Abstract

Various reasons explain why firms opt for market insurance instead of using other strategies in risk management. In fact, the number of risks being covered under insurance policies has radically increased. The reason is that risks related to disasters and manmade catastrophes such as terrorism that were not included in the traditional insurance policies are currently being considered as potential hazards to businesses.

The indication is that the demand for corporate insurance has increased considerably in the last decade. Besides, studies indicate that the demand for corporate insurance is price inelastic. However, the degree of price inelasticity depends on the type of the policy. Moreover, firms will purchase insurance policy depending on the probability of being bankrupt. Bankruptcies result from financial losses. The reason is that large firms are highly differentiated and have established own risk control capabilities, which result in decreased risk coverage.

Introduction

Firms purchase insurance policies for a range of reasons. In fact, various studies have indicated sets of incentives that corporations utilize to purchase insurance policies. According to the classical economic theory, firms are supposed to be free from any risks. Therefore, in the circumstances that the premiums placed on certain risks are high, firms cannot purchase such insurance premiums. In other words, firms have no interest in buying insurance policies whose premium rates are higher than the actuarial fair prices (Hoyt & Liebenberg, 2011).

Practically, firms normally purchase insurance coverage against fire, natural disaster, and property exposure as well as coverage against terrorism. Unlike consumers, firms are currently purchasing increased insurance policies against natural disaster risks. The reason is that prices of such insurance policies are fair compared with property coverage policies (Hoyt & Liebenberg, 2011).

While empirical studies indicate increasing demand for insurance coverage against natural disaster risks, the demand for property insurance coverage risks have remained constant over the last decade. However, the comparative data on the catastrophic and non-catastrophic insurance coverage is lacking. Besides, existing empirical studies indicate the increasing trend in the intake of insurance policies by firms for standard properties.

The findings of previous studies indicate that corporate demand for insurance policies particularly the increasing catastrophic risks does not have greater erraticism (Aunon-Nerin & Ehling, 2008). Besides, several studies have demonstrated that demands for corporate insurance policies are not flexible in pricing. However, when categorized according to the given risks, some policies have increased price inelastic demand.

In particular, the rise in the actuarial price policies causes a decrease in corporate demand for insurance coverage. Nevertheless, some policies would be greatly reduced compared with others. For instance, within the US insurance market, the reduction of the policies prices cause a decrease in the corporate demand for catastrophic coverage by about 2.41% compared with property coverage of about 2.90%.

The results are different with the property coverage. Studies indicate that firms in the property industry do not voluntarily purchase insurance coverage (Grace, Klein & Kleindorfer, 2004). Further, studies indicate that firms purchasing insurance coverage exhibit an elastic demand.

The behavior of individuals buying property coverage differs with that of the corporations. In addition, empirical studies indicate that the capability of firms to self-insure decreases the demand for corporate insurance coverage for other policies apart from the property exposure (Grace et al 2004).

Types of Risk and the Corporate Demand

Several risks exist in business operations ranging from financial loses to hazards associated with natural disasters. While insurance firms have been covering several risks associated with property losses and damages, the threats related to natural disasters have not been part of the insurance coverage market (Hoyt & Liebenberg, 2011).

Generally, the economic costs of various risks have increased dramatically over the last three decades raising the corporate demand for insurance coverage. Besides, it is estimated that the economic costs of natural disasters on businesses has increased by over $1.2 trillion. In the US, most of these damages are caused by catastrophes ranging from technological accidents to wildfires.

Firms behave invariably to protect themselves against any financial effects of undesirable consequences. In other words, firms have various financial risk-transfer instruments options to protect themselves against any losses caused by both natural and artificial damages (Aunon-Nerin & Ehling, 2008). The most critical risk relating to property damages is deficiency in asset liquidity. Such deficiencies enable firms to sell their liquid asset portfolios at undesirable reduced prices.

Damages in the firms’ properties have increased possibility of causing disruptions in the normal operations of the firm. As such, firms cannot fulfill their contractual agreements of delivering excellent services and quality products to the target clientele. In situations where the firm is incapable of raising short-term capital to repair the damages, the possibility of being driven out of operation is high (Aunon-Nerin & Ehling, 2008). However, several sources of financial capital are available to firms.

Firms can exploit such sources to repair the damaged properties and offer coverage to future business disruptions. One of the options is self-insurance, which entails the utilization of their cash reserves. Besides, the firms can resort to both short-term and long-term debts. On the other hand, firms can opt for market insurance that covers future potential damages (Aunon-Nerin & Ehling, 2008). Market insurance is one of the corporate risk management options firm can utilize to avert any potential future hazards.

