Foreign Exchange Market

- Foreign exchange market refers to the organizational setting within which businesses, individuals, governments…etc. buy and sell foreign currencies and other debt instruments.

- The foreign exchange markets are dominated by four currencies: the U.S. dollar, the euro, the Japanese yen and the British pound.

Types of Foreign Exchange Transactions

Three types of foreign exchange transactions:

- Spot transaction.

- Forward transaction.

- Swap transaction.

A Spot Transaction

- In a spot transaction you make an outright purchase or sale of a currency now or on the spot date.

- A spot deal will settle two working day after the deal is agreed to by the two currency traders.

- The two-day period gives enough time to the two parties to confirm the agreement and to arrange the clearing and necessary debiting and crediting of bank accounts.

- A spot transaction is risky to the extent that exchange rate fluctuations can increase or decrease the prices until the transaction is actually made.

A Forward Transaction

- In a forward transaction two parties are to buy or to sell a currency or an asset at a specified future time at a price agreed upon today.

- The maturity date of forward transactions can be a few months or years in the future. The exchange rate is fixed when the contract is made and money only changes hands on the maturity date.

- A forward transaction allows participants to plan safely and avoid risks of unfavourable fluctuations in the exchange rates.

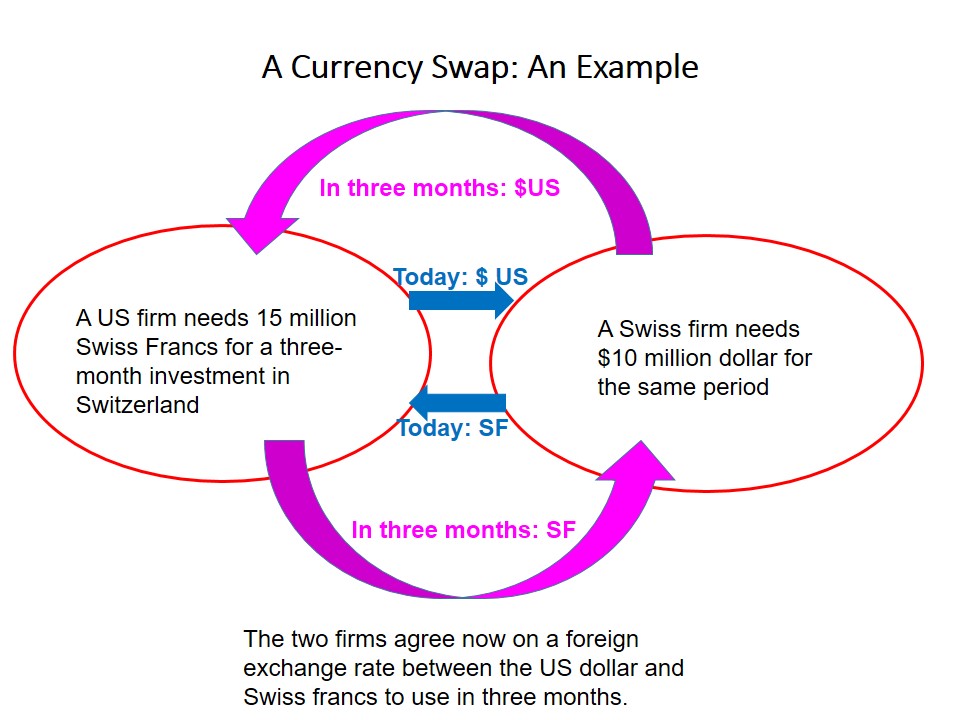

A Currency Swap

- A currency swap is the conversion of one currency to another currency at a specified point in time.

- Usually the two banks arrange a swap as a single transaction in which they agree to pay and receive stipulated amounts of currencies at specified rates.

- Swaps allow traders to meet their foreign exchange needs over a period of time.

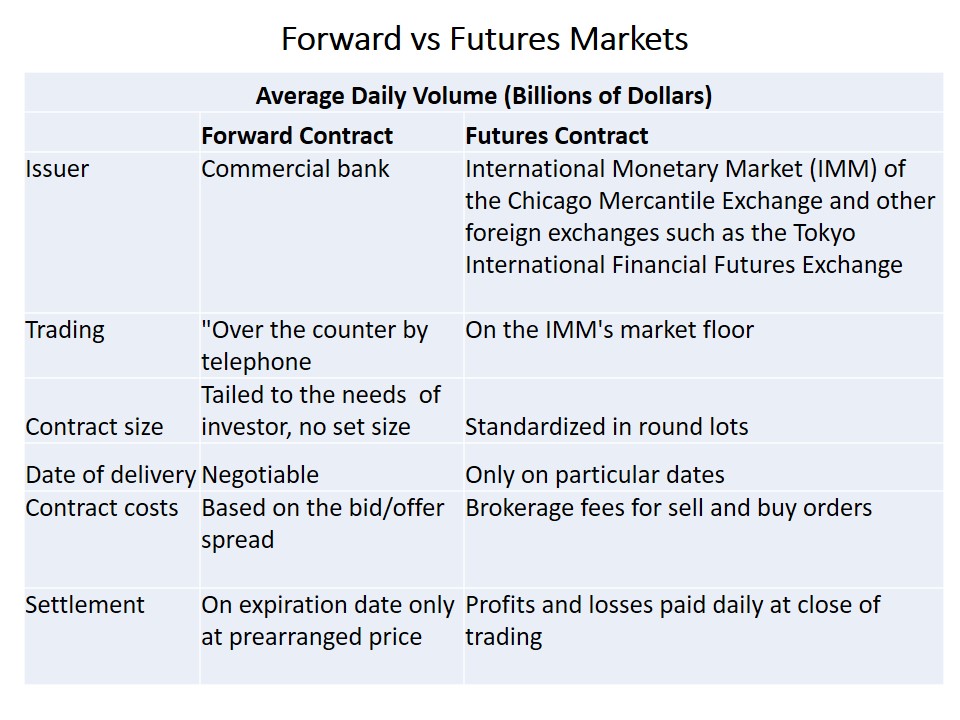

Forward vs Futures Markets

- Foreign exchange can be brought or sold for immediate delivery (spot market) or for future delivery (forward market or futures market).

- In the future market contracting parties agree to future exchanges of currencies and set applicable exchange rates in advance.

- Future market is different from the forward market in the following:

- Only a limited number of leading currencies are traded in the future market.

- Trading takes place in standardized contract amounts and in a specific location.

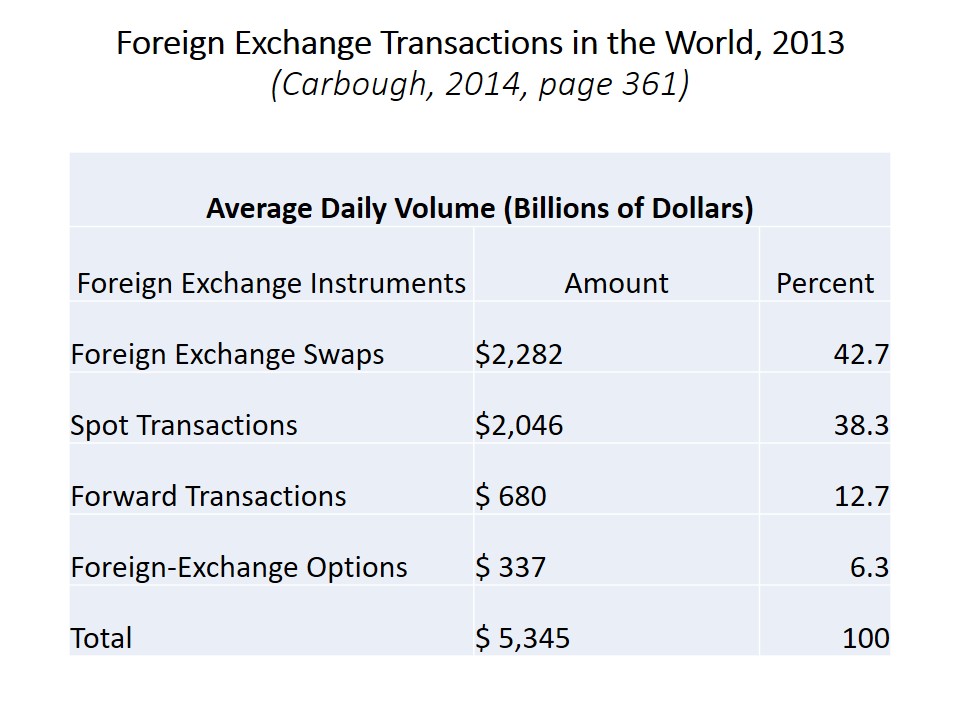

Average Daily Volume (Billions of Dollars)

Foreign Currency Options

- An option is an agreement between a holder (buyer) and a writer (seller) that gives the holder the right, but not the obligation, to buy or sell a fixed amount of financial instruments (a foreign currency, for example) at a prearranged price and at any time through a specified date.

