Introduction

Portland Drake Beverages’ Vice President of marketing, Sarah Ryan is seeking to position a newly purchased beverage brand, Crescent Pure, into the market. Sarah Ryan’s responsibility is to decide whether Portland Drake Beverages (PDB) should introduce the drink as a sports drink or an energy drink.

This report analyzes the potential of introducing Crescent Pure as either a sports drink or an energy drink by identifying the pros and cons of the options and performing a break-even analysis.

Positioning Alternatives

The increase in people’s concern about the sugar levels in their drinks makes it possible for producers to market products with low sugar contents. Crescent Pure is PDB’s choice drink because it offers lower sugar contents and has a caffeine content equivalent to one cup of coffee.

Crescent Pure’s sales performance has been impressive as it sold one thousand cases in the last month at approximately $3 per can. The drink’s low-calorie content, and its energizing, hydrating and organic characteristics increases its marketability.

Sarah Ryan must harness Crescent Pure’s marketing advantage by identifying and analyzing the pros and cons of each positing option.

As earlier stated, PDB has two options for its branding strategy. The first option is for PDB to strategically introduce Crescent Pure as an energy drink while the second option is to strategically brand Crescent Pure as a sports drink. An analysis of the feasibility of the two options will influence choice of the final brand introduced into the market.

Crescent Pure as a Sports Drink

Sarah Ryan has the option of positioning crescent pure as a sports drink but she must weigh the merits and the demerits of using this strategy. A key advantage of sports drinks is that users choose them more often than energy drinks.

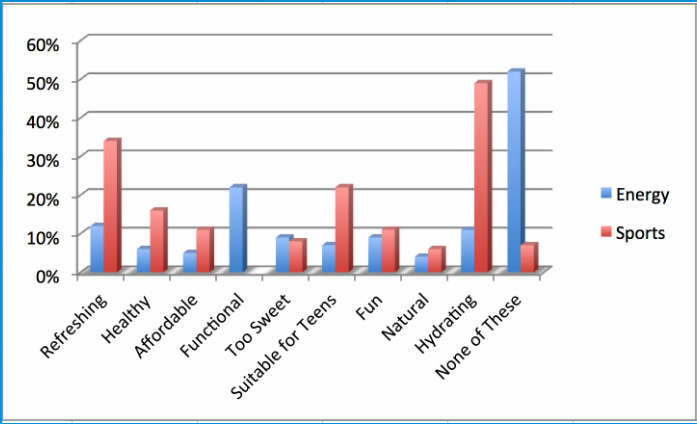

Figure 1: Factors influencing consumer choices

Some pros of strategically positioning Crescent Pure in the market for sports drinks are identified. For instance, participants in the survey reported an increase in increase in endurance and a decrease in stress after consuming sports drinks.

The market for sports drinks is worth $6.3 Billion and an effective positioning will make Crescent Pure a major revenue generator for PDB. Sports drinks gain more acceptability by consumers because many respondents to the market survey believed they could consume sports drinks at any time.

Figure 1 is a visual summary of the multiple factors that make consumers prefer sports drinks to energy drinks.

Despite the advantages of, some cons reduce the marketability of strategically positioning Crescent Pure as a sports drink brand. The market for sports drink is smaller than that of energy drinks.

For example, numerous sports drinks have been banned from schools by food authorities due to sugary concerns and this has affected people’s opinion of sports products. The pricing of the product is also a disadvantage.

The retail price of Crescent Pure is $2.75. Pricing is an important factor that affects people’s perception of a product’s quality and a lower benchmark price for Crescent Pure may become disadvantageous.

Crescent Pure as an Energy Drink

Sarah Ryan may opt to strategically position Crescent Pure as an energy drink. Her decision will be based on an analysis of the advantages and disadvantages of energy drinks and its market. The analysis of the pros and cons will be compared to what is obtainable in the market for sports drinks.

Unlike other energy drinks, Crescent Pure does not contain any artificial substances but comprises caffeine derived from organic products. This feature will increase the sales of Crescent Pure because consumers of sports and energy drinks are becoming more conscious of the health effects of what they consume.

Socioeconomic variables such as spending habits and brand popularity are obviously favoring the market for energy drinks. Revenue from energy drinks increased by 40% between 2010 and 2012 and there is potential for further growth.

Thus, it may be feasible to strategically position Crescent Pure as an energy drink when the industry is experiencing such a positive boom.

Notwithstanding the positive pros of strategically positioning Crescent Pure as an energy drink, some challenges are also identified from the case study. One significant disadvantage is the widespread perception of the health risks of consuming energy drinks.

The target market may not be attracted to energy drinks because only 32% of the participants in the survey agreed that they had consumed any energy drink in the past six months. Furthermore, 11% of the participants directly affirmed that they avoided energy drinks because of its health risks.

Crescent Pure’s low pricing is another disadvantage of strategically positioning it in the market for energy drinks. Although low pricing attracts consumers, the strategy has boomeranged against PDB because some survey participants questioned the quality of an energy drink priced at only $2.75.

Marketing Mix

Portland Drake Beverages understands the importance of strategically positioning Crescent Pure by using specific decision variables. The company decides to position a product that has 70% less sugar than other competing brands in the market.

Instead of using energy substances created in the laboratory, Crescent Pure considers the consumer appeal for natural products by using caffeine. It attracts consumers by setting its price at $1 below the average price in the market.

This decision strategically places PDB’s at an advantage for consumers that prefer lower-priced products. Nevertheless, the low pricing may have a negative effect on the general perception of the product’s quality.

Break-Even Analysis

The results of a break-even analysis show that Sarah will need to sell 31820 cases of Crescent Pure to recover an advertising cost of $750,000.

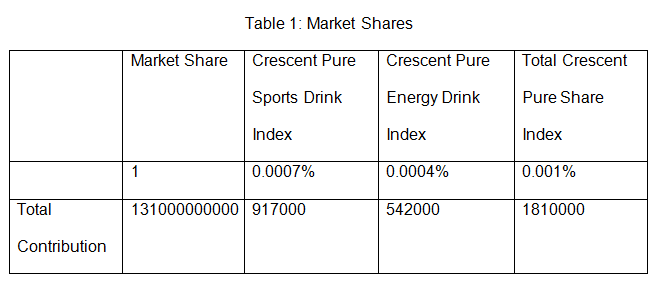

Crescent Pure controls 0.0004% + 0.0007% = 0.001% of the nonalcoholic beverage market. Table 1 above summarizes the market shares. The market was valued at $131 billion in 2013. With a market share of 0.001%, Crescent Pure will generate revenue of $1,810,000.

Each case of Crescent pure is sold for $29.76, which means that 181000 ÷ 29.76 = 60820 cases will be sold in 2013. Thus, the PDB will be able to sell the number of cases required to break-even because it will be supported by a new production capacity of 12,000 cases monthly.

Recommendations

The analysis shows the potential for both products. Nevertheless, it is recommended that PDB introduces Crescent Pure into the market for energy drinks. Crescent Pure’s ability to boost energy and mental focus places it in the energy drink category.

PDB can harness the advantages of competitive health benefits and low pricing to perform better than existing brands in the energy drink industry. The current market growth of approximately 40% biannually is an opportunity that PDB must not overlook.