Executive Summary

This research seeks to investigate issues surrounding deregulation of the air transport industry in the Middle East. Restrictions in the distribution of traffic rights have caused a key barrier to the entry and development of new carriers functioning intra-regional routes. The open skies policies of the UAE and the carriers’ triumph have granted the catalyst for new low cost carriers to surface.

The UAE, Oman and Kuwait and have currently opened their skies to low cost carriers fully. Jordan and Syria may, as well, do the same as the low-fare services profits both the nation and its residents. Both GCC and ACAC are working extremely hard towards deregulation. This is likely to prompt an open skies policy amid these nations.

Introduction

Air transport system, in the Middle East, continues to be heavily regulated, with considerable restrictions on the traffic rights allocation. Traffic rights’ negotiation takes place inside a bilateral scheme.

Restrictions in the distribution of traffic rights have caused a key barrier to the entry and development of new carriers functioning intra-regional routes. This paper is a research on fundamental aspects surrounding deregulation of air transport industry in the Middle East.

Literature Review

Growth and Development Plans for Airports in the Middle East

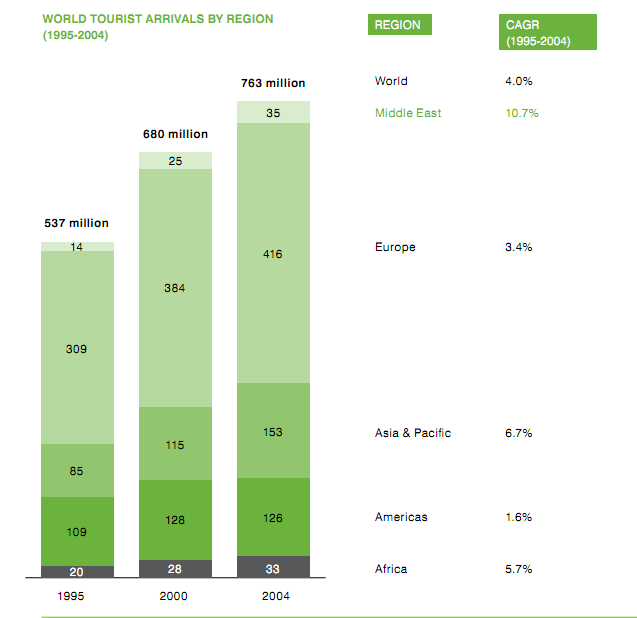

In the last 10 years, global tourism has been the main source of air transport growth in the Middle East region (Panariello 2007). Tourist arrivals in the region almost tripled, from 14 million to over 35 million arrivals, between 1995 and 2004 (AACO 2007). Thus, tourism is a main force of growth in the area, as demonstrated in figure 1.

Last year, Airports Council International, forecasted an international economic growth, which may be anticipated to push the aviation industry to its past course of remarkable growth.

An additional Dh106billion in a range of segments of this area is under the contemplation of industry specialists in Middle East (Aircargo Update 2012). So as, to execute the fourth stage of Dubai Airport extension, the Airport has publicized plans to propel, in Dh28.4 billion, to meet anticipated growth needs. Regardless of highly revealed afflictions, Dubai’s airport is currently world’s fourth biggest as air passenger travel increased in the last five years.

At the moment, the cargo size has augmented fivefold. Dubai solely handled more freight than all the other GCC airports merged, in 2010 (Sambidge 2011).

This lofty growth can be supported by a number of aspects including tourism, government expenditure, inexpensive airlines, deregulation, and airplane orders. Again, open bilateral accords and large augments in fleet capacity are propelling development, chiefly in Qatar and the UAE.

These state carriers have developed into international names and are helpful in increasing capacities at their local airports apart from adding vastly to economic development, in the region.

