Introduction

Systemic risks are those risks that are faced by the economy rather than by financial institutions such as banks. Systemic risks exert a significant impact on the behaviors of investors. These risks sometimes overshadow their responses to standard business fundamentals. It is important to understand that if systemic conditions worsen, the value of investments can greatly be affected.

To the extent that business organizations are exposed to systemic risks, systemic shocks can lead to a future deterioration of fundamentals that have not been captured by the current values of these investments (The Levin Institute. 2011).

The recent waves of financial crises have revived the interests in market discipline in the global financial system. It is also worth noting that the control and effective management of systemic risks can actually support the zeal of globalization in business organizations (Moneyterms. 2011).

This paper discusses the effects of globalization in all business institutions and also the ways in which systemic risks can be controlled in order to enhance the various aspects of globalization.

Globalization

Globalization is the global trend in which there is the growth of a free trade and investment across borders and the resulting integration of the international economy. (Waters 2001). This happens only to those countries that open themselves to international trade. Thus, the global market plays a leading role in the process of globalization. The above definition by Cato focuses on the economic aspects of globalization.

Therefore, according to Cato, globalization is an individual process. This process enables the free markets to provide individual freedom. It is worth noting that free markets have positive effects on the standards of living (Steger 2009). This is because it increases the standards of living for those people who take part in the globalization process. The explanation above is called the neoliberal worldview (Ervin & Smith).

Positive aspects of globalization include the rapid growth and poverty reduction (Boudreaux 2008). Although it has been hailed by a section of leaders across the world, globalization has also passed through rigorous opposition from other people, citing increased inequality and environmental degradation (Ervin & Smith).

Another definition of globalization according to the International Monetary Fund is that it is a historical process that comes as a result of synthetic innovations and technological progress.

This term refers to the increasing economic integration throughout the world using specific machinery such as trade and financial flows (Robertson 2000). This term can also refer to the movement of people in terms of labor, and knowledge in terms of technology, across international borders (Ervin & Smith).

Another definition of globalization given by Edward Herman describes it as a process whose overall idea is to support the ideology of free markets. The ideology justifies a contemporary form of imperial domination that has been in existence since time immemorial (Suarez-Orozco & Qin-Hilliard 2004).

Another definition of globalization describes it as a process that encompasses a transformation in the spatial organization of social relations and transactions. The transactions are assessed in terms of their extensity, intensity, velocity, and impact. The process further generates transcontinental or interregional flows and networks of activities (Ervin & Smith).

It is important to note that the concept of globalization together with all the issues that define it convey strong aspects of the ideologies of a common pool. This is to say that the concepts visualize a shrinking globe that is characterized by a dense network of interaction among all its parts (International Forum for Globalization 2010).

This means that people have to take into consideration the entire globe when making any kind of judgment. This is important even in situations where local solutions remain crucial to a particular issue. It is worth noting that globalization reflects the tragedy of the common people and common situations. It also transcends individual actors and this includes even the most powerful nations.

Globalization should therefore be treated as an ecological system. Globalization is a system that has elements which are all important in their functions. It is therefore important to comprehend that there is no element within this system that does not affect our individual being. Any modification that occurs in one area of this system will always affect other areas.

Brief history of globalization

A brief history of globalization is essential in understanding the processes that have led up to what we see today. Globalization began several decades back during the days of ancient civilization. Thus, early human civilizations resembled distinct and separate societies. These civilizations never occurred from external stimuli (O’Rourke & Williamson 1999).

For instance, the agrarian revolution grew from internal mechanisms with minimum interactions with others. On the flip side of it, the ancient civilizations were also aware of each other. This would later on bring about the aspect of a form of interaction with each other.

The minimum interactions occurred because the civilizations were formed around internal social dynamics and not by the influence of outside forces (Gills & Thompson 2006). Internal social dynamics also played a key role in various civilizations. For instance, Incan, Mayan and the Aztec, were a distinct kind of civilization that were formed due to internal social mechanisms. These civilizations are also called Meso-American civilizations.

