Introduction

United Arab Emirates (UAE) is located in the Gulf of Oman coast in the Middle East. UAE is a member state of the Gulf Cooperation Council (GCC). GCC is an economic cum political organization founded by Arabs countries that border the Persian Gulf.

According to the 2012 GCC economic report, UAE was the second largest economy among the member states. The association further ranked UAE as the third largest economy in the Middle East. In the world ranking, UAE is rated as the 30th largest economy.

UAE is said to be one of the fastest growing economy in the world. Tourism industry is the largest source of foreign exchange in the UAE.

Export of natural gas and petroleum products plays a significant role in the country’s Gross Domestic Product (GDP). Plans are underway to diversify UAE’s economy beyond tourism, energy and service industry (International Monetary Fund 2013).

Germany is located in the central region of Western Europe. Germany is among the 17 countries that constitute the European Union (EU) member states. Just like GCC, EU is a Europe regional organization that facilitates political and economic interest of the region (Thompson 2013, p. 228).

According the international monetary fund (IMF), German economy is the largest national economy in the entire Europe. In addition, German nominal GDP ranked fourth in the world ranking after United States (US), China, and Japan.

The country further ranked fifth in terms of the GDP purchasing power parity (PPP) in 2012 (International Monetary Fund 2013). Germany earns largest foreign exchange from exports. The exports include automobiles, chemicals, and machinery.

However, the country imports a third of its power from other countries. German and UAE economies benefit largely from EU and GCC inter-regional trade. GCC and EU organizations have facilitated the trade by signed several economic agreements since (Braun 2012, p. 2005).

Economic variables

UAE and Germany economies can be well compared through macroeconomic variables and theories. Research asserts that macroeconomics provides the best analysis of country’s economy. Macroeconomics is best analyzed using the Output-Expenditure identity, Y=C+I+G+(X-M).

Y is the GDP representing the total value of service and goods that a country produces annually. C is the consumer expenditure which represents the total value of services and goods customers buy annually. I represent the total business investment value.

Finally, G represents the government spending. X represents the total export while M is the total value of imports annually. This is the annual purchases of all capital goods in a given country.

The Output-Expenditure identity leads to the circular flow of the economy. Y=C+I represent the fundamental economy of a country. The equation states that the total income of the country is equal to the total business investment and consumer spending (Dunn & Mutti 2012, p. 85).

Macroeconomics experts use the Output-Expenditure identity to explain economic variables. Economic variable is the statistical measure of the economic status. Therefore, there are three economic variables in the Output-Expenditure identity.

The variables include Y (total output, or GDP), C (consumption), and I (investment). The fiscal economic policy defines GDP as the total purchases that government, businesses, and consumers of a country make within a year.

Secondly, the total consumption is a function of the citizen’s disposable income. Income is the net personal income after the prevailing taxes. Therefore, government taxes influence the consumption rates in the economy.

Finally, taxes are functions of the citizen’s income. Therefore, we can evaluate and compare economy of UAE and Germany based on the history of the total country income, consumption, investments, government and taxes.

However, all these variables are usually involved in the calculation of the annual GDP growth rate and value. In summary, we can substantially analyze the economy of UAE and Germany by focusing on their annual GDP (Dunn & Mutti 2012, p. 88).

World development indicators (WPI) from 2003 to 2013

Germany

Table 1 Germany WPI data (World Data Bank 2013).

United Arab Emirates (UAE)

Table 2 UAE WPI data (World Data Bank 2013).

National Bureau of Statistics data

Germany

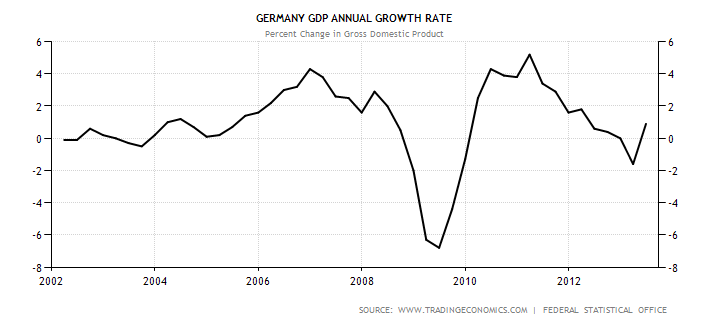

According to the German Federal statistical Office, GDP growth rate slightly improved in 2013. The office reported that GDP grew by 0.9 percent in the second quarter of 2013 compared to the same period in 2012.