- A call (put) option gives the holder the right to buy (sell) foreign currency at a specified price.

Foreign Exchange Transactions in the World

Arbitrage

- Arbitrage is only possible if the prices for the same currency are different in different world locations.

- Exchange arbitrage refers to the simultaneous purchase and sale of a currency in different foreign exchange markets in order to profit from exchange rate differentials in the two (or more) locations.

- Example: if the dollar/pound exchange rate is £1=$2 in New York but £1=$2.01 in London foreign exchange traders would find it profitable to purchase pounds in New York and sell them in London.

Speculation

- Speculation is the attempt to profit by buying currencies that are expected to go up in value and sell currencies that are expected to go down on value.

- In foreign exchange market about 90% of daily trading volume is speculative in nature.

- Speculator assume risk by taking positions in the spot market, forward market and future markets.

- Example: Following the election of Shinzo Abe as Japanese Prime Minister in 2012 George Soros expected the yen to be overvalued at the time and to depreciate in the future. He decided to take a short position on the yen.

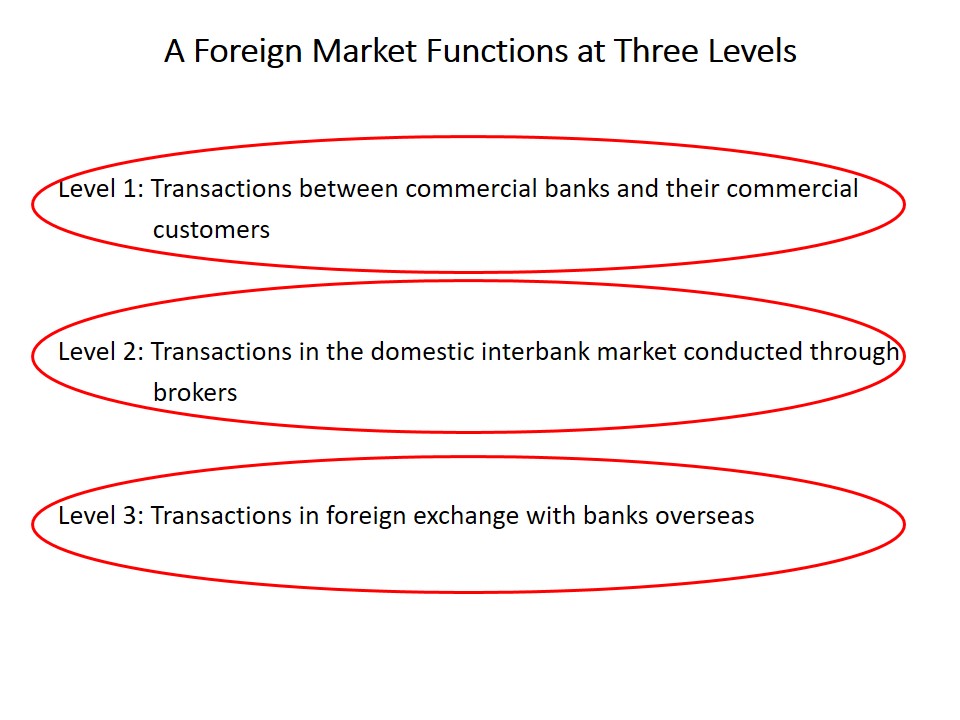

A Foreign Market Functions at Three Levels

- Level 1: Transactions between commercial banks and their commercial customers.

- Level 2: Transactions in the domestic interbank market conducted through brokers.

- Level 3: Transactions in foreign exchange with banks overseas.

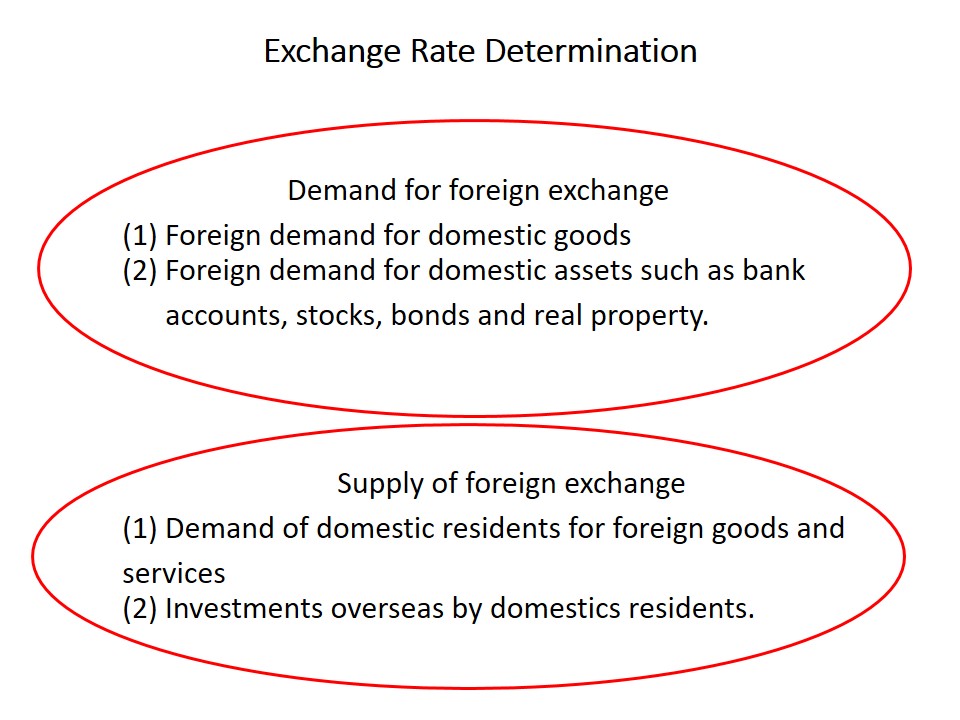

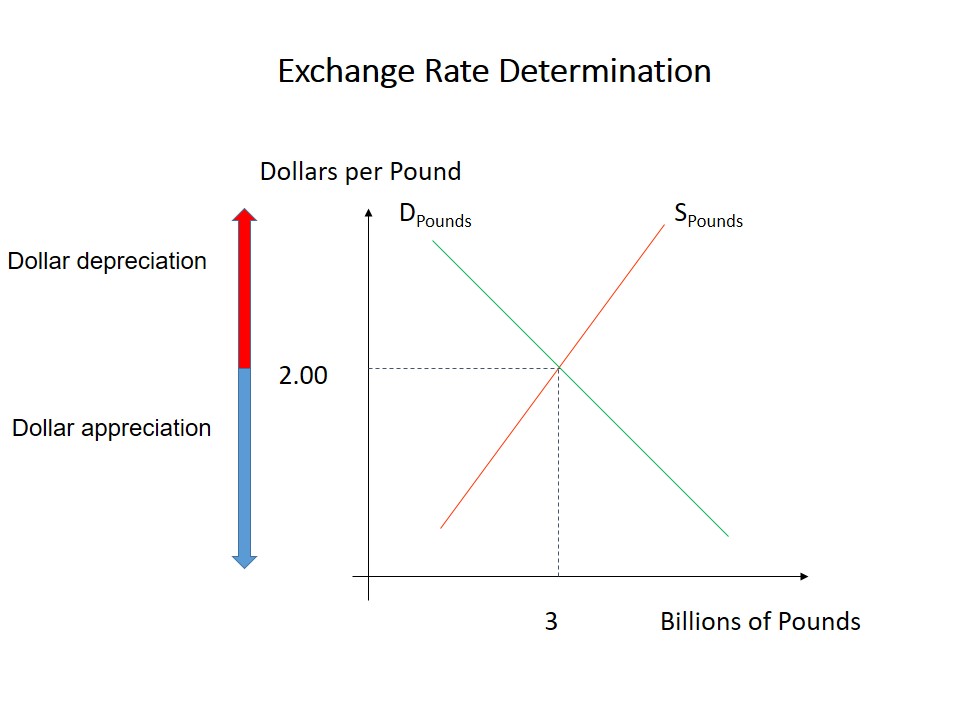

Exchange Rate Determination

- Demand for foreign exchange:

- Foreign demand for domestic goods;

- Foreign demand for domestic assets such as bank accounts, stocks, bonds and real property.