Many ancient civilizations dissolved and interactions between civilizations increased with time (Osterhammel & Peterson 2005). This was the first time in which the human society began to group itself into an empire. To be specific, an empire is a system in which one civilization dominates the others. Examples of early empires include the Macedonian empire and the Roman Empire.

Early in history, the European empires emerged from the middle ages with the renaissance (Bordo et al. 2003). The period lasted from the fourteenth to the sixteenth centuries. Renaissance simply means the rebirth. This period marks the time in which Europe returned to the intellectual and cultural traditions of the classical civilizations of the Greek and Rome (Iqbal et al. 2009).

During the seventeenth century, the Netherlands became the financial center of the world. This was achieved through fractional banking, which is the creation of money made possible by the low probability that deposits in banks were likely to be removed at the same time.

Thus, the Dutch began creating money through public confidence in their financial institutions. Britain followed this strategy later on and this enabled it to finance wars against Louis XIV of France.

The international slave trade flourished between the 15th and the 19th centuries (Conrad 2005). This trade was first dominated by the Portuguese, followed by the Dutch, the French, and the British. Britain later on consolidated its position to be the dominant world power (Diene 2001).

This is because it had the ability to exploit a worldwide network of colonies (Burnett & Manji 2007). The main idea of having colonies was to extract wealth for Britain. Britain’s power was also enhanced by its transition to become an industrial economy.

The history of globalization cannot be complete without a brief inclusion of the concept of industrial revolution. Industrial revolution began in Britain and it represents the greatest alterations and advancement of human society (Rodriguez 1997). The steam engine in Britain is the single element that heralded the industrial revolution.

Exploitation of natural resources such as wood and coal for energy also characterized the industrial revolution (Holsey 2008). It is important to note that the industrial revolution increased economic efficiency and productive capacity. Industrial revolution later spread across other parts of Europe thereby characterizing a globalization process.

Waves of globalization

One of the first waves of globalization occurred in Jamaica. The wave began as a legal process that led to a British officer securing a piece of land for sugarcane cultivation (Lechner a. 2004). Huge amounts of capital were invested in order to purchase land, prepare it for production and buy provisions for the process. Britain provided capital while the labor was sourced from slaves.

The large number of slaves increased and became more than the whites who were present in Jamaica (Collier et al. 2002). In addition to sugarcane plantations, the land, which was later called Worthy Park, was used for cattle rearing and planting of vegetables.

Many more slaves were brought from Africa. Capital flowed through the hands of the land owners to food suppliers and slave traders and African slave sellers, and often right back into the hands of the home country suppliers (Lechner b. 2009). This network was enabled by the sugar plantations. The mechanisms that brought about this wave include commerce and Christian fervor, the lust for money and the urge to save souls.

The three waves of globalization

There are three waves in which globalization appeared. The first wave appeared during the colonial period. This period characterized the colonization of Americas, Africa, Asia, and Australia. The main colonizers were the European powers. This period was triggered by a combination of falling transport costs. For instances, the colonizers shifted from sailing to the use of steam ship.

This resulted into opening up of the use of more land that was available in Africa, Asia and the Americas. Thus, it was during this period that there was an increase in production of primary commodities (Kwok 2005). Another result of this wave was migration of people. There was movement of capital and labor throughout this period. Also the manufacturing process developed rapidly during this period.

The countries that were rich in human labor include New Zealand and the US. Australia and Argentina were also some of the greatest labor abundant countries. European countries were the biggest labor exporting countries. The period lasted for 1,500, years.

The second wave (1945-1980) was the imposition of western ideas of development on non-western cultures in the post colonial era during the last five decades. The period was characterized by a continuous fall of transport cost. It was after the World War II that liberalization of trade began.

This developed till the period beyond 1980, when international trade was free of barriers. It is also during this period that international trade with the developing countries was free of barriers. The results were that it led to the agglomeration of economies especially in developed nations. There was also redistribution of manufacturing within developed countries to lower wage areas.

