Case Study

Company X is a financial organization that operates globally. The firm deals with money transfer services where customers set their transfer orders, after which the organization performs payout duties. Company X is unique because it operates in over seventy countries and currencies. Besides, the business is safe because its owners have a financial licence in more than fifteen countries. The profits originate from the conversion fees. The transfer of one currency to the other determines how much the company makes. The case study is fictional, but it helps in the estimation of the month-over-month growth rate and expected revenues gained over a short business period.

Projection of the Revenue Over the Next 12 Months

The organization’s annual revenue can be lucrative based on the recent assumptions of the firm’s current monthly revenue. The value is 10 Million GBP. If the value is held constant, then the company has higher risks of doubling its monthly revenue based on the ratios split between the 12 months. shows the exact growth per capita as 45 million GBP. Applying both formulas leads to approximating of the expected revenues over the short business period. The MoM shows the increase in the number of users of Company X, while the CMGR. Social, demographic, and economic factors need to be stable for the realization of the forecast.

The MoM growth rate indicates the change in the metric values for the currency transactions in company X. Generally, the organization’s revenue increased by 33.33%, assuming that the prior month’s revenue was 7.5 million. In contrast, the current month’s revenue is 10 million GBP, as indicated in the case study. To determine the value of revenue earned at the end of 12 months, take the MoM’s ratio and multiply it by 12. The resulting value is then multiplied by the initial revenue earned. In this case, the value is 7.5 million GBP. Meaning by the end of 12 months, the business will close the sales period with a revenue of 29.7 million.

Modeling

In this scenario, company X’s compounding monthly growth rate is 0.06. Therefore, the number of users from January to December grew by 6%. The logic in this reasoning applies that by the end of 12 months, the total revenue earned by the organization will be 45 million GBP. The value is calculated by multiplying 6 with the initial value of 7.5 million. The percentage in the number of users increased by 6%. Therefore, introducing the last month to twelve indicates the rise or growth of the company in the issued business period.

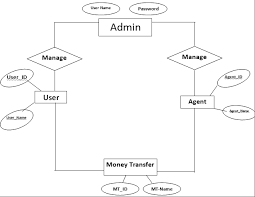

ER Diagram

The above ER diagram can work best for company X because the model prioritizes the security of customers and the firm. Every admin employed by Company X must have a username and password to avoid confusion in service delivery. In addition, the chart creates room for users and agents; both parties must have user IDs and names for tracking purposes. Fraudulent transactions can be blocked using the ID’s IP addresses. In short, money transfer occurs in ways on this platform. First, an agent can contact the admin on behalf of a client through user IDs and names for inquiry purposes (Mensah et al., 2019). Secondly, users can directly make transactions through the admin portal. The admin has full access to the money transfer system. However, they cannot determine the trades completed by agents and users. The password and username issued to the admin only apply for monitoring and controlling the site from fraudulent behaviors. The admin on duty protects the information of users. As a result, the presence of individuals facilitates smooth transactions.

The technical challenges linked to the bounce back of transactions are foreseen in company X. However, the organization adopts a technological framework that distinguishes transactions based on captured data. For example, red flags can be raised for a failed or delayed transaction because of merging online transaction processing (OLTP) and online analytical processing (OLAP). The historical data linked to the platform are aggregated using the OLAP, while raw data is captured using the OLTP.

Technical Solutions

OLTP systems permit several users to access particular websites simultaneously. Clients depending on Company X can change information from the website because the system allows them to access the page simultaneously. As a result, the data obtained through the OLTP is not accurate for decision-making. However, the software allows stakeholders to expect complete data daily. Admins from company X can limit the problem through recovery mechanisms and concurrency control. Recovery mechanisms like OLAP’s introduction can influence aggregated transaction histories’ tracking. Stakeholders can complete data management and review every 30 minutes 24/7 based on the policies of operations for OLAP. Solving the technical and operational activities is complex because users must access the website at their time of will (Yun et al., 2021). The recovery mechanism keeps the system safe and secures it for reuse.

Decision Making

The architect of OLTP systems assists company X in monitoring transactions across the website. The first step to encounter in the establishment of the decisions includes the identification of the strategy. Voinov et al. (2019) Highlight that business strategy defines organizations’ success or failure rates based on isolated virtues, values, and organizational beliefs. The second phase incorporates the planning process for the money transaction system. Company X’s business nature follows closely, after which the ETL process arises. Data warehousing technology helps OLTP store, process, and aggregate data.

The company would need currency, user identity, amount of money transacted, and update buttons data sets, outputs, and visualization to make a business decision on the revenue performance. The quality of data can be ensured through continuous monitoring ad control of the servers while having a semi-real time pipeline constantly running.

Data Visualization, sets, and Outputs

The decisions on revenue performance depend on the visuals, data sets, and output recorded in money transfer services offered at Company X. The data sets are the essential elements in this segment because it contains the insert, delete, and update buttons which enhance users to add or remove their transactional information. The currency, amount of money transferred, and the people involved in the particular acts are also integral for company X in monitoring activities. The outputs determine the quality, efficiency, and accuracy of transactions.

How to Improve Quality of Data

The quality of service in the output can be improved using the warehouse tool and the maintenance of the technology. According to Roy (2019), warehouse technology increases the quality of data shared with stakeholders. As a result, company X will save a lot of money used in a telephone conversations to confirm or cancel transactions. Money transfer options become more visible with the installation of the data warehousing technology since the application showcase data sources on screens. The data integration, storage, and refreshment process become easier and more effective with the incorporation of extra transaction options initiated by the data warehousing software.

References

Abrate, G., Nicolau, J. L., & Viglia, G. (2019). The impact of dynamic price variability on revenue maximization. Tourism Management, 74(12), 224–233. Web.

Mensah, I. K., Chuanyong, L., & Zeng, G. (2020). Factors determining the continued intention to use mobile money transfer services (MMTS) among university students in Ghana. International Journal of Mobile Human Computer Interaction, 12(1), 1–21. Web.

Roy, M. K. (2019). A Survey of Big Data Tools and Technologies. Northern Illinois University

Voinov, N., Rodriguez Garzon, K., Nikiforov, I., & Drobintsev, P. (2019). Big data processing system for analysis of github events. 2019 XXII International Conference on Soft Computing and Measurements (SCM)). Web.

Yun, Y., Ma, D., & Yang, M. (2021). Human–computer interaction-based Decision Support System with Applications in Data Mining. Future Generation Computer Systems, 114(23), 285–289. Web.