The federal annual report indicates that annual growth rate from 1992 to 2013 stands at 1.3 percent. The highest GDP growth rate was 5.2% in 2011, March.

On the other hand, the lowest GDP growth rate recorded was -6.8% in 2009, January. The growth is attributed to the contribution of various sectors that constitute the Germany economy (Trading economics 2013).

Service sector is reported to contribute the highest income in the country at 18 percent. The most significant service industries include health, education, and public service.

Accommodation, food industry, trade, hotels, and transport contributed 16 percent of the Germany’s GDP in the second quarter of 2013. Real estate industry and business contributed 11% and 10% respectively.

Agriculture and other industries contribute the remaining 1% of the total GDP in the annual Germany income. Germany is the fourth largest national economy in the world. This prosperity is attributed to the large exports that Germany do annually.

In that regard, exports contribute over 25% of the Germany’s national GDP annually. The following figure provides a graphical trend of the Germany GDP growth rate.

United Arab Emirates (UAE)

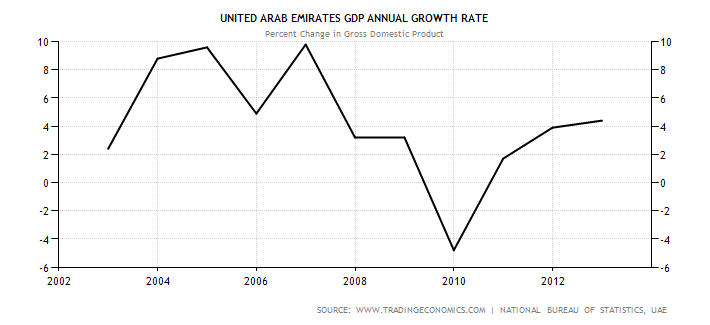

National Bureau of Statistics, UAE reported a substantial GDP growth in 2012. The department reported a 4.4 percent GDP growth rate in 2012 compared to 2011. The Bureau articulated that average annual GDP growth rate of UAE was 4.6 percent from 2000 to 2012.

The highest GDP growth was recorded in December 2006. On the other hand, the lowest GDP growth rate was -4.8 percent in 2009. The GDP growth rate in the past twelve years was as a result of improvement of various economic sectors.

It is worth noting that the UAE GDP growth rate is fast. Very few countries register such growth and consistency in the national GDP growth rate.

Figure 2 below shows the graphical representations of the UAE annual growth rate from 2003 to 2013.

The Bureau asserts that the service industry contributes over 40 percent of the annual GDP. The most profitable segments in the service industry include: retail and wholesale trading (12 %); Business and real estate (9%); and warehousing, communication and transport (8%).

Export of natural gas and oil contributes about 38% of UAE national income. 13% of the national GDP comes from distribution of gas, water, and electricity to the neighbouring countries.

Manufacturing industry is said to contribute 8% of the annual GDP. The remaining 1% of the national GDP is contributed by agriculture and fishing industries (Trading economics 2013).

Explanation of the economic data

The International Monetary Fund (IMF) attributes the 2009 economic meltdown in the two countries to economic depression. IMF defines economic depression as the decline in economic growth in two consecutive financial quarters.

IMF report indicates that aggregate demand (AD) represents Y in the Y=C+I+G+(X-M) equation. A fluctuation in any of these components results to the economic recession. Common causes of the recession include borrowing, less government spending, and high taxes.

This eventually reduces the disposable income hence fall in the real GDP. The adverse effect of AD fall results leads to the economic recession (International Monetary Fund 2013).

In 2009, Europe experienced a severe economic recession. IMF asserts that the recession was caused by several economic constraints. Abrupt shortage of lending funds resulted to the credit crunch. Decline of the credit loans led to reduced credit availability and fall of housing prices.

The fall was as a result of reduced mortgages and persistent credit crunch. In the beginning of 2009, the inflation rates escalated leading to decline disposable income in many EU countries. The condition resulted to loss of confidence to the financial sector across Europe.

The confidence in the real economy led to the economic recession. The economic recession resulted to fall of international trade in Europe. This explains why there is GDP decline in both Germany and UAE in 2009 (International Monetary Fund 2013).

