Student’s Note: For the purposes of this paper all prices of the various locations chosen for this assignment have been converted into U.S. dollars in order to better show the price differences discovered during the course of investigation.

Product chosen: Starbucks Cappuccino (large/Grande)

(Hu Much, 1)

Findings of the study

The primary purpose of this paper was to examine the price difference between the large/Grande sized Starbucks Cappuccino available in Riyadh with that of 10 other Starbucks locations scattered around the world. The locations chosen for this study were 3 Starbucks stores in the U.S. (New York, District of Columbia, and Virginia) in order to examine price differences on a local level within a different country as well as seven other locations consisting of: the Philippines, Australia, France, Japan, Hong Kong, U.K., and China.

The result of the findings of this paper show that not only is there a discrepancy in pricing on an international level between different countries but in the 3 locations examined within the U.S. there were also varying prices of the same product despite the stores being in the same country.

What must be understood is that despite the difference in prices there is no overall difference in the way in which the product is packaged, prepared or sold. All locations utilize the same type of equipment, ingredients and packaging as dictated by the corporate policy of Starbucks with all ingredients originating from their main production facilities. Taking this into consideration it can be assumed that there must be other factors affecting the differences in prices per location.

Examining Price Discrepancies between Japan, France, U.S. (New York), the Philippines, Hong Kong and Australia

When examining the table provided by this study it becomes obvious that out of all the locations examined the Philippines has the lowest price at $2.52 while Japan and France have the highest prices at 5.20 and 5.64 respectively. Immediately below Japan and France is the U.S. (New York) at a price of $5.01 while Hong Kong ($4.38) and Australia ($4.34) can be considered the median price range.

For this particular part of the examination China, Saudi Arabia and the U.K. will not be included; rather they will be utilized for another type of examination later on. Going back to the matter at hand, when examining the price discrepancies per location several factors need to be taken into consideration, namely: employee salary rates, local taxation, differences in property prices and rent, local competition, market penetration as well as local brand awareness. Some of these factors will be examined in this section while the other factors will be examined in the section involving the locations that are not included in this particular examination.

a.) Employee Salary Rates

Each country or city has different salary rates which affect the cost of doing business within that particular area (Business Resource Software, 1).

For example, one of the reasons why the outsourcing of various manufacturing facilities to China by U.S. based companies has become as popular as of late is due to the relatively low salaries paid to Chinese workers as compared to what the company would have paid if they had used American workers instead. Salary rates are affected not only by the set minimum wage of a particular country but also by the strength of the local economy which affects localized demand for particular products and services.

The better and more productive the local economy in a particular region is the more likely it is that salary rates for specific types of jobs would be higher as compared to similar jobs in other countries or regions. It must also be noted though that employee salary rates are considered part of the cost of doing business and as such are factored into the overall cost of a particular product being sold in a store.

While each formula varies per company the basic formula for calculating employee salary rates is usually a combination of minimum wage rates plus the type of job being done which is then added into calculations which factor the strength of local demand and the state of the local economy which results in the overall salary given to an employee.

Another factor to take note of is the fact that each country has varying levels of economy strength with France, Japan and the U.S. being in the upper tier of economic strength while the Philippines is more or less in the mid-range. When combining these various factors and the fact that employee salaries affect operational costs which either increase or decrease the price of a particular product it becomes clear that one of the main reasons behind the difference in prices between the locations in the table is the fact that Japan, the U.S., Australia, and France have stronger economies than the Philippines which affects the salary rates of employees resulting in subsequently higher prices for Cappuccinos within Starbucks. In fact it can even be stated that should the local economy within the Philippines increase to the same level as these countries the price of a Cappuccino would subsequently increased as well. It must also be noted that the difference in Cappuccino prices between the high income economies is a direct result of differences in minimum wage rates.

As stated earlier, one of the factors that influence employee salary rates within a company is the minimum wage rate set by the government, differences in minimum wage rates when combined with different economic strengths result in vastly different salary rates which result in differing prices across the international locations of Starbucks.

b.) Local Taxation

Government taxes also play a part in subsequent price differences for products with some governments having much higher taxes as compared to the governments of other countries which result in higher prices for certain products.

For example, within the examples in the table it can be seen that Japan ($5.20) and France ($5.64) have the highest prices for coffee, what isn’t stated in the table is the fact that both countries also have a much higher tax bracket for products resulting in not only Cappuccinos being more expensive but nearly all other products as well when compared to the prices seen in the Philippines, Australia and even Hong Kong.

Local taxation doesn’t just involve sales tax but import tariffs as well which drastically increase the price of a product. Tariffs are a special type of tax added onto particular products in order to ensure that locally produced goods of the same type are not crowded out of the market. Tariffs also have another function wherein they provide governments with income from products that come into the country.

