Executive Summary

This paper offers an assessment of the investment attractiveness of the HBSC company by describing the organization’s current position and comparing its vital financial indicators with those of a direct competitor in the market. Financial analysis, in conjunction with an assessment of current accounting policies, provides a broad picture of internal factors and determinants of efficiency, profitability, and liquidity. As a result, critically evaluates the possibility of buying shares in a given company.

Introduction

HSBC is one of the largest banking conglomerates in the world and holds a solid first position in the UK in terms of market capitalization and asset size. This organization has numerous subsidiaries worldwide under this brand, including those featured on the Forbes list (Forbes, 2022). The company offers primary services in commercial, global, consumer, and corporate banking, continually diversifying its offerings through technological advancements and horizontal expansion into new regions. This conglomerate is also part of the globally systemically important banks (Financial Stability Board, 2018). HSBC offers a wide range of banking services, and its connection with financial indicators is crucial for the company.

Performance Overview

The revenue of HSBC Holding has been a dynamic indicator since 2009. Although ups and downs can sometimes be attributed to global external factors, such as the 2008 crisis and the 2020 pandemic, in general, the gross margin remains at a stable level, indicating the company’s stability and efficiency (Macrotrends, 2022). This fact also confirms the long-term assets and liabilities ratio, which remained in equal positions for over ten years (Macrotrends, 2022). At the same time, over the last five years, both Gross Profit and Revenue have tended to decrease. The share of borrowed capital held by shareholders is relatively small, although it is growing at a modest rate.

Over the last five years, the share of spending on intangible assets has increased, contrasting with the stable dynamics of property, plant, and equipment in the cash flow statement. This fact suggests that horizontal development into new geographic regions is proceeding systematically and simultaneously. At the same time, innovation has begun to acquire greater significance in maintaining competitiveness and securing a leading market position.

In addition to its M&A policy, HSBC sells its businesses in selected regions and focuses its capital on targets that meet modern social and environmental responsibility. The sustainability of HSBC’s business, among other factors, relies on the optimal allocation of assets, as demonstrated by sales, such as those in Canada, and investments in the transition to renewable energy sources (HSBC, 2022). Finally, the company highlights digital banking as a priority area of development (HSBC, 2022). The latter includes focusing on security, globalization, and the availability of funds for each client by implementing modern blockchain technologies, tokenization, and other solutions.

Finally, the company’s operating activities have begun to generate excess returns, reflected in the retained earnings figures for the past five years. Cash flow from operating activities increased more than five times in 2020 due to a more stringent and effective policy for collecting accounts receivable during the pandemic (Macrotrends, 2022). However, against the backdrop of this crisis, the company’s share price fell to almost an all-time low in 2008; it has since shown signs of recovery, until the tense geopolitical situation in Eastern Europe (Macrotrends, 2022).

The company’s capitalization in this regard is quite sensitive to external factors, especially in light of the globalization policy and the implementation of relevant technologies. However, in the long term, HSBC still, as a rule, restores positions. Although the organization is associated with many stories that tarnish its reputation, management performance remains high (Naheem, 2018). Legal risks associated with the increased emphasis on security issues are steadily growing. This fact can be seen as a threat to reducing capital inflow from investors and shareholders, but HSBC does not rely on it.

