Executive Summary

When the news broke out that Refco’s Chief Executive Officer and Chairman Philip Bennett had been implicated in a fraud that had taken million of dollars from the company’s account, nothing could have prepared the market for the turn of events that followed. Within a week of this announcement, the company had filed for bankruptcy following panic withdrawals.

To explain the event’s at Refco, this report has taken the company as a case study. In the analysis, it is obvious that rather than being a CEO, Bennett had been the epitome of hope for the company and hence the news of his fraudulent deeds have not only meant that investors could no longer trust the company, but had also sent a shadow of doubt on the entire internal operations in the company.

Bennett had taken up the helm of Refco’s leadership in 1999 when there was suspicion that the company was not performing. Under the public watch, he was able to turn around the company’s fortunes for the better. His actions (of course supported by others in the company) led to unpredicted good fortunes and growth for the company eventually culminating in the 2005 listing of the company in the stock exchange.

To most analysts, Refco had come full circle from a little known futures company to a public listed company. The greatest growth had however been registered during the years that Bennett had been in leadership. Since leaders are responsible for governance in any organization, it can be argued that Bennett not only excelled as a good leader in the eyes of the public, but also excelled in leading Refco to good governance.

The great revelation that he was therefore part of ‘stealing’ from the same business he created was not only worrisome to the shareholders who had spent some years with him in the company, but alarming to the new shareholders who had bought into the company just weeks before the fraud was discovered.

To the observers, the Bennett case was an example of how corporate governance had failed to prevent fraud. This means that despite the measures that Refco had taken to institute rigorous audits, independent board of directors and the training and educative programs that had been used to make board members better in governance, there still were fundamental flaws in the company’s governance structures.

In this report, it is apparent that even when corporate governance needs to include transparency in handling financial information, checks &balances in the systems, autonomous oversight in a company’ affairs and accountability are systematic tools whose importance should never be overlooked. Any laxity or ignorance on the people charged with the named responsibilities could result in a fraud like what happened in Refco, or worse still, in a conspiracy among company employees to fleece the company.

The Refco case study is a lesson in governance that too much trust placed in one person can be detrimental to the welfare of the organization. As observed hereunder, Bennett used a holding company he owned to perpetuate the fraud.

It could have been a case of complacency in the auditing firm’s part who were too trusting to suspect that Bennett-the CEO and chairman- was capable of carrying out a deal that could cost the same company he help bring up millions of dollars. May be it was a case of the audit committees taking trust and support of the CEO a bit too far or simply a case where the board believe and trusted that their CEO could do nothing else but adhere to good corporate behavior.

The only reason Bennett was able to initiate this fraud from the very beginning was because as a 50 percent shareholder in 1999, he needed to make decisions that reflected well on the company, which he was also taking up as a CEO. Considering that the bad debts accrued during the Asian-Financial crisis happened under his watch as the company’s Chief finance officer, he may have designed the fraud to cover the company’s bad financial records in order to retain the market’s confidence.

As suggested by Cangemi (2006), one of the ways that corporate governance can avoid corporate fraud by people in leadership positions in future is by requiring certified financial systems from the CFOs and the CEOs. By attesting to financial reports of their companies, the chances of fraud would be minimized. With laws such as Sarbanes-Oxley put in place, fraudulent undertakings by people in leadership and governance positions may become harder.

However, this is not to mean that fraud will be completely wiped. This therefore raises the need for vibrant governance structures in the company because as stated hereunder, leaders in any organization should ideally have the interests of the shareholders at heart. Since human beings are always culpable to selfish tendencies, corporate governance structure must ensure that the leaders are accountable at all times.

The conclusion of this reports states that though laxity in the part of auditors was partly to blame for the fraud Bennett perpetuated over the years, other companies should take the Refco case as a lesson that good corporate governance is not only proven through good performance in organizations.

Rather, the ability to be avoid fraud and fleecing investors off their money is a key agenda in any corporate governance’s things to accomplish. This is mainly because having put their trust in the company’s leadership, good governance and good returns for their investments is the least the investors can expect.

Introduction

Like other management concepts, corporate governance is a term that has elicited many debates in the scholarly corridors. To start with, there are many definitions that seek to explain the concept in its totality. In this case study however, the definition by Cadbury (1992, p.15, cited by Clarke, 2007) was found to be most appropriate.