- Supply of foreign exchange:

- Demand of domestic residents for foreign goods and services;

- Investments overseas by domestics residents.

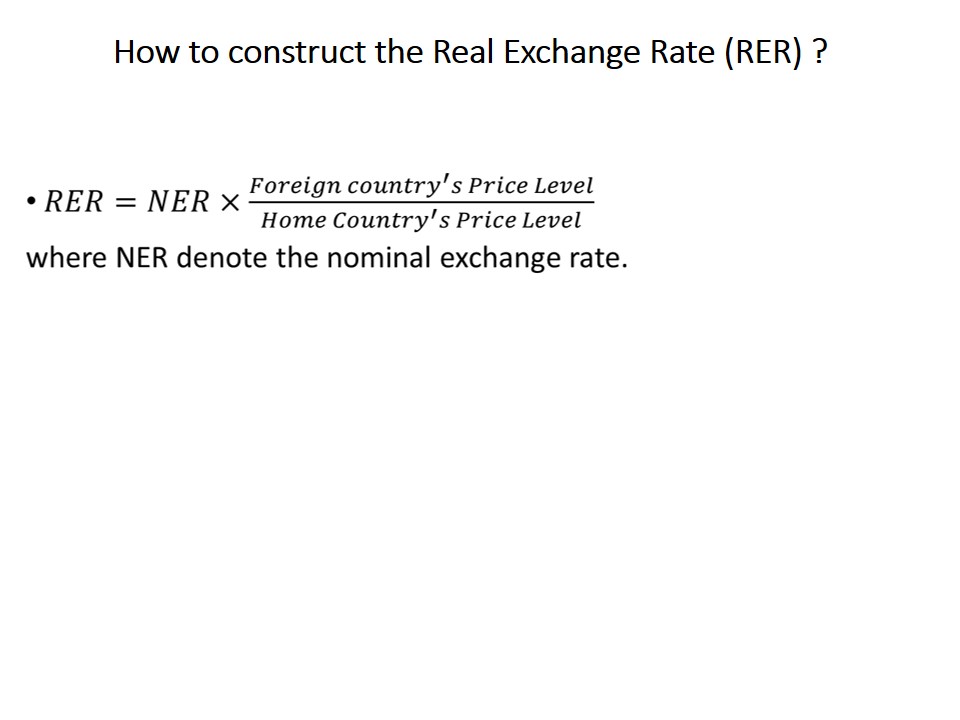

Indexes of Foreign Exchange Value of the Dollar: Nominal and Real Exchange Rates

The dollar exchange rate index is a weighted average of exchange rate between the domestic currency (the US dollar for example) and the nation’s most important trading partners with weights given to the relative importance of the nation’s trade with each of these trade partners.

For the US dollar, the major currency index constructed by the U.S. Federal Reserve Board of Governors is a popular one.

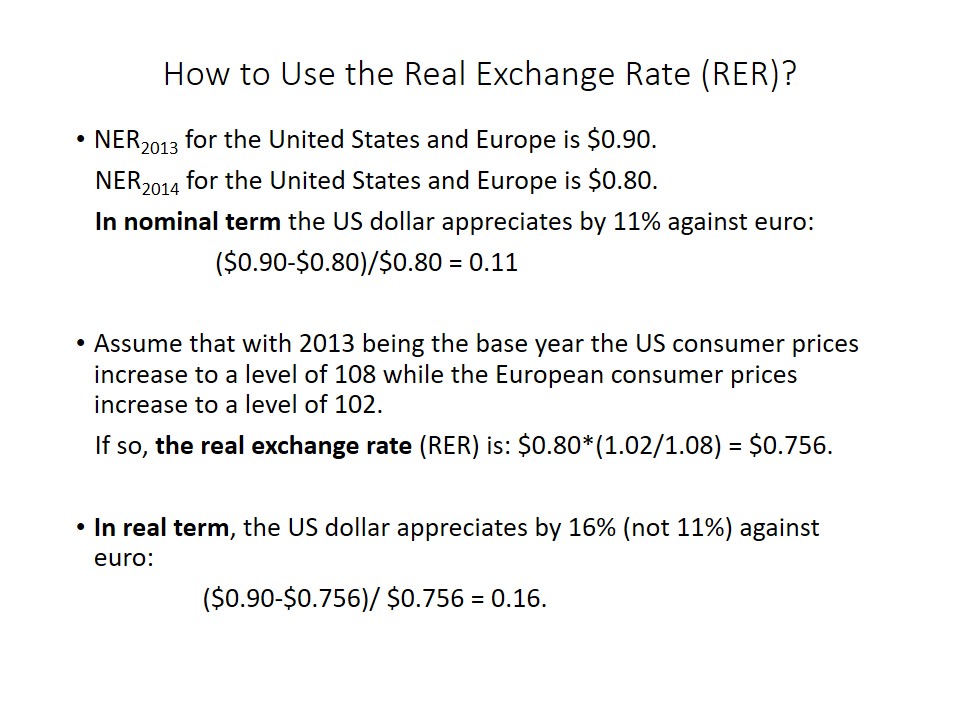

How to Use the Real Exchange Rate (RER)?

NER2013 for the United States and Europe is $0.90.

NER2014 for the United States and Europe is $0.80.

In nominal term the US dollar appreciates by 11% against euro: ($0.90-$0.80)/$0.80 = 0.11

Assume that with 2013 being the base year the US consumer prices increase to a level of 108 while the European consumer prices increase to a level of 102.

If so, the real exchange rate (RER) is: $0.80*(1.02/1.08) = $0.756.

In real term, the US dollar appreciates by 16% (not 11%) against euro: ($0.90-$0.756)/ $0.756 = 0.16.