Financial Ratios

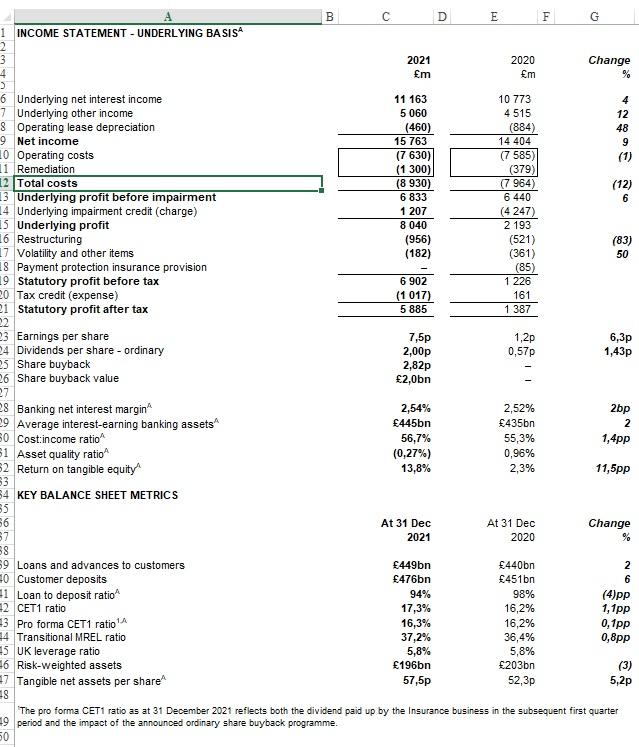

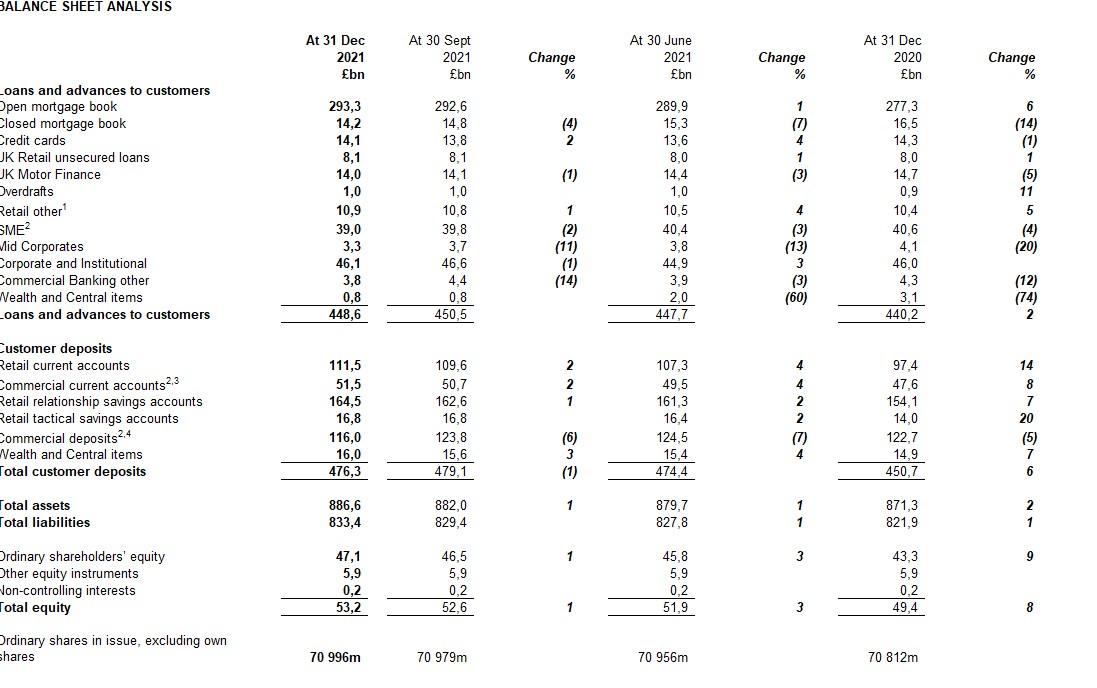

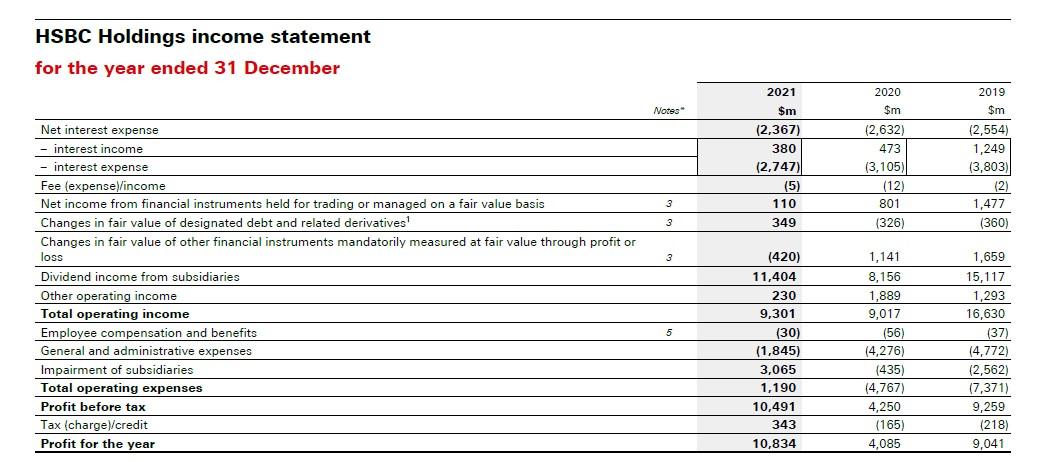

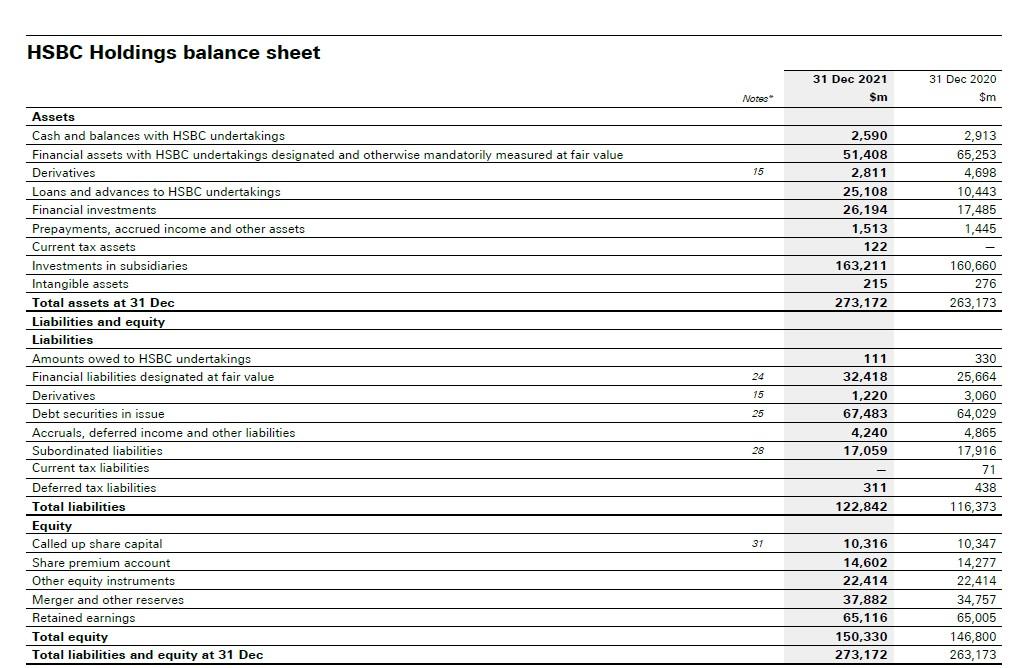

Table 1. Financial Ratios (See Appendix A)

Financial ratios are most illustrative of a company’s efficiency and liquidity, especially when compared to direct competitors in the banking sector. Dozens of financial ratios are tracked to determine a business’s value. The most significant among them are the following ten coefficients, which allow one to evaluate efficiency and investment.

The Asset Turnover ratio (ATO) reflects the specific assets held by banks and is nearly identical for HSBC and Lloyds Banking Group. However, given the scale, HSBC is seen as a more attractive investment from this perspective due to the company’s more significant capabilities. This indicator measures a company’s sales or earnings in relation to its total assets.

