Introduction

Entering a new economic environment is always a challenge, even for a successful organization. Caterpillar, Inc., which has been enjoying a borderline success over the past few years, seems to have certain chances at succeeding in the Chinese economy. It is desirable that the dozers produced by the organization should be viewed as the key product. However, to attain its goals, the company will have to consider the use of the sustainability principle and a cost-efficient strategy along with the JIT approach so that it could increase its profit margins.

Revenue and Cost

It is expected that, by introducing the principles of sustainability into the project and applying the concept of sustainability in resource allocation, the entrepreneurship will be able to reduce the costs to a considerable extent. In addition, the Just-In-Time framework may be incorporated into the firm’s design so that the amount of expense should be reduced to a minimum (Liozu and Hinterhuber 11).

Considering the expected scenario, one may assume that entrepreneurship will take a total of approximately $270,000,000 in costs. In light of the fact that the framework designed for the company’s operations will allow for retrieving the total of $180,000 in the first quarter, $160,000,000 in the second, $130,000,000 in the third, and $100,000,000 in the fourth, it is assumed that the expenses will be covered successfully.

Table 1. Direct Costs Allocation.

Although the costs listed above can be viewed is set, there are still options for cutting the above expenses as well so that CAT could have better chances of integrating into the target market. Particularly, the principle of sustainability in the use of resources needs to be mentioned (Pride and Ferrell 63).

Table 2. Indirect Costs Allocation.

As the list of expected costs provided above shows, CAT is likely to face certain challenges in allocating its budget. Even though having an impressive amount of money, the entrepreneurship is likely to spend a substantial part of it on marketing. Indeed, in the environment that can be defined as not only alien but also hostile, the design of a proper marketing approach is required (Chaffey and Smith 12). Particularly, the following steps will have to be accomplished, and the following costs will need to be taken in order to facilitate the successful integration of CAT into the Chinese economy:

Table 3. Marketing and Promotion Costs.

It should be borne in mind, though, that entrepreneurship should have enough financial resources for the worst-case scenario, in which it may need to choose the option of an exit strategy. Particularly the adoption of tools such as the stop-loss and take-profit tools can be viewed as the primary means of reducing the threat to the wellbeing of entrepreneurship (Gerristen and Olderen 89).

In addition, the fact that entrepreneurship is currently producing 50,000 machines at 25% capacity utilization needs to be brought up. By focusing on the increase in its capacity rate, the company will be able to cover the costs taken to purchase the necessary machinery (Mahanty 29).

5 Years Later: Expected Gain

It is assumed that the entrepreneurship will be able to gain the total of $M 236 during five years of operating in the Chinese market. Although the cost required to acquire the necessary machinery and carry out the corresponding promotion campaign are going to be impressive, it is expected that the production rates can be increased significantly.

As it has been stressed above, the increase in the production speed will require the subsequent adoption of an efficient quality management strategy due to the threat of errors increase and, therefore, a rapid rise in the number of defective products. Seeing that the latter is bound to cause the following drop in the number of customers and orders, it is crucial that the above framework should be introduced to CAT’s design (Stevens, Liudon, and Nukkei 85).

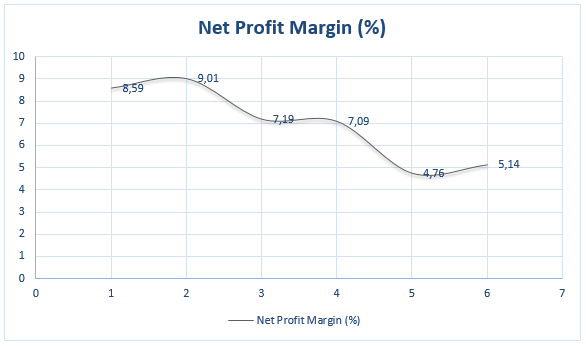

Naturally, reducing waste produced to zero would be impossible for CAT even with the acquisition of the advanced technology. However, the incorporation of an adequate quality management model such as the TQM framework will allow for the increase in the production speed and at the same time a drop in the number of defects produced. Therefore, CAT will be able to increase its profit margins significantly (see Fig. 3)

As the figure provided above has shown, CAT has been suffering from rather inconsistent policies over the past few years, which has led to its profit margins shrinking nearly twice compared to the results delivered five years ago. Nevertheless, it is assumed that the current policy will allow for a gradual increase of the above index. It would be wrong to assume that the entrepreneurship will revive immediately; however, a consistent grow is expected as one of the effects of the adoption of the cost-efficient and sustainability-based approach determined above. It is assumed that the company will make approximately $750,000,000 during the next five years, starting $120,000,000, and increasing its profit margins gradually.

Works Cited

Chaffey, Dana, and Paul R. Smith. Emarketing Excellence: Planning and Optimizing Your Digital Marketing. New York, NY: Routledge, 2013. Print.

Gerristen, Dale, and Richard Olderen. Events as a Strategic Marketing Tool. New York, NY: CABI, 2013. Print.

Liozu, Stephan, and Andreas Hinterhuber. The ROI of Pricing: Measuring the Impact and Making the Business Case. Routledge, 2014. Print.

Mahanty, Aropp K. Intermediate Microeconomics with Applications. New York, NY: Academic Press, 2014. Print.

Pride, William M., and Oliver C. Ferrell. Marketing 2016. Boston, MA: Cengage Learning, 2015. Print.

Stevens, Robert E., David Liudon, and Ronald A. Nukkei. Marketing Your Business: A Guide to Developing a Strategic Marketing Plan. New York, NY: Routledge, 2013. Print.