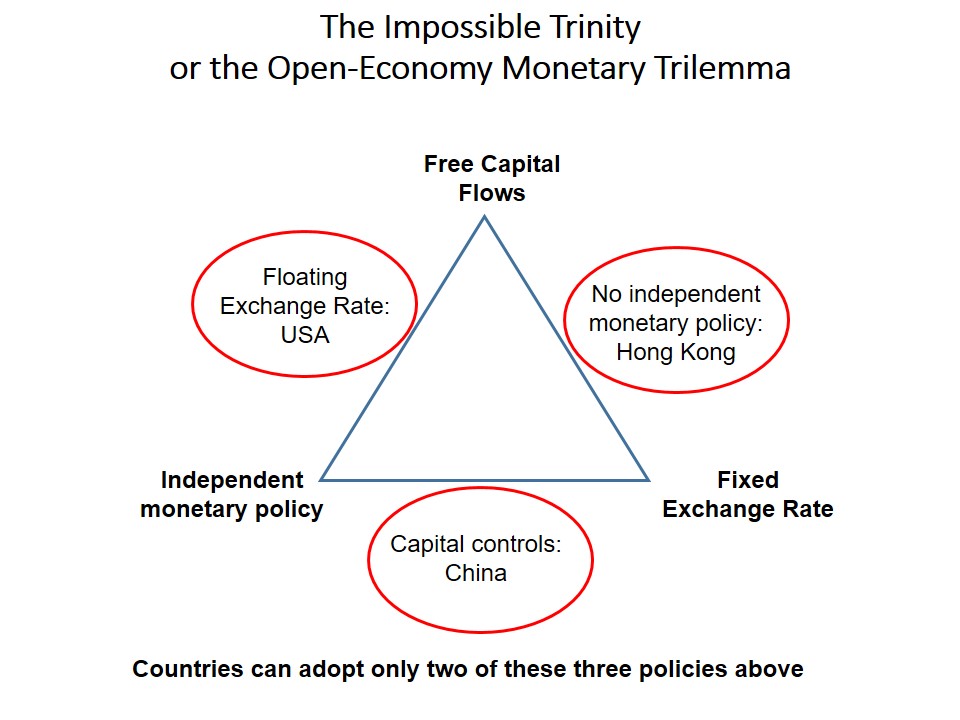

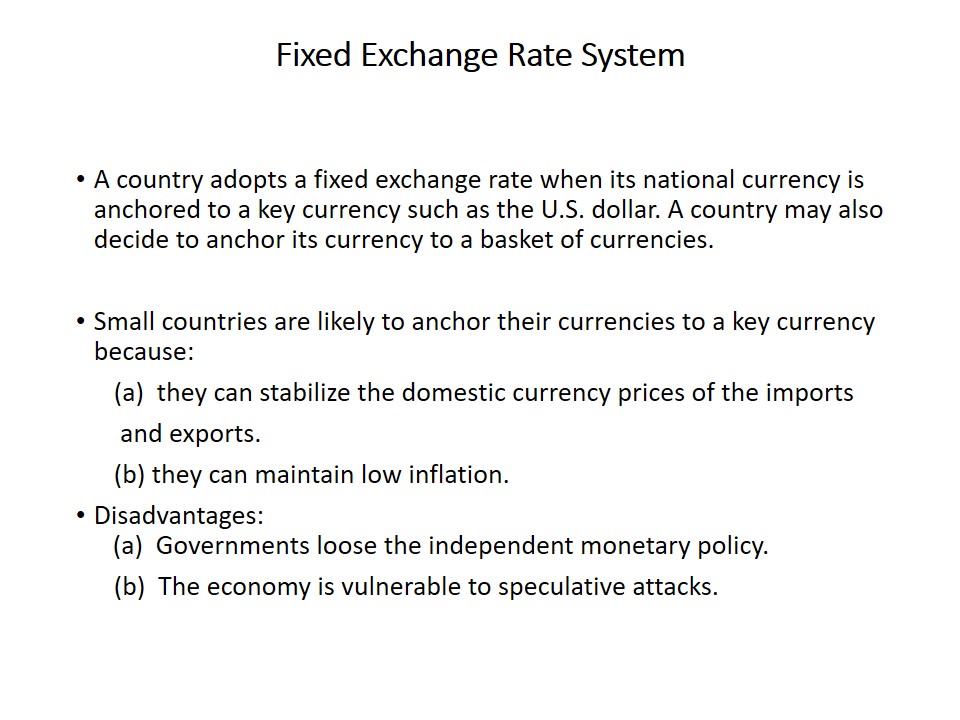

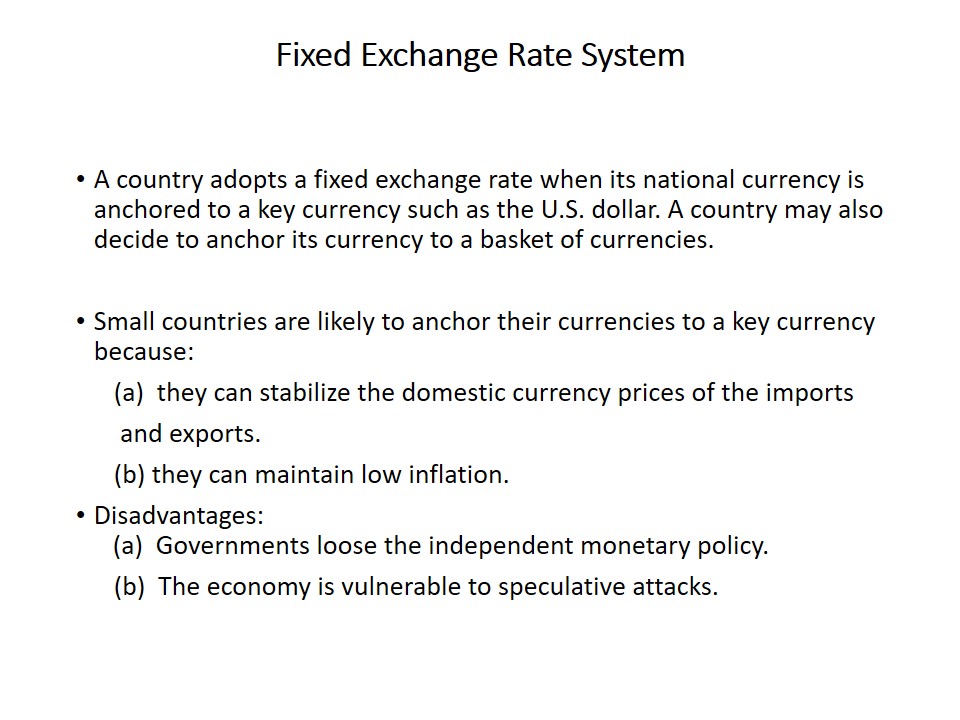

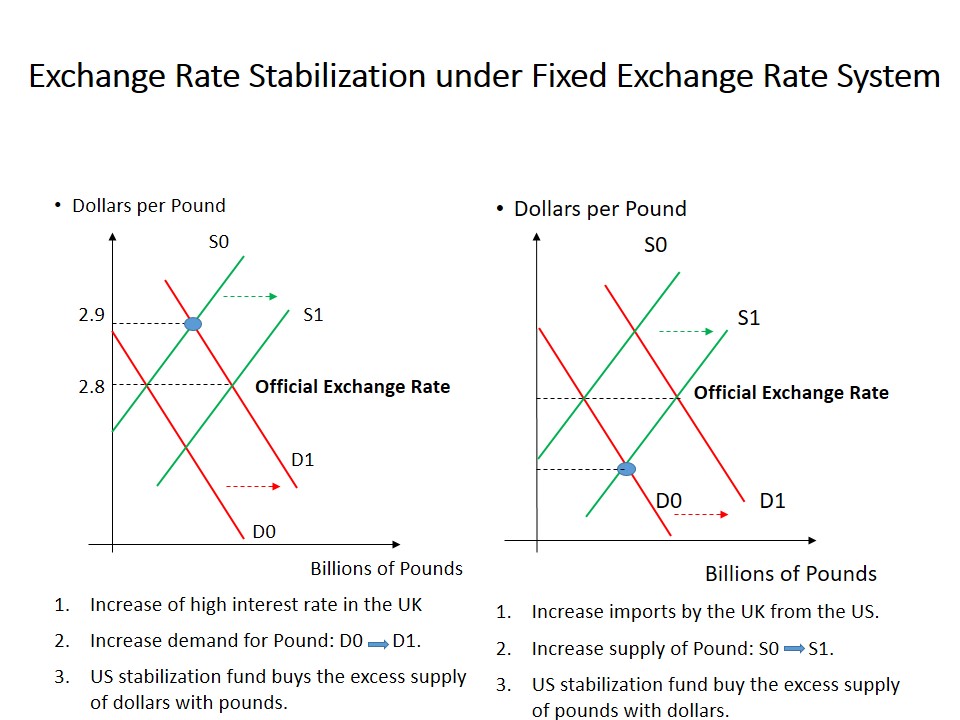

Fixed Exchange Rate System

A country adopts a fixed exchange rate when its national currency is anchored to a key currency such as the U.S. dollar. A country may also decide to anchor its currency to a basket of currencies.

Small countries are likely to anchor their currencies to a key currency because:

- they can stabilize the domestic currency prices of the imports and exports.

- they can maintain low inflation.

Disadvantages:

- Governments loose the independent monetary policy.

- The economy is vulnerable to speculative attacks.

