Abstract

Any business enterprise regardless of how well developed has to experience occasional changes, some of which may end up shaking the entire framework of the institution. This is primarily the reason why companies need to come up with change management strategies.

Change management strategies are basically an already established procedure that an organization will follow in order to avert the negative effects of change on the company as well as provide for the opportunity to embrace the positive changes that may come about as a result of change.

Like with any other laid down company procedures, change management strategies also get redundant with time hence the need to constantly re-evaluate and identify areas that need to be tweaked in order to ensure that the strategy implemented is well suited to handle the challenges that may come about.

This is a proposal for an analysis of the change management strategies of the Standard Chartered Bank, UAE while touching on the roles of management in relation to the process of change and the challenges encountered in the process.

Introduction

The change management strategy in the case of institutions such as the Standard Chartered Bank aims at reinforcing the primary goal and mission of the institution. Changes need to be made to the existing change management strategy and this is accomplished by offering support to already established policies including the financial plan, performance assessment strategy, and the corporate plan.

Objectives

- Assess the process of the Consumer Banking change management at Standard Chartered Bank, UAE.

- Identify the current situation of the Consumer Banking change management process.

- Analyze competitive position.

- Identify desired future states.

- Analyze the change context.

Research Questions

The major research question that shall govern the development of the argument is the importance of change management as a tool for corporate governance in the Standard Chartered Bank. This shall be supported by the following questions:

- How has internal audit gained prominence in the business environment at the Standard Chartered Bank?

- What are the determinants of change and their roles in the application of corporate governance from the perspective of professionals in the Standard Chartered Bank?

- What are the different benefits of consumer banking in relation to corporate governance in the Standard Chartered Bank?

Methodology

Taking into account the importance of obtaining the information from real life scenarios for the business analysis, the survey of the employees’ attitudes and perceptions was conducted for getting insight into the effectiveness of current change management strategies within the Standard Chartered Bank and identifying the existing deficits which require special consideration and further improvements.

20 employees of the Standard Chartered Bank were informed on the survey, its main objectives and were offered to give their consent to participating in it by answering the questionnaire.

These employees were sent the questionnaires with brief explaining letters concerning the research problem and goals via e-mail. Follow up calls were made to the potential participants who did not respond in a timely manner for making sure that the e-mails with questionnaires were delivered to them.

The questionnaire consisted of the five main sections, including the parts devoted to responsibilities, capabilities, communication, positioning and attitudes. Each of these sections contained the combination of yes/no, rating questions and the questions which required full answers.

This design of the questionnaire allowed collecting valuable information on not only employees’ awareness of the company’s vision, implemented change management strategies and other ongoing processes but also the degrees of their attitudes and personal perception of the current situation in the Standard Chartered Bank.

Serious consideration was given to the development of tools for the following systematization and evaluation of the research findings. The analysis of the received responses was carried out in several ways, including the evaluation by each employee, by company’s divisions and by the sections of the questionnaire.

Then, the data was integrated for creating a comprehensive picture and detecting the main deficits within the Standard Chartered Bank which can be compensated through corporate training and making the necessary changes.

Taking into account the small size of the research sample, simple tables were used for the statistical analysis of the collected data. The next step in the data processing was the error check and the consideration of possible biases and limitations of the research design.

After the systematization and evaluation of the collected data concerning the employees’ motivation, involvement into the decision making, attitudes to work and corresponding quality of their performance, proper conclusions can be drawn as to the necessary improvements which are required for improving these parameters and the company’s performance in general.

Thus, the findings of this study can be valuable for enhancing the effectiveness of the change management strategies at the Standard Chartered Bank.

Reasons for Selecting the Above Methodology

The main reason for selecting the above described methodology for conducting the current research is the importance of giving serious consideration to the human resource awareness of the company’s vision and implemented change management strategies for the business analysis of the company’s performance in general and detecting the spheres which require improvements.

The accessibility of the internet connection for the participants of the survey and the convenience of processing data in digital formats explain the chosen mode of conducting the survey and the research design which allowed minimizing the risks of biases and the technical errors while processing the collected data.

Expected Outcome

The outcome expected out of this research process is results that would make professionals and organizations involve corporate governance aspects and in particular change management as well as re-evaluate the benefits of the procedure as compared to the demerits. The research and subsequent paper will show the various loopholes which if sealed can increase the profitability of the Standard Chartered Bank.

Research Process Plan

The first step in conducting the research will come in the form of extensive review of literature from various secondary sources. Information on the topic of internal auditing and its integration processes will be collected from company records, journals, Magazines, conference proceedings and websites.

The second step in the process is the collection of data directly from the field. This will to a large extent depend on various forms of interviews including one-to-one interviews as well as the use of questionnaires. Some of the people expected to be targeted for this part of the process include economic specialists and administrators from the Standard Chartered Bank, as well as qualified financial analysts.

