Cost-Volume-Profit

Cost-Volume-Profit Analysis refers to financial management tool used to predict and determine the level of production, sales and profitability of the business. In essence, the tool enables corporate managers to ascertain the probable changes in profit with respect to variations in sales price, fixed cost or variable cost. As such, these changes directly affect the contribution margin of a firm in pursuit of the targeted sales volume.

On the other hand, the knowledge of CVP is crucial in computing the expected break-even point with critical considerations of the market forces such as competition, technological advancement as well as the market and product mix (Cunningham, Nickola & Bazley, 2000).

Business management is perpetually incomplete without prerequisite competency in CVP, especially where sales activities form the basic nature of a given firm. For example, a company must accurately determine the cost of production, fixed and variable cost so as to establish a desired profit margin.

CVP also enable the management to make appropriate decisions regarding the sales target, expected profitability, unit selling price, BEP, among other costs such as advertisement or adoption of quality production technologies. These are essential components of steering a profitable business amidst a competitive business environment with rational consumers as reiterated by Vanderbeck, (2009).

At workplace, CVP analysis is important is determining the path of production or sales strategy. For example, it is worth considering the impact of using modern technology in production as compared to reliance on manual production. While the cost of acquiring modern technology and production machinery might be expensive, the decision will enhance faster production of quality products with less errors or wastage.

Thus, there is likelihood of meeting increased demand and quality of service. In the long run, the idea will improve customer satisfaction and loyalty thus enhancing the firm’s competitive advantage with improved revenue performance (Swathi, 2010).

Fixed cost and variable cost

There are cost elements that do not change with changes in sales activities. They remain constant over a predetermined period of time regardless of the revenue performance of the business. Such include costs renting the premises, salaries and utility bills. Variable costs however, are more related to the production and sales activities (Cunningham, Nickola & Bazley, 2000).

They vary with changes in the number of units produced and sold. For instance, the company may incur increased cost of commission with increased sales revenue. On the other hand, the cost of raw material increases with increased unit production.

In business management and cost accounting, fixed and variable costs may be treated differently by different managers. This is due to the fact that other underlying factors such as inflation, competitions and administration may impact on the cost elements (Swathi, 2010).

For example, salaries are often considered to be fixed irrespective of revenue. However, in a firm where labour is relative to production and sales needs, a company may rely on hired workforce per unit hour to accomplish the targets. Thus, salaries may be apportioned to every unit produced or sold thereby rendering it a variable cost element.

The implications of these costs are vital in computing the prospective sales and profit margin. Furthermore, CVP analysis helps in budgeting for the volume of production and modalities of manipulating supply to sustain a given selling price (Vanderbeck, 2009).

CVP for Compnet/Prime Compnet

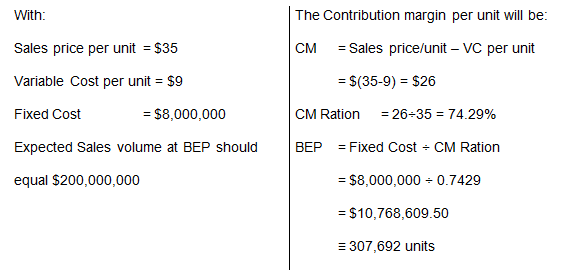

The total variable costs VC for Compnet product line acquisition = direct material + direct labour + marketing cost = $(6 + 2.5 + 0.6) = $9 per unit item respectively. Fixed cost however has been determined at $5 million with and extra $3 million annual interest expense on borrowed capital.

Thus, total fixed cost = $8 million. While Prime Component has quoted a final price of $200 million with an appreciation period of ten years, the amortization expense will thence be $20 million per annum.

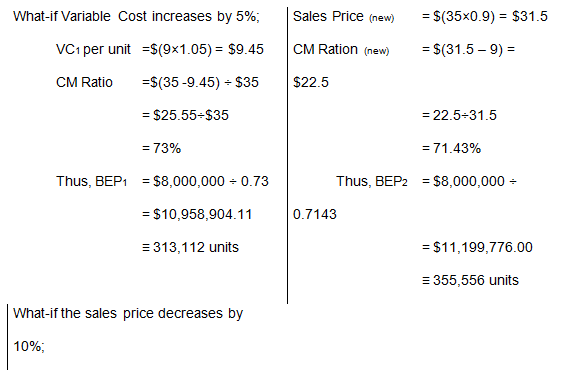

The sales volume and break-even point of Compnet is will vary as computed below under the following what-if scenarios:

Table 1: Pro forma Statement for Prime Component Product line Acquisition

Notes

Since the Compnet is still in the negotiation stage, it is worth noting that the envisioned product line acquisition will require aggressive marketing and customer analysis. These intangible costs will influence the mode of acquisition, price line and product mix in general.

On the contrary, proper connotation of these factors is essential to the sales department of Prime Component in developing sustainable sales projection and marketing strategy with respect to the expected revenue performance as illustrated in Table 1. Moreover, computations for each what-if scenario are attached in Excel CVP template.

References

Cunningham, C.B., Nickola, L., & Beazley, J. (2000). Accounting: Financial Information for business decisions. San Diego, CA: Harcourt Brace.

Swathi, S. (2010). Managerial Economics and Financial Accounting. Upper Saddle River, NJ: PHI Learning Pty Ltd.

Vanderbeck, E. (2009) Principles of Cost Accounting. Stanford, CN: Cengage Learning.