Introduction

The area of money and finance is witnessing transformations that have the potential of affecting the global economy significantly. In particular, the advent of innovative financial instruments and systems is changing the way parties engage in monetary transactions. The introduction of cryptocurrencies in the recent past is one of the outcomes of innovation in the money market. Bitcoin is one of the cryptocurrencies that have recorded a significant market value over the last few years. The growth of cryptocurrencies has influenced the development of new business opportunities that have contributed to the advancement of economies such as the United Kingdom, Germany, and France. While these countries have gone a step further to implement policies that embrace this new business concept, others such as China and South Korea have proscribed any cryptocurrency operations.

This contrast indicates how some concerned parties identify cryptocurrencies as legitimate institutions that play key functions, owing to the benefits realized by such innovative financial instruments. Nonetheless, economists who have raised opposing opinions question the sustainability of cryptocurrencies because of the inconsistent nature of digital financial instruments. However, it is crucial to examine what cryptocurrencies entail, including their mode of operation. As this paper states, economists who argue against the sustainability and legitimacy of virtual means of doing business claiming that artificial bubbles generated by cryptocurrencies have the potential of crippling economies at an international scale are probably agents hired by governments to spearhead their monopolist agendas. In my opinion, such digital currencies should be introduced into the global market, owing to their capacity to address the issue of inflation and insecurity associated with government-controlled fiat currencies.

Cryptocurrencies and their Functionality

A cryptocurrency consists of a chain of virtual inscriptions allowing individuals to sign digitally after acquiring it from the previous proprietor. The digital signing process entails altering the nature of all preceding transactions and public keys of the succeeding vendor. Effected changes are then added at the end of the digital coin (Farell 4). The programmed computer code lines are stored in the form of hard drives or through Internet-enabled wallets.

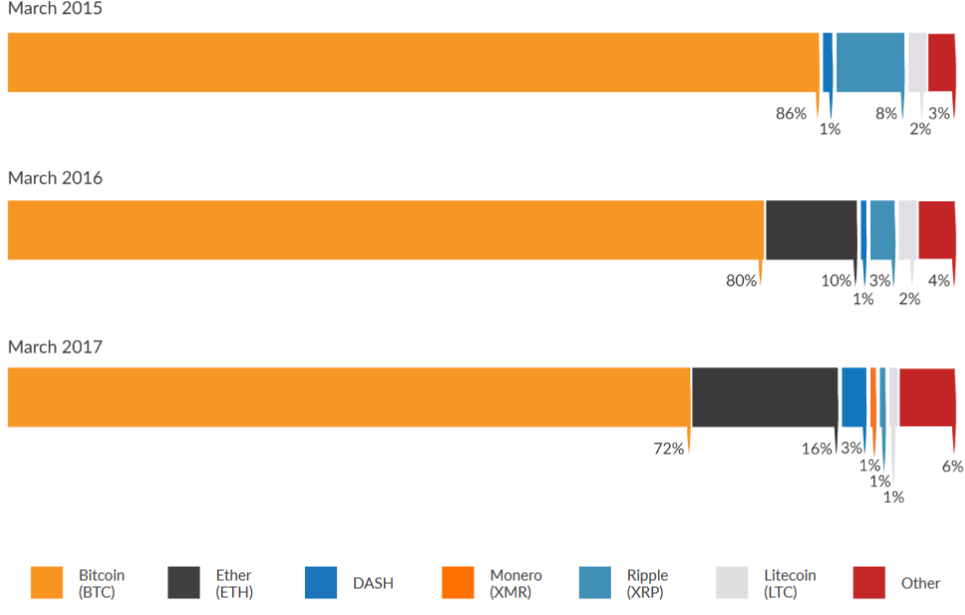

According to Hileman and Rauchs, bitcoin is a pioneer cryptocurrency that commenced its operation in 2009 (15). The decentralized nature of digital currencies depends on peer-to-peer technology to facilitate their functionality. The transfer of bitcoins requires proprietors to specify the amount they need to transmit from the wallet to other users before entering the recipients’ address and completing the process (Howden 747). As denoted by its technology-based features, significant innovative efforts influenced the successful creation of bitcoin. Currently, hundreds of cryptocurrencies operate in the digital market. Some of them, which lack a sense of innovation, are regarded as altcoins. Important to note, most altcoins function ineffectively compared to stable cryptocurrencies such as bitcoin. As shown in Figure 1, bitcoin has a greater share of the cryptocurrency market capitalization relative to other currencies.