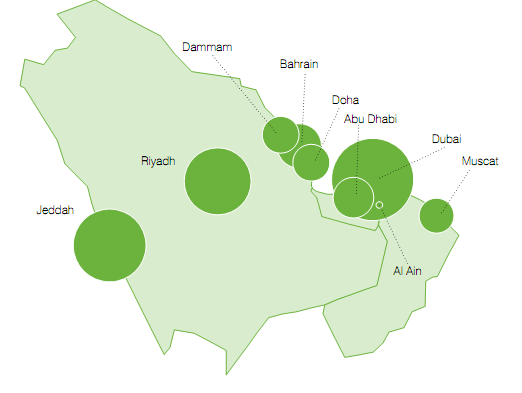

It may be envisaged that, in 2015, Doha, Abu Dhabi and Dubai airports will cover a joint annual capacity of 190 million travelers (Aircargo Update 2012). From 2002-2010, Passenger travels in the GCC have developed at a CAGR of 10%, which is considerably higher than the international traffic growth in the similar phase.

UAE, especially, has insistently followed this model for the past ten years. Thus, it swiftly climbed up in global rankings. At present, Dubai is among the world’s leading airports. On the other hand, Qatar and Abu Dhabi aim to achieve a hub position for the area. Nevertheless, the story is not only one of international aspirations, but providing to presented demand adequately.

Present capacity operation in the GCC (passengers/capacity) rests above 115%. Bahrain owns the sternest case of under-capacity, budging double its competence in 2010. The UAE is the lone GCC nation working with some reserve, as it has experienced massive airport growth in latest years.

Capacity consumption is at 84% because of the ending of Dubai Airport extensions, which increased capacity from 22 million to 60 million travelers annually, with an anticipation of additional raise to 90 million in 2020.

Kuwait, Dubai, and Qatar hold at least a single airport scheme on the anvil. Oman boasts two main airport extensions in Salalah and Muscat (Aircargo Update 2012). Saudi Arabia has begun to develop Jeddah and Medina airports. Bahrain, also, has started the increase of its current terminal.

Growth of Airlines in the region

Growth objectives, for Middle East, are enormous. At present, Middle East has almost 504 aircrafts, and extra 260 aircrafts are becoming organized.

Qatar Airways, Emirates Airlines and Etihad Airways guide the pack and comprise the majority of the new aircrafts organized. In the subsequent five years, they may be projected to boost capacity at above 15% per year, which is well prior to orders and holds the risk of strong rivalry, further propelling down aircraft operation and overall performance competence.

Hence, investment schemes pretense solemn risks of harmful rivalry and unanticipated overcapacity that the area should tackle. Tourism development only is unlikely to offer a solution in the interim since a considerable extent of airlines in the area fight for similar global traffic, since catchment areas overlie with some correspondence in the local tourism contributions as shown in figure 2.

In 2011, the Middle East airlines led the globe for expansion in demand, with a 7.7 percent boost over the preceding year, 2010 (Sambidge 2011).

According to the International Air Transport Association (IATA), carriers in the area recorded the strongest expansion in order against a capacity boost reduction in air cargo levels, in October 211, demonstrating a 3.1 percent increase against a 4.7 percent decline. Internationally, traffic demonstrated a 3.6 percent increase, in 2011, over the previous year.

Growth of LCC in the region

Air Arabia became the earliest budget carrier, in Middle East, operating past Sharjah International, in 2003. In 2007, it could carry 2.7 million travelers in the Middle East and to nearby states by means of A320s. Air Arabia broke even in its initial year of business and has continued to be profitable from then.

Nevertheless, regulatory limitations by other nations in the Middle East have made the carrier to function with extremely low frequencies, three- 4 times per week. So as, to balance this it has had to enlarge its operations to supply 40 centers in 20 nations – with the omission of Kuwait, Alexandria(Egypt) and Bahrain that become run double every day as these nations cover open skies.

The open skies pact in Kuwait enabled Jazerra Airways, a Kuwaiti low cost carrier, to begin action in late 2005 and battle with Kuwait Airways. After two years of work, this carrier had transported over one million travelers to 22 capitals.

Jazeera Airways caught 11% of Kuwait’s market by the last part of 2007 (Sobie 2008). Jazerra Airways, in harmony with the plans followed by low cost carriers in the free markets of Europe, formed a second center in Dubai. The UAE, Oman and Kuwait and have currently opened their skies to low cost carriers fully. Jordan and Syria may, as well, do the same as the low-fare services profits both the nation and its residents (Sobie 2007).

Bahrain Air is the fifth low cost carrier in the area. By 2008, Bahrain had already arrested 7% of the Bahraini economy, crafting it the second prime carrier behind Gulf Air (Bahrain International Airport 2009).