Apart from being brief and clear, the definition , which states that “corporate governance is the system by which business corporations are directed and controlled” (p. 2), has elaborated on the governance objectives and structures contained in corporate organizations.

From the definition, it is clearly understandable that corporate governance includes the board of directors, the corporate managers and the shareholders. People in the three identified corporate structures are responsible for setting the company’s objectives and also ensuring that the decision-making rules and procedures are clearly set and spelled out to those people responsible for upholding the same.

The main aim of corporate governance as identified by Clarke (2007) is the provision of the necessary incentives through which the company can attain success in business and the provision of accountable, transparent distribution of profits generated by the business among all stakeholders.

Case study: Refco

Refco Inc. was a futures brokerage firm registered in the United States. Since its inception, the company had grown tremendously and had extended its services to the international market. More to this, the company had diversified its services portfolio to include diversified financial services (Prasad & George, 2006).

Until 2005, the company had portrayed a good image to the public as it expanded rapidly and made several acquisitions in the financial markets. The culmination of this good financial period was the listing of the company in the New York Stock Exchange in august 2005 where it offered 26.5 million shares to the public.

Just two months after the initial public offer in October 2005, the auditing board discovered that Refco’s CEO P.H. Bennett owed the company $ 430 million, a debt which had been concealed since 1999 through manipulation of accounting records. Bennett was forced not only to repay the loan, but also take a compulsory leave from the company. The company then hastily went public with the fraud details, consequently triggering panic among investors.

At the time of Refco’s collapse, the company was fully compliant to Sarbanes-Oxley, which is a legislation that has 11 provisions that public companies need to meet in their financial reporting. The legislation addressed governance issues by requiring companies to have an accounting oversight board (AOB), independent auditors and individual responsibility by all directors into the completeness and accuracy of financial statements released by the company among other financial disclosures means to prevent fraud (Kuschnik, 2008).

Questions

Why did the CEO and chairman in Refco engage in Fraud?

Since Bennett never answered this question, this report can only speculate based on the situation that faced Refco between 1998and1999. Though many public companies owe their obligations to the public in theory, reality suggests that the leaders who govern such organizations are professionals who pursue profits in order to maximize the organizations’ returns (Monks & Minnow, 2008, p. 54).

In Refco’s case however, it looks like Bennett had his own interest rather than the interest of the organization or the public at heart. The possible explanation why Bennett was involved in the fraud indicates that he may have been trying to cover up for the losses that Refco accrued after the 1997 to 1998 Asian Economic Crisis that left the company with Billions of dollars in bad debt (Cangemi, 2006).

However, instead of letting the bad debts to be written off, it is suspected that Bennett represented the company’s financial statement since 1999 in order to prove that the company’s financial status was healthy. Having been promoted as the company’s CEO at the same time this was happening, it is suspected that Bennett feared revealing that his decisions of advancing loans as Refco’s CFO earlier could have negatively affected his position in the firm.

Refco’s accountants, the Abernathy accounting firm had a lot of explaining to do on how it had missed the more than a dozen money-shuffling incidences by Bennett as he tried to cover his debt. To some in Wharton School suggests that the fraud carried out by Bennett looks like a very clear cut case.

This further raises questions about the leadership in some of the associated firms that handled the internal operations in Refco. Especially astounding to Wharton School (2005) was the fact that Abernathy missed the fraud even after preparing the accounting records of Refco in preparation for the IPO.

The audit carried out on most companies before taking such a giant step is usually thorough and it therefore beats logic how a major accounting firm missed the fraud for the same to be discovered by a sole auditor just a month later. At this point, Prasad & George’s (2006) comment that Bennett might have had help in concealing the debt throughout the years appears plausible.

Why carry on with such a debt for so long? One wonders if Bennett realized that the fraud would come to light one day or the other. Well, according to Badaracco, (2006), wise corporate leader not only focus on getting their companies to perform well, they also keep reflecting on their moral ethics.

This explains why leaders in a corporate governance structure need to have instinctive, innate and deep values. While it is suggested that Bennett had initiated the fraud to cove r up for his shortcomings as CFO, it beats logic why he postponed settling the debt for so long. Or even why he did not alert other shareholders in the company at that time about the debt for it to be written off. In this essay’s perception, Bennett failed the wisdom test regardless of his achievements at turning around Refco’s fortunes.

In making public details about the fraud, did the board act on an informed basis, good faith, care and diligence considering the interest of Refco and its shareholders?