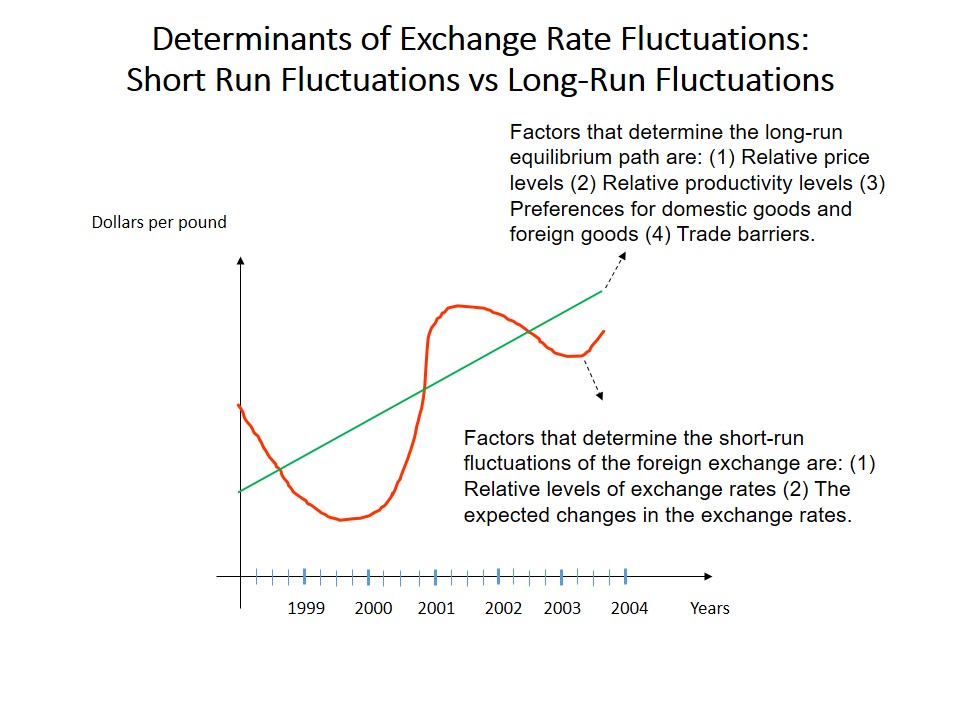

Determinants of Exchange Rate Fluctuations in the Long-Run

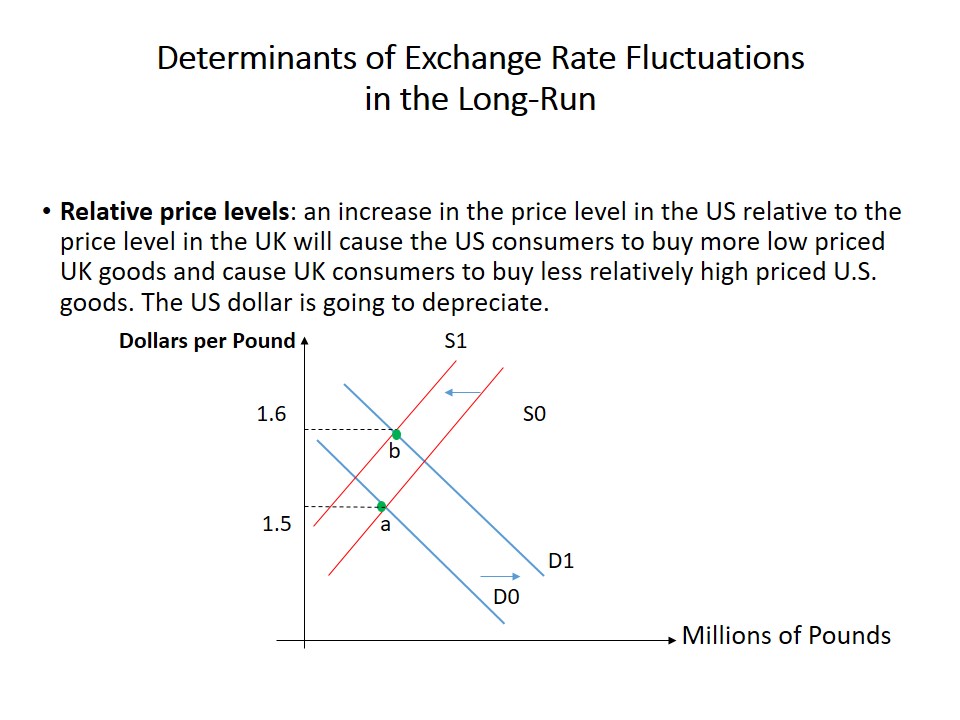

Relative price levels: an increase in the price level in the US relative to the price level in the UK will cause the US consumers to buy more low priced UK goods and cause UK consumers to buy less relatively high priced U.S. goods. The US dollar is going to depreciate.

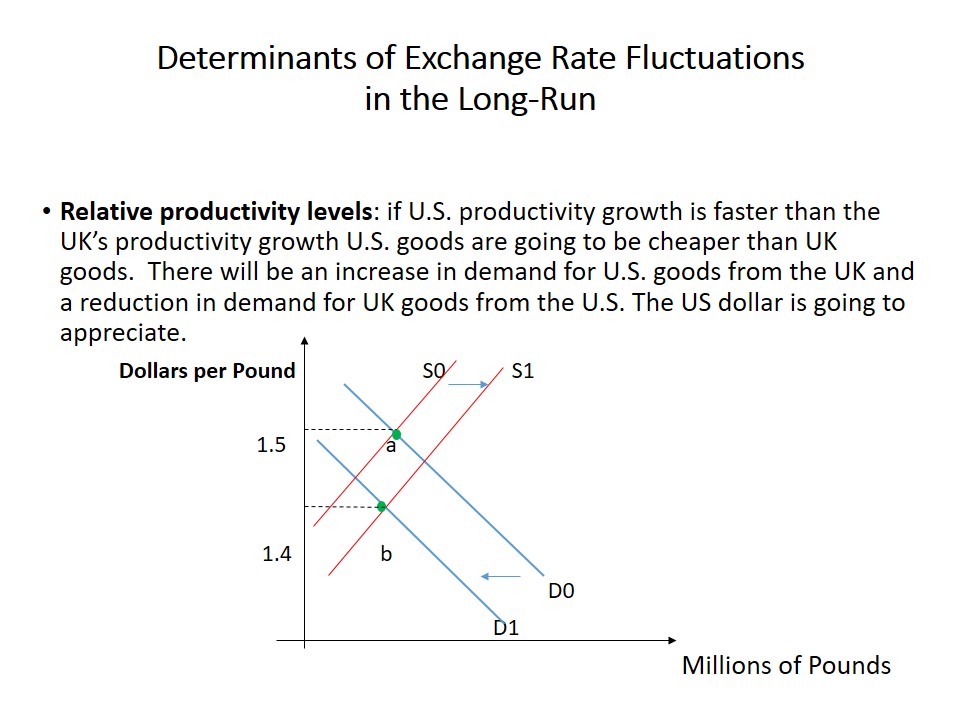

Relative productivity levels: if U.S. productivity growth is faster than the UK’s productivity growth U.S. goods are going to be cheaper than UK goods. There will be an increase in demand for U.S. goods from the UK and a reduction in demand for UK goods from the U.S. The US dollar is going to appreciate.