From the information presented in Figure 1 above, bitcoin has recorded consistent growth in the total cryptocurrency market share capitalization compared to rivals such as Ether and DASH (Hileman and Rauchs 18). The innovativeness of bitcoin has led to its popularity and hence its greater competitive edge compared to rival cryptocurrencies. Nonetheless, bitcoin’s rivals emulate the functionality of the pioneer cryptocurrency to realize market capitalization. As a result, this digital currency has recorded a reduction in market capitalization because competitive forces such as DASH continue to secure a larger share of the market.

According to Farell, the exchange of cryptocurrencies, especially bitcoins, requires the logging of dealings on the blockchain, which is an unrestricted ledger coin (5). The blockchain is a crucial aspect of self-regulation in the cryptocurrency market. As Hileman and Rauchs assert, a network of participants shares the blockchain that facilitates the logging of dealings involving a given digital currency (21). The use of native tokens also offers the participants incentives that aid the operation of the decentralized network. Cryptocurrencies operate in the absence of a central regulatory authority unlike the case of the traditional fiat money.

Forces of supply and demand determine the value of bitcoin among other cryptocurrencies (Farell 5). In this respect, digital currencies do not gain value from the interventions of the government. As a result, the lack of administrative involvement paves the way for self-regulating cryptocurrencies (Howden 756). Such regulation function of cryptocurrencies goes a long way in addressing the issue of double-spending, which is a notable problem in the traditional financial system.

As noted earlier, transactions involving innovative cryptocurrencies require signatures that enhance the transfer of ownership. Such inscriptions offer security by preventing the previous proprietor from spending an already used cryptocurrency again. In particular, the distribution of a ledger in the entire bitcoin fraternity addresses the issue of double spending in the market. Preventing forgery using the blockchain is referred to as mining (Howden 748). Importantly, mining provides buyers an opportunity to earn bitcoin without the need for transactions involving third parties. Instead of introducing a third party, the public ledger facilitates the recording of transactions regarding a particular bitcoin. In this respect, the aspect of mining in cryptocurrencies enhances the legitimacy of transactions.

Notably, the functionality of cryptocurrencies such as bitcoin is founded on the need to foster price, safety, and ambiguity (Howden 750). Transactions involving bitcoin among other cryptocurrencies require no extra charges, owing to the elimination of other parties such as governments or financial agencies, for instance, PayPal and Payoneer, which charge transaction fees after verification. In this regard, cryptocurrencies do not involve the conversion of currencies in the international market.

Bitcoin transactions are founded on security mechanisms that enable users to mine such digital currencies without any attempt at double-spending. Furthermore, the self-monitoring element of cryptocurrencies fosters clients’ security by preventing the interference of governments, as well as the central bank. As such, it is possible to prevent inflation through the provision of a fixed supply of a given cryptocurrency. According to Howden, cryptocurrencies are believed to gain more stability with increased participation of users across the world (751).

The aspect of inscrutability also influences the functionality of bitcoin. Here, the address of a particular cryptocurrency is not connected to a particular public identity that can disclose users’ information. The blockchain functions in a way that stores various transactions, as well as addresses, without revealing them to the public. Instead, the blockchain publicly logs transaction records, which do not expose the individual or entity behind the business deal. Nonetheless, amid the anonymity surrounding cryptocurrencies and their acceptance by recognizable business entities, some users still view it as an unnecessary feature of facilitating transactions (Howden 752). Nonetheless, concerns have developed regarding the sustainability of decentralized currencies. Therefore, discussing the sustainability issue in cryptocurrencies is crucial in the context of this paper.

