reduction in sales and low revenues.

Another problem is the persistent low credit rating, which poses a risk to the company and could lead to challenges when attempting to access funds in the future (Bradbury & Galloway, 2021). The company has been performing poorly over the years and is likely to continue facing problems.

Opportunities

The company also has the opportunity to continue producing high-quality products that are attractive to the market while ensuring the brand remains profitable. Still, it has failed to progress (Caldwell & Akintunde, 2020).

Threats

The major threats the company faces include competitors who offer similar products that are better and have more control of the shoe market. These competitors are more innovative and try to adopt new trends to remain competitive and continue attracting the market.

PESTEL Analysis

A PESTEL (political, economic, social, technological, legal, and environmental) analysis is vital. It focuses on six significant external variables that will affect the company and shows the significance of each one (Saiz-Alvarez, 2021). The analysis focuses on external variables affecting the shoe company and helps determine the ideal location and competitive environment. It is a perfect tool that helps make better choices about the business and the nature of its operations.

Political

The political factors include variables linked to the political system or government that would affect a company’s operations. This includes taxes, which can be pretty high in some locations, affecting the company’s operations, which is why it has not been making profits (Rathore, 2023).

Economic

The economic factors include variables in a country that impact business operations, such as inflation, energy prices, and prices for raw materials for marketing shows. If the economy offers a lower price, the company has an advantage since the cost of production is lower. However, the company has set high prices for its products, which have been unattractive to customers in different regions.

Social

The social variables include the cultural climate and expectations, population dynamics, and other social variables (Milani, 2019). If society is against certain types of shoes or does not wear them, it would be harder to produce and sell such types of shoes there.

Technological

The technological variables include the adoption of new technologies and the local population’s ability to purchase innovative shoes. The company has a poor brand image, which can arise if it fails to adopt innovative technologies to sustain its market base growth.

Legal

The legal variables include labor laws regarding safety standards and minimum wage, which can impact a company’s operations in a foreign country (Jiang et al., 2022). If the operations are unfavorable, the company will face challenges, such as difficulties paying its employees or finding suitable people to employ. The environmental variables include the country’s location, water sources, ground conditions, and natural resources.

Emerging Technology and Recommendations

An emerging technology that could impact the shoe industry is smart shoes, which can perform various functions. A notable example is Nike, which has developed self-lacing shoes that can adjust to fit the wearer’s sole (Standaert, 2022). The shoes are marketed as high-performance products for athletes, especially professional basketball players.

Moreover, the user can also control the shoes via their smartphone, allowing them to modify various settings, such as tightening and loosening the shoes over time. The shoes have an inbuilt custom gear and motor that can sense when a person wears them, and then it can make changes accordingly. The shoes feature a built-in sensor that can track strides, steps, and distances covered (Myers et al., 2019). All this information can be used to correct a person’s posture, track calories, and determine other types of health information.

Nike has also adopted a digital strategy involving a direct-to-consumer approach, where the company deals directly with consumers to understand their needs and identify potential design elements that can be incorporated into its shoe designs. These changes will impact the company, which means it must update its production process to manufacture new and innovative smart shoes that incorporate current technologies, particularly those related to smartphones.

The new technologies will be a good option in the long term. A recommendation for a future manager is to consider that the market is still not very competitive, as few companies are producing such shoes. However, innovation requires considerable investments, innovative processes, expertise, and additional resources to enter the field of wearable technologies. The demand will continue to increase, so it would be imperative for the company to be prepared and for future managers to set objectives that focus on meeting the need for smart shoes.

Innovations are widespread, and companies must adopt new technologies to meet the market’s demands. Introducing shoes with sensors to measure data about the user wearing them is a good step toward ensuring that the company produces future-proof products (Myers et al., 2022). Demand in the market is changing rapidly, necessitating the need to adapt to various demands, which could be a factor that makes the company more competitive. If other companies cannot copy the technology, the business will remain a leader in the shoe industry.

McKinsey 7S

Hard Elements

According to the McKinsey 7S Framework, a company can consider various elements to improve its performance and develop an effective change management process to adapt to new customer demands. The models suggest that there are seven elements; the first group consists of complex elements. These are tangible and include systems, structure, and strategy.

The leadership can determine and control strategy, so it must be adjusted to enable the company to meet its objectives and grow (Thompson et al., 2013). The changing consumer demands and competitive pressures necessitate that the company develop a sound strategy to address these challenges and ensure sustainable adaptation to evolving market needs.