The above two steps would make it easy to come up with a survey question which will guide us into the third step of the process. In this stage, an analysis of the data obtained shall be carried out and the challenges that are raised regarding the process of change management shall be picked out and effectively compared with the strategic approaches for dealing with them.

In this phase, an evaluation of the financial backlog that face the Standard Chartered Bank due to poor accountability and lack of auditing shall also be carried out.

Literature Review

In order to effectively analyze institutional change management it is mandatory that a clear documentation of the company’s (in this case Standard Chartered, UAE’s) financial situation is clearly presented and this will be realized after an intensive analysis of all company sectors.

This section shall use various literatures in describing the different company approaches taken by the Standard Chartered Bank, UAE in the process of implementing its change management strategies.

According to Allen and Herbert (1972) in order to implement the change management strategy, a proper management team should be established. This team is led by senior managers who are required to take charge of the programme and make sure that all the principles and goals of the strategy are effectively handled.

The culture of the Standard Chartered Bank demands that the institution dedicates the required resources to ensuring that the change strategy is affected. The projects that will be established as a consequence of any agreed upon change management strategy should auger well with organization’s project management guidelines.

Warren, Kenneth and Chin their book, the planning of change (1969), say that a framework for seeing proper allocation of responsibilities to members of the team should also be set up. Other than this, plans developed for the project, methods for risk assessment as well mechanisms for monitoring the accountability of the team members should also be emplaced.

It is necessary that all the stakeholders involved in the change management strategy implementation be identified and adequately involved in the development of the plan. For the Standard Chartered Bank, UAE, stakeholders include employees, investors and all other people whose involvement in the programme will be of appreciable importance.

Communication channels between all levels of the team are always well set up in order to ensure that all the stakeholders share in the vision of the strategy and are actively involved in the implementation (James 1967).

Allen and Herbert (1972) state that different aspects of the change management strategy should be communicated to the top management from junior staff as well as to other principle stakeholders. This information could also serve the company well if communicated to the public.

In the case of the Standard Chartered Bank, UAE some of this information includes the reasons as to why the institution needed to implement the change, the results that the company is expecting from implementation of the change and the requirements (resources) that have been put into implementing the change.

Feedback is an important aspect of the communication process and this is more so if the changes that are being fronted are particularly challenging.

In summary, it is of vital necessity that all the players in the implementation of the Standard Chartered Bank change management strategies understand the changes properly in order to avoid the instances of having to re-do things; a factor that contributes to increased costs of operation.

Change must be managed in a strategic manner; this will facilitated its fast adoption and ensuring that the business enjoys the benefits that are thought to be attributed by the change. Leaders in Standard Chartered Bank are mandated with the task of pioneering a business to its desired objectives; in transitional period the leaders are the one who guides subordinates to the desired path.

They should be involved right from planning for change all the way to monitoring the change. Change needs to be planned at all times when it is being implemented and conducted in such a way that it will be accepted in the business. The role of the leader in such case is the change agent. His (charisma) is put to test.

Different scholars have developed different strategies to implementation of change, they have the believe that a certain strategy is universal; however what stands out is that there is no single most effective method but there are some shared characteristics of managing change that Standard Chartered Bank can use.

John P. Porter in his theory of change management illustrated eight common steps to successful change, they should be the start point of Standard Chartered Bank, and the steps are:

Increase urgency/ internal analysis

Standard Chartered Bank should have a current interpolation of its standing in the industry and aim at improving and recognizing areas that needs improvement. With the market position understanding, the top managers should come up with the changes to be effected.

With clear objectives and goals, the next step is involving all the people who will be affected by a change in understanding the current position and the need for change. The management should let their employees understand how the change will affect them. One of the barriers to an effective change is negative perception of employees. The perception is brought about by lack of people understanding of change effects.

Build the guiding team

Standard Chartered Bank should develop an implementing team based at the head office and another local support team in the UAE branch. Depending with the kind of change that is to be implemented, the management should develop a team of change agents.

The team should understand the current position in the bank and forge the way forward together with the management and the affected employees. They are people who should be well informed about the change to occur and used to train other on the way forward. They are opinion leaders. The most effective people for this task are leaders in departments.

Get the vision right

The UAE team and the head office team should have a common understanding of what the bank want to implement; it should hold discussion and let the project move when they have a common destiny.

This is the stage where objectives and timeframes for change are set and discussed with the people who will be affected by the change to occur in a business. Objectives should be attainable and frameworks to have them operating put in place.

Communicate for buy-in

This is the most important stage where there is communication to employees on the change; Standard Chartered Bank in the UAE has the role of training and preparing the staff to the change likely to occur. It is the time for training of the new way to employees.

An effective communication strategy should be prepared to be proactive. This is a plan that is prepared after defining a business’s success and getting solution from the listening activities.

