This paper aims to compare the structure of corporate governance in such companies as Lukoil and Palmali. Furthermore, it is necessary to show how these companies can join their efforts in order to become more successful. Finally, we need to compare these corporations with their major competitors.

At this point, Lukoil is considered to be the largest oil-producing companies in Russia and one of the biggest market players in the world oil market. Among the key people of this company, we can single out Vagit Alekperov who is the president and founder of this organization (Lukoil, 2010, unpaged).

Secondly, we need to mention Valery Grayfer holding the position of chairman. Overall, it is possible to argue that Lukoil has a very complex hierarchy which has the following levels: president, vice-presidents, heads of major business units, head of the board office and chief accountant (Lukoil, 2010, unpaged). It should be taken into account that each division has its own structure and hierarchy. This complex structure of corporate governance is usually typical of large companies.

In turn, Palmali is a Turkish shipping company: its fleet includes two hundred vessels of various capacities. The key people are Mubariz Gurbanoglu, who is the founder of this company. Furthermore, we need to mention Mubariz Mansimov who is the president of this enterprise (Palmani, 2011, unpaged). Similarly, Palmali includes heads of different business divisions. However, corporate governance of this organization is less complex. In part, this difference can be explained by the fact that these enterprises differ in terms of their size.

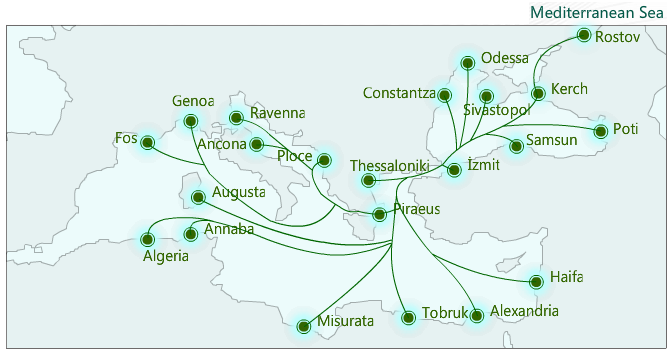

Overall, it is quite possible for us to speak about the synergy of these two companies. Lukoil has its facilities in Russia and in other countries such as Egypt, Uzbekistan, Saudi Arabia, Ukraine (in particular, Odessa), etc. Additionally, one should bear in mind that Lukoil intends to start its operations in Turkey (Lukoil, 2010, unpaged).

Thus, it is quite possible that Lukoil establishes a long-term partnership with Palmali to transport oil. Certainly, Lukoil primarily relies on the use of pipelines, but see fleet can benefit them as well. The Turkish shipping company operates in some of these areas, and its services can be of great use to the Russian corporation.

At this point, it is necessary to compare these companies with its some of their competitors. One can take such an example as British Petroleum which is one of the leading energy companies in the world. The structure of its corporate governance comprises owners and shareholders, board of directors, consisting of different committees, and executive management (British Petroleum, 2010, unpaged).

British Petroleum has a very complex governance hierarchy and from this perspective, it is very similar to Lukoil. This corporation focuses on exploration and refining of oil. Additionally, they attach great importance to distribution and marketing of petrochemicals. In comparison with Lukoil, this company has a larger market share, and it has more sources of revenue.

However, this does not mean that British Petroleum and Lukoil cannot join forces. For instance, they can work on numerous exploration projects in Iran, Iraq, Columbia, and so forth. The thing is that exploration projects require considerable investment from the company, and even international corporations prefer to work together on these projects.

Secondly, oil companies invest heavily in the development of infrastructure, especially pipelines, and this is another area where Lukoil and British Petroleum can work together. These examples indicate that oil-producing companies are not always in direct rivalry with one another. There are some situations when they can cooperate in order to succeed.

Additionally, we need to compare Palmali with one of its competitors, in particular, with National Shipping Company of Saudi Arabia or NSCSA as it is also known. At the moment, this company is ranked among the largest tanker operation in the world. The corporate governance of this company comprises board of directors, chairman, several chief executive officers and vice-CEOs.

One should bear in mind that it is a state-controlled organization which serves the needs of Saudi oil-producing companies. At first glance, it seems that these companies can only compete rather than cooperate with one another. However, Saudi companies export oil to Turkey refineries owned by such company as Tüpraş. Palmali’s fleet can assist NSCSA with the transportation of oil to Turkey.

This will greatly alleviate current workload of NSCSA fleet. On the one hand, this partnership will enable Saudi shipping company to focus on more important destination such as Europe or the United States. On the other hand, the alliance with NSCSA will provide Palmali with extra sources of revenue.

Thus, these examples indicate that despite the intense competitiveness of the oil market, companies operating in this area can work together in effort to maximize their profitability. This principle can be applied to both oil-producing and shipping companies. The cases that we have described exemplify the situations when partnership is equally beneficial for each of the sides.

References

British Petroleum. (2011). Official Website.

Lukoil (2011). The official website.

National Shipping Company of Saudi Arabia. (2010). Web.

Palmali. (2011). The official website.