Introduction

Sorouh Real Estate PJSC styles itself as one of the largest real estate developers in the Middle East. The firm was founded in 2005 and since that time it has grown into one of the most leading companies operating in the property sector. Sorouh has already carried out several projects that have earned them a good reputation in the United Arab Emirates, for example, we can mention the Towers on Reem Island or Golf Gardens in Abu Dhabi (Sorouh, unpaged).

So, we may say that this enterprise holds a strong position in the UAE market. However, it has recently faced several challenges due to its imprudent policies and dramatic changes in the global economy and housing market. One of these challenges is the decline in lease and sales profits. This paper aims to propose recommendations that can alleviate the problems which Sorouh currently experience. It is based mostly on primary sources, namely annual income statements and sustainability reports.

Overall, the management of this organization should develop more flexible pricing policies for those customers who may want to rent their buildings and purchase them in the future. This may give them a competitive advantage over other firms operating in this area. To prove the validity of this strategy, we should first discuss the factors which have led to the decline in their profits.

Financial situation in the company

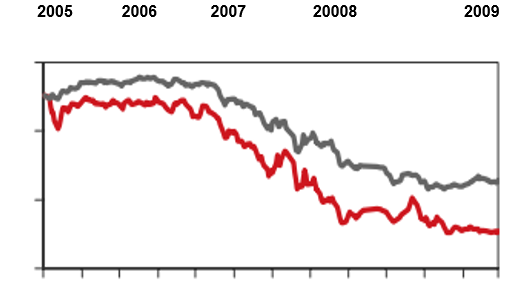

First, the World Economic Crisis and especially the notorious credit crunch has produced profound effects on the performance of many real estate developers. Their income rates have significantly dropped because the products are no longer as valuable as they used to be. Moreover, these organizations are struggling to work out their pricing policies. The thing is that before the housing bubble, the cost of real estate reached its peak and leading companies expected to gain considerable income from them. But in 2007 and 2008 it drastically decreased and real estate developers can no longer yield the profits which they initially expected.

Additionally, many of them have several long-term projects which could be started before 2007 and these projects have involved considerable investments. Currently, the return on these investments is relatively low. Some real estate developers are on the brink of bankruptcy. Naturally, Sourouh has passed through this crisis and the financial situation is stable and yet this company has not escaped the aftereffects of the housing bubble.

According to their annual reports, one may single out several rather disturbing tendencies. The basic earnings per share decreased twice, from 0,19 per cent to 0.09 (Sorouh, 2007, p 4). There is additional evidence that eloquently proves that this firm is passing through a very difficult period. Over these two years, the cost of revenue has grown by almost thirty per cent.

In 2008, this number constituted $503,227 while in 2009 this number has risen to $955,511 (Sorouh, 2009. p 2). Overall, this data indicates that the companys operating expenses are becoming more costly. In part, these numbers show that Sorouh fails to meet rather ambitious standards which they set for themselves. Most importantly, this ineffectiveness is not only due to the global economy. These low results may stem from some of their internal policies.

At this stage, we need to carry out a ratio analysis to identify the peculiarities of the companys development over this period. One of the most important criteria is the relationship between total assets and total liabilities. This is one of the first questions which draw the attention of potential investors. It has to be admitted that the statistics are not very encouraging because Sohour increases its debt obligations.

- Current Ratio Assets/Liabilities = 16.558.382/10.638.658= 1,556 (Sorouh, 2009, p 6)

In sharp contrast, in 2006 this ratio was much higher. In fact, in 2006 this ratio was 1, 777. To some extent, this is a sign which shows that the liquidity of this firm has diminished. Potential investors who may be looking at these numerical data may find that Sorouh now encounters certain financial difficulties. Apart from that, experts usually focus on such parameters as the ratio between current assets and daily operation costs

- Current Ratio Assets/Costs = 16.558.382/75.392 = 219,530. (Sorouh, 2009, p 6)

Again, we have to emphasize the idea that in 2006 and 2007, daily expenses of the company were much lower. These figures demonstrate that over the past years the performance of this firm has deteriorated. But we cannot attribute these changes only to the world financial crisis. The thing is that they began to manifest themselves before the crisis. Hence, they may have even different origins. One of the key issues is that the company mostly rents their building but nowadays more and more customers are willing to purchase houses rather than rent them. Sorouh has not developed appropriate lending schemes for the customers.

Performance (Profitability) Ratios Calculations.

Liquidity Ratios Calculations.

Investment Ratios Calculations.

On the one hand, it is quite possible to understand the logic of Sorouh management because renting a building seems more profitable to them. But this is not what their clients are looking for. They need ownership but the housing, developed by this organization is rather expensive. Therefore, Sorouh must give them feasible credit options for the long term.