New entrant, FlyDubai, might, as well, transform low cost carrier activities in Middle East. FlyDubai is an auxiliary of Emirates. Flag carriers, in the Middle East, focus well on the threat caused by the budget airlines.

FlyDubai and Saudi Arabian Airlines are both researching on the alternative of instituting their personal low cost subsidiaries. Also, Qatar Airways has initiated a budget carrier.

GCC/ME Country Profiles, Political, Economic, Social, Technological and Environment

United Arab Emirates profile

The United Arab Emirates (UAE) constitutes seven countries including Dubai, Umm al Qaiwain, Abu Dhabi, Fujairah, Ajman, Sharjah, and Ras al Khaimah.

Political and Legal

The head of Abu Dhabi, Sheikh Khalifa, governs UAE. The UAE administration supports the free trade open culture and promotes globalization and FDI. The court structure is yet to be established, because its rulings are not constantly enforceable owing to the immense alien population.

Economy

The citizens of the UAE usually enjoy a high standard of lifeblood due to oil wealth. The UAE population comprises three million citizens and over half of them are in the labor force.

Social-Cultural

The UAE is remarkably liberal as it accommodates other customs and beliefs. The multicultural environment of the state allows, for many aliens, to go there functioning in well-paying posts.

Technology

The UAE area constitutes a large population of extremely young experts who are well conversant with technology. The IT sector concerns hotel, tourism, IT and computer segments.

Environment

There has been anxiety amid the UAE and Iran due to the conflicted Gulf islands. The US regards the UAE as a partner in its battle towards terrorism.

Saudi Arabia Profile

Saudi Arabia has developed from a small desert realm to one of the richest countries s in the area, due to enormous oil resources. However, its rulers experience the delicate duty of reacting to demands for reform while fighting a growing issue of radical violence.

Politics

The dynasty of Al Saud has dominion over the region. Political parties get prohibited, and the antagonism becomes planned from overseas. Rebellious Islamists have instigated a number of lethal attacks.

Economy

Saudi Arabia a leading oil producer and holds the biggest hydrocarbon resources.

Social- Cultural

The country is the cradle of Muslim religion. Thus, it has a powerful religious self-identity. However, swiftly growing unemployment is a chief concern for the country.

Environment

The ruling family endeavors to maintain stability in the area and crack down on radical elements. Saudi Arabia allowed the entry of US troops in the nation following Iraq’s attack on Kuwait, during 1990. Saudi Arabia is the warden of the origin of Islam.

Technological

The country is leading in science and technology in the region.

Qatar Profile

Qatar, a previous pearl-fishing hub and formerly one of the poorest Gulf nations, is currently among the richest states in the area.

The Country remained under the dominion of Thani family for about 150 years. Until 1971, it remained a British protectorate.

Politics

Sheikh Hamad, the ruling monarch, promotes superior political openness. In 2005, constitution supporting partial democratic reforms took effect. The fresh, basic law supported a legislature that would contain 30 chosen members and 15 others selected by the emir.

Economy

Qatar is among the wealthiest states in the area, owing to oil.

Social

Qatar is a Muslim country, though it supports diversities.

Technology

Technology in the state is extensive. Through Al Jazeera, Qatari satellite TV station, Qatari has emerged as a significant broadcaster in (Arab Aviation Business 2006).

Environment

Qatar is ahead in regional control. Qatar’s TV station caused anger to a number of its neighbouring countries.

Oman Profile

Oman is among the most conservative states in the Gulf area. Up to the 1970s, it remained isolated. Residing in the south-east area of the Arabian Peninsula, it has a tactically significant spot at the entrance of the Gulf.

Politics

Sultan Qaboos held control in 1970 and governs by decree. Recently, he has changed to raise popular involvement in decision making.

Economy

The country is reliant on oil. A diversification force involves tourism. The rule of Omanisation seeks to substitute expatriate employees with locals.

Social-Cultural

The majority of Omanis pursue the Ibadi cult of Islam, which is the remaining appearance of Kharijism.

Technological

The country embraces modern technology, especially in the area of transport and communication.