An examination of the tariff rates of Japan and France reveal exceptionally high tariff rates for foreign imports and as such this has also affected the price of coffee within both countries resulting in the higher prices evident at most Starbuck’s location in their various cities. On the other hand when examining the case of the Philippines it can be seen that the country has a relatively low product taxation rate and has a low tariff rate as well which doesn’t impact the price of coffee as much as it does in the case of France and Japan.

The same can be seen in the case of Australia where import tariffs for coffee aren’t as high as compared to the cases mentioned and as such results in its lower price range ($4.34) which is closer to that of the Philippines. In some special cases such as in the case of the U.A.E. there are no local taxes or tariffs that subsequently increase the price of certain products however such a case is not being examined in this paper and is only being mentioned in order to give a full overview of the effect taxes have on product prices.

c.) Difference in Property Prices and Rent

In the table provided it can be seen that three locations in the U.S. were chosen as part of the examination of this paper, the reason behind this is to give a clear overview of the effect property prices and rent have on product prices on a local level before examining the differences on an international level. When looking at the table it can be seen that there is a distinct discrepancy in Cappuccino prices within the U.S. between New York ($5.01), the District of Columbia ($3.96) and Virginia ($4.05).

To understand the difference in prices from the perspective of property prices and rent it is necessary to examine all three locations on the basis of their inherent economic value. New York is a well known location and is not only a major financial center but contains the headquarters of numerous banks, corporations and multinational companies.

Furthermore the area has one of the greatest concentrations of well-to-do individuals within the country and as such whether it’s for residential purposes or business ventures property prices and rent is normally pretty high in New York due to the greater potential for higher sales revenue since the local economy does much better as compared to other locations within the country.

The District of Columbia on the other hand isn’t as well known in terms of its economic capability or the number of businesses located within the area. The region is more inclined towards emphasizing its historical significance and the number of colleges within the state; it is due to this that it subsequently has a far slower and less vibrant economy as compared to New York.

This translates into far lower property and rental prices for local businesses which thus results in lower prices for Cappuccinos within the area since Starbucks pays far less rent as compared to its locations in New York.

The same situation can be seen in Virginia wherein its less vibrant economy results in lower coffee prices as well due to lower property prices and rent. Based on this example it can be stated that property and rental prices are connected to the economic viability of a particular location which increases the value of the land resulting in higher prices for products sold in the area.

On the other end of the spectrum low economic viability in a particular location lowers the cost of properties and rent and as such lowers the price of products sold within the area. It must be noted though that this particular example is not applicable to all cases. Price differences only become more evident when examining regions and not small units of measurement such as local neighborhoods.

For example, price differences become more evident in different neighborhoods within a city such as Los Angeles due to concentrations of different classes of people into distinct areas in the city which increases or decreases property values however in the case of localized examples such as within two neighborhoods close to each other there is little price discrepancy to speak of.

When taking the facts presented into consideration and applying them to the case of property prices and rent in different countries it can be stated that the economic level of a particular country affects local property prices which conversely affects the price of particular products sold within that country (Girouard and Sveinbjörn, 1 – 12). In the case of Japan, Australia, the U.S. and Hong Kong their economies are leaps and bounds ahead of the Philippines and as such subsequently increases their land prices and rent due to their greater economic viability.

This increases the operational cost paid by Starbucks which contributes to the higher price of the Cappuccinos sold. In the case of the Philippines due to its relatively medium scale economy this results in far lower property and rental prices which enables Starbucks to sell their coffee at a much lower price. In a sense this is a perfect example of the economics of scale wherein it is the size of the economy and its overall performance that creates price differences of products among different countries.

Examination of the Cases of Riyadh, China and the U.K.

It is rather interesting to note that the theory of perfect competition has proponents related to having infinite buyers and sellers, no barriers to entry and exist and that there is perfect mobility in terms of making transactions, such factors though are not at all evident in the following examples that will be examined since there are not only numerous barriers to entry and exit but based on the overall data accumulated it can be seen that competition in this case is far from ideal.

d.) Local Competition and Market Penetration

When examining the case of China and Saudi Arabia it becomes evident that local competition plays a distinct factor in the prices they have for their product. In the case of China, there is actually little local competition for a Starbucks franchise due to barriers to entry within the country. This has resulted in a distinct monopoly of sale for the company which in effect allows it to dictate prices.

Saudi Arabia on the other hand has a completely different situational case wherein the tradition of drinking coffee which has been firmly established within the region for hundreds of years has resulted in the presence of numerous coffee houses of which Starbucks has risen to a certain degree of prominence.