Cryptocurrencies as Schemes that Create Artificial Bubbles

Cryptocurrencies have experienced considerable criticisms regarding their sustainability in the market. In particular, the creation of artificial bubbles by cryptocurrencies is identified as a major issue, which has the potential of undermining the sustainability of decentralized currencies, including bitcoin. According to Hanley, cryptocurrencies offer users an array of counterfeit claims that seek to conceal the dysfunctionality of the digital currency in the long term (1). For instance, according to Hanley, claims such as the ability of cryptocurrencies to act as a reserve coinage for banking and the assumption that hoarding is analogous to saving mislead users (1). In this light, developers of cryptocurrencies seem to establish forged claims to attract more participants in the cryptocurrency community. Such false declarations are perceived as strategies for concealing the unsustainable nature of cryptocurrencies.

Hanley questions the integrity and possibility of cryptocurrencies expanding in the future (2). The segment of bitcoin, namely satoshis, seeks the realization of at least 21 billion bitcoins that can sustain the currency demands of the world (Hanley 2). In particular, developers of bitcoin project that the attainment of 2.1 quadrillion Satoshis, equivalent to 21 million bitcoins may be sufficient to cater for the currency needs of the entire world. In this respect, the realization of the 21 million bitcoins is expected to support the currency expansion demands of various nations.

However, Hanley identifies this asymptotic maximum value of bitcoins as unworkable because it is generated synthetically (2). Furthermore, the author refutes the point that cryptocurrencies have the potential of functioning comparably with financial institutions through reserve banking. Notably, conventional banking systems run through reserves and the issuance of loans to create money (Hanley 10). The exclusivity of cryptocurrencies implies that they cannot be duplicated. In other words, they are unable to avail of a mortgage that facilitates the creation of money. Therefore, the nature of cryptocurrencies experiences a limitation regarding the foundation of money, which is one of the fundamental functions of central banks that regulate the distribution of fiat currencies in an economy.

The fact that cryptocurrencies cannot be applied in reserve banking undermines the possibility of allocating such virtual coins to savings. Instead, bitcoins among other cryptocurrencies can only be disbursed, accumulated, or mislaid. According to Chohan, uninformed investors fail to understand that they cannot save bitcoins to realize interest (2). Therefore, the inability to save bitcoins undermines its capability of earning interest when the owner is not making transactions. In this respect, cryptocurrencies cannot be widely applied in the economy when the user is quiescent. On the other hand, fiat currency deposits intended for savings allow banks to redistribute the money in the economy to bolster growth. As a result, it is difficult for economies using cryptocurrencies to record economic growth because the currency cannot be hoarded.

Chohan also points out that the lack of regulatory mechanisms in cryptocurrency markets undermines the chances of economic restoration after a crisis (2). Notably, in the traditional market, governments and financial institutions intervene during financial predicaments to facilitate the recovery of an economy. Specifically, the instability of cryptocurrencies, especially bitcoin, makes it difficult to secure its fluctuation against traditional currencies (Howden 751). The issue of unpredictability discourages participants from investing or accepting the digital currency. Hence, it is impractical to expect governmental interventions in the cryptocurrency market, a situation that subjects investors to a decision-making dilemma. Therefore, the lack of last-resort institutions undermines the sustainability of cryptocurrency markets, especially after the emergence of any crisis.

