Recently, several nations around the world have attempted to devalue their currencies through artificial means. This has resulted in global currency wars as countries battle for economic recovery by intervening so as not to allow their currencies to float freely in the market. Besides China, the other country that has been criticized for fuelling this battle is Japan.

The Japanese government has historically been concerned about the rising value of the yen against other countries. Therefore, it has been engaged in buying and selling of dollars so as to make the country’s products competitive in the international market.

Most recently, on 15 September 2010, the Japanese government unilaterally intervened in the foreign exchange market with the intention of lowering the exchange rate of the yen. It sold about one trillion yen that was equal to about twenty billion dollars (Grey; Butler).

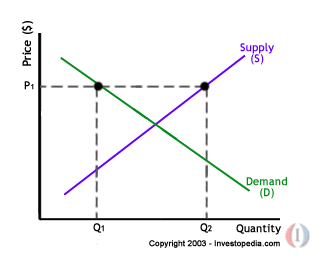

As illustrated by the figure below, the Japanese government took the biggest ever one-day currency action since the value of the yen had risen by more than ten percent since the month of May. It is important to note that the action was contrary to the international agreement that prevents industrial powers from effecting unilateral currency moves in the financial market.

Since October 2009, USDJPY has been on a downtrend and now the pair is at its 15-year record bottom (Prescience; Nasdaq). The behavior of the pair for the past one year can be contributed to a number of fundamental and technical factors. The downtrend suggests that the yen has been growing stronger against the dollar.

During the period, the Japanese government has traditionally maintained its interest rates at low levels. This is a strategy by the country to artificially keep the yen weak in the international market so as to increase profits for its exports (Keating; Hotten).

Nonetheless, from the chart above, it is evident that the interest rate action has not had very much impact on the behavior of the pair (Saettele). The USD continued to fall against the JPY signifying the speculation of the United States Federal Reserve possible expansion of the country’s quantitative easing program.

The balance of trade represents the quantity of goods that the U.S. is importing in relation to the quantity that it is exporting to other countries. If the U.S. is exporting more than it is importing, then it implies that it will have a positive balance of trade. On the other hand, if it is importing more than it is exporting, then the balance of trade will be negative.

Currently, the U.S. is accustomed to operating at a negative balance of trade since it imports more goods from Japan than it exports to Japan. It is believed that most of the U.S. negative trade balances come from much more importing of goods from China and Japan. The balance of trade influences the value of the United States dollar in the foreign exchange market.

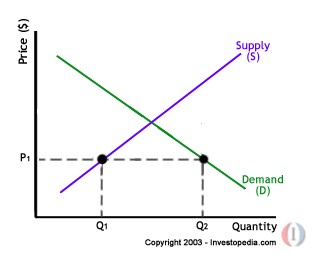

Using the monetary approach exchange rate theory, the demand and supply of the dollar affects the value of the United States dollar. When the U.S. is importing more goods from Japan than it is exporting, which results in a negative balance of trade, it has to convert U.S. dollars into Japanese yen by selling U.S. dollars on the foreign exchange market.

This increases the supply of the United States dollar in the open market. As the supply of the U.S. dollars increases, the value of the currency reduces. The figure 2 below illustrates how the price point for the United States dollar decreased as the supply of the currency is increased.

According to the monetary approach exchange rate theory, the demand for yen may have played a significant role in the fluctuation of the pair.

Businesspersons carrying out investments in the country and require the local currency or foreign corporations who are purchasing the country’s exports may have caused the demand for the yen to go up, which increased its strength (Economy Watch).

Therefore, the increasing strength of the yen resulted in the downtrend. In addition, instead of allowing its currency to float in the market, there were interventions to prevent its appreciation.

The devaluation of the Japanese yen is advantageous for the country since it has more exports than imports that make up its Gross Domestic Product. Since it is largely dependant on exports, maintaining its currency at weaker relative levels encourages other countries to purchase its products at cheaper prices.

Because the demand for the country’s products has increased in the international market, more jobs have been created, which has led to increased economic development. The depreciation of its currency has also assisted Japan to have a lower current account deficit.

The improvement in the country’s current account has resulted from the more sales it has made from its competitive exports. It is believed that the main cause for a current account deficit in any country is the reduced levels of domestic savings. This is because of the increased levels of consumer spending.

Lastly, the depreciation of the Japanese yen has resulted in increased inflationary pressures because of at least three reasons. First, the boost of the country’s exports has resulted in the rise in Aggregate Demand (AD). Consequently, this has led to demand inflation.

Second, imported goods to the country are generally more costly than goods produced locally. Japanese consumers have inevitably experienced an increase in the price of imported products.

The cost of manufacturing products, which require imported goods, has also risen. Lastly, it is believed that the depreciation of the yen has lowered the incentives for producers and exporters to reduce costs and produce at greater efficiency.

In conclusion, the intervention of the Japanese government to prevent the appreciation of its currency has played a crucial role in the economic development of the country. Because of this initiative, its goods are able to compete favorably in the international market. In addition, it assists in increasing the profits of firms when they exchange foreign earnings back into the yen.

If there were no such intervention, the economic growth of the country could be lower than it is now. In addition, the initiative that Japan took to devalue its currency competitively in the foreign exchange market assisted it in tackling some of its domestic problems. These are the problems of its aging population, increased public debt, and the yen’s susceptibility to deflation.

References

Änderung, L. Dollar – Yen – Devise/Währung – Line-Chart. Web.

Butler, J. Begun, The Currency Wars Have. Web.

Economy Watch. Monetary Approach to Exchange Rate Determination. Web.

Grey, B. Economic crisis threatens to unleash global currency wars. Web.

Hotten, R. Currency wars threaten global economic recovery. Web.

Investopedia. Economics Basics: Demand and Supply. Web.

Keating, J. E. Why do currency wars start. Web.

Nasdaq. Forex: USD/JPY still close to 15-year low. Web.

Prescience. USD/JPY nears 15-year low ahead of Philly Fed, U.S. jobs data. Web.

Saettele, J. USD/JPY Monthly Technical Forecast. Web.