Introduction

The present document critically analyzes the financial information of CarMax, Inc. using fundamental and technical analysis. The report focuses on firm valuation by implementing fundamental investment management concepts. It further determines the financial position of the selected company i.e. CarMax, its industry, and the overall economy of the US to provide an investment recommendation.

Company Overview

CarMax Inc., which is one of the largest used car retailers in the United States, is listed on Fortune 500, and its registered office is in Richmond Virginia. Initially, Circuit City formed the company in 1993 (CarMax annual report, 2013). A co-founder of the company was Richard L. Sharp, who was also the CEO of Circuit City. The company was incorporated under the laws of the Commonwealth of Virginia in 1996 as CarMax, Inc.

The company is registered as a holding company, and it carries out its operations through its subsidiaries (CarMax annual report, 2013). Currently, the company operates in more than 128 locations of different U.S. cities. An increase of 14 percent in operating income was recorded in 2013 and its net earnings grew by 5 percent to $2.16 per share. The company’s performance significantly improved in the last five years. Ninety-eight percent of the company’s revenues were generated from its used car retail business. Only two percent of revenues were generated from used cars trading.

Economic Analysis

The difficult economic conditions as a result of the recent economic and financial recession in the United States adversely affected consumers’ behavior and their spending on automobiles. The overall and regional changes in the country’s economic conditions and its fiscal policy affected the availability of credit, consumer credit delinquency and loss rates, interest rates, oil prices, inflation, and unemployment rates. These factors immensely affected the sentiments of consumers due to which the overall spending declined. However, revenues of the automobile industry in the U.S. improved since 2012 as the economy recovered from the effects of economic recession (Hirt & Block, 2012).

The GDP increased by 1.7 percent during 2013-2014, and the downward trend in unemployment rates pushed up the overall personal consumption expenditure. The interest rates remained low, which facilitated access to credit. It majorly contributed to the increase in sales of automobiles in the U.S. The inflation rate increased during this period (2013-2014). The high inflation rate increased the prices of cars sold in the U.S. A decline in gasoline prices also contributed to higher sales of cars.

Industry Analysis

The automobile retail industry of the U.S. proved its resilience and achieved high growth rates since 2012. In 2013, substantial growth of 13.4 percent in new light-vehicle sales was recorded. A recent report indicated there was a significant increase in sales from 12.7 million in 2011 to 14.4 million in 2012 (NADA DATA State of the Industry report, 2013). The incentives provided by the Federal government helped the industry.

An increase in consumer demand was considered as one of the leading factors contributing to the increase in new vehicle sales. In addition, an increase in new medium and heavy-duty truck sales was observed in 2013. Moreover, sales of used cars increased by 4.5 percent to 40.5 million units in 2012 from 38.8 million units sold in 2011. The increase in oil prices in the United States did not affect the overall growth of automobile sales (NADA DATA State of the Industry report, 2013).

Furthermore, an increase in franchise dealerships was recorded in 2013 that generated great employment opportunities. The used car dealership sales affected the profitability of new-vehicle dealerships. However, an overall increase in the profitability of used and new vehicles was reported in 2013 (NADA DATA State of the Industry report, 2013). The average gross profit margin on used vehicle sales increased to 25.6 percent in 2013 from 25.4 percent in 2012 (NADA DATA State of the Industry report, 2013).

Moreover, in 2013 new vehicle sales were more than light vehicle sales 2012 (U.S. economy at a glance: Perspective from the BEA Accounts, 2014). In 2013, the general price index of used cars increased by 1.6 percent as compared to 2012. The used cars retail sector generated the majority of its revenues from trade-ins. In addition, 24 percent of revenues were derived from auctions and 15 percent from other purchases (NADA DATA State of the Industry report, 2013).

Financial Analysis

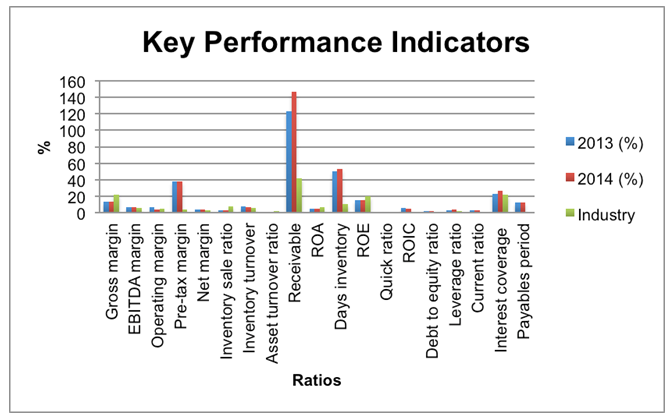

The following table shows the values of key financial indicators of CarMax for the period 2013-2014.