The 1960s ushered in the third wave of globalization. For some business people, this third wave indicates an end to history. But for those who live in the third world, interpreters of this event purport that it signifies a return to the colonial era. It is important to understand that each wave of globalization is cumulative in its impact.

This is true even though it creates a discontinuity in the dominant metaphors and actors of the globalization process. It is also worth noting that each wave of globalization has only served western interests thus creating deeper colonization of other cultures and of the planet’s life (Lechner & Boli 2004). During the third wave of globalization, many developing countries joined the global markets as first timers.

These countries include India and China. It was also during this period that the share of total exports of developing countries of manufactured goods increased up to four fifth of their production. The reasons behind this were because there were changes in economic policies in the international trade. Thus, many countries in the developing world shifted from localized fixed trade to global liberalized business practices.

Therefore, these countries were able to reduce the barriers to international or globalized trade. There was also a continual process in which the transport sector continued to decline in its production costs. There was an upsurge in new information technologies such as digital information. The cheap cost of shipping digital information attests to the fact that cost of transport has decreased in the transport sector.

Drivers of globalization

Politics is one thing that drives globalization. Few decades ago, when the Berlin wall fell and the soviet empire collapsed it was believed that the end of politics was near. This is because the current age was thought to be beyond socialism, capitalism, utopia and emancipation.

However, the events that followed depict a situation that is far from ending politics. This suggests that politics plays a major role in many aspects of globalization. As discussed in the preceding sub topics, globalization is like an ecological system in which every element involved has an effect especially if it is altered.

Systemic risk

Systemic risk is the risk directly related to the economy. This is different to the risk that is directly pointed at an investor (Pietersz 2011). Systemic risk is a term used mainly in the banking sector and other financial institutions (All business 2011).. In a globalized world, systemic risk must be controlled by the regulators. These regulators can use several options available to regulate the risks.

Such options include minimum disclosure requirements, risk management and control guidance through local supervisors, cross-border coordination of local regulators, and shared control of supranational organizations (Noble trading 2011). Currently, there is a systematic control procedure that highlights the focus of these regulations. These procedures are summarized in topics as discussed in the following paragraphs.

Enhancing bank transparency is a way of ensuring that systemic risks are put under control. Thus, there must be public disclosures and supervisory information that promote safety and soundness in banking systems.

The other way of checking systemic risks is through supervisory information framework for derivatives trading activities. Establishing a framework for internal control system in financial institutions is also quite important for an organization to globalize its operations.

Financial crises have continued to rock the business world in the recent years thereby causing an increase in the levels of unpredictability of the future. This has caused many organizations to employ market discipline as the one mechanism that will help in the process of globalization.

The attention of this process is not only just academic. It is also dependent in the latest market policies. It is thus important to enhance market discipline in a way that will help organizations face risks that are quite manageable (Yeyati et al. 2004).

Systemic risk control

Even when we are examining the events responsible for market illiquidity, it is still possible to attain enhanced provision of information in as far as pricing-based risks. It is important therefore to determine who should have access to this kind of information. The source of provision is also important. This is because all the sellers and buyers of a commodity need to access the appropriate information in the market.

Since it is hard to address the issue of unpredictability in funding illiquidity, it is important for one to get information about institution asset structure (Evanoff et al. 2009). This also includes maturity and marketability. The information is quite crucial because the associated funding liquidity will be easily managed.

Many observers have pointed to the long standing conflict of interest in the globalized market as a principle cause of recent difficulties in enhancing globalization.

The market participants must therefore have access to the necessary information. Nonetheless, it is important to have regulation measures in place. By doing this, liquidity stress will be minimized and thus harmonizing the competition present in many organizations offering their products in the market.

Managing trade risk

Managing trade risk is an essential part of any business organization, whether it is dealing with local products or dealing with international products. Trade risk management has helped business organizations expand and remain in the market for a long period of time. This means that without trade risk management, it is difficult for a business to expand. Therefore, trade risk management is an important aspect of globalization.