Analysis

Explanation of the economic variables

The above tables show a detailed 10-year WPI data from the world data bank database. The table contains the annual GDP values, in dollars, from 2003 to 2012. The tables further provide the GDP growth rate in both countries by giving the percentage change from the previous year.

This change is significant since it helps us evaluate the economic progress of both countries. In addition, the table provides the gross national income (GNI) of the two countries.

Economic experts use the prevailing international dollar value to determine the GNI per PPP values of various countries for ranking purposes. Consequently, the GNI listed in terms of per capita PPP in dollars (EIU Country Analysis 2013).

According to the 2011 World Bank GNI/PPP report, Germany ranked 16 while UAE ranked 15. This implies that UAE had higher income than Germany. GDP growth rate is the percentage change in the total production of a given country over a specified duration.

The above WPI tabulations have included population details. Population growth rate is an important factor in the determination of the country’s GDP. The total population of the country is used in the calculation of the per capita income.

In addition, the population is also used in the determination of the purchasing power parity and consumption rate. The more the population, the higher the consumption since every person in the population consumes goods and services daily (EIU Country Analysis 2013).

From the table, it is clear that UAE population increased from 3,369,254 in 2003 to 9,205,651 in 2012. This translates to about 200% increase in population in a span of 10 years.

Such high rate of population growth resulted to increased dependency ratio, increased pressure on social amenities and economic resource. Advantages of high population growth rate include increased local consumption, taxes, and investment.

On the other hand, Germany population declined from 82,534,176 in 2002 to 81,889,839 in 2013. This implies that Germany has experienced reduced population pressure (EIU Country Analysis 2013).

Data analysis

UAE economy is growing at very high rate. This paper earlier focused on how UAE’s population increased by over 300% in a decade. Despite high population growth rate, UAE recorded a GDP growth rate of 4.4% compared to 1.3% of Germany in 2013.

On the other hand, German population declined over the same period. Economies argue that increased population is detrimental to the country’s economy. Therefore, it is expected that UAE GDP growth rate should decline following the effects of the increased population.

Contrary, UAE GDP has a high growth rate for the last three years. This confirms the widespread speculation that UAE has the fastest growing economy in the world (EIU Country Analysis 2013).

German GDP growth can be termed as stagnating. Given that the country is the fourth largest national economy for a while now, a better growth is expected. In addition, with fairly constant population for a decade, the GDP should be even better.

However, Germany has recorded a slow growth of 0.9% in 2013 and 1.3% overall. Though this is economic growth, this is low for a country of such economic status. A slight decline in population should have improved the German GDP.

Decline in population implies that German government had little spending on health and other social amenities. Furthermore, this means job opportunities of their citizens have been high.

Decline in population means low population under the age of ten. Therefore, there is a low dependency ratio hence high disposable income among the citizens. Following these advantages, German should have a faster growth rate than now (EIU Country Analysis 2013).

Comparative analysis

Germany

Germany GDP growth rate declined in 2009. This was as a result of the 2009 economic depression in Europe. Eurostat statistical office reported that poverty levels in most part of Europe increased by approximately 2.5 percent from 2009 to 2011.

This percentage translated to over 117 million citizens in Europe. The poverty level increase is associated with social transfers that took place during that period. Eurostat asserts that the most affected citizens were those earning a disposable income of less than 60%.

The working group working for a total of less than 20% working hours were also subject to this condition (Braun 2012, p. 2020).

Social transfer resulted to severe material deprivation. Eurostat defines material deprivation as the state of being unable to afford the four indispensable items in life. The four items include a car, daily balanced diet, rent, and a washing machine.

The report reveals that the severely deprived people increased over 5% from 2009 to 2011. Severe deprivation leads to reduced purchasing power in the region. Germany Exports contributes over 25% of the annual National GDP.

Therefore, social deprivation across Europe must have affected the GDP from 2009 to 2011 as shown in the GDP growth rate graph in figure 1. Perhaps, Germany experienced reduced local consumption of the due to the same condition (Braun 2012, p. 2022).

United Arab Emirates (UAE)

UAE experienced fast GDP growth rate from 2003 to 2008. Earlier this paper stated that export of oil and natural gas contributes to 38% of the UAE’s annual GDP. Macroeconomic reports state that there was significant growth of the world prices of oil and natural gas from 2003 to 2008.

