Introduction

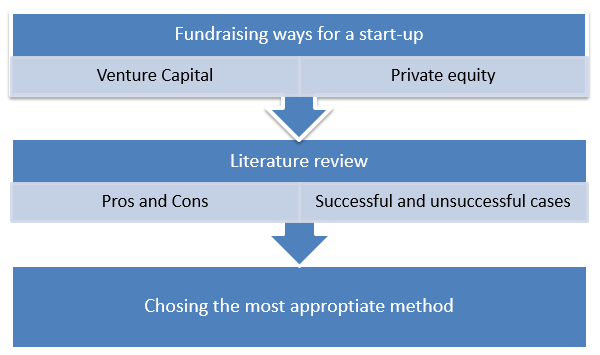

Funding a start-up is a crucial step to success; only having the right investor can the start-up reach its goals and raise income. There is a knowledge gap based on the lack of understanding of fundraising ways. What is the best choice for acquiring funding, venture capital, or private equity? To answer this question, the following objectives were set:

- To understand the difference between venture capitals and private equities

- To describe the main benefits and drawbacks of each

- To decide which one is preferable for a start-up.

Literature Review

Cremades (2016) claims that “By building the product first, entrepreneurs establish ownership, control and lead” (p. 5). This means looking for funding after having established the business plan would be much more beneficial. As a start-up founder, one can approach a venture capital or a private equity firm. The literature on the topic included materials on ways of fundraising (Busulwa, 2020; Cremades, 2016), literature describing venture capitals and private equities (Lahr, 2018; Manigart, 2017; Crane, 2018; Islam, 2018). Also, some articles on cases of successful and unsuccessful cases fundraising (Harris, 2016; Brown, 2019) were examined. All these components help to answer the research questions:

- What are the main ways of investing for an entrepreneur?

- What are venture capitals and private equities?

- How venture capitals and private equities are beneficial?

Research variables included the amounts granted by both venture capitals and private equities, how much of a start-up they will control, and what is the success rate of using each method. The research framework for understanding what the best way to fund a start-up is can be described using this scheme:

Research Design

The research was based on a quantitative design, including reviewing the cases of using venture capitals and private equities to determine the success rate. The strategy of the research was a survey, which allowed both to develop theoretical knowledge on the topic and discover the ways of practical application. The primary data involved the main features of a start-up and requirements for fundraising, as well as characteristics of venture capitals and private equities. The secondary data included statistics on cases of application of these fundraising methods. The samples were taken based on the specification and the size of start-ups. The research data was collected by way of measuring the amounts given by venture capitals and private equities and the income that followed.

References

Harris, M. (2019). Ambitious web fundraising startup fails to meet big goals. Science, 354(6312), 534. Web.

Brown, G. W, Gredil, O. R., & Kaplan, S. N. (2019). Do private equity funds manipulate reported returns? Journal of Financial Economics, 132(2), 267-297. Web.

Busulwa, R., Birdthistle, N., & Dunn, S. (2020). Startup Accelerators: a field guide. Hoboken, NJ: John Wiley & Sons.

Crain, N. G. (2018). Venture capital and career concerns. Journal of Corporate Finance, 189, 168-185. Web.

Cremades, A. (2016). The art of startup fundraising. Hoboken, NJ: John Wiley & Sons.

Islam, M., Fremeth, A., & Marcus, A. (2018). Signaling by early stage startups: US government research grants and venture capital funding. Lournal of Business Venturing, 33(1), 35-51. Web.

Lahr, H., & Trombley, T. E. (2018). Early indicators of fundraising success by venture capital firms. Web.

Manigart, S., & Sapienza, H. (2017). Venture capital and growth. In Sexton, D., L., & Landström, H. (Eds.), The Blackwell handbook of entrepreneurship (pp. 240-258). Hoboken, NJ: John Wiley & Sons.