Trust issues

By the time the announcement about fraud in Refco was made, it is observed that Bennett had repaid the money he owed the company and measures had already been taken to ensure that the accounting practices in the company were improved. In short, Refco was well back on its feet.

However, soon after the company went public with the news about the fraud, investors panicked and this led to the company’s collapse within a week. Analysts suggests that since a lot of investors had trusted Bennett before, the revelation that he was behind the fraud was not a very wise decision to make especially so soon after his departure from the company.

More discerning

Knowing that an announcement would trigger mistrust among investors especially those who had pegged so much hope on Bennett, Refco’s board would have been more calculative in breaking the news to the public. The wise thing would have been to wait until operations in the company were running as smoothly as was the case when Bennett was at the helm. This would have given the company a good enough basis to proof that the new CEO could run the company just as well as Bennett had done before.

The narration by Prasad & George (2006) suggests that no prior discussions were made by the board about the situation and that the decision to announce the news was solely made by the board members.

Having been listed on the stock market, the public company board members should have followed some kind of protocol as suggested by Clarke (2007) that allows board members to share some information and power with the management. This means that decisions affecting the future of the company cannot be made by either the board or the management without consulting the other party.

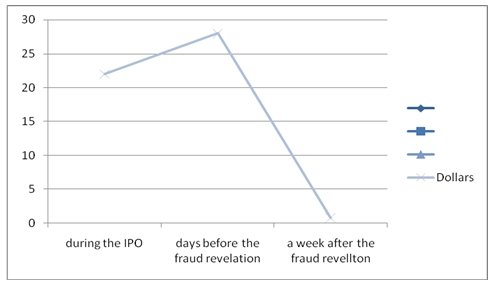

Figure 1: Refco share performance on the NYSE

The refco shares dramatically lost value from $ 28 dollars to $ 0.8 within a week of the company announcing that Bennett had been misappropriating its funds

Judging from previous panic that had gripped the US market, people charged with corporate governance would have been discerning enough to know the consequences of such a discovery and announcement. This would have led them to find a milder way of breaking the news to the investors. According to Prasad & George (2006) bankruptcy was inevitable no matter how long it would have taken to break the news to the public. However, a more considerate delivery of the news may have avoided the massive losses accrued by the investors.

Panic and Massive withdrawals

As it were, the unwise decision of making a public announcement so soon, not only drove massive withdrawals, but also jeopardized the investor’s money as the shares lost value just hours after the announcement. This report holds the opinion that it would have been wise to postpone the public announcement until a later date, before which investors would have been briefed on the happenings and assured that the company was still performing well in the futures market.

As Monks & Minnow (2008) observe, corporate governance requires decision-makings to think about the consequences of their actions or utterances beforehand. This in turn helps the company avoid situations that would jeopardize its existence and by extension the interests of the investor. But doesn’t the public deserve to know the truth? One would ask. The appropriate answer to this in this essay’s opinion is that truth does not have to be unnecessarily expensive.

Why did the Refco board fail to uncover and therefore report the fraud before the public listing of the company especially considering that the board is required to disclose the ownership, performance, governance and financial situation of the company? In short why was the fraud not detected earlier?

Change in leadership

It was not until 2005, when a new auditor, hired by a fairly new CFO realized that the accounting books in Refco were not as good as they appeared. This means that were it not for the change of leadership, the fraud could have continued for longer. Analyzing this case, one gets the impression that the auditors either were too complacent to notice the fraud, or was fully aware of what Bennett had been doing over the years but chose to ignore the same.

According to Colley (2003), financial disclosure issues and accounting irregularities have served to mislead both the regulatory bodies and the public about the well-being of major companies. The involvement of key decision-making personnel in the accounting processes of a company like was the case of Bennett in Refco, further compounds the matter.

As Prasad & George (2006) suspect however, most fraud cases are not perpetuated singlehandedly by greedy self-seeking people. Rather, they receive assistance from negligent financial auditors and lax boards that fail to diligently fail to execute their oversight duties.

Unclear line between the board, leaders and shareholders

In cases where there is an unclear line between shareholders, leadership and the board, Promper (2006) observes that good governance can be blurred. When Refco started up, the directors were also the owners and therefore knew only too well how to manage their own monies.

Enlisting in the stock exchange as a public company would have ended this culture, but as Bennett was a major shareholder, the culture persisted. With Refco having had a past marred by financial misreporting, the auditors would have done a better job at checking the company’s account before approving it for public listing. As Promper (2006) points out, the auditor’s role in corporate governance can not be understated.

