Introduction

Controlling cash and financial requirements is the foundation of working capital management. The business’s capital management relies heavily on estimating demands, sustaining cash balances, and maximizing the movement of funds. The paper compares the working capital management of Hasbro and Mattel, illustrating calculations of rations with data retrieved from businesses’ financial reports from fiscal years 2021 and 2022, as seen in the Appendix. Consequently, after reviewing the financial results of Hasbro and Mattel, the former business holds an advantageous position due to its emphasis on research and development and inventory management.

Overview of the Companies and Industry

The worldwide toy market is intensely competitive and innovative and is valued at billions of dollars. North America, particularly the United States, represents one of the most lucrative and significant geographic marketplaces for these businesses (Tighe, 2023). The yearly total financial effect of the toy industry on the United States in 2021 was over $100 billion, and slightly over 572,000 jobs directly tied to the American toy industry were created (Tighe, 2023).

Among the largest players in the industry are Hasbro and Mattel. The toy and game firm Hasbro creates unique customer experiences for worldwide consumers through toys, consumer goods, playing games, and entertainment (Hasbro, n.d.). Brands including Transformers, Peppa Pig, Play-Doh, and others are part of its portfolio (Hasbro, n.d.). Another large toy business is Mattel, which owns children’s and family entertainment brands as well. In Mattel’s portfolio of brands, one can find Barbie, Hot Wheels, UNO, Monster High, and others (Mattel, n.d.). Together, companies are among the leading corporations in the industry.

Current Ratio

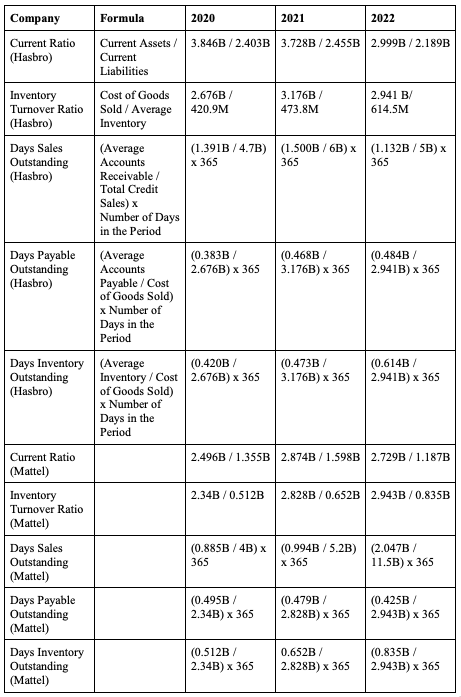

The first ratio that is crucial for understanding the effectiveness of working capital management is the current ratio. This metric is designed to show whether the business would be able to cover its current liabilities within a short period of time with its current assets (Prin Jagtap, 2020). As a result, it is crucial for a company to have a positive current ratio. As seen from Table 1, Hasbro has been struggling with improvement in the current ratio, with a poorer ability to meet its short-term obligations with its current assets.

In comparison, Mattel demonstrates organic growth of assets that can offer quick coverage of debt, despite supply chain disruptions during the pandemic. However, if one looks at the annual report of Hasbro, one will see that the business admits that its assets have decreased in the last several years due to “research and experimentation expenditures” (Hasbro, 2022, p.69). Therefore, Hasbro still shows more effective working capital management due to its focus on lucrative business areas.

Table 1. Current Ratio of Hasbro and Mattel.

Inventory Turnover Ratio

Another important ratio for analyzing the working capital management of Mattel and Hasbro is the inventory turnover ratio. The metric helps one understand how many times a business sells its inventory and replaces it over a period of time (Prin Jagtap, 2020). Evidently, the higher the results, the better since it indicates high demand for the company’s products and, thus, growing revenue.

As seen in Table 2, Hasbro has experienced growth in the inventory turnover ratio from 2020 to 2021 but faced a decline in 2022, with a three-year percentage change of negative 25%. In contrast, although Mattel’s percentage change is better than Hasbro’s, a negative 24%, the table illustrates that throughout the three years, Mattel faced a gradual increase in inventory turnover ratio. Moreover, Hasbro’s position is better due to its ratio being still higher than the one of its competitor in 2022.

Table 2. Inventory Turnover Ratio of Hasbro and Mattel.

Days Sales Outstanding

Furthermore, another ratio, a Days Sales Outstanding (DSO), is crucial for recognizing the strengths or weaknesses of the company as well. In general, DSO is used to understand how long it takes the business to collect payment for its products and services that were acquired on credit (Prin Jagtap, 2020). Here, the lower the figure, the faster the payments are collected. As seen in Table 3, Hasbro’s position has improved significantly since 2020, reducing the waiting period from 104 to 82 in 2022, which is a change of 21%. Although Mattel has experienced an improvement as well, its change has been slower, with only a 16% change. As a result, Hasbro’s in a better position than its competitor again.

Table 3. Days Sales Outstanding of Hasbro and Mattel.

Days Payable Outstanding

A similar calculation is the Days Payable Outstanding (DPO) ratio. When analyzing this metric, one finds the period of time a company requires to pay its suppliers (Prin Jagtap, 2020). Obviously, the lower the figure, the better it is for the business since it demonstrates the reliability of the company. As seen in Table 4, Hasbro’s DPO has been rising, with a slight increase from 2020 to 2021 and a drastic increase in 2022.

In contrast, Mattel’s results show that the company has been decreasing the time to pay its suppliers. Still, although companies that take longer to make payments can be seen as a negative factor, it is possible that the company uses cash to make investments. Indeed, Hasbro admitted that the company has been focused on research and development in the last several years (Hasbro, 2022). Therefore, there have been delayed payments to the suppliers.

Table 4. Days Payable Outstanding of Hasbro and Mattel.

Days Inventory Outstanding

Finally, Days Inventory Outstanding (DIO) helps gauge the performance and management of the working capital of companies. This ratio is used to understand how many days usually pass before the company sells its inventory (Prin Jagtap, 2020). In other words, the metric demonstrates the efficiency of the company and its ability to convert the inventory into cash. As seen in Table 5, Hasbro is in a worse position compared to Mattel. While Hasbro faced a decrease in DIO from 2020 to 2021, there has been a 40% increase in DIO from 2021 to 2022. In contrast, Mattel demonstrated a lower result and experienced only a 20% increase from 2021 to 2022. Thus, Mattel is capable of managing its capital more effectively.

Table 5. Days Inventory Outstanding of Hasbro and Mattel.

Conclusion

Hence, after comparing the financial statistics of Hasbro and Mattel, it is clear that the former company enjoys an advantage because of its focus on research and development and inventory control. Hasbro acknowledges that costs associated with research and testing have caused a decline in its assets over the past few years. Additionally, Hasbro’s situation has greatly improved since 2020, resulting in a 21% decrease in the DSO from 104 to 82 in 2022.

References

Hasbro. (n.d.). Hasbro fact sheet. Web.

Hasbro. (2021). Annual report 2021. Web.

Hasbro. (2022). Annual report 2022. Web.

Mattel. (n.d.). About us. Web.

Mattel. (2021). Annual report 2021. Web.

Mattel. (2022). Annual report 2022. Web.

Prin Jagtap, K. (2020). Advanced accounting. Diamond Publications.

Tighe, D. (2023). Toy industry. Statista. Web.

Appendix