This led to increment of UAE’s economy with over 145% to $261.4 billions. In addition, UAE embarked on economic diversification programs in the same period.

Investment in other sectors like trade, real estate, transport and communication, and distribution of electricity and gas boosted UAE economy. This explains why UAE experienced the fastest GDP growth rate despite high population growth (EIU Country Analysis 2013).

UAE GDP growth rate declined in 2009. This was mainly caused by the effects of the economic recession in 2009. Since UAE earned high GNI through export, global economic contraction in 2009 reduced the annual GDP in 2009.

The economic recession led to reduced global prices of oil and natural gas. In addition, many EU countries that import energy products from UAE reduced their import quantities. This resulted to a sharp decline in the GDP growth rate.

IMF reported that UAE annual GDP growth rate declined by 12% in 2009 alone. However, the growth rate improved in 2010 after economic recovery (International Monetary Fund 2013).

From 2010 to present, UAE GDP growth rate has been on the rise. In 2010, UAE oil and natural gas exports gradually started increasing. This was due to the economic recovery in Europe following the severe 2009 recession.

Through EU-GCC regional partnership, most EU economies increased their spending on natural oil and gas products. Furthermore, the international prices of oil and gas increased from 2010. This resulted to increased UAE GDP growth rate at 1.8% (2010), 3.9% (2011), and 4.4% (2012).

The 4.4% mark was the highest since 2006. Bureau statistics office reported that this was due to stable world oil prices. In addition, the office attributes the rise to the increased tourism and trade activities in Dubai, the state’s capital (EIU Country Analysis 2013).

Trend Analysis

Germany

Despite slow GDP growth rate in the second quarter of 2013, the rate is predicted to continue growing. According to EIU, Germany US GDP is expected to hit 2.6% and 2.4% by 2014 and 2015 respectively. In addition, the OECD GDP is expected to increase from 1.1% to 2.2 by 2015.

However, Eurostat postulates that there is a possibility of economic contraction by the end of this year. This might result to an increased number of severely deprived people in the European countries.

As stated earlier, this might lead to reduced purchasing power of the region. Exports contribute the highest income in the Germany’s economy. Therefore, severe deprivation in Europe might result to reduced national GDP by the year 2015 (International Monetary Fund 2013).

UAE

The International Monetary Fund (IMF) postulates that UAE GDP might decline to 3.6% in 2013. However, the body reports that the growth is expected to grow to 3.7% (2014), 3.8% (2015), 3.5% (2016), 3.4% (2017), and 3.5% (2018).

The report asserted that earning from both oil and non-oil sectors will grow significantly. However, the report noted higher growth in non-hydrocarbon sectors than in the oil sector. IMF attributed the growth forecast to increased government spending and foreign capital inflow.

In addition, UAE is perceived as the safest country in the warring Middle East countries (International Monetary Fund 2013).

UAE government is committed to maintaining fast GDP growth rate. Consequently, the government is currently under intensive economic diversification programs to supplement energy. UAE government has rolled out a $ 90 billion 5-year projects to construct a new city.

This city will host about 100 international hotels and the world’s largest shopping mall. The city will be the best tourist destination in the world. In addition, Dubai has one of the largest airports in the world.

Its strategic locations have and will continue attracting most international stopover for flights. The government is planning to take advantage of the airport to establish the world trading centre in its capital.

At this rate, UAE will soon be one of the largest national economies in the world (International Monetary Fund 2013).

References

Braun, H. 2012, German Economy in the Twentieth Century, Routledge, London.

Dunn, M. & Mutti, J. 2012, International Economics, Routledge, London.

EIU Country Analysis 2013, Country Report Germany 2013. Web.

EIU Country Analysis 2013, Country Report UAE 2013. Web.

International Monetary Fund 2013, Germany 2013 Article IV consultation, International Monetary Fund, Washington, D.C.

International Monetary Fund 2013, United Arab Emirates 2013 Article IV consultation, International Monetary Fund, Washington, D.C.

Thompson, W. 2013, Western Europe 2013 (32nd ed.), Stryker-Post Publications, Lanham, Maryland.

Trading economics 2013, Annual GDP growth rate. Web.

World Data Bank 2013, World development indicators. Web.