Environment

Omani has, to this point, been secured as the militant Islamist aggression that has beset a number of its neighbors. It is a helpful Arab friend to Washington, because of its solid associations with Iran.

Bahrain profile

Bahrain was at one time perceived, by the earliest Sumerians, as an island heaven to which the intelligent and the courageous got taken to take pleasure in eternal life. It was among the earliest nations, in the Gulf, to realize oil and build a plant.

Politics

The nation gets governed by the Khalifah family. Bahrain is currently a constitutional kingdom with a designated legislative congress.

Economy

The country is a banking and financial services hub. Its affluent economy is less reliant on oil than other Gulf States.

Social-Cultural

The country discriminates citizens while offering jobs and services and, in 2011, a demonstration became held about the same. Demonstrators assembled at the centre of Manama, where a number of them got killed in fights with security forces.

Technological

The country embraces modern technology, especially in the area of communication.

Environment

Bahrain is a retreat for tourists from the area, who take the lead of its tranquil social environment. It is a close partner of the US, and a home to the American navy’s fifth convoy.

Bahrain accommodates US Navy’s Fifth convoy. Bahraini-Qatari relations often get strained.

Kuwait profile

Kuwait is a minute, oil-rich state located at the zenith of the Gulf, bordered by large or strong neighbors including Iraq, Saudi Arabia and Iran.

Politics

The designated parliament has frequently disagreed with the ruling family. Hence, the state experiences frequent violence from aggressive Muslims.

Economy

The country is a leading producer in oil.

Social-Cultural

The society of Kuwait is male-dominated. The country holds the Islamic belief.

Technological

Most residents of Kuwait are technologically-knowledgeable.

Environment

Kuwait became attacked and taken by Iraq in 1990. In 2003, it played as a catalyst for the attack of Iraq.

Air Transport Development in the Last 10 Years and Future Scenario for the Next 10-15 Years

The airline business has been in an economic crisis for a large phase of the last 10 years. However, as from 2008, the industry continues to recover. Several world regions are guiding the return to development and will likely appear as financial powerhouses.

The recession was cruel, but the recuperation is much faster than anticipated. Foreseers mirror this strength with an aggregate annual expansion rate of 5.2% for air transport in the following fifteen years (Aircargo Update 2012).

The tendency to substitute worn out fleets and trim surplus capacity that was apparent in Europe and North America, in the previous few years, is currently dispersing to other regions.

Airlines in China, the Middle East, Latin America and Asia are on watch as they find out the latent of regional towering to enlarge their networks, and attain elevated heights of competence.

For a huge part, these markets became unharmed by the regional jet uprising and have been the spheres of huge-capacity aircrafts. By 2030, the quantity of new 61 to 120-seat planes to be obtained by airlines in Asia and China may be predicted to equal that of carriers in Europe (Teffaha 2008).

In 2020, Qatar, Emirates and Etihad will boast the capacity to hold almost 200 million travelers: four times their present ability (Sobie 2008; Teffaha 2008).).

The Abu Dhabi, Doha and Dubai airports, will attain a yearly capacity of 190 million travelers by 2015 (Teffaha 2008). Dubai’s latest airport will have the capacity of 70 million travelers. This is enormous bearing in mind that the population comprises just a few million, together with guest personnel.

In its latest projection, Boeing envisaged that Middle Eastern airlines would necessitate 2,340 aircraft before 2029, with a sum cost of $390 billion as the local industry develops (Aircargo Update 2012). Airbus, as well, predicts that, before 2028, the Middle East fleet might have increased three times.

Furthermore, Boeing approximates that the local aviation industry will rise at 7.1 per cent annually for the subsequent 20 years. Thus, one may say expansion in the Middle East gets anticipated going on at a swift clip, giving a substantial reason for additional optimism in the coming years.

How Long will it be Before Deregulation Comes to the Middle East?