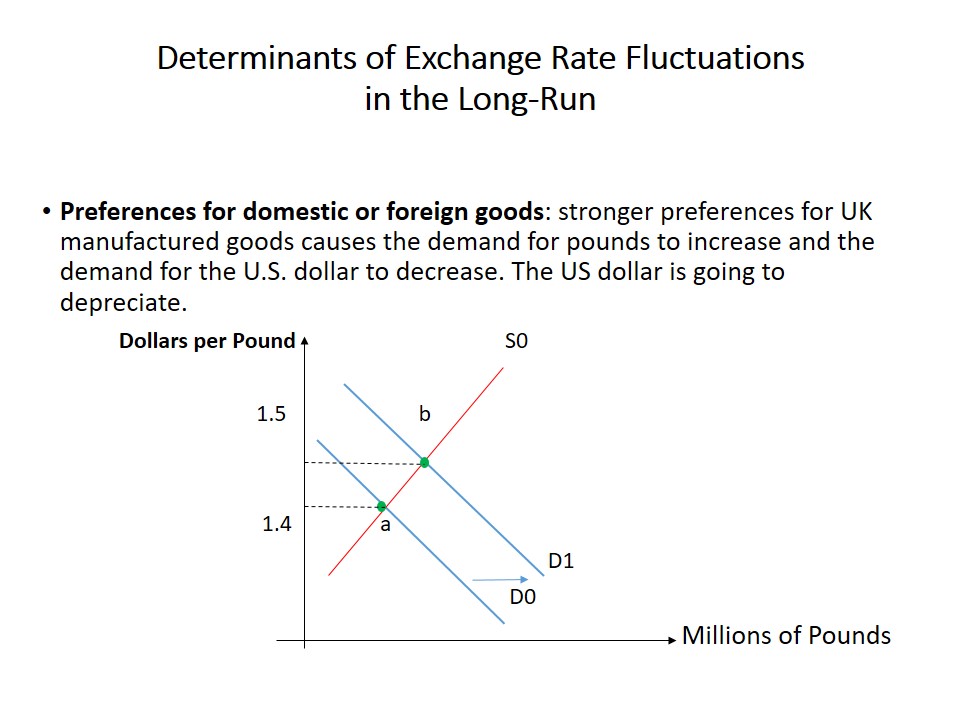

Preferences for domestic or foreign goods: stronger preferences for UK manufactured goods causes the demand for pounds to increase and the demand for the U.S. dollar to decrease. The US dollar is going to depreciate.

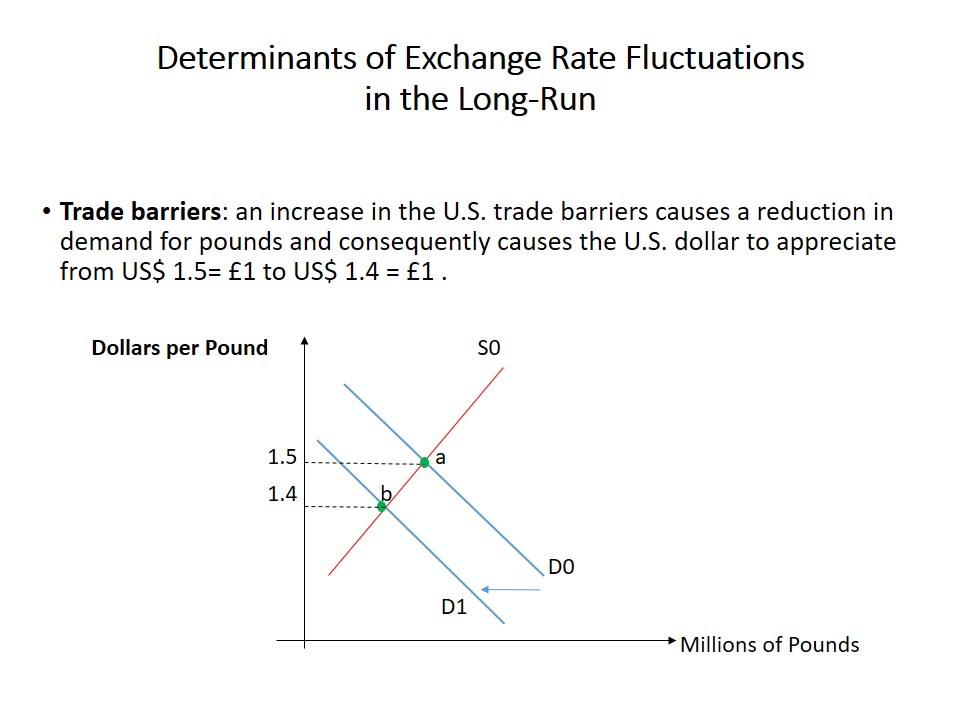

Trade barriers: an increase in the U.S. trade barriers causes a reduction in demand for pounds and consequently causes the U.S. dollar to appreciate from US$ 1.5= £1 to US$ 1.4 = £1 .

Determinants of Long-Run Exchange Rates: the Law of One Price

- Assuming that it is costless to ship a good between nations, there are no barriers to trade and markets are competitive identical goods must be sold everywhere at the same price when converted to a common currency.

- The Law of One Price holds reasonable well for globally tradable commodities such as oil, metals, and some agricultural crops.

- The Law of One Price does not hold in presence of high transaction cost or/and trade barriers.

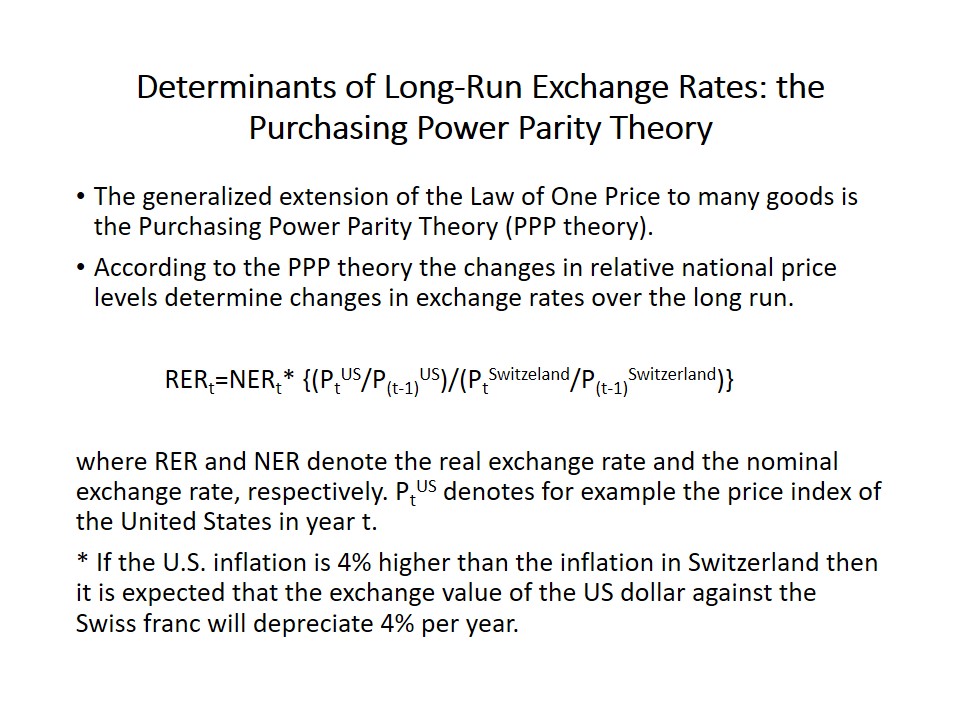

Determinants of Long-Run Exchange Rates: the Purchasing Power Parity Theory

- The generalized extension of the Law of One Price to many goods is the Purchasing Power Parity Theory (PPP theory).

- According to the PPP theory the changes in relative national price levels determine changes in exchange rates over the long run.

RERt=NERt* {(PtUS/P(t-1)US)/(PtSwitzeland/P(t-1)Switzerland)}

where RER and NER denote the real exchange rate and the nominal exchange rate, respectively. PtUS denotes for example the price index of the United States in year t.

* If the U.S. inflation is 4% higher than the inflation in Switzerland then it is expected that the exchange value of the US dollar against the Swiss franc will depreciate 4% per year.