To propose recommendations to the management it is first necessary to assess the major strengths of this enterprise. First, as it has been noted before, they have established their reputation. They no longer must spend money on the advertisement of their services. Furthermore, over this period they have acquired vast experience in this field. Even though this company was founded only o in 2005, it has already participated in various projects ranging from the construction of single houses to urban planning.

Sorouh has also established partnerships with domestic and foreign real estate developers and at this stage, they are trying to render their services to several foreign clients (Sorouh, 2009, unpaged). The firm has also been given a substantial number of awards like Best New Business, Best Commercial Project of the Year, Best Strategic Real Estate Portal and so forth (Sorouh, 2009, unpaged). So, their record speaks for itself. To some degree, this reputation lays the foundations for success, but the company must take full advantage of this opportunity.

Relative Performance for five years

As regards their major weaknesses, we should first mention inappropriate marketing policies. Again, there are more interested in renting the buildings which they construct but now more and more customers want to buy housing. We also need to say that their target audience is rather limited. Sorouh attempts to suit the needs of such private organizations, like luxury hotels and oil companies. However, there also may be smaller enterprises willing to rent or buy their buildings and Sorouh should carry out the projects which are affordable to such clients. Overall, one can say that their buildings are not easily accessible.

It seems that Sorouh should place more emphasis on civil construction. We should also take into consideration that the construction market in UAE is becoming more competitive and Sorouh management also needs to improve their customer service. Thus, one can conclude that recent difficulties were caused by external and internal factors, particularly instability of the construction market and marketing strategies.

Comparison with related firms in the UAE

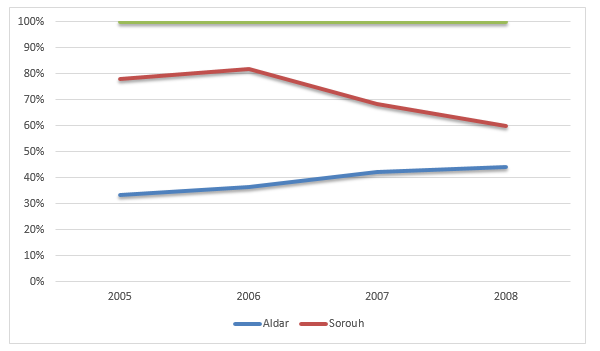

At this stage, it is of crucial importance for us to draw parallels between Sourouh and other real estate developers, operating in the United Arab Emirates, for example, Aldar Properties PJSC. The vast majority of their developments are located in Abu Dhabi. Aldar specializes in the construction of hotels. Overall, we can say that, unlike Sourouh, they give preference to selling rather than renting their building. To compare their performance, we need to pay attention to such parameters as return on assets (RoA) and return on equity (RoE).

As far as Sorouh is concerned, we may say that these numbers are not as encouraging. For instance, their return on assets has decreased in comparison with the previous year. At this stage, their ROA equals 5, 8 %. 1 Furthermore, their return on equity reduced from 35% to 15, 9 per cent. (ADCB, 2009, p 1) This data eloquently demonstrates that Aldar is much more efficient. This can be accounted for by the fact that their developments (hotels) enjoy more demand. Additionally, Aldar provides more opportunities for clients to purchase their buildings.

This graphic demonstrates that Sorouh profits may be larger than those of Aldar. However, their performance is gradually declining.

Recommendations

Judging from this discussion, one can propose the following recommendations. 1) At first, the management must implement a more flexible pricing strategy for those clients who want to buy their buildings. This can eventually increase their sales rates. 2) Secondly, they should carefully analyze the situation in the housing market because the prices of real estate are unstable. It seems that Surah should avoid grand-scale projects because they entail higher risks. There are several rationales for this policy: 1) it may be quite difficult to find clients for such buildings. Moreover, due to market fluctuations, they may eventually devaluate and bring virtually no dividends. Finally, the company should try to diversify their products

Conclusion

Currently, Sorouh Real Estate PJSC can win the palm of supremacy in the Middle East. It has the experience and resources to do it. However, this can be done only by adopting flexible pricing policies on their buildings. Naturally, the difficulties faced by this enterprise are only temporary, but their effects may be disastrous unless the management changes its policies.

Reference List

ADCB (2009). Sorouh Real Estate. PJSC. Web.

Oxford Business Group (2009). The Report Abu Dhabi 09. Oxford Business Group.

Ross S. Westerfield R, W. & Jordan B.D (2008). Corporate Finance Fundamentals Eighth. McGraw-Hill Education.

Sorouh Real Estate PJSC (2007). Review Report and Interim Financial Information for the period ended in 2007. Web.

Sorouh Real Estate PJSC (2009). Web.

Sorouh Real Estate PJSC (2009). ADX Financial Report. Web.

TAIB Research (2009). Aldar Properties. Web.