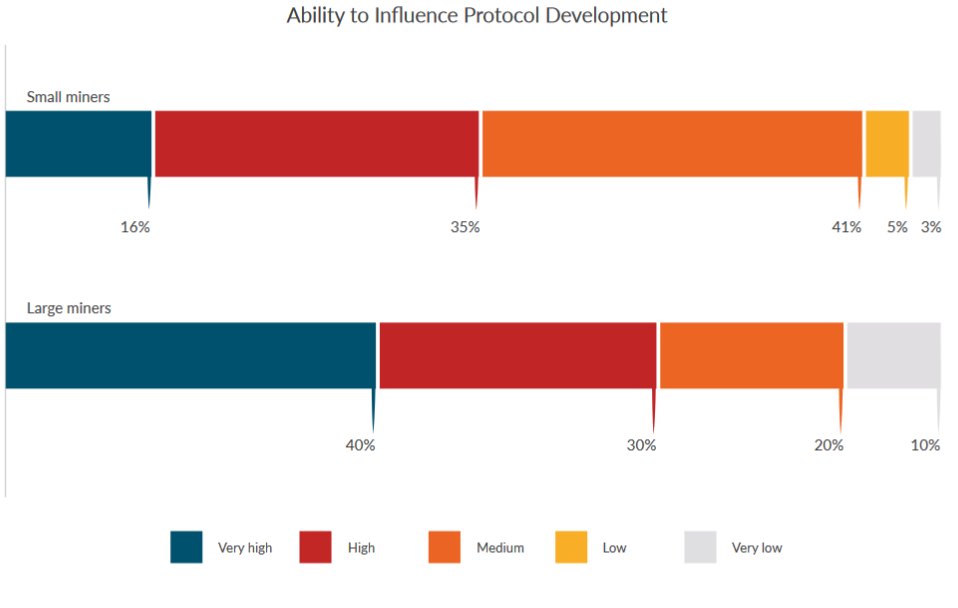

As shown in Figure 2, the absence of regulation provides large miners an opportunity to alter the cryptocurrency markets to their advantage. Notably, some groups have interfered with the mining process of bitcoin. This attempt has established a sense of control that can undermine the sustainability of the cryptocurrency (Howden 750). On the other hand, as can be seen in Figure 2, small miners experience a reduced influence on policy establishment in the market.

The hoarding element implies that the owner of bitcoins only realizes personal wealth after a devaluation of the decentralized currency. Important to note, the deflation of currencies is an indication of a financial breakdown (Hanley 16). In this respect, cryptocurrencies benefit owners at the expense of the growth of an economy. Hence, hoarding a cryptocurrency to realize profits may result in a financial crisis. The process of hoarding cryptocurrencies while expecting an economic slowdown is almost unsustainable. However, stockpiling is the only way of realizing short-run income after which investors are subjected to huge losses. In other words, cryptocurrencies are short-lived schemes that end up creating artificial bubbles at the expense of investors.

Cryptocurrencies as Legitimate Institutions

It has been a quite common occurrence that economists offer contradicting opinions concerning particular business matters. This situation poses a substantial risk to the affected business schemes because they negatively influence shareholders’ level of investment, owing to the lack of a clear picture of the future of such business ventures. With these highlights in mind, although the previous section has depicted cryptocurrencies as illegitimate schemes that may not last long before the bubble bursts, other economists seem to hold a contrary opinion by presenting the same business as a justifiable venture that seeks to serve constructive functions and whose nature does not call for any form of regulation.