The structure can also be centralized, making it easier to ensure that all employees are aligned with the organizational values and goals. There needs to be more coordination between the various departments within the company, which can enhance the quality of products. Coordination enables different experts to provide their input on footwear, which can help improve production facilities and product quality.

The systems, such as production facilities, must operate efficiently and generate profits for the company. To remain profitable, the organization also needs a sound system for managing human resources, operations, marketing, and finance. These systems must be well-defined and designed using methods and tools as controls for evaluating goal attainment and performance (Thompson et al., 2013).

Soft Elements

The soft elements include strategy, skills, staff, and shared values, which are intangible and often difficult to quantify. The company should have a defined value system that ensures employees are motivated and working optimally. The value system relies on the leadership style, influencing whether the employees are cooperative. The company needs effective managers and leaders who can handle conflicts and problems within the organization while guiding employees.

Employees also need to be included in the decision-making process, which involves sharing their input when making important decisions. Skills must be enhanced so workers can make higher-quality shoes (Thompson et al., 2013). The company needs to hire experienced professionals to ensure its profitability. The company needs to hire sufficient staff for each region to meet its operational and business needs.

Conclusion

The company has been performing poorly over the years. It has constantly failed to meet investor expectations in all metrics, including earnings per share, return on equity, credit rating, and image rating. The BSG game reveals some of the major problems that led to the company’s constant losses.

Over the years, we have made several major decisions to improve productivity and quality, including lowering prices, reducing shopping times, and expanding production facilities. However, the outcome was not always positive; in most instances, the decisions led to losses. The SWOT and PESTEL analyses suggest that the company faces significant challenges that hinder its growth. However, based on the McKinsey 7S framework, the company can undergo changes that lead to a profitable future.

List of References

Bradbury, T. and Galloway, C., 2021. “SWOT analysis.” In Encyclopedia of Sport Management (pp. 480-482). Edward Elgar Publishing. Web.

Caldwell, P.K. and Akintunde, O.D., 2020. ‘USA and Nigeria: SWOT analysis of social entrepreneurship.’ Social Entrepreneurship and Corporate Social Responsibility, pp.161-174.

Cheng, Z.A., 2021. ‘How can a new brand enter the US market: A SWOT analysis of the amor dance company’. Management, 9(1), pp.55-60.

Jiang, Y., Luo, Y. and Peng, Z., 2022. ‘Development Analysis of Outdoor Sportswear Based on PEST Model’. In 2022 International Conference on Social Sciences and Humanities and Arts (SSHA 2022) (pp. 999-1002). Atlantis Press. Web.

Milani, F., 2019. Digital business analysis (pp. 1-429). Basel, Switzerland: Springer International Publishing.

Myers, C.A., Allen, W., Laz, P.J., Lawler-Schwartz, J. and Conrad, B.P., 2022. ‘The impact of self-lacing technology on foot containment during dynamic cutting’. Footwear Science, 14(2), pp.94-102. Web.

Myers, C.A., Allen, W., Laz, P.J., Lawler-Schwatz, J. and Conrad, B.P., 2019. ‘Motorized self-lacing technology reduces foot-shoe motion in basketball shoes during dynamic cutting tasks. Footwear Science, 11(sup1), pp.S189-S191. Web.

Rathore, B., 2023. ‘Digital Transformation 4.0: A Case Study of LK Bennett from Marketing Perspectives’. International Journal of Enhanced Research in Management & Computer Applications, 10(11), pp.45-54. Web.

Saiz-Alvarez, J.M., 2021. ‘Entrepreneurship in the Fashion Industry: The Case of Carolina Herrera’. In Entrepreneurial Innovation for Securing Long-Term Growth in a Short-Term Economy (pp. 90-110). IGI Global.

Standaert, W., 2022. ‘Product digitalization at Nike: The future is now’. Journal of Information Technology Teaching Cases, 12(1), pp.28-34. Web.

Thompson, A., Janes, A., Peteraf, M., Sutton, C., Gamble, J. and Strickland, A., 2013. EBOOK: Crafting and executing strategy: The quest for competitive advantage: Concepts and cases. McGraw hill.

Zonyfar, C., 2020. ‘Social Media Marketing and Brand Awareness for Millennial Generation’. PalArch’s Journal of Archaeology of Egypt/Egyptology, 17(1), pp.131-140. Web.