Trade risk management predicts by indicating where or when the risk is lowest (Reuvid 2006). Thus, it helps business organizations to have the opportunity of making more money. To summarize this, trade risk management is actually practiced by smart business organizations. It is not necessarily important for one to feel lucky, or for a business organization to fancy its chances of flying blind into the market.

As a matter of fact, the business organization should actually feel the opposite. It is very important for the organization to conduct a serious market research and analysis before venturing into a business operation.

The good part of making money in business is that a business organization need not have gurus and the smartest mathematicians in order for it to make money in the market. The organization only needs smart people who would let trade risk management give the business a winning edge (Trade Risk management 2010).

In a globalized business there are many risk factors that can affect the organization. This means that there need to be trade risk mitigation mechanisms that give the business assurance and protection when going about its operations (WHO 2010). For instance, in an import and export transactions, there are several risk factors that need to be considered.

In such kind of a business, there are payment risks, delivery risks, performance risks, and foreign exchange risk. In payment risks, the situation is such that there may be no payment to the buyer.

Delivery risks involve a situation where the buyer does not receive the goods even after making all the necessary payments (Blas et al 2010). Performance risk occurs in a situation where one of the parties in the business contract does not do things according to the agreement, while foreign exchange risk is concerned with such things as inflation and foreign currency fluctuations (ANZ 2011).

In a trade risk management process, there are three aspects of control. First, it is important for one to understand that trade risks are caused mainly by risks and commitments made by traders. This means that the controls need to focus more on monitoring these trades. In a globalized business scenario, employees act as the representatives of the company at large.

Therefore, the employees are given the freedom to decide on crucial commitments to the market place. Since employees operate in the market as individuals, their decisions, although seem to be bent on benefiting the business operation, may be biased to an individual level (Shah, 2005). Thus, their decisions can cause plenty of liabilities to the business organization.

Secondly, it is worth noting that a business organization operates with the idea of maximizing profits by minimizing risks. It is very important for such an organization to follow concepts such as risk adjusted rates of return. Such a situation helps in establishing a risk management system that occupies the central position of its operations.

Last but not least, credit control must be considered while dealing with any risk management process. There is no business organization that would want to be penalized for the mistakes made by another party that operates together with the organization.

This is why, for any globalized business organization, there must be a tighter credit control mechanism in place that is responsible for dealing with mitigating risks that are caused by credit problems (Dobson & Dozois 2008).

Case studies

A good example of a situation in which trade risk management and its effects on expansion to an organization was in the Californian energy crisis. This energy crisis is also known as the Western U.S. Energy crisis. It occurred in the year 2000 and spilled over to the year 2001. The state of California had a shortage of electricity during this period. The cause of the shortage was the manipulations of the market.

This was coupled by the illegal shutdowns of pipelines by the energy sectors of Texas. The effects were disadvantageous to the states economy because there were series of black-outs that were experience at a large scale. This resulted into the collapse of one of the biggest energy companies in the state of California.

In this situation it can be deduced that there are several factors that can affect the existence and growth of an organization. Thus, an analysis of the factors that led to the collapse of the energy company is directly related to the factors that caused the energy black-out. Such factors include the unexpected high demand of electricity. This high demand was as a result of the prospering economy of the state.

The second factor that caused this situation was the low retail rates of electricity. It is important to note that retail prizes are very much dependent on time factor. This means that the rates must be modified as time goes by. The third factor was the low level of new generation plant investment. This factor indicates that there was a particular kind of uncertainty that surrounded the energy sector.

The fourth factor relates to the increase in operation costs. During this time, the consumer rates remained constant while the cost of operating generation plants went up. Since most of the plants relied heavily on fossil fuel, they were greatly affected by the fluctuating oil prizes. The last factor relates to the new wholesale electricity market structure (Cabral 2002).