Table 1: Key financial indicators (CarMax, Inc. Financials, 2014).

The above financial information indicated an overall decline in the profitability of the company during the period 2012-2013. Gross margin and net margin decreased in 2013. On the other hand, the operating profits of the company increased. It showed that the company’s operations remained efficient, but an increase in administrative and other expenses lowered the company’s profit margins. In addition, a decline in the return on assets was recorded (2012: 4.77%, 2013: 4.56%).

It showed the company’s inefficiency to utilize its assets in 2013 as compared to 2012. The reason was a decline in assets and inventory turnover. CarMax’s sales declined in 2013 due to which the overall profitability of the company declined in the current year. Moreover, an increase in tax amount suppressed the company’s profits. However, the return on shareholders’ equity increased significantly in 2013 (ROE remained 15.26% in 2012 and 15.55% in 2013).

Leverage ratios give an idea about the company’s ability to acquire additional finance using an appropriate financing method. An upward trend in leverage and liquidity measures was noted. The company remained solvent to meet its long-term obligations. However, the company’s ability to meet its short-term liabilities deteriorated. It was based on the reported decline of 0.36 in the quick ratio value of the company during 2012-2013 (CarMax Inc Financials, 2014). Furthermore, the company’s ability to meet its interest payment obligations significantly improved in 2013.

Investment Analysis

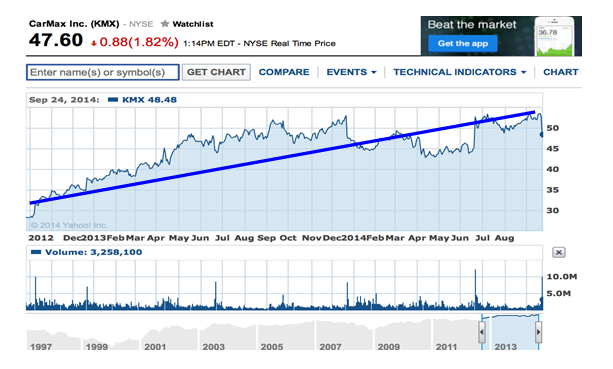

The graph shows the stock movement of CarMax. Based on the trend analysis, it could be noted that during 2012-2013 the stock value of CarMax rapidly increased as compared to 2013-2014. The rising trend line indicated that the stock value significantly increased but at a slower pace in 2013-2014, which suggested static growth in the stock value as compared to the previous year (CarMax, Inc. (KMX), 2014).

Company Valuation

Conclusion

Based on the above analysis, it could be concluded that an investment in the company’s stock could be profitable. The financial indicators of CarMax indicated that the company’s operational efficiency and revenues significantly improved with betterment in the economic conditions (Setia, Setia, Krishnan, & Sambamurthy, 2010). However, CarMax’s performance in the industry was relatively higher as compared to other companies.

The company generated a large proportion of the industry revenues as it is one of the largest used car retailers in the United States. The increase in new car dealerships in the industry is expected to increase the prices of used cars which could affect the overall profitability of CarMax. The financial information showed that the values of leverage measures improved in the last reported year.

However, the sales volume of the company declined due to which its profits were affected. It was overcome by higher prices of used cars that helped the company to generate greater revenues. In addition, EPS significantly increased in 2013. It is recommended that the company should focus on improving the utilization of its assets. The technical analysis indicated that the stock value increased at a slower pace in 2013. However, it is anticipated that an investment in CarMax would generate higher returns as its price is at higher multiples of EPS (P/E ratio) and also the stock valuation indicated greater value of the stock as compared to its current price. Therefore, an investment in CarMax, Inc. is recommended.

References

CarMax annual report. (2013). New York: CarMax.

CarMax, Inc. (KMX). (2014). Web.

CarMax, Inc. financials. (2014). Web.

Hirt, G., & Block, S. B. (2012). Fundamentals of investment management. New York: McGraw Hill/Irwin.

NADA DATA State of the Industry report. (2013). New Tork: NADA.

Setia, P., Setia, M., Krishnan, R., & Sambamurthy, V. (2010). The effects of the assimilation and use of IT applications on Financial performance in Healthcare organizations. Journal of the Association for Information System, 12, 274-298.

U.S. economy at a Glance: Perspective from the BEA Accounts. (2014). Web.