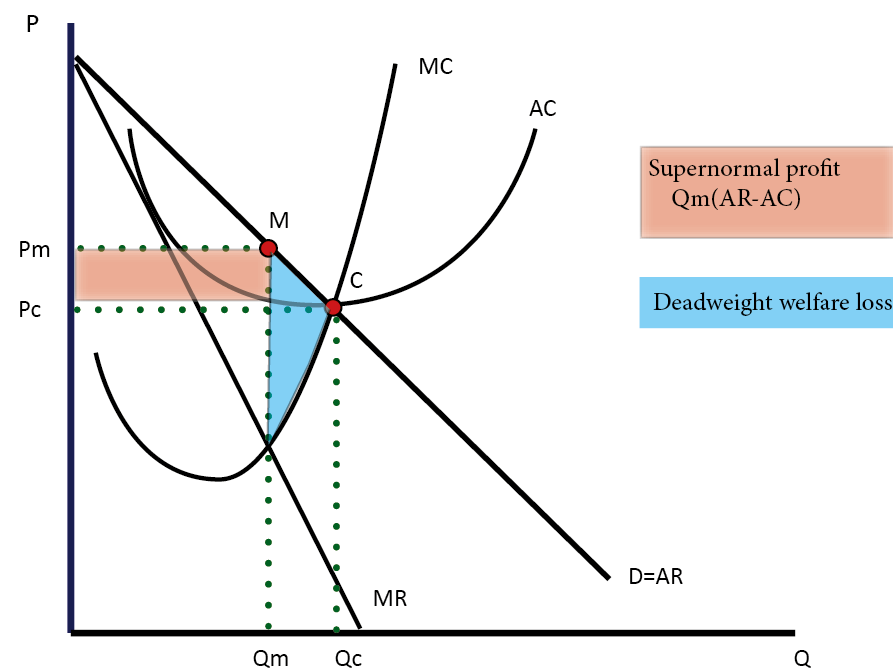

Friedrich Hayek and Nikolai Kaplanov are some of the well-known economists who view cryptocurrencies as a legitimate venture whose operation should not be subjected to governmental control. According to Hayek, the entire plan of governments regulating currencies, in general, has been counterproductive to the extent that it has led to the provision of an unreliable mode of making transactions while at the same time resulting in volatilities and inflation, both of which have been linked to money for centuries (12). The author approaches the issue of governmental control of money from a monopolistic point of view. He regards countries as monopolies whose agenda of controlling currencies is to make profits, as opposed to allowing money to serve its core function of facilitating transactions. This situation informs Hayek’s claim that countries should not be allowed to exercise a monopoly regarding monies, including cryptocurrencies (13). Consequently, it is crucial to examine how monopolies operate and how they take advantage of various factors to attain supernormal profits in the short and long term at the expense of other legitimate schemes such as cryptocurrencies whose entry into the market is sufficient to address issues ranging from currency instability to inflation.

From an economic perspective, a wholesome monopolistic government or business is known to be the sole provider of a particular commodity, in this case, money. Although it does not mean that other potential agencies have no power to supply the same item, a monopoly creates a situation that bars the survival or even the entry of other rivals into the market. In the current context, governments may be viewed as schemes that enjoy supernormal returns from their sole supply and regulation of money at the expense of the common individual and other potential competitors. The move by rivals such as cryptocurrencies entering the market and supplying another form of money, virtual currencies, may not be welcome by government officials. Such states people may attempt to publish articles or even air news on various media platforms such as TVs depicting cryptocurrencies as illegitimate schemes whose bubble may burst anytime. It is crucial to point out that such attempts are characteristic of monopolies. In other words, governments will adopt this strategy while being aware that cryptocurrencies are lawful ventures. Figure 3 below shows how a monopoly generates supernormal returns at the expense of other potential rivals such as cryptocurrency schemes.

Figure 3 above reveals why a monopoly such as a government reaps supernormal returns when the price D=AR is greater compared to AC. In other words, when the difference between AR and AC is positive, a monopoly attains nonstandard returns, although the situation does not last before other competing forces are introduced into the market. Nonetheless, respective monopolies (governments) will use their financial powers to disrupt any entry efforts made by rivals, in this case, cryptocurrency schemes. As such, they continue realizing abnormal revenue in the long term. In other words, from Figure 3, the link between the price (P), Marginal Revenue (MR), and Quantity (Q) of the money availed in the market continues to hold, despite attempts by rivals to join the business.

In line with Hayek’s opinion, the case of supplying metallic money was a preserve of the government, regardless of whether the provided currencies met the goals they were supposed to achieve or not (31). However, the fact that monopolies leave consumers with no alternative forces them (clients) to continue using what is availed to them, regardless of the cost attached. In other words, according to Hayek, the step by governments to regulate money is a well-calculated move that is purely meant to block efforts to discover other probably superior mechanisms for achieving similar goals or requirements for which a pure monopoly, in this case, the government, lacks an enticement plan (31). Innovative alternatives implied here entail cryptocurrency schemes whose entry into the market may revolutionize the entire idea of doing business by introducing virtual coinage that is free from government regulation and consequently inflation.