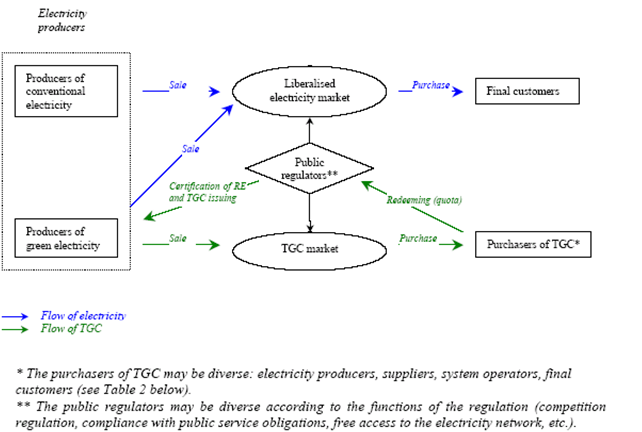

Figure 1: Diagram showing how liberalization of electricity market relate with each other.

Adapted from Krook & Nouri

This situation did not go without proposition of possible solutions to the crisis. Theoretically and practically, the crisis was more of a supply and demand problem. It was therefore necessary to tackle the issue on demand and supply perspective (McNamara 2002). One proposition was to increase the supply at two points: the generation point and the transmission point.

However, dealing with the problem in this manner alone is pretty one sided. The retail prizes at the market also need to be reviewed. This is because the prizes must be competitive in order to make the product more affordable and popular to the consumers. This suggests that the situation could be shifted from a uniform price auction to a pricing system that is more discriminatory.

This means that there will be a trade off under a discriminatory auction. Thus, the approached is deemed as being quite appropriate. Another solution is to make the consumer prices more flexible. This solution is quite political, but on the flip side of it, cannot be overlooked because of its positive effects (Pearson et al. 2002).

Another case study of globalization is the Doha round. This study provides one of the best examples of the unexpected consequences of globalization. The Doha round seemed to follow things according to the way they were done in previous negotiations like in the Uruguay Round. However, the Doha round was a slower method of furthering world trade in agricultural products, manufactured products and financial services.

In this scenario, it can not be said that risk-taking is to be blamed for its failures. The lack of any serious effort to size up exposure, evaluate returns and keep risks under lock and key are the mechanisms that are to be blamed.

In the process of trade liberalization, it is important to employ the reference of big risks because it is beyond doubt that there have always been risks associated with any process of trade liberalization (Hitt et al 2009). Such risks include periodic crises during the process of negotiations (Kegley 2008). The crises can occur due to the presence of too many conflicting aims and expectations resulting from compromises of sensitive issues.

It is very important to understand that sensitive issues such as agricultural, manufactured, banking and special treatment for developing countries are important in determining the risk control mechanisms of globalization (Lan & Unhelkar 2005). This has also proved to be a highly sensitive issue to developing nations.

Even the thought of destruction of western agriculture has caused negative effects to global integration (Bonanno & Constance 2008).

In an attempt to stop the repetition of globalization and trade liberalization crises, experts suggest that national trade authorities should stop contemplating getting out of the WTO talks more than they contribute to it. This is because the aftereffects of these actions only lead to disagreements. In any disagreements, it has to be known that the best results are that all parties get to lose (Chorafas 2009).

How countries depend on each other

It is worth noting that countries do not actually trade with each other. Organizations do. In terms of business operations, countries fall into three groups as follows. The first group is the group of countries that produce both capital and consumer goods. These countries are in a position to expand their own industries with little outside help (Mott 2004.).

Examples of countries that fall in this category include Russia, the US and the U.K. (U.S. Department of State 2011). The second group of countries includes those countries that satisfy most of their consumer goods requirements but produce few or no capital goods. Such countries depend on countries in the first group for their machinery and equipment.

They also depend on the first group of countries for technical assistance in the running of factories and other industries. Examples of such countries include China and India (The Skills Portal, Not Dated). Brazil, Canada, and Australia also fall into this category. The third group of countries is those countries that have little or no modern industry at all.

