Competitors

The idea of creating a digital app that allows for more effective management of finances is far from being revolutionary, which suggests that My Family Tree is likely to face quite stiff competition. However, My Family Tree has a strong and unique competitive advantage, namely, that of providing a framework for an entire family to build their financial management strategy, while also offering enough flexibility for its individual members. Nevertheless, My Family Tree will have to take note of the competitors such as DigitalLeaf with its Family Budget Finance Tracking, PocketGuard, and You Need A Budget (YNAB) (“Family Budget Finance Tracking,” n.d.; El-Bawab, 2021; Gravier, 2021).

Family Budget Finance Tracking has the advantage of an elaborate framework and the opportunity to adjust the settings to the individual needs of its customers. In turn, PocketGuard has a straightforward interface that offers even users at the beginner level to delve into the complexities of financial planning. Finally, YNAB offers a connection to multiple platforms, which allows tracking key changes within the budget very simple.

However, the competitors in question are also affected by several disadvantages that restrict their competitiveness rate. For example, YNAB requires a thorough control of a range of factors that make the overall experience rather messy. In turn, PocketWatch represents the opposite problem, failing to incorporate complex analysis and computations into the process of calculating the budget. Even Family Budget Finance Tracking, which is a doubtless leader in the industry, lacks the polished look that prevents any glitches from disrupting customers’ experiences (“Family Budget Finance Tracking,” n.d.).

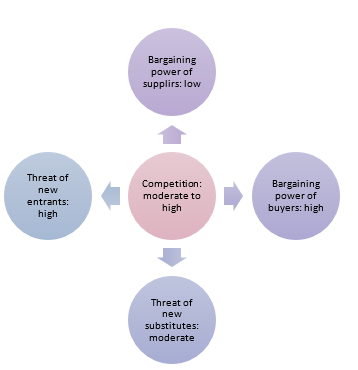

Porter 5 Forces Framework

As Fig. 1 above proves, the competitive environment of the target market is quite challenging, with the competitive rates being moderate to high. Due to the existence of an already established leader, namely, Family Budget Finance Tracking, My Family Tree will have to prove to be especially efficient in order to register among the target audiences. Therefore, the current competitive advantage, which consists primarily of the opportunity to connect multiple financial plans within a single-family unit, must be marketed particularly insistently.

Challenges

The information provided during the module has been quite thought-provoking and crucial to the development of professional skills, including analytical thinking. For example, reevaluating the effects that technological advances have had on the realm of finances has led to understanding the core of challenges associated with collaboration in the fintech setting. Specifically, the nature of possible conflicts in the target environment has become immediately evident. The specified challenges are quite similar to those that I have encountered in my professional career when having to navigate a cross-disciplinary team of experts.

Opportunities

As shown in the examples above, the nature of fintechs implies dealing with a range of challenges. However, there are many opportunities that fintech can pursue. For example, in a traditional retail bank, fintech tools can be applied to reinforce security. Similarly, in the investment bank setting, fintech tools can be used to boost the rates of international trade and attract foreign investments with the help of global collaboration. Finally, in a financial services firm, fintech-based strategies can be used to lower costs.

Strengths Comparison

Fintechs are often compared to incumbents for an understandable reason. Representing two distinctively different approaches to managing financial processes within a company, the two frameworks provide different sets of tools to their leaders. Fintechs offer an opportunity to arrange the key data so that essential documents are readily available. Similarly, fintechs provide a deeper understanding of the problem and, thus, contribute to its solution. In comparison, incumbents set the stage for improved leadership and create the platform for experimentation. Therefore, in the scenarios that require a profound understanding of the core corporate processes, fintechs are preferable, whereas, in the settings where active experimentations are needed, incumbents should be selected. To choose between the two, organizations should opt for the framework that allows them to represent their competitive advantage best.

References

El-Bawab, N. (2021). This is the best budgeting app for over-spenders. CNBC. Web.

Family Budget Finance Tracking. (n.d.). GooglePlay. Web.

Gravier, E. (2021). The best budgeting app for people serious about getting out of debt. CNBC. Web.