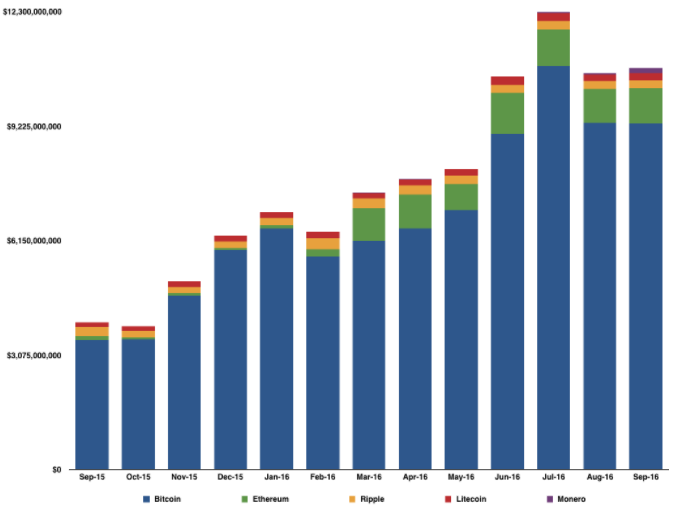

Hayek reveals a worrying issue whereby monopolies such as the government have subjected their citizens to substantial expenses, which they (people) incur following periodic currency fluctuations and inflation, owing to the lack of alternatives such as cryptocurrency agencies (28). In this case, such schemes are not only legitimate ventures that can successfully serve the same function of currency supply, although in a different form, but also avenues that can address issues of currency inflation and volatility costs revealed by Hayek (14). Governments may not be viewed as being unaware of the contribution that cryptocurrency schemes can make to the world of money business. Nonetheless, as earlier mentioned, they will try to paint a biased picture that such ventures are unlawful and hence prohibited from transacting businesses. As shown in Figure 4, their high performance noted since 2015, despite the resistance introduced by monopolies, is a proof that digital currencies will overcome the pressure from governments and revolutionize the nature of conducting business around the globe.

Kaplanov holds a similar opinion that cryptocurrency agencies are legitimate schemes that can overturn the financial sector once introduced into business (113). This economist argues that virtual currency organizations have only suffered the fate of monopolistic governments, which claim to encourage conventional money-based transactions, owing to the lack of security when cryptocurrencies used as a new means of exchange (Kaplanov 113). However, this author presents the claim of insecurity as ill-informed and outdated because the entry of bitcoin into the market as the first virtual currency shook the confidence of economists who embraced the idea that cryptocurrencies could not survive in a monopolistic market. It was realized that such virtual money could operate without any control from governments. As Kaplanov reveals, while conventional monies gain or lose their worth because of governments’ involvement in regulating them, virtual currencies such as bitcoin only require the existence of peer-to-peer connections to boost their worth or retain their security based on the applications run by customers on their PCs (113). In other words, these legitimate schemes are not only safe to use but also economic-friendly because they rarely subject users to unwarranted inflation expenses witnessed in conventional government-controlled transactions.

Opinion

In my judgment, challenges that have been linked to fiat currencies for centuries can be tackled effectively with the introduction of other competing means of exchange into the market. According to Brennan, cryptocurrencies will change the future of contemporary business dealings (8). Some of the substantial losses that people faced during the Great Depression may be linked to governments’ move to exercise monopolistic powers of controlling the supply of fiat currencies. This strategy has had the potential of influencing the value of conventional money in favor of monopolies that solely adopt this strategy to hinder the survival of other potential rivals. Although digital currencies such as bitcoins may be facing a significantly harsh entry into the market, the resistance should be viewed as normal and bound to happen whenever a shift from outdated means of transaction to a contemporary and public-friendly option is about to be witnessed.