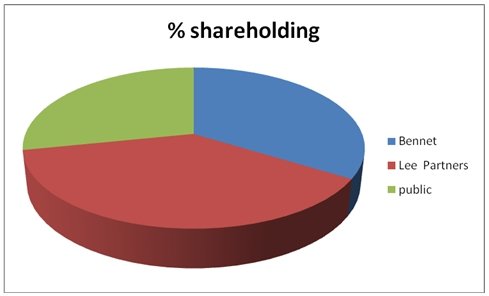

Figure 2: Shareholding in Refco after the IPO

Even after the IPO, the two previous owners of Refco ( Bennett and Lee Partners) retained majority of the shares. Bennet had 33.8 percent shareholding, while Lee partners had 38.2 percent thus leaving the public shareholders with 28.2 percent shareholding.

Corporate governance in Refco had always been linked to its ownership. While Bennett had only joined the company in 1981 as the Chief-Financial officer, he acquired 14.5 percent of the company’s stake in the same year. The same percentage stake was acquired by Tone Grant who was Refco’s CEO at the time (Prasad & George, 2006).

In 1999, the initial owners of Refco sold their entire stake in the company to Grant and Bennett, thus making them equal shareholders with each having a 50 percent share. In the same year, Bennett became the chairman and CEO of the group. Over the years, other shareholders bought into the company and Grant sold his stake in the company to Bennett and others.

When fraud was discovered in 2005, it was traced back to 1999 when Bennett was taking over as CEO and the company trying to cover up its financial shortages which had been acquired during the Asian Financial Crisis.

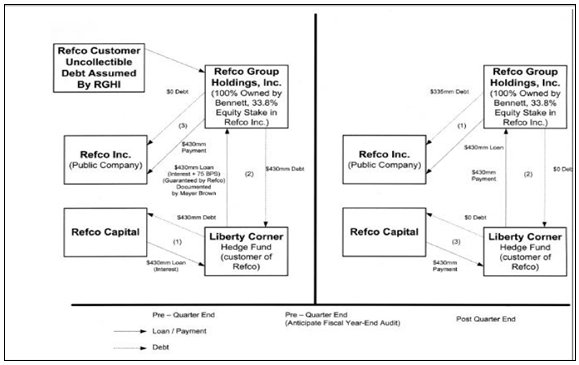

Using his Refco Group Holding Inc., Bennett had been financing Refco’s debt over the years in order to clean the company’s balance sheet. Unfortunately, this money would be borrowed from Refco by a client named Liberty Corner LLC, which would then advance the same cash to Refco Group Holdings Inc.

Where were the regulators?

A risk taker

According to Prasad & George (2006) Refco had established a name as a risk taker in the futures industry. It had flaunted regulations and was always playing on the edge. In fact, its attitude towards regulation was so notorious that a US commodities exchange regulator commented that the firm saw fines as a cost associated with doing business in the US (Robinson, 2006).

Refco’s record of regulation non-adherence was so bad that between 1983 and its collapse in 2005; the company had faced 140 punishments for sloppy record keeping, false trade reports, and inadequate supervision of its traders among other violations. According to Colley (2003), a disregard of the regulations is in itself a sign that corporate governance in an organization is underperforming and hence needs restructuring.

This is because one of the core mandates of corporate governance is ensuring that the company abides to the set regulations. In addition, corporate governance should ensure that the organization upholds ethics will fulfilling its obligations to stakeholders, and must also ensure that the management makes effective and efficient decisions that must be enacted within the set period of time.

Figure 3: How Bennet perpetuated the fraud

The above diagram shows how Bennett hid the $430 billion by borrowing money from Refco Inc. through his Refco Group Holding Inc. The same money was then transferred to a hedge fund which could make a $430 payment to Refco. This meant that the Refco books reflected no debts at all.

The board’s role

As the major oversight organ in-charge of corporate governance, the board in Refco would have worked at ensuring that it works as a team, and that it also maintains an effective relationship with not only the management, but the investors too.

If this was the case, maybe the initial fraud case in the company could have been avoided. If not, the consequent decision to make a public announcement about the fraud without consulting with the management or even discreetly explaining the company’s financial status after the fraud case was resolved could have been avoided.

