Evaluation of the financial performance of Cash Connection

The table presented below shows a summary of the financial information of Cash Connection for three years, that is, between 2007 and 2009.

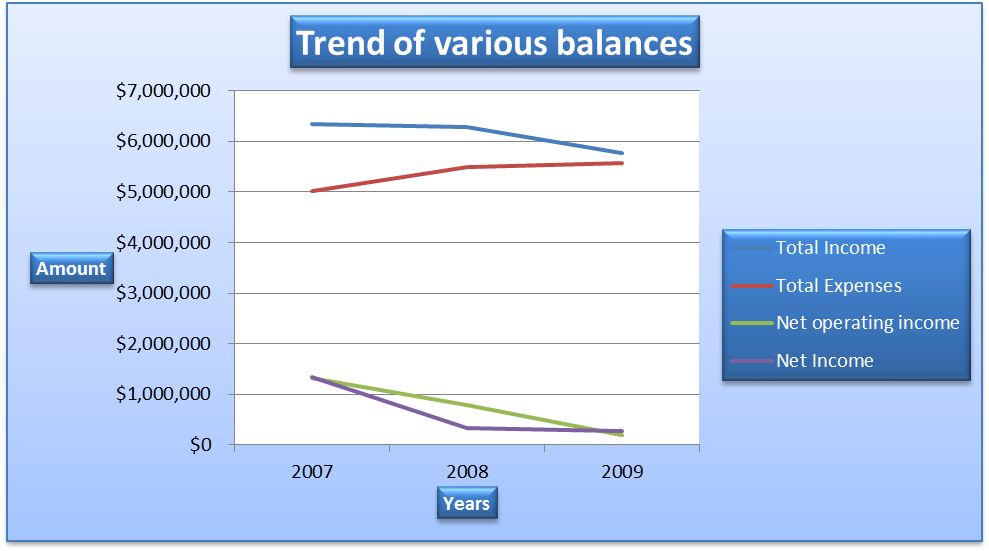

The total income earned by Cash Connection declined from $6,348,544 in 2007 to $6,283,860 in 2008. The decrease is equivalent to 1.02%. The value further declined to $5,768,805 in 2009, an equivalent of 1.02% decrease. The decline can be attributed to the global recession that was experienced during this period and negative publicity. The economic conditions resulted in a decline in the ability of the customers to repay their loans on time.

Despite the decline in total income, the total expenses increased from $5,017,173 in 2007 to $5,488,623 in 2008, an equivalent of a 9.40% increase. The value further increased to $5,569,912 in 2009, an equivalent of a 1.48% increase. It shows that Cash Connection had difficulties in managing the cost of operations during the economic recession. A company needs to manage costs so that as revenue earned decreases, the total cost also declines. The changes in total income and expenses resulted in a significant decline in net operating income. The value declined from $1,331,171 in 2007 to $795,237 in 2008, an equivalent of 40.26% decrease.

The value further declined to $198,893 in 2009, an equivalent of a 74.99% decrease. Also, the net income decreased over the period, that is, from $1,336,617 in 2007 to $342,689 in 2008, an equivalent of 74.36% decrease. The value further declined to $271,961 in 2009, an equivalent of a 20.64% decrease. Further, the net profit margin of the company declined over the period. The value decreased from 21.05% in 2007 to 5.45% in 2008. It further declined to 4.71% in 2009. The decrease implies that the overall profitability of the company declined. The balances in the table above can be presented in a graph as shown below.

Evaluation of internal and external environment of the company

TOWS criterion will be used to analyze the internal and external environment of the company. It gives information on the threats, opportunities, weaknesses, and strengths. The external and internal environment of the company is discussed below.

Threats

- The increase in the number of payday advance stores to approximately 23,586 in 2007 increased competition in the market. The impact of the increase is a reduction of the market share of the company and its profitability.

- The second threat is the change in global economic conditions. For instance, the recession experienced between 2007 and 2009 reduced the ability of the customers to repay their debt. This affected the bottom line and the internal operations of the company.

- The third regulation is stringent government regulations in the industry in the payday loan industry. The government regulates the industry to avoid a potential loss to consumers.

Opportunities

- The key opportunity for the company is the untapped market. A large number of Americans prefer to use payday lenders over banks because they can obtain loans easily through payday. Statistics provided in the case study show that about 10% of Americans prefer to use payday.

- Also, the recession creates an opportunity for the company to create products that can suit the needs of the population during the period. Thus, the company should focus on giving out more loans because its competitors will reduce the number of loans they give out.

Weaknesses

- The first weakness that the company faces is that the nature of the business does not take into account customers who have other sources of income apart from income that is generated from employment. This condition reduces the number of customers that the company can reach.

- The second weakness is that the business requires all customers to have a checking account. This also reduces the number of customers that the company can reach.

- The third weakness is the general perception of the public about the company and the payday advance industry. Several people think that the payday industry exploits low-income earners and those who require urgent finances.

Strengths

- The first strength of the company is that it has developed several products apart from just giving out loans. Some of the other products that are offered by the company are payment of bills, money orders, and being agents of western union. This improves service delivery to customers.