Essentially, corporate risk management involves processes that reduce the possibility of the occurrences of risks associated with both internal and external events. Currently, firms utilize insurance purchases to manage risks because it is easier to quantify the hazards likely to affect the firm and the type of policy that offer protection against such risks (Hoyt & Liebenberg, 2011). In other words, it is easier to understand the type of risks and the possible remedial policies that firms should purchase.

As indicated, problems facing firms normally anticipate nonconformity in the daily business activities. Risk professionals have varied explanations of what constitutes risks in insurance. Some of the explanations depend on the consequence of deviation from the expected occurrence (Aunon-Nerin & Ehling, 2008; Hoyt & Liebenberg, 2011). In some cases, the word risk is used to denote the entity that is exposed to possible losses. Risks come in different categories ranging from pure or static risks to fundamental risks.

Pure or Static Risks

Sometimes firms incur huge losses with no prospect of compensations. The circumstance in which a firm has increased potential of incurring huge losses with no gain results in pure risks. On the contrary, speculative risks are threats that have equal chances of resulting into either a loss or a gain.

Most insurance companies deal in pure risks since it can only result into two definite results (Aunon-Nerin & Ehling, 2008). In other words, the policyholders can gain or fail to be compensated from the losses. Pure risks policies pay off when there is an absolute loss of insured item (Hoyt & Liebenberg, 2011).

Most of the pure risks occur when losses happen unintentionally. In addition, most insurance firms draw benefits from pure risk policies due to the likelihood that the policy will remain active for a very long time (Hoyt & Liebenberg, 2011; Grace et al 2004). On the other hand, pure risk policyholder would hugely benefit from compensations in case of a calamity.

Personal risks are the main type of pure risks. Risks are normally considered extortions that affect individuals. The risks form the basis from which most insurance firms operate. A personal risk involves the possibilities of loss of income and the removal of financial assets (Hoyt & Liebenberg, 2011; Grace et al 2004).

Main forms of personal risks comprise of premature death, old age, poor health and unemployment. Other examples of pure risks include property and liability risks. Property risks are threats of having assets destroyed or lost while liability risks are threats that arise from various litigations. In terms of demand, pure risks have increased demand compared with others.

Speculative or Dynamic Risks

Speculative risks are policies that can result into either a profit or loss. Business executives are usually faced with decisions that include certain elements of risks. In most cases, insurance companies do not consider speculative risks insurable except with certain reservations (Hoyt & Liebenberg, 2011; Grace et al 2004).

For example, it is very difficult for insurance companies to cover betting in horse races. Speculative risk is quite distinct from pure risks in a number of ways. For instance, societies normally gain from the losses as opposed to pure risk policies.

Fundamental Risks

Fundamental risks are widespread. In extreme situations, important threats might involve the whole society. Natural disasters such as earthquakes, socio economic problems like unemployment, high inflation rates and civilian upheavals form the wide range of threats that fall under fundamental risks.

In developed countries, fundamental risks are handled by the government agencies since they cover wide scope of interdependent functions (Hoyt & Liebenberg, 2011; Aunon-Nerin & Ehling, 2008). The commonly applied remedies governments utilize to reduce critical threats range from social insurance to the provision of subsidies to the affected populations and businesses.

Causes of Increased Corporate Demand for Insurance on Risks

The increased demand for corporate insurance on risks can be attributed to a number of causal factors. While most firms find it obligatory to buy insurance coverage against any potential risks, the law also required firms to have some coverage against certain risks. Apart from these obligatory requirements, firms also buy insurance policies because of tax incentives.

In the circumstances where tax incentives exist, most firms would opt for insurance policies since insurance premiums are normally deducted as business expenses (Hoyt & Liebenberg, 2011). Moreover, most firms perceive insurance as one of the forms of financing which could prevent the transactions costs of bankruptcy.

In fact, the insurance policy reduces the probability of incurring additional costs resulting from uncertainties. The additional costs resulting from loses is reduced through the transfer of exposure risks to insurance companies (Grace et al 2004). According to behavioral economics, risky firms would over- insure as a precaution against any ensuing loses that might occur in case the firm is liquidated. However, most firms focus on the consequences of the risks.

For instance, firms would focus on the finances losses instead of the risk occurrence. In other words, for risks associated with damages, firms would insure for financial compensation instead of prevention of the causes of the damages (Hoyt & Liebenberg, 2011; Grace et al 2004).

While the main principle behind any insurance policies is to offer compensation in case of losses, the compensation depends on the type of policy the firm has taken. The reason why firms focus on the consequences of the risk is the difficulties in estimating the possibility of the risk occurrences.