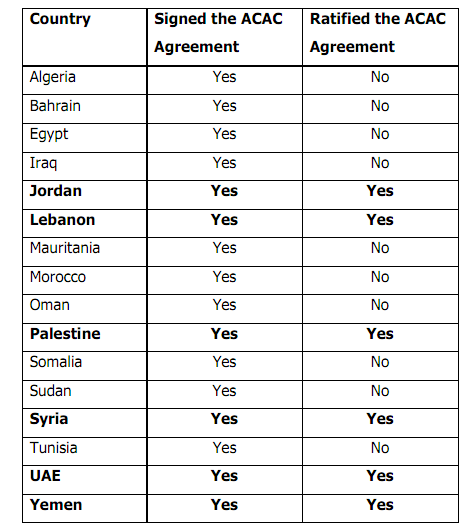

Deregulation will come to the Middle East soon, may be in two years time. This is because both GCC and ACAC are working extremely hard towards this realization. Table 1 demonstrates that Lebanon, UAE, Palestine, Jordan, Syria and Yemen have currently endorsed the ACAC liberalization agreement.

GCC states are in the course of building an integrated economic with the objective of forming a single market (Sobie 2008). This is likely to prompt an open skies policy amid these nations. Again, a liberalization procedure that holds 16 member states under the patronage of ACAC is ongoing.

This process directly replicates the proposal of the EUs third parcel, which changed Europe’s bilateral agreements amid member nations into an open skies policy. Hence, GCC integration may mark the start of deregulation in the Middle East.

Role of International organizations and AACO, in particular, in Deregulating the Middle East

The role of AACO is to support collaboration, quality and secure standards amid the Arab airlines (AACO 2007). In this month, AACO dared the Arab Civil Aviation Council’s (ACAC) regarding their suggested free-trade area. This is because AACO became concerned that deregulation could form a wedge amid state flag carriers and their administration owners (World Airline News 2012).

AACO does not back ACAC’s decision, requiring the institution of a free-trade zone enclosing trade in commodities, excluding services. Abdul Wahab, the Secretary-General AACO, feels that air transport deregulation ought not to be connected to political actions, but should be disputed on its individual merit (World Airline News 2012).

This came in response to ACACs’, which includes the area aviation ministers, desire to start air transport liberalization, so as, to attain complete deregulation and decline in cross-border charges.

A different concern facing AACO entails technical actions as it considers the acquirement of market intelligence services (World Airline News 2012). AACO is exploring on how to obtain data from computer reservations structures, which will allow members to examine data for utilization in marketing.

Methodology

Research Design

Workers in Air transport industry in the Middle East shall be selected, to take part in an interview, where they shall be required to give their views concerning their perceptions on the state and development of air transport industry in the Middle East.

Data Collection and Analysis.

The interview shall be conducted amid all air transport industries in the Middle East. The outcome will be analyzed, without prejudice or modification whatsoever. The outcome will be presented to all companies in the Middle East and AACO.

Results

Saudi had agreed to a contract to invest about Dh27 billion on the latest airport scheme. The Salalah and Muscat airports, in Oman, are getting increased, at a sum cost of Dh1.2 billion, to cater for 48-10 million travelers, yearly.

Kuwait has invested about Dh172 million in airport development project, even as Qatar is aspiring to increase to its aerospace division at an expenditure of Dh4 billion. Dubai Airport has developed enormously. Qatar and Abu Dhabi have, as well, started to grow tremendously.

In states, where there are few enormous schemes, airports currently experience clogging. GCC Pax and freight development of about 10% are extremely inspiring particularly for a decade which faced two main crises. Dubai holds double the cargo size of any new GCC airport.

Discussion

Airport plans in Middle East are flamboyant. A number of countries, for instance, the United Arab Emirates, wish for a top share of global link traffic. They desire to extend international air freight and air commuter market to the Middle East.

Such targets challenge airports to broaden their air transport facilities and demand highly refined and competent ground transportation. Open bilateral accords and large augments in fleet capacity are propelling development, chiefly in Qatar and the UAE.

Abu Dhabi, Dubai and Qatar, are doing well. Oman, as well, has had lofty passenger expansion, undoubtedly, reaping the remuneration of its tourism plan. Saudi Arabia has the slightest development by far, although from a considerably higher foundation.

Regardless of the acute fiscal catastrophe, Passenger travel, at Dubai, has now surpassed Saudi Arabia. This demonstrates that the industry of air travel in Dubai is both booming and extremely tough. The open skies policies of the UAE and the carriers’ triumph have granted the catalyst for new low cost carriers to surface.