Monitoring performance

Although Colley (2003) alludes that shareholder can now monitor the performance of companies more easily thus preventing the occurrence of fraud, it is notable that the fraud executed in Bennett in Refco was far beyond the detection abilities of many investors especially because it was cleverly concealed through careful financial transactions.

However, seeing that this deceit continued for an extended length of time to an extent that Refco issued its share to the public without the anomaly being detected, it raises questions about the analytical ability of the auditing board and the firms employed to check the financial records of the company before it was approved for listing in the stock exchange market.

The regulatory systems are not entirely blameless in this. According to a Wharton school report released in 2005, the documents forwarded to the Securities Exchange Commission before Refco was approved to carry out an initial public offering indicated that the company needed to expand its in-house company controls.

Though the report states that statement such as the one issued by the commission usually contains multiple warnings to the investors, the internal controls warning should have elicited some investigative reaction on Refco especially considering that its past handling regulations and its books of accounts was questionable.

Conclusion

For a company that had satisfied all identified corporate norms to succumb to the very ills raised by poor corporate leadership and governance was surprising to many financial analysts as well as investors.

Where as the company could carry on profit making business even with Bennett out and the fraud monies channeled back to the company, the trust that investors had in the company’s governance was simply wiped in a matter of days after the fraud details were announced to the public.

As Ravimohan notes (2005), at the time of bankruptcy, Refco had met all the corporate governance measures stipulated as structural safeguards. This includes independent directors who could think and act without being influenced by the management, an established code of ethics which stipulated how board members and directors in the company had to behave while in the company, compensation committees that oversaw money issues, and a self-evaluation code to be followed by its board.

More to this, the Refco board attended regular training and educative programs and the company had employed the services of audit committees which would rigorously audit the companies account. Yet, despite all the effort, a fraud by the CEO and chairman of the company run for year in the company’s book without raising an eye blow.

Whether Bennett was too smart for the auditors or was receiving inside help to conceal the fraud was a non-issue for most investors. What mattered most was the fact that they could not trust the board of directors or the management to carefully guard their investments; and that sealed the fate for Refco.

In the contemporary world, good corporate governance is linked to good performance. There is also the recognition that without good, principled and ethical leaders, not much mileage can be attained towards effective corporate governance. Just as a president in a country is held responsible for the country’s welfare regardless of the people working under him, a CEO like Bennett was well known as the person in charge of success and the well-being of Refco.

As chairman and CEO (titles he held because the company did not believe in two people holding these positions separately), the focus of the investors was entirely on him. Since his takeover in 1999, he had proven that the company’s fortunes were better under his leadership. News that he was at the ‘architect and perpetuator’ of the fraud must have stripped the investors any trust they had in the company.

While as the Refco case study simply focused on the laxity of the accounting auditors to detect a fraud that had lasted five years, it is a lesson to other companies that good corporate governance is not only proven through good performance in organizations. Rather, the ability to be avoid fraud and fleecing investors off their money is a key agenda in any corporate governance’s things to accomplish. Having put their trust in the company’s leadership, good governance and good returns for their investments is the least the investors can expect.

References

Badaracco, J. (2006). Questions of Character: Illuminating the heart of leadership through literature, Harvard, Harvard Business Press.

Cangemi, P. (2006). Refco Inc.: A Sarbanes-Oxley test case, Information Systems Journal, 1(1), 1-5.

Clarke T. ( 2007). International Corporate Governance: a comparative approach: a comparative approach, London: Routledge.

Colley, J.L. (2003). Corporate Governance. New York, McGraw-Hill professional.

Kuschnik, B. (2008). The Sarbanes Oxley Act: “Big Brother is watching” you or adequate measures of corporate Governance regulation? Rutgers Business Law Journal, 5(1), 64-95.

Monks, R.A. & Minow, N. (2008). Corporate Governance, London, John Wiley & Sons.

Prasad, N. V. & Govind, S. (2006). Corporate Governance issues at Refco Inc., IBS Center for Management Research, CGOV/006, 1-20.

Promper, N. (2006). An Analysis of recent corporate governance development in an international context: current legislation and proposed regulations in Europe and the USA. Web.

Ravimohan, R. (2005). Sox did not prevent Refco. Web.

Robinson, E. (2006). Refco’s Collapse reveals Decades of Quarrels with Regulators. Bloomberg. Web.

Wharton School. (2005). Refco’s Meltdown: An isolated Incident? Finance and Investment. Web.