Several corporate frauds have become known in the recent years making the tightening of the internal control measures in the corporations an absolute necessity. The financial costs arising out of corporate frauds might be enormous both for the corporations and for the economy as a whole. Losses due to corporate frauds have increased from $ 400 billion in 1996 to $ 600 billion in the year 2002 (360training).

Corporate frauds can take the form of fraudulent financial reporting and the second one is the misappropriation of assets. In the case of frauds, involving fraudulent financial reporting the firm faces large risks against its financial stability due to misstatements about its financial status, when there is pressure exerted by the analysts and investors. Similarly, the organization may face huge losses if it goes ahead with ambitious expansion programs based on fraudulent financial statements. It may affect the financial position of the individual directors also (Moschella). Misappropriation of assets would reduce the firms’ resources leaving the organization to face liquidity issues.

Ethical training programs will instill in the employees a sense of responsibility. It will make them to comply with laws and report misconduct (360training). The training will also make the employees aware of the frauds so that they can detect them at when they are perpetrated. In addition to the employee, training ethics should be made a corporate culture to get the fullest advantage of the ethical training to the employees. The top management and senior leaders of the corporation should follow ethical values and be an example to the staff at middle and lower levels of the organization.

Components of Balance Sheet/Income Statement and “Red Flag” for Fraud Detection

Current inventory level in the balance sheet as a ratio of net revenue is an indicator of any manipulation in the accounting. By comparing the ratio for the current period with that of the previous period, the chances for any fraud can be detected.

Comparison of the ratio of cost of sales to total sales for the current period with that of the previous period and any abnormal variation found would indicate the chances of manipulation of earnings and consequent fraud.

Analysis Ratios

One of the useful techniques for detection of frauds is the calculation of data analysis ratios for key numeric fields. Just the same, way the financial ratio analysis gives the financial health of a firm, data analysis ratios provide information on the fraud health of the company identifying the potential symptoms of fraud being perpetrated. There are three ratios, which are commonly employed for fraud detection. They are:

- the ratio of the highest value to the lowest value – the ratio of minimum to maximum,

- the ratio of the highest value to the second highest value and

- the ratio of the current year to the previous year.

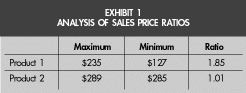

For instance where the auditors want to check on the correctness of the product prices they can calculate the ratio of the maximum sales price to the minimum sales price for each product. If they find the ratio is close to 1 they can be satisfied that there is only minor variance in the prices charged to different customers. If the ratio is larger it indicates that a customer has been charged with either a higher price or lower price (Coderre, 1999).

Illustration

In the above illustration there is a large difference between the maximum and minimum price of product 1 (1.85) whereas in the case of product 2 it is only 1.01. This may give rise to a suspicion to the auditor and consequently he might want to examine the transactions for the customers of product 1 who were charged $ 235 and $127.

References

360training. (n.d.). Corporate Fraud Detectiion and Awareness. Web.

Coderre, D. (1999). Computer-Assisted Techniques for Fraud Detection. Web.

Moschella, W. (n.d.). Reduce the Risk of Fraud. Web.