Low cost carriers, in the Middle East, seem to be propelling shifts to deregulate in the region. The GCC nations are planning to create an integrated market. This market will offer equal chances for all GCC residents including the privilege to work in all GCC states and move liberally amid the states.

Such integration is comparable to what happened to the European Union, and it might prompt an open skies policy to be created amid the six GCC states. Although this is tentative, it may turn out to be a distinct probability.

Deregulation among the GCC nations will prompt further competition and elevated rates of intra-Middle East traffic development. The risk of overcapacity is especially significant for the area, since government support and funding of airlines would imply that regular market forces will be incapable to decrease the market’s surplus capacity, in the future.

Conclusions

In conclusion, a number of countries, for instance, the United Arab Emirates, wish for a top share of global link traffic. They desire to extend international air freight and air commuter market to the Middle East. Such targets challenge airports to broaden their air transport facilities and demand highly refined and competent ground transportation.

Presently, the Middle East maintains to allocate enormous investments for expanding the current airports and constructing fresh ones, at a cost of 119 billion. At present, Middle East has almost 504 aircrafts, and extra 260 aircrafts are becoming organized.

Qatar Airways, Emirates Airlines and Etihad Airways guide the pack and comprise the majority of the new aircrafts organized. In the subsequent five years, they may be projected to boost capacity at above 15% per year, which is well prior to orders and holds the risk of strong rivalry, further propelling down aircraft operation and overall performance competence.

The open skies policies of the UAE and the carriers’ triumph have granted the catalyst for new low cost carriers to surface. The UAE, Oman and Kuwait and have currently opened their skies to low cost carriers fully. Jordan and Syria may, as well, do the same as the low-fare services profits both the nation and its residents.

New entrant, FlyDubai, might, as well, transform low cost carrier activities in Middle East. FlyDubai is an auxiliary of Emirates. Flag carriers, in the Middle East, focus well on the threat caused by the budget airlines. Low cost carriers, in the Middle East, seem to be propelling shifts to deregulate in the region.

The Abu Dhabi, Doha and Dubai airports may attain a yearly capacity of 190 million travelers by 2015. Dubai’s latest airport will have the capacity of 70 million travelers. Boeing envisages that Middle Eastern airlines may necessitate 2,340 aircraft before 2029, with a sum cost of $390 billion as the local industry develops. Airbus, as well, predicts that, before 2028, the Middle East fleet might have increased three times.

The activities of GCC are likely to prompt an open skies policy amid these nations. Deregulation among the GCC nations will prompt further competition and elevated rates of intra-Middle East traffic development.

Again, a liberalization procedure that holds 16 member states under the patronage of ACAC is ongoing. This process directly replicates the proposal of the EUs third parcel, which changed Europe’s bilateral agreements amid member nations into an open skies policy. Hence, deregulation may come to the Middle East soon, may be in two years time. This is because both GCC and ACAC are working extremely hard towards this realization.

Recommendations

To contain the growth of airlines, the prime airline sectors in the area should augment their fleet size. All nations in the Middle East should adopt open bilateral accords, similar to Qatar and the UAE.

As of the volatile growth in passenger travel, there is a need for large scale extensions of existing amenities in all Middle East air transport sectors. The GCC states should augment investment in the improvement and extension of airports to meet prevailing demand and attain future strategic objectives.

References

- AACO 2007, Arab airlines traffic data. Web.

- Aircargo Update 2012, Ambitious Middle East to Invest 119bn on airport expansion. Web.

- Aviation Business 2006, Jazeera’s era, ITP Publication Dubai UAE, pp. 24-26.

- Bahrain International Airport 2009, Bahrain International Airport. Web.

- Panariello, A 2007, Regional highlights, Airline Business, pp.62-63.

- Sambidge, A 2011, Middle East airlines lead global growth in October. Web.

- Sobie, B 2007, Arabian pioneers, Airline Business, pp.46.

- Sobie, B. 2008, Dubai opts to take low-cost plunge, Airline Business, pp. 24.

- Teffaha, A 2008, Pan-Arab liberalization, Airline Business, pp.66.

- World Airline News 2012, Arab carriers resist deregulation move for the Middle East. Web.