These countries depend entirely on the other countries in the first and the second group to go about their business operations (FAO 2001). They include countries such as the smaller republics of Latin America, most African countries, and Asian countries such as Afghanistan, Pakistan and Indonesia (Freedom in the World 2011).

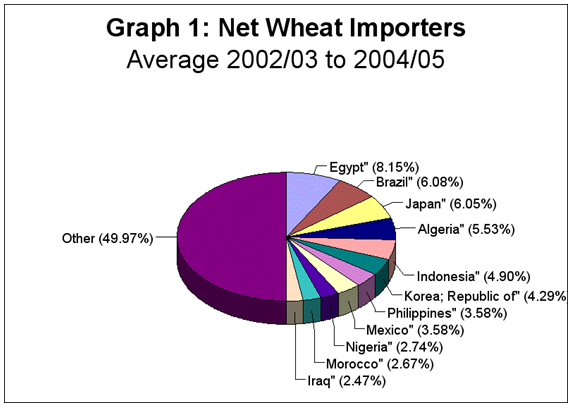

Figure 2: Diagram of wheat importers.

Adapted from Web.

The diagram above shows how wheat is traded in the world. The countries that import the wheat are dependent on those that export the wheat. This indicates that the countries of the world are interdependent on each other.

Industrialization plays a big role in enhancing globalization. According to the discussions above, all the countries that fall in the first category are highly industrialized (Goudsblom 2003). According to modern lines, industrialization can be greatly influenced by many factors.

These factors include the resources available in the country and the size and standard of living in the country (Conor 2010). Thus, it is important to remember that each country has to be placed in a class of its own according to the contemporary standards of categorization (Inadomi 2010).

Also countries that are highly populous are the ones that can run certain industries economically. For instance a country like Switzerland can not make a motor vehicle works simply because, although it is capable financially, the industry cannot be sustained by a population of four and a half million people (Cole).

Conclusions and recommendations

Globalization is the global trend in which there is the growth of a free trade and investment across borders and the resulting integration of the international economy. It is important to note that the concept of globalization together with all the issues that define it convey strong aspects of the ideologies of a common pool. Globalization should therefore be treated as an ecological system.

It is a system that has elements which are all important in their functions. Systemic risk is the risk directly related to the economy. This is different to the risk that is directly pointed at an investor.

In an attempt to stop the repetition of globalization and trade liberalization crises, experts suggest that national trade authorities should stop contemplating getting out of the WTO talks more than they contribute to it. This is because the aftereffects of these actions only lead to disagreements.

Reference List

All business. (2011). Business Definition for: systematic risk. Web.

ANZ. (2011). Products and Services. Web.

Blas et al. (2010). Equity, Social Determinants and Public Health Programmes. WHO.

Bordo et al. (2003). Globalization in Historical perspective. Chicago: The University of Chicago Press.

Bonanno, A. & Constance, D. (2008). Stories of globalization: transitional corporations, resistance, and the state. University Park: Pennsylvania State University Press.

Boudreaux, D. (2008). Globalization. Westport: Greenwood Press.

Burnett, P. & Manji, F. (2007). From the Slave Trade to Free Trade: How Trade undermines Democracy and Justice in Africa. Oxford: Fahamu.

Cabral, L. (2002). The California Energy Crisis. New York, Elsevier.

Chorafas, D. (2009). Globalization’s limits: conflicting national interests in trade and finance. Surrey: Gower Publishing Limited.

Cole, J. (1959). Geography of the world. Victoria: Penguin Books limited.

Collier et al. (2002). Globalization, Growth, and Poverty: Building an Inclusive World Economy. Oxford: Oxford University Press.

Conor, S. (2010). Countries Join Forces to Save Life on Earth. Web.

Conrad, C. (2005). African Americans in the U.S. Economy. Oxford: Rowman & Littlefield Publishers.

Diene, D. (2001). From Chains to Bonds: The Slave Trade Revisited. UNESCO.

Dobson, K. & Dozois,D. (2008). Risk Factors in Depression. San Diego: Elsevier.

Evanoff et al. (2009). Globalization and Systemic Risks. World Scientific Press Ltd.