- The second strength is the ability of the company to venture into new markets. Analysis carried out by the company revealed that opening a new store in a new location is more profitable than opening several stores in one location. Therefore, the company should use the opportunity to strengthen its network in a wider geographical area than its competitors.

Ethics of payday lenders

Payday lenders play a critical role in the economy by providing small and short-term loans within a short duration. Thus, the lenders help individuals to take care of urgent financial requirements. As compared to the services offered by banks such as overdraft facilities, payday lenders are relatively cheap. For instance, the cost of borrowing $100 from payday lenders ranges between $15 and $20 in addition to the administrative fees of about $5.

Thus, the total cost ranges between $20 and $25 for $100. However, to borrow a similar amount from a bank through an overdraft facility will cost a customer about $50 and bank charges for operating the account. Besides, the charges will be deducted at any time and it may create additional solvency problems for the customer. Thus, payday lenders are cheaper than other financial institutions for a small number of loans.

However, payday lenders make a substantial gain when the borrowers fail to make repayments as scheduled. The ethical dilemma for the payday lenders is the cost implication of a rollover. This occurs when a customer does not repay the loan on time. However, the industry came up with alternative ideas that can reduce the cost of borrowing. The industry also creates jobs and contributes significantly to the growth of the gross domestic product of the country. Besides, it creates job opportunities and it is a source of revenue for the government. For instance, labor income from the payday industry amounted to $6.4 billion, while the revenue for the State in the form of taxes amounted to $2.6 billion in 2007.

Cash Connection has improved the quality of services it offers to customers by offering other products apart from giving out loans. These products will improve the ability of customers to transact and pay their bills. This improves the quality of service delivery to customers.

Recommendations

- The first recommendation is derived from the opportunities discussed above. The company should reach out to the 24 million Americans who have a positive opinion about payday lenders.

Justification

A review of the income statement shows that the expenditure on advertising increased from $142,160 in 2007 to $176,939 in 2008. The value further increased to $187,294 in 2009. This shows that the company has intensified advertisement over the years. Therefore, the company should consider other avenues through which it can reach the untapped market. Some of the avenues are direct mail and promotional activities.

The entire payday advance industry has been able to reach only half of the US market. This implies that the industry and the individual firms such as Cash Connection have great growth potential.

- The second recommendation focuses on the weaknesses of the company. As mentioned in the section above, the services offered by Cash Connection exclude citizens who do not have a checking account and those who lack employment income. Therefore, the company should introduce checking account services so that the unbanked citizens are not left out. This will increase the number of customers.

Justification

There are some reasons why a segment of the population is underbanked. First is that the minimum operating balance is high and cannot be afforded by a certain segment of the population. This discourages the citizens who think that they lack adequate finances to operate a bank account. Secondly, there is a lack of education on the importance of maintaining a bank account among unbanked citizens. Therefore, they will not see the value or importance of maintaining a bank account. Thus, Cash Connection can reach out to the unbanked segment and educate them on the importance of having a bank account. Finally, the banks perceive the unbanked segment to be low-income earners and therefore, it will not be profitable to offer them banking services.

- The third recommendation is that the company should develop products that will be more appealing to the population that is considered to be unbanked or underbanked. This recommendation will enable the company to strengthen its brand name and gain market share.

Justification

- Statistics provided in the case study show that the number of locations of payday lenders exceeds the banks. There are about 9,500 banks and 22,000 locations for payday lenders. This shows that payday lenders have a greater potential of selling their products to the unbanked segment of the population than banks.

- There is a high probability that the ten million unbanked citizens of America will prefer payday advance services to banking services. This also gives a justification for why the company should target the unbanked population.

- Finally, the company can gain the trust and loyalty of the citizens by offering a variety of products and not only loans.

- The final recommendation is that the company should create a brand name of its own in the industry. The payday industry is growing at a faster rate and the intensity of competition is increasing. Thus, the company needs to segregate itself from other firms in the industry by building a strong brand name. One way through which the company can differentiate itself is by packaging its products more competitively. For instance, the company can develop new products that have a flexible repayment schedule. This will reduce the number of default loans because customers will be able to repay their loans on time. Besides, it will improve customer loyalty.

Justifications

- The income statement shows that the net income earned declined from $1,336,617 in 2007 to $342,689 in 2008. It further declined to $271,961 in 2009. The decline can be attributed to the recession that was experienced in the economy. This also affected the ability of customers to repay loans on time. Thus, if the loan products are repackaged, then the customers will be able to make repayments on time.

- The second justification focuses on the competitive strength of the company. The table below shows an assessment of the competitive strength of the Cash Connection and other companies that offer similar services.

The rankings are in ascending order, that is, ten represents very strong while one represents very weak. In the table, it can be noted that the image of Cash Connection is lower than the other companies that offer similar services. Also, it can be noted that the overall competitiveness of the company is lower than those of other firms offering similar services. Thus, the company will be able to improve its image and overall competitiveness by differentiating itself.