Introduction

Harley-Davidson Inc. was established during the first ten years of the 20th century in Wisconsin. It is one of the major motorcycle manufacturers that was not hard hit by the Great Depression. It has also survived stiff competition from Japanese motor cycle manufacturing firms due to its high quality and competitive products and services.

The external analysis of the company reveals that Harley-Davidson Inc. is one of the companies that are highly recognized and admired worldwide. One of its notable marketing strategies entails excellent academy for training individuals who desire to learn riding motorcycles.

Issue I: Competition

On the basis of internal rivalry, the company inevitably faced competition from firms which manufacture similar products as well as enjoy larger market share and stronger financial bases. For instance, Yamaha Company is one of its close market rivals. Consequently, just like Harley-Davidson, the three other competitors also concentrate on production of heavy weight motorcycles.

These competitors include Honda, Yamaha and Suzuki which are all Japanese companies. In addition, Honda Company which stands out as the major competitor of the company in the United States of America enjoys a larger market share (Grant, 2005).

Causes of stiff competition

It is imperative to note that Harley-Davidson products are highly priced and therefore, it locks out customers who are of low-income levels. Additionally, in some European nations, the company has problems in attaining larger market share. In the markets that are considered big and diverse such as India, Harley-Davidson has failed to venture and exploit the same. Finally, the company has not met the requirements of the production process by analyzing the future of their product’s market segment (Bloomberg business week, 2011).

Impacts of competition

Competition has been heightened by the fact that most of the competitors have larger market segment, diversity and financial capabilities. Following stiff competition the company is likely to experience a fluctuation in its market share if no action is taking to retain and attract new customers. Apparently, los of market share due to increased competition also translates to a decline in the company sales and subsequently a reduction in profitability (David, 2010).

Recommendations

It is highly recommended that the company should penetrate the market by obtaining a larger market share from the existing ones such as UK, U.S and Japan. It can attain this by employing advanced marketing techniques such as online advertising and intensive use of social media. The fact that the company has a well established brand name, it can viably compete with other market rivals. Moreover, due to the fact that there is high level of competition in US market, the company can achieve more as a result of market penetration (Reuters, 2008).

Issue II: Reduced threats from potential entrants

In regards to potential entrants into the market, the company faces minimal threats since most entrants are quite often deterred by high amount of capital investments required in establishing Motorcycle Company. Furthermore, the motorcycle industry has already reached what may be referred to as maturity stage. Therefore, there are only four players in the market segment who are also major competitors.

The small number of players can also be attributed to the fact that optimum profitability may only be enjoyed when manufacturers take advantage of economies of scale.

Causes

One of the important elements in the operations of Harley-Davidson is the presence of substitute products or services. The main substitutes of Harley-Davidson products are cars, scooters and sports bikes.

This is because the company concentrates on production of luxurious motorcycles. Hence, it has fewer substitutes. In addition people who want to purchase heavy weight motorcycles produced by Harley-Davidson do not consider buying the existing substitutes. Consequently, lack of substitutes reduces the threat of entry by potential competitors.

Impacts

Barriers to entry imply that Harley-Davidson operates to nearly oligopolistic competition whereby they the power of suppliers. It has a large number of suppliers and hence if a supplier increases base price, the company has the option of switching to others without necessarily affecting production process.

The only materials that Harley-Davidson seeks from the suppliers are electrical and steel equipments in addition to shipping process (Bloomberg Business Week, 2011). The same significantly impact on the financial position of Harley-Davidson (Pahl & Richter, 2005).

Recommendations

Harley-Davidson should exploit the oligopolistic competition situation to increase customers’ power. They should not be tempted to exploit customers in terms of prices but they should continue developing attracting offer to their wide consumer base. In addition, they should continue treating their suppliers with utmost respect to ensure a smooth interaction (Grant, 2005). The fact that both young people and women are becoming more and more interested in the bikes should be treated as an opportunity whereby Harley-Davidson can utilize its position to tap into this emerging consumer base. Another aspect is that clients highly value motorcycles which are of high quality so they should continue offering the same. Moreover, the global market has continued to grow and it is wider than the existing market in U.S alone (David, 2010).

Issue III: Strong capital and market base

The strengths of the company can be analyzed on the basis of financial status of the company. Against this background, the company enjoys the wider international market. This has been en attributed to products of the company that are highly demanded in most European markets.

Causes

Harley-Davidson is the only company that manufactures heavy weight motorcycles in American addition to having a brand which is very strong. Consequently, the European market for heavy weight motorcycle is made up of performance and standards of Harley-Davidson’s segments which take up to 70% of the market share (Scott, 2008). In addition, the company has two segments in which it operates in. This consists of financial services of Harley-Davidson Company and the company’s motorcycles and other related products.

Impact

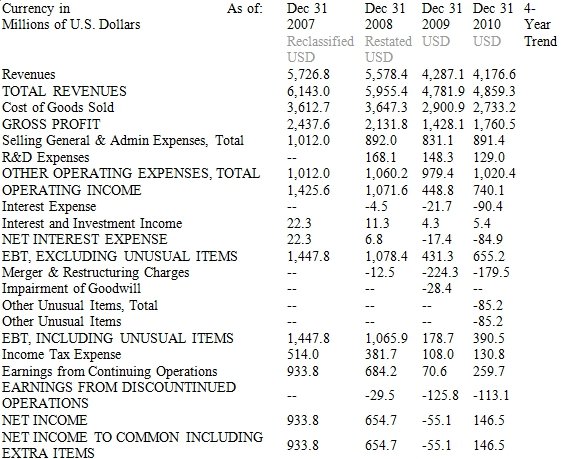

In 2003 financial year, the net income of the company increased by 30%b as compared to 2002 (Harley-Davidson Latin America, 2011). This data can also be accessed in the appendix below. The company further customizes its products and therefore it makes significant returns from the same as the cost is tied to specifications of customers.

Recommendation

The Company should further strengthen it marketing strategies such as public relations, events for customers, direct mails, use of magazines and even dealer promotions. This enables them to compete productively with their rivals and have a large market share (Harley-Davidson Latin America, 2011). Furthermore, Asian and European markets have been expanding over the years in addition to increasing demands for bikes in United States so Harley-Davidson should consider further investment in these markets (Grant, 2005).

Conclusion

In addition, the leadership should concentrate on product development. For instance, the company should consider expanding its products to females and younger generations who are becoming interested in motor bikes. The leadership should also concentrate on building the existing Asia market which has high population level thus higher market potential (Sandretto, 2011).

Based on the above analysis of Harley-Davidson Inc., it is pragmatic for the company leadership to consider the idea of not only expanding the Asian market but also the European one.

Furthermore, the firm should aim at marketing sales of motorcycles for both females and young enthusiastic buyers. In conclusion, the leadership should embrace both concentric and horizontal diversification as part and parcel of retaining and attracting new customers.

References

Bloomberg Business Week (2011). Harley-Davidson inc. Web.

David, R. F (2010). Strategic management concepts. London: Prentice Hall.

Grant, R. M. (2005). Contemporary strategy analysis. London: Wiley-Blackwell.

Harley-Davidson Latin America (2011).Timeline 1900s. Web.

Pahl, N. & Richter, A. (2005). SWOT Analysis -Idea, Methodology and a Practical Approach. London: Wiley-Blackwell.

Reuters (2008). A complete and comprehensive analysis of Harley-Davidson includes an overview. Web.

Sandretto, M. (2011).Cases in Financial Reporting. Boston:Cengage Learning.

Scott, M. (2008).Harley-Davidson-motor company. London. ABC-CLIO.

Appendix: Financial ratios of Harley-Davidson Company