Generally, most firms purchase insurance in order to reduce the liabilities related to taxes. In other words, the insurance is purchased to reduce losses associated with increased taxation. In addition, most firms purchase insurance to avert the amount of financial distress resulting from mismanagement (Grace et al 2004).

Moreover, in some cases, insurance coverage is needed to mitigate against the agency conflicts, signal private information and to fulfill the creditors’ requirements. Most importantly, firms take up insurance coverage to avoid the consequences resulting from increased competition in the market (Aunon-Nerin & Ehling, 2008).

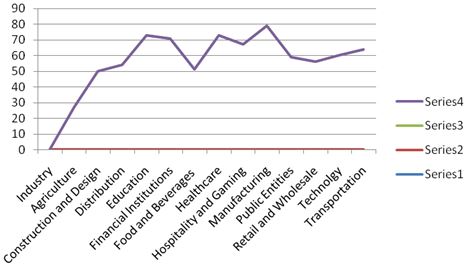

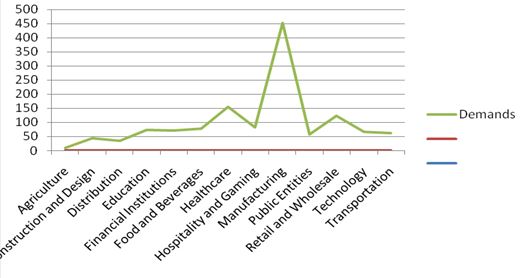

Distribution of Corporate Insurance Demand in Terms of the Industry

Studies indicate that the corporate demand is not uniform according to the industry. While most firms purchase the insurance policies depending on size and riskiness of the business, the type of industry in which the firm is operating also plays a critical role. Moreover, studies indicate increased corporate demand in the manufacturing industry compared with other industries (Aunon-Nerin & Ehling, 2008).

The reason is that most of the smaller firms that greatly purchase insurance policies are found within the manufacturing sector. In addition, most of the firms are operating in hazardous environments prompting their coverage of potential risks. In aggregate, the market penetration of corporate demand for insurance in the manufacturing sector is estimated to be about 79% (Aunon-Nerin & Ehling, 2008). The penetration is higher compared with other industries and is expected to increase in the coming decade.

The healthcare industry follows the manufacturing sector in terms of the corporate demand for insurance. The demand in healthcare is driven by the healthcare regulations and the increasing need of health coverage among the population (Aunon-Nerin & Ehling, 2008). The healthcare industry is estimated to have over 73% market penetration, which is higher compared with associated industries.

While some industries such as manufacturing and healthcare have increased corporate insurance demand for risks, some industries have very low demands including the agricultural sector (Aunon-Nerin & Ehling, 2008). The agricultural industry is estimated to have about 27% market penetration, which is the lowest in terms of industrial estimates.

Table 1: Distribution of corporate demand in terms of market penetration

Table 2: Corporate demand in terms of firms in the industry

As indicated, the type of risks, actuarial premium rates and the type of business determine the demand for insurance policies. Considering these factors, the risks associated with the manufacturing processes is very high.

The high risks make most of the firms in the industry to increase their insurance coverage despite high prices for such policies (Aunon-Nerin & Ehling, 2008). On the other hand, the risks in the agricultural industry are very low making most of the firms to opt for individual insurance despite low premium rate for market insurance.

Essentially, while prices determine the level of corporate demand for insurance, the type of risks involved plays a critical role. Besides, in this case, the market penetration is defined as the percentage of firms having insurance policies over the total costs of insurance (Hoyt & Liebenberg, 2011; Grace et al 2004).

Market penetration = (no. of firms/total cost of insurance) × 100

In other words, the measurement does not take into account the amount of assets firms have insured against risks. Most studies indicate that industries with large volumes of small firms have increased demand for corporate insurance (Hoyt & Liebenberg, 2011; Grace et al 2004; Aunon-Nerin & Ehling, 2008). In aggregate, the corporate demand for insurance is higher in industries with uppermost number of small firms.

Factors Determining Corporate Demand for Insurance on Risks

Studies indicate that prices, company size and the industry determine the corporate demand for insurance on risks (Aunon-Nerin & Ehling, 2008). While these factors are plausible, they interact to determine the demand for insurance policies. As indicated in most of the empirical studies, the types of insurance coverage also play a critical role. For instance, the demand for property coverage differs with other policies. The differences also explain the variations in price inelasticity (Aunon-Nerin & Ehling, 2008; Hoyt & Liebenberg, 2011).