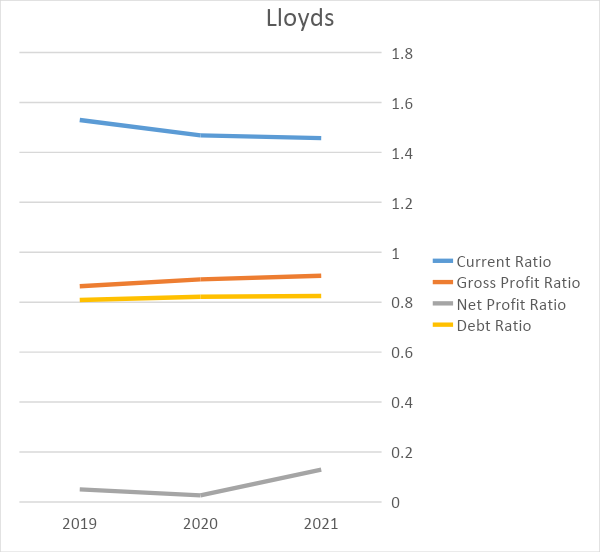

The Current Ratio (CR) indicates to investors and analysts how a company can utilize its existing assets on its balance sheet to settle its current debt and other payables. Lloyds’s current ratio, which is almost half that of HSBC, demonstrates a more stable picture. From this, it follows that Lloyds has more assets to cover its short-term liabilities in the event of a potential economic crisis.

The Creditors Turnover (CTO) indicates the frequency with which a particular company pays its suppliers’ debts during a specified reporting period. The coefficient is calculated by dividing the cost of all goods sold by the average accounts payable. Both companies show high ratios, which is a good sign and means they are paying off their debts quickly.

The Debtors Turnover (DTO) is also known as Accounts Receivable Turnover. This indicator measures how often a company receives its average accounts receivable over a period. A high ratio indicates that the company is effectively collecting its debts. The example of Lloyds Banking Group and HSBC shows that the companies are approximately at the same level in this indicator and show similar dynamics.

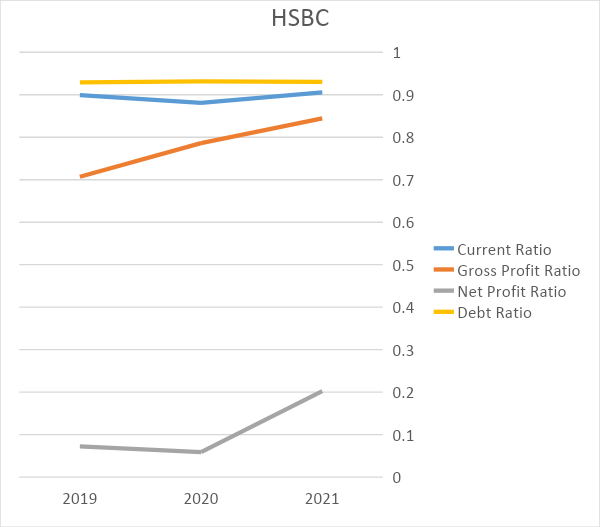

The Gross Profit Margin (GPM) is a crucial factor for investors, as a high ratio indicates that the investment will likely yield a return. According to Figure 1, Lloyds has a consistently high Gross Profit Margin. Over the last five years, HSBC has been approaching its competitors in this indicator.

The Liquid Ratio (LR) measures a company’s ability to pay its debt obligations. Three key indicators are typically used: the current ratio, the cash ratio, and the quick ratio. HSBC’s lower cash ratio indicates a somewhat risky position for the company against falling revenue dynamics. Currently, Lloyds is perceived as a less risky investment for investors; however, historical charts indicate that HSBC is in the midst of recovery, and the upcoming peak has yet to be reached. Depending on the investment’s purpose, HSBC and Lloyds are attractive targets, but HSBC shares carry significant risks.

The Net Profit Margin (NPM) is the ratio of a company’s net profit to its revenue. The calculations in Table 1 indicate that Lloyds Banking Group is more efficient than HSBC in terms of gross margin; however, HSBC’s net profit is higher. This fact suggests that competitors have less direct costs for the services provided, while HSBC is more efficient in terms of operating expenses.

The Return on Assets (ROA) measures how efficiently a company utilizes its assets to generate profits. The higher the ROA number, the more money the company can make with less investment. According to this indicator, Lloyds wins over HSBC, although not by a significant margin.

The Return on Capital Employed (ROCE) is the most indicative measure, implying the company’s ability to effectively manage capital borrowed from shareholders. Here, HSBC is more attractive, but its performance is dynamic, while Lloyds is more stable, albeit with promised profits only in the long term. This is because Lloyds has a more significant influence on shareholders, with a debt-to-equity ratio approximately twice that of Lloyds.