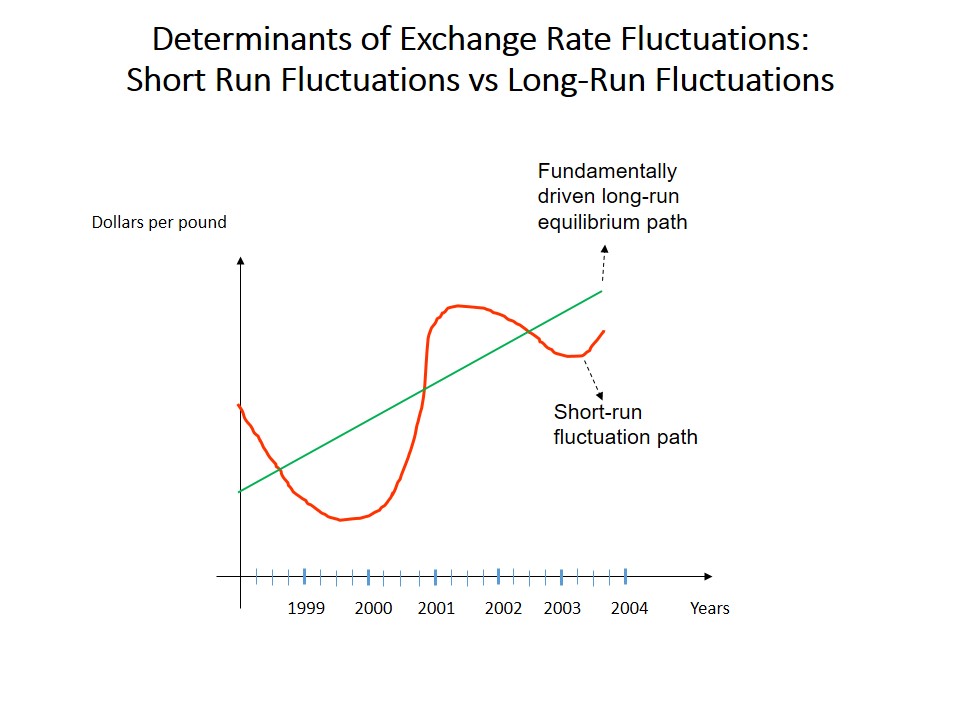

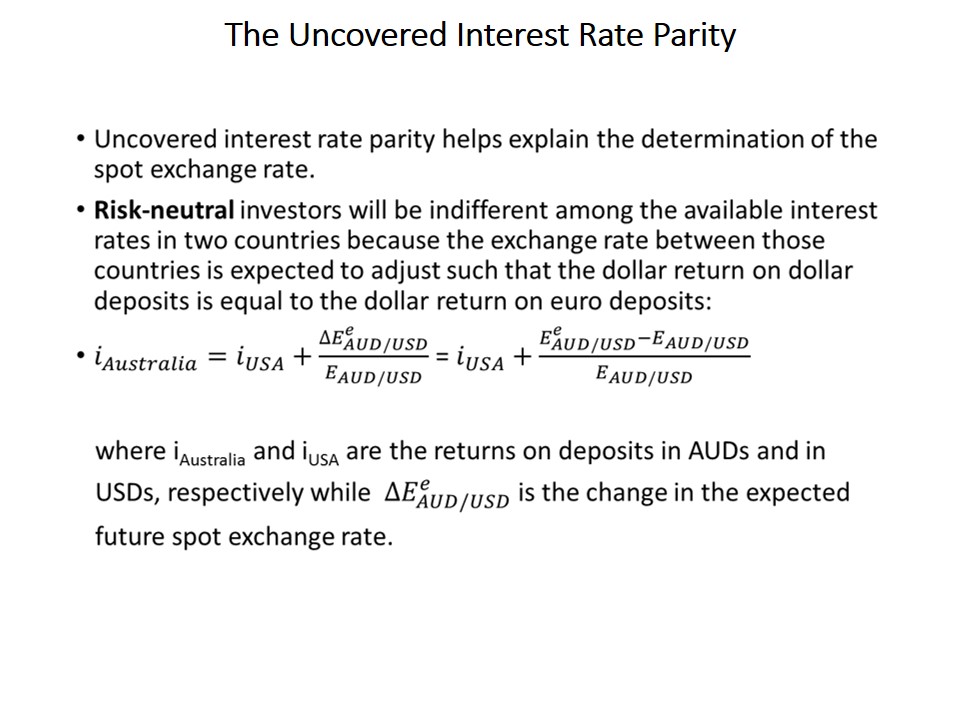

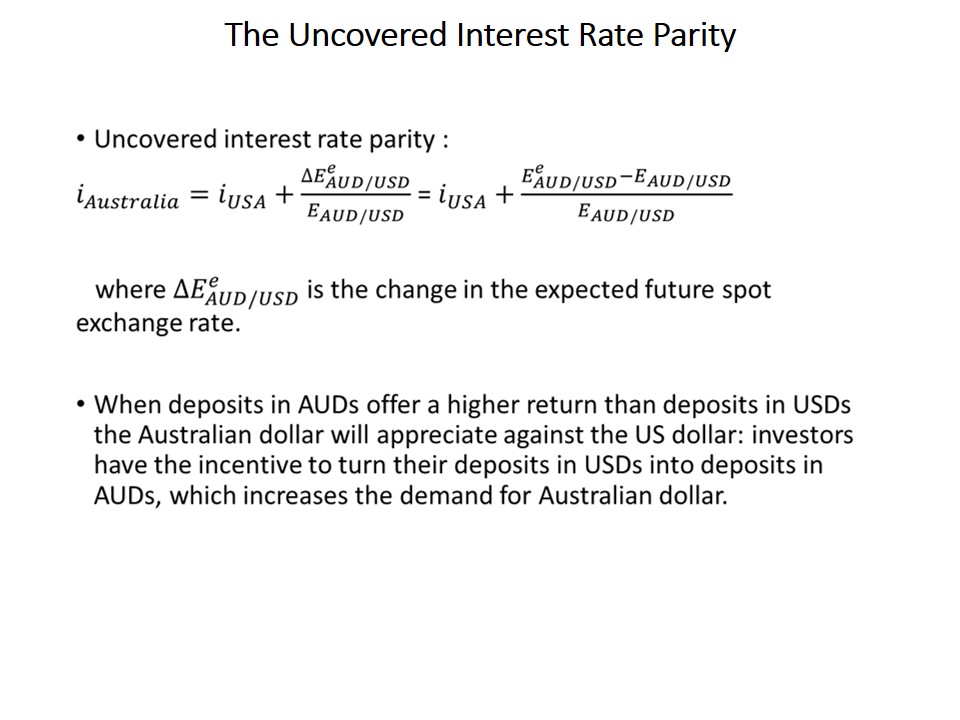

Determinants of Exchange Rate Fluctuations in the Short-Run

According to the Asset Market Approach, investors consider two key factors when deciding between domestic and foreign investments: relative levels of interest rates and expected changes in the exchange rate itself over the term of the investment.

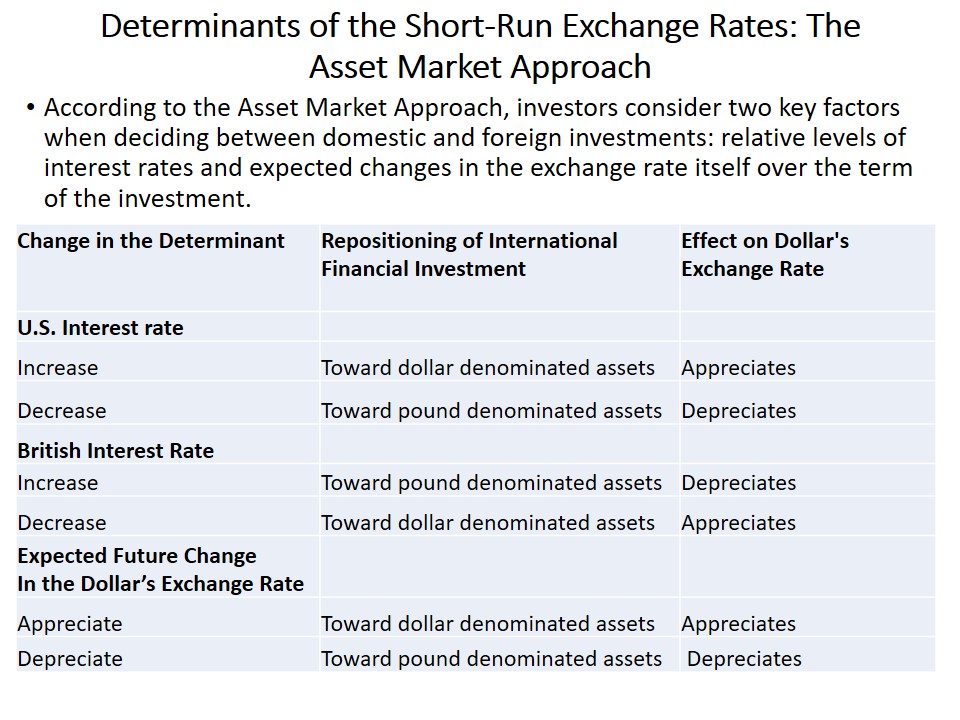

Determinants of the Short-Run Exchange Rates: The Asset Market Approach

According to the Asset Market Approach, investors consider two key factors when deciding between domestic and foreign investments: relative levels of interest rates and expected changes in the exchange rate itself over the term of the investment.