Things to be included in the plan includes: taking employees to seminars that cover topics such as customer care, organizing get together between employers and employees, rewarding employees, holding regular meetings, including major stakeholders in business decision, assurance to personal service, among others.

This plan does not concentrate in solving past troubles but in laying down a good foundation that guarantees business future success. A communication plan should take into consideration the availability of resources and whether the business aims at a long term or short term objective. Once a communication plan has been prepared, the company now focuses on its implementation.

The expected result should be kept in mind and the main constitute of the plan reviewed to make sure they are in line with the expected result. The implementation process should involve as many people as possible but it should have one person who is answerable to it (Ian & Dunford, 2005).

Empower action

This stage is reached when the internal customer (bankers), stakeholders and management have appreciated what the bank want to implement and supported it. The change agents should be busy on the ground implementing the required changes and letting the business on a new wave of things. At this stage practical change is undertaken although operated with the traditional system.

This stage assists in polishing any issues which may have been ignored in the initial stage. Employees learn more about the new system and its operations; incase there are areas that need to be polished, then the change agents have an ample time in clarifying issues.

Create short-term wins

At this stage, the management should have short lived evaluations of the system to ensure that it is efficient and can replace the old system. There is no need to wait for long periods for results but can even be done on daily basis or weekly basis.

Don’t let up

If the change strategy has been successful in the creation of short-term wins stage, then the Standard Chartered Bank should go ahead and reinforce the use of the changed system. Polishing any deficits recognized as the new system is undertaken.

Make change stick

At this stage, the change adopted has been fully implemented in the bank: monitoring and sticking to change is the main function at this strategy; it is also important to improve the systems further (Kotter, 1995).

Standard Chartered Bank expects that the change likely to be implemented is likely to face some challenges; these challenges. Psychologists refer to resistance to change as a natural reaction to uncertainty and/or unknown.

Organizations have human capital, thus in times of change, resistance to change are dominant, and Standard Chartered Bank will have to start with the internal customers to ensure that their resistance to change has been well addressed.

When a change is implemented in an organization, employees feel more comfortable in their status quo rather than change; the nature of human beings is that they are comfortable to the current standing rather than moving to a new system that they are not aware of its operation and the effect it can have on them.

When an organization or a country at large, wants to make a change in the way things are done, or the way that things are done then the start point is understanding the need that require a change (Laura-Georgeta, 2008). People are not willing to change, they are static; however if well implemented then it can be a smooth transition.

Standard Chartered Bank in UAE organizational culture can be a hindrance to change; how well the management has prepared its employees to embrace change has an effect on whether the change will be embraced or not.

Alternatively, there is an effect by experiences with change that the organization has had; if in the past change had been effective with positive effects on employees, then change will be more welcomed than when the employees in the past suffered because of change (Ford, Ford & D’amelio, 2008).

Conclusion

To remain competitive in the changing banking industry in the UAE, Standard Chartered Bank should embark on internal operation improvement. The current stability level enjoyed by the bank will be threatened in the future if improvements are not continually done.

Change is inevitable in business, thus Standard Chartered Bank management should adopt effective strategic change management systems. To understand areas that need change, the company should undertake internal and external audits of its company and the industry respectively.

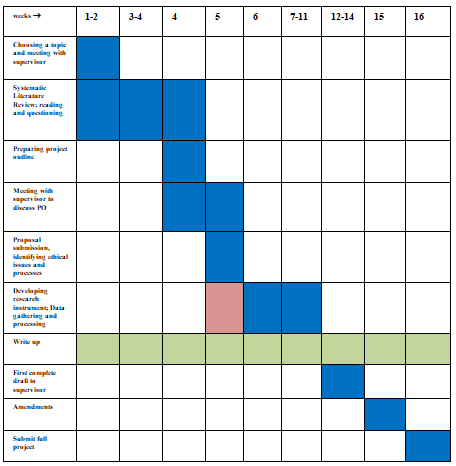

Timeline

Reference List

Allen, N., & Herbert, A. (1972). Human Problem Solving. Englewood Cliffs: Prentice-Hall.

Ford, J., Ford, L., & D’amelio, A. (2008). Resistance To Change: The Rest Of The Story. Academy of Management Review, 33(2), 362-377.

Ian P. & Dunford, R.(2005). Managing Organizational Change. New York: McGraw-Hill.

James, D.T. (1967) Organizations in Action. New York: McGraw-Hill.

Kotter, P. (1995). leading change: Why transformation efforts fail. Harvard Business Review, 73(2), 59.

Laura-Georgeta, T. (2008). CHANGE MANAGEMENT – RESISTANCE TO THE CHANGE. Annals of the University of Oradea, Economic Science Series, 17(4), 622-624.

Warren, G.B., Kenneth, D.B., & Chin R. (1969). The Planning of Change (2nd Edition). New York: Rinehart and Winston.