Finally, the Return on Equity (ROE) shows a corporation’s profitability. This indicator is calculated by dividing net income by the cost of equity. According to this indicator, Lloyds is better at converting equity financing into profit.

Lloyds Banking Group demonstrates greater efficiency than HSBC in terms of gross margin; however, HSBC reports a higher net profit. This indicates that while competitors incur lower direct costs for services, HSBC achieves superior efficiency in managing operating expenses. (HSBC, 2021). Investors have more power in the management of Lloyds than in HSBC, which demonstrates the company’s effectiveness in optimizing banking costs despite having a smaller market capitalization. In the case of HSBC, this power is less, but the net income provides more opportunities for comprehensive development compared to Lloyds (HSBC, 2021). Figures 1 and 2 illustrate the dynamics of key indicators for the two companies.

Lloyds presents a more stable position in terms of its current ratio, which is nearly half that of HSBC. This suggests that Lloyds holds greater assets relative to short-term liabilities, offering stronger resilience in the event of an economic downturn. At the same time, if one looks at Lloyds’ financial report in more detail, one can see that the company spends significantly more on development than HSBC. At the same time, the costs are significantly higher, as shown by the cash flow statement (Lloyds Banking Group, 2022). HSBC is generating less profit from the sale of assets, which suggests that investments are primarily focused on R&D, whereas Lloyds is more prudent with its costs and optimizes them.

Finally, capital structure ratios reflect the long-term perspective and the ratio of shareholders’ debt capital and other sources of financing. HSBC is less dependent on shareholders, yet it pays enormous dividends simultaneously. On the contrary, Lloyds has a higher debt-to-equity ratio, which indicates a greater diversification of sources of borrowed capital. From an investor’s point of view, these metrics, including HSBC’s higher debt ratio, suggest long-term stability, making Lloyds a less attractive investment target.

Accounting Suggests Long-Term Stability and Policies

HSBC invests in subsidiaries to optimize control activities, but Lloyds has a more stringent practice and considers this accounting policy more carefully. Lloyds and HSBC rely on the latest IFRS standards, which reclassify receivables as financial assets for depreciation purposes, taking into account the discount rate, a benefit for companies (HSBC, 2021; Lloyds, 2022). Otherwise, banking organizations need to have critical differences in these policies.

Limitations

This analysis is primarily based on financial ratios, but also considers, to a lesser extent, internal and external factors that may affect them. Global determinants strongly correlate with HSBC’s performance, but Lloyds has fewer opportunities in this market size. The current uncertainty caused by the geopolitical situation in Europe, as well as artificial and environmental problems, including inflated energy prices, can significantly impact share prices in the short term. The recommendations presented in this paper cannot fully address these limitations and, therefore, are provided for informational purposes only.

Recommendations and Conclusion

HSBC is an attractive investment target for several reasons. Firstly, the company is investing more in development, including environmental and digital developments, which are sustainable success factors in this competitive market. Secondly, the size of the company and its long-term capabilities, despite reputational risks and less stable performance compared to Lloyd, make it possible to overcome such crises by diversifying assets, which are increasingly becoming non-material, while material assets continue to grow.

Finally, the efficiency of the market leader is similar to that of its competitors, although there is still potential for optimizing the cost of services. Therefore, Lloyd shares can be used as a long-term store of value, given their prudent policy, while HSBC promises big gains with a volatile and risky momentum, as analyzed.

Reference List

Financial Stability Board. (2018) 2018 list of global systemically important banks (G-SIBs). Web.

Forbes. (2022) HSBC Holdings. Web.

HSBC. (2021) Annual Report. Web.

HSBC. (2022) News. Web.

Lloyds Banking Group. (2022) Annual Report 2021. Web.

Macrotrends. (2022) HSBC Financial Statements 2009-2022 | HSBC. Web.

Naheem, M. A. (2018) ‘Illicit financial flows: HSBC case study’, Journal of Money Laundering Control, 21(2), pp. 231-246. Web.

Appendix A

The Figure 1 was compiled based on the annual reports of HSBC and Lloyds Banking Group. Based on these data, the ratios were calculated.