Introduction

When creating a strategic plan, there a company executive or the person left in charge of creating it has the responsibility to ensure the document forwarded contains the necessary steps to consider and take. A strategic plan gives a company the direction to take when they are looking to move from strength to strength, from one level of productivity and profitability to the next.

This paper is a case study of an employee, Angelina, charged with the responsibility to ensure the company she works at has a strategic plan that will allow the company to grow over a certain period. The firm is an insurance firm, so the main issue to consider in her quest to create a perfect strategic plan is the oligopolistic competition that is commonplace in that sector. In this paper, the main factors she is to consider are analyzed and discussed. The four factors that are analyzed in this paper are the current market, competition, the economy, and the regulatory environment.

A strategic plan is a document prepared by business entities that outlines the direction the entity is planning to take in order to attain a number of set goals. A firm comes up with its goals by determining where it is, where it intends to be, and how it intends to get there. The document that captures all this information is known as a strategic plan. A strategic plan is not cast in stone, and in the constantly changing business environment, it is inevitable that a successful business will keep changing its strategic plan to adapt.

Oligopolistic competition

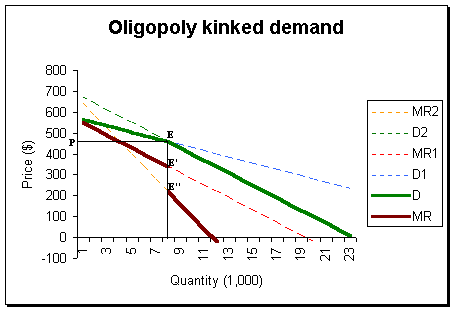

Stroux (2004) states that industry is said to be oligopolistic when a remarkably large share of its total output is in the hands of few relatively large firms. In an oligopolistic market, a change in the output of any one of these firms in the market causes a significant shift in the market price of a commodity. The demand curve in an oligopolistic market is kinked, as shown in Figure 1.

In the upper part of the demand curve, the market is extremely elastic. If a firm increases its prices, other firms will not follow suit, and the firm loses market share. On the other hand, if a firm increases prices in the lower part of the curve, the other firms will do the same and, therefore, no firm increases its market share (Petroff, 2002).

Key Factors to Consider

The Current Market

It is necessary for a firm to understand the market within which it operates, how it will respond to its products, and how best to appeal to this market within the timespan of the strategic plan. When examining the insurance market, key factors to consider are insurer profitability and the appetite for insurers to provide cover. These two factors are mainly affected by the economic environment, the volatility of the investors’ market, commercial considerations of the insurers, and climatic conditions (AON, 2011).

Between 2000 and 2009 in the United States, for example, the most profitable sector in the insurance industry was medical insurance. Hall (2009) writes that, among the top ten publicly traded health insurance companies, profits rose 428 percent between 2000 and 2007. This shows that there is a great demand for medical insurance in America at the moment. The Patient Protection and Affordable Care Act (2010) has made the market even more lucrative as individuals try to get medical insurance.

Competition

In order to create a proper strategic plan, it is inconceivable not to consider what the competition is doing and the current trends in the market. In the United States, for example, healthcare is the biggest issue in the business, and health insurance is soaring. This means that most competitors in the market will most likely provide attractive health insurance packages. Understanding the competitors’ trends, studying possible moves a rival company could make, and strategizing on the best way to beat competition are some of the core reasons that strategic plans are made in the first place.

An effective method that economists use to study the market is Game Theory. According to Levine (2011), one of the sections of the theory deals with how intelligent individuals interact with one another in an effort to achieve their own goals (Levine, 2011). Take, for example, a health insurance package that Angelina’s firm believes a competitor will introduce. Let the product be Health Insurance Product X, abbreviated HPx. A matrix will be used to analyze the possible outcomes of firms offering the product. In the payoff matrix below, it is necessary to note that a larger number represents more utility and vice versa.

Figure 2: Payoff Matrix of launching HPx.

If both firms launch HPx, they get relatively high utility and split the proceeds equally. If one firm chooses to launch the product and the other does not, the firm that launches it receives particularly high utility (12) while the other one does not (-4). However, if both firms do not launch the product, both do not lose at the expense of the other, hence the small utility of 2. However, this utility is not a high as if both firms had launched the product.

The Economy

The current economic environment is another crucial aspect that the firm must consider when creating its strategic plan. The United States, for example, is still suffering the effects of the recession. An insurance firm has to tread extremely carefully when making its strategic plan, particularly since the industry was extensively blamed for the recession that hit the nation, and the world, in 2008. This means that in order to win the trust of the market back, the firm must sell itself as trustworthy and a company with integrity.

More importantly, the firm must offer products that a majority of the population can afford. Studies have shown that, after the recession, fewer families than before are now able to afford insurance (AHRQ, 2009). The economy is set to grow as years go by, so the structure of the products produced by the company must be in such a way that they are at a lower price in the short run and at a higher price as the economy continues to recover from the recession. That way, the company can gain a sizable market share in the short run and maintain a high turnover over the strategic period.

The Regulatory Environment

Just like in most countries with a functioning government and a healthy economy, all sectors in the United States are regulated by state and federal laws. It is imperative that when Angelina’s firm is strategizing, it does so while keeping in mind the governmental regulations that exist within the country.

Angelina needs to understand the history of regulation in the United States, why it exists, and what is expected of them as a firm. Regulation of the insurance sector in the United States began nearly 70 years ago, although the first case involving the insurance sector in the United States was the Paul v. Virginia case (1868), where it was determined that the insurance industry is subject to state regulation (Randall, 1999). Developing an understanding of all aspects of insurance regulation within the country enables the firm to operate within the confines of the law and ensure it does not get in unnecessary trouble with the government.

The strategic plan must involve supporting the legal section of its operations. The legal arm of its operations ensures that the firm keeps in touch with current government regulations. The legal team also ensures that government regulations are adhered to by the firm.

Conclusion

It is obvious that the different aspects discussed in Section 2 above are related to each other, and none can work in isolation. For example, understanding the market means the firm also needs to understand the current economic environment. That way, the firm is able to determine how to positions its products in a manner that will suit customers in the prevailing market environment.

Angelina has a daunting task ahead of her, and she has to plan meticulously to ensure she keeps the company on a progressive path. A strategic plan provides guideposts for the firm’s progress. Therefore, no mistakes can be made.

References

AHRQ. (2009). New Study Finds Fewer Families Can Afford Health Insurance. Web.

AON. (2011). A current view of the insurance market. Sydney: AON.

Hall, M. (2009). Health Insurance Profits Soar as Industry Mergers Create Near-Monopoly. Web.

Levine, D. K. (2011). What is the Game Theory? Web.

Petroff, J. (2002). Oligopoly. Web.

Randall, S. (1999). Insurance Regulation in the United States. Florida State University Law Review, 630-631.

Stroux, S. (2004). US and EU Oligopoly Control. Hague: Kluwer Law International.