FAO. (2001). Seed Policy and Programmes for the Central and Eastern European Countries, Commonwealth and Independent States and Other Countries in Transition. Budapest, Hungary, 6-10 march, 2001.

Freedom in the World. (2011). The Authoritarian Challenge to Democracy. Web.

Gills, B. & Thompson, W. (2006). Globalization and Global History. Oxon: Routledge.

Goudsblom, J. (2003). Mappae Muindi: Humans and Their Habitats in a long-Term Socio-Ecological Perspective. Amsterdam: Amsterdam University Press.

Hitt et al. (2009). Strategic management: competitiveness and globalization: concepts and cases. Mason: South Western Cengage Learning.

Holsey, B. (2008). Routes of Remembrance: Fashioning the Slave Trade in Ghana. Chicago: University of Chicago Press.

Inadomi, H. (2010). Independent power projects in developing countries: legal investment Protection and Consequences forD. Netherlands: Kluwer Law International.

International Forum For Globalization. (2010). IFG Board Members Vandana Shiva and Maude Barlow Together on Earth Day Speaking on the Rights of Mother Earth. Web.

Iqbal et al. (2009). Globalization and Islamic Finance: Convergence, Prospects and Challenges. Hoboken: John Wiley and Sons.

Kegley, C. (2008). World Politics. Mason: Cengage Learning.

Krook, A. & Nouri, S. Tradable Green Certificates in Combination with Investment Subsidies: What Does it Change? Gotaborg School of Business, Economics and Law. Sweden.

Kwok, P. (2005). Post Colonial Imagination and Feminist Theology. Louisville: John Knox Press.

Lan, Y., & Unhelkar, B. (2005). Global enterprise transitions: managing the process. Hershey: Idea Group Publishing.

Lechner, F. &Boli, J. (2004). The Globalization Reader. Oxford: Blackwell Publishing.

Lechner, F. (2009). Globalization: The Making of World Society. West Sussex: Blackwell Publication.

McNamara, W. (2002). The California Energy Crisis: Lessons for a deregulating Industry. Tulsa: PennWell Corporation.

Moneyterms. (2011). Systemic Risk. Web.

Mott, W. (2004). Globalization: People, Perspectives, and Progress. Westport: Praeger Publishers.

Noble trading. (2011). What is Systemic Risk. Web.

O’Rourke, K. & Williamson, J. (1999). Globalization and History. Massachusetts Institute of Technology.

Osterhammel, J. & Peterson, N. (2005). Globalization: A Short History. Princeton University Press.

Pearson et al. (2002). Technically Speaking: Why All Americans Need to Know More About Technology. USA: National Academy of Science.

Reuvid, J. (2006). Managing Risk: A Practical Guide to Protecting Your Business. London: Kogan Page Limited.

Robertson, R. (2000). Globalization: Social Theory and Global Culture. London: SAGE Publications Ltd.

Rodriguez, J. (1997). The Historical Encyclopedia of World Slavery, Volume 1: Volume 7. Santa Barbara: ABC-CLIO, Inc.

Shah, R. (2005). Energy trading & Risk Management- Top 5 IT imperatives. Win in the flat world. Commodities now.

Steger, M. (2009). Globalization. New York: Sterling Publishing Co., Inc.

Suarez-Orozco, M. & Qin-Hilliard, D. (2004). Globalization: Culture and Education in the New Millennium. Los Angeles: University of California Press.

The Levin Institute. (2011). What Is Globalization? Web.

The Skills Portal. Africa and China Dependent on Each Other. Web.

Trade Risk Management. (2010). Trade Risk Management. Web.

U.S. Department of State. (2011). Independent States in the World. Web.

Waters, M. (2001). Globalization. London: Rout ledge.

WHO (2010). Global Health Risks: Mortality and Burden of Disease Attributable to Selected Major Risks. WHO.

Yeyati et al. (2004). Market discipline and the systemic risk: evidence from bank runs in emerging economies. WPS3440.