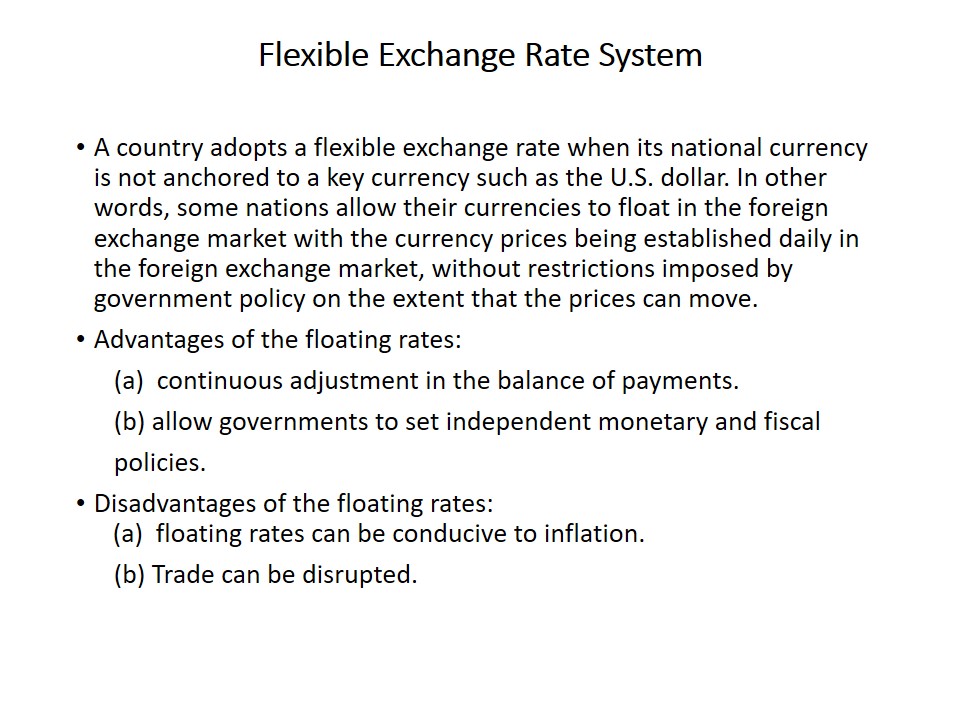

Flexible Exchange Rate System

A country adopts a flexible exchange rate when its national currency is not anchored to a key currency such as the U.S. dollar. In other words, some nations allow their currencies to float in the foreign exchange market with the currency prices being established daily in the foreign exchange market, without restrictions imposed by government policy on the extent that the prices can move.

- Advantages of the floating rates:

- continuous adjustment in the balance of payments;

- allow governments to set independent monetary and fiscal policies.

- Disadvantages of the floating rates:

- floating rates can be conducive to inflation.

- Trade can be disrupted.

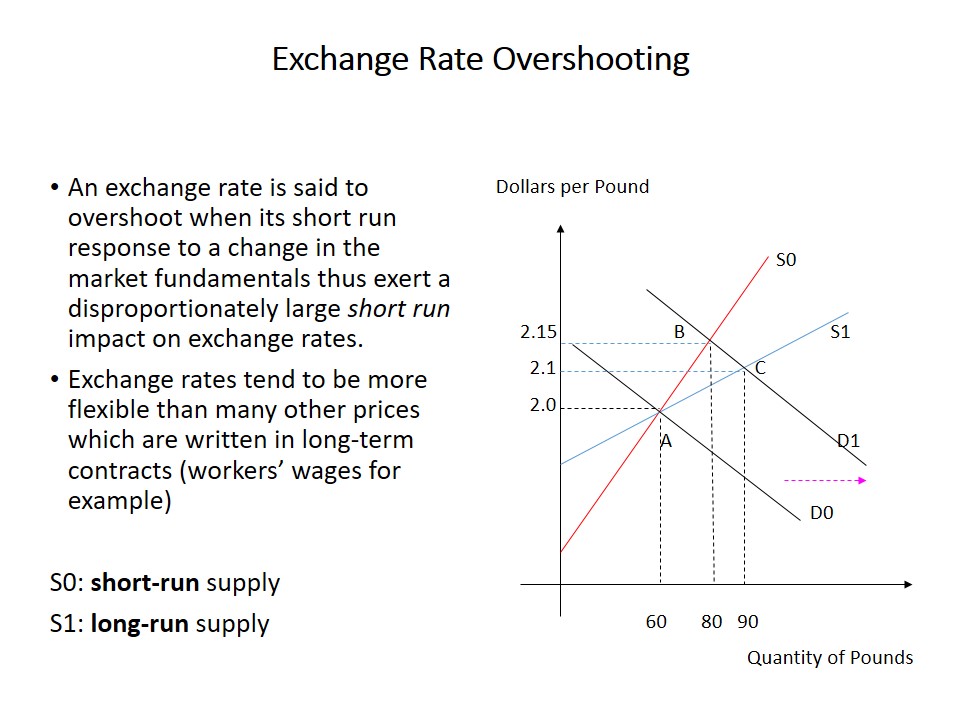

Exchange Rate Overshooting

- An exchange rate is said to overshoot when its short run response to a change in the market fundamentals thus exert a disproportionately large short run impact on exchange rates.

- Exchange rates tend to be more flexible than many other prices which are written in long-term contracts (workers’ wages for example).

S0: short-run supply.

S1: long-run supply.

Currency Depreciation and Exports

- The depreciation of a country’s currency makes its exports cheaper.

- An example: Assume that the US dollar price of the AU dollar is $US 0.80 per AU dollar the price of an Australian-made car in the US market is $US 20000.

If the AU dollar depreciates and the US dollar price of the AU dollar is $US 0.60 per AU dollar the price of an Australian-made car in the US market is now only $US 15000.

Currency Crises

A currency crisis is a situation in which a weak currency experiences heavy pressure.

Indications of selling pressure:

- Significant losses in the foreign reserves held by a country’s central bank.

- Depreciating exchange rates in the forward market where buyers and sellers promise to exchange currency at some future date rather than immediately.

Consequences of currency crises: the depreciation of the currency and a new exchange rate is established for countries that keep adopting fixed exchange rate regimes. In some cases a country that suffers from a currency crises adopts a floating exchange rate.

Mexico, December 1994-1995: Mexico maintained the value of the peso within a band that depreciated 4% against the U.S. dollar. The inefficient use of the debt results in the debt soon exceeding the central bank’s foreign exchange reserves. The increasing debt coupled with the unrest in the province of Chiapas resulted in a speculative attack on the peso, which forced the government to let the peso float.

Russia 1998: Russia in late 1990s also applied on official crawling band with the U.S. dollar. Falling prices for oil, a major export and a weak economy resulted in speculative attacks against the ruble. This crisis led to the floating of the ruble and its depreciation of the dollar by 20%.

Turkey 2001: Turkey in early 2000s also had its currency pegged to the U.S. dollar. Rumours about an investigation into ten government-run banks led to a speculative attack on the lira, which caused interest rates to rose to 2000%. The interest rates later increased further following a public dispute within Turkey’s coalition government, which caused a loss of confidence in the government. Finally, the government was forced to let the lira float.

Sources of Currency Crises

- Large budget deficits financed by creating money, which causes high inflation.

- Weak financial system: weak banks.

- Weak economy.

- Weak rule of law, unstable political system, not fully politically independent central bank …etc create political uncertainty about monetary policy.

- Unfavourable external factors such as an abrupt increase in interest rates in major international currencies.

- A fixed exchange rate system makes countries vulnerable to speculative attacks on their currencies.