Both examples are clear cut cases of imperfect competition for the company wherein the case of Saudi Arabia is one of monopolistic competition whereas the case of China is one of monopoly which takes the form of it being the only source of a particular “product” (the look and feel of a coffee shop along with a variety of coffee products exclusive to Starbucks). What must be understood is that in other global regions the biggest competition for a Starbucks store is usually another Starbucks that has been built nearby.

When examining areas where such cases occur in earnest (having 1 to 2 Starbucks in one neighborhood for instance) it can be seen that there is a certain degree of price collusion wherein both stores have the same prices yet pay differing rents which should have affected their individual price ranges to a certain extent (Newmark, 14).

Local competition actually influences prices to either increase or decrease in response to the level of competitiveness within the region (Newmark, 1 – 18). In the case of Saudi Arabia it can actually be seen that most of the Starbucks stores within the area have the exact same prices which tend to undercut those of local coffee shops.

This shows a certain degree of collusion as evidenced by the average price of $3.99 for a Grande Cappuccino in all stores despite differences in rent and location which should have affected the price of the drink by either raising or lowering the price itself. In the case of China, since the Starbucks there is the only supplier of the “coffee house experience” this has allowed it to subsequently raise prices to $4.55 despite the fact that employee salaries and rent within the area are far cheaper as compared to Japan and France which the price is getting to close to.

What must be understood is that in cases where monopolies and collusion isn’t evident the situation gets close to the state of perfect competition due to fewer barriers to entry. On the other hand when monopolies and collusion are evident this results in a state of imperfect competition due to numerous barriers to entry. Prices are usually influenced by the interchange between such differing forces (as seen in the case examples) and as such it comes as no surprise that the prices are what they are in Saudi Arabia and China at the present.

Welfare Implications

When examining possible welfare implication of product surplus within the various markets examined for this study it becomes evident that there really is none whatsoever. What must be understood is that the products of Starbucks are priced at a far higher rate than they should be (Lee, 1). Normally this wouldn’t make sense that people would willing buy a product that is priced at such a high rate when they could get the same type of product at a lower cost elsewhere.

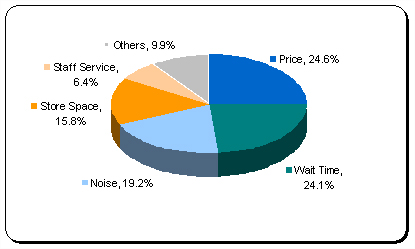

For example, based on the graph shown above it can be seen that there is a lot that consumers are dissatisfied about regarding the store itself. The reason though behind the success of the brand is the fact that people aren’t just buying coffee at Starbucks but are also buying the “experience” of purchasing and using the store.

This comes in the form of calming ambience, comfy chairs and soft music that are synonymous with most of the locations of Starbucks. Since “experience” cannot be truly turned into a surplus and the fact that Starbucks itself keeps careful control of its inventory there is quite literally no welfare implications to speak of (in terms of product surplus) for consumers of the product within all markets examined.

Conclusion

Based on the various facts presented in this study it can be seen that employee salary rates, local taxation, differences in property prices and rent, local competition, market penetration as well as local brand awareness all influence product prices in one way or another and thus result in the different product prices for Cappuccinos seen in the paper. It must be noted though that the researcher actually did expect to find varying prices to be present when examining the prices across different regions.

The reason behind this is due to lessons learned regarding economic strengths and the resulting ability of local economies to actually grow and develop as a result of such strengths which affects their buying power. Overall though, this investigative study was quite interesting in that it helped to open the eyes of the researcher as how an international franchise is affected by the conditions in local markets which results in differences in prices.

What wasn’t examined in this study though is the effect outsourcing has had on product prices. Most of the products of Starbucks aren’t actually or produced within the U.S. itself but rather come from various international locations and are thus shipped to their stores worldwide from such factories.

It is based on this that further examination would be warranted as to whether or not the distance involved or special agreement between the country where the products are being shipped from and the country that they are being shipped to has any effect on the price as well.

While this study may have touched on the concept of tariffs and trade relations this is just a fraction of what may be happening in the background. In fact it cannot be truly stated that all the information presented so far is a complete and accurate measure of what Starbucks actually utilizes as a means of determining product prices. There are far too numerous product resource and production considerations that need to be examined before any solid conclusion can be drawn.

Works Cited

Business Resource Software,. “Issues Affecting Price.” Business Plans. Center for Business Planning, N.I.

Girouard, Natalie, and Sveinbjörn Blöndal. “House Prices and Economic Activity.” OECD. 279. (2001): 1 – 50.

HuMuch. “Starbucks Cappuccino (large/grande).” HuMuch. HuMuch.com, 2011.

Lee, Sampson. “Are Starbucks’ Prices Too High?” CustomerThink. N.p., 2007.

Newmark, Craig. “Price-Concentration Studies: There You Go Again Prepared.” DOJ. (2004): 1 – 40.