The Actuarial Prices

The amount a firm spends on insurance plan would determine the possibility of taking up the policy. In fact, in a highly competitive market, most insurance firms always reduce the prices of policies enabling many firms to take cover for potential risks.

Additionally, most insurance companies tend to quantify the possible risks and offer the coverage at minimum market rates to make firms buy policies related to such hazards (Hoyt & Liebenberg, 2011; Grace et al 2004). While the coverage prices differ with policies, most firms take shorter durations with expensive policies while inexpensive policies tend to attract long-term coverage (Aunon-Nerin & Ehling, 2008).

Competition in the Product Market

The levels of competition between firms determine the demand for insurance policies. In fact, studies indicate that the degree of rivalry in the product market affects the firms’ demand for insurance (Aunon-Nerin & Ehling, 2008; Grace et al 2004). Essentially, changes in the competitive environment induce firms to strategically demand for insurance. In other words, increased competitive product environment encourages higher probability of firms to purchase insurance policies in order to mitigate the risk of exposure.

Studies indicate positive relationship between increased competitiveness in the product market and the demand for insurance (Hoyt & Liebenberg, 2011; Grace et al 2004; Aunon-Nerin & Ehling, 2008). Essentially, the firm’s risks increases due to the rise in competitiveness. Similarly, risk management of firms is also maintained whether the firm is demonstrating risk aversion or not in their preferences for insurance purchasing decisions.

While most firms manage their risks in terms of hedging portfolios, they ignore risk management activities in the product market competition. In most cases, the externalities such as industry characteristics, market environment and competitive pressure determines the risk management strategies of firms (Hoyt & Liebenberg, 2011; Grace et al 2004; Aunon-Nerin & Ehling, 2008). Essentially, firms maximize on their risk management investments through leveraging the strategic commitment benefit and the cost of insurance.

Generally, increased competitive product markets encourage firms in the industry to exhibit risk aversion characteristics through the transfer of risks to insurance companies (Aunon-Nerin & Ehling, 2008; Grace et al 2004). The interactions existing between the cost of insurance and the competitiveness of the product market predicts the firms’ risk management strategies.

The Size of the Firm

Studies indicate that large firms would not opt for insurance coverage due to increased costs involved and the presence of internal risk management capabilities. In fact, large firms have established internal risk management procedures that contribute greatly in the reduction of losses associated with such hazards (Aunon-Nerin & Ehling, 2008). Moreover, the quantities of risks determine the required premiums, which in effect increase the cost of insurance.

On the other hand, small firms are vulnerable to losses associated with business risks. As such, small firms opt for insurance coverage to protect themselves against such uncertainties. Besides, small enterprises seek for risk management advice from insurance firms (Hoyt & Liebenberg, 2011; Grace et al 2004). Therefore, corporate demand for insurance are higher among small firms compared with large firms.

Conclusion

As indicated, various reasons explain why firms purchase insurance policies. Indeed, different studies have indicated sets of incentives that corporations utilize to purchase insurance policies. Classical economists assert that firms are supposed to be free of any risks. Therefore, in the circumstances that the premiums placed on certain risks are high, firms cannot purchase such insurance premiums. In other words, firms have no interest in buying insurance whose premium rates are higher compared with actuarial fair prices.

The prices, company size and the industry determine the corporate demand for insurance on risks. While these factors are plausible, they interact to determine the demand for insurance policies. As indicated in most of the empirical studies, the types of coverage also play a critical role. For instance, the demand for property coverage differs with other policies. The differences also explain the variations in price inelasticity.

Generally, most firms purchase insurance in order to reduce the liabilities related to taxes. In other words, the insurance is purchased to reduce losses associated with increased taxation. In addition, most firms purchase insurance to avert the amount of financial distress resulting from mismanagement.

Moreover, in some cases, insurance coverage is needed to mitigate against the agency conflicts, signal private information and to fulfill the creditors’ requirements. Most importantly, firms take up insurance coverage to avoid the consequences resulting from increased competition in the market. The increase in the mentioned risks increases the corporate demand for insurance on risks.

References

Aunon-Nerin, D. & Ehling, P. (2008). Why firms purchase property insurance. Journal of Financial Economics, 90(1), 298–312.

Grace, M. F., Klein, R. W. & Kleindorfer, P. R. (2004). Homeowners insurance with bundled catastrophe coverage. Journal of Risk and Insurance, 71(3), 351–379.

Hoyt, R. E. & Liebenberg, A. P. (2011). The value of enterprise risk management. Journal of Risk and Insurance, 78(1), 795–822.