Based on my opinion, challenges associated with conventional currencies, especially their unsteadiness and the unpredictable loss of worth, may finally be solved through the entry of cryptocurrency schemes since bitcoin among others attain value depending on the prevailing supply-demand conditions or specifically via what the public is ready to buy or sell (“5 Cryptocurrencies Investors Should Watch”). On the contrary, fiat currencies that operate under the influence of monopolies (governments) subject the public to not only unmerited expenses but also insecurity issues, which cryptocurrency schemes have managed to overcome. Zhuravlyova depicts cryptocurrency technologies as the way forward for entrepreneurs not only in Switzerland but also across the world (18). The security and convenience of transacting with digital currencies are guaranteed through the elimination of third-party involvement.

Conclusion

Decentralized currencies led by bitcoin have received considerable criticisms, as well as support by concerned parties. Their lack of credibility regarding expansion, their inability to act as a financial reserve, their failure to facilitate savings, and the influence of large miners undermine bar investors from joining cryptocurrency schemes. This paper has revealed the significant role that governments play in hindering the survival of cryptocurrency schemes in the market. For instance, the use of monopolistic powers by governments has played a substantial role in painting a public image that cryptocurrencies are bubbles that can burst anytime. This characteristic of monopolies entails hiring various economists who publish information warning interested parties not to invest in cryptocurrencies. On the contrary, presently, huge economies such as the United Kingdom, France, and Germany among others have realized the momentous revolution brought by cryptocurrency organizations.

As such, they have implemented policies that encourage people to seize this innovative and game-changing business opportunity. Advantages of cryptocurrencies, including cost efficiency, security, and ambiguity, foster the sustainability of these decentralized coins. The functioning of cryptocurrencies has a bearing on the legitimacy of the instruments as useful mediums of exchange in the contemporary money and financial system. Notably, some financial institutions have accepted cryptocurrencies partnering with bitcoin among other cryptocurrencies, thus denoting the growing authenticity of the present-day medium of exchange. Nonetheless, China and South Korea have been depicted as regimes that have exercised monopolistic powers to ban cryptocurrency operations. In other words, as explained in this paper, their agenda is to continue subjecting citizens to inflation and instability costs associated with fiat currencies.

Works Cited

Chohan, Usman. “Bitcoins and Bank Runs: Analysis of Market Imperfections and Investor Hysterics.” SSRN. Web.

Farell, Ryan. (2015). An Analysis of the Cryptocurrency Industry. Dissertation, University of Pennsylvania, 2015. Web.

Hanley, Brian. “The False Premises and Promises of Bitcoin.” Butterfly Sciences. Web.

Hayek, Friedrich. Denationalization of Money-The Argument Refined. 3rd ed., Ministry of Economic Affairs, 1990.

Hileman, Garrick, and Michel Rauchs. Global Cryptocurrency Benchmarking Study. University of Cambridge, 2017.

Howden, Ed. “The Crypto-currency Conundrum: Regulating an Uncertain Future.” Emory International Law Review, 29, 2015, pp. 742-798.

Kaplanov, Nikolei. “Nerdy Money: Bitcoin, the Private Digital Currency, and the Case Against its Regulation.” Loyola Consumer Law Review, vol. 25, no. 1, 2012, pp. 111-174.

Manesh, Mahtab, and Farhad Karimani. “Differences Between Monopoly and Perfect Competition in Providing Public Transportation (Case Study: Lane No. 10 and 96 of Mashhad Bus System).” International Journal of Economic Management Science, vol. 6, no. 3, 2017, pp. 1-8.

Zhuravlyova, Sonia. “The Future of Money: Bitcoin and Other Cryptocurrency Technologies are a Way of Life in this Small Swiss Town; The Town of 30,000 has Attracted Entrepreneurs who have Created Cryptocurrency Startups.” Newsweek, vol. 169, no. 3, 2017, pp. 18-21.

“5 Cryptocurrencies Investors Should Watch.” Bitcoinira. 2017. Web.