Company and Market Analysis

Financial Markets

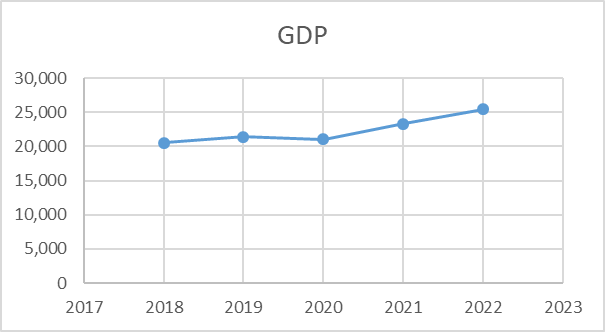

Five-Year Performance of Domestic Economy

Domestic economy can be evaluated using a wide variety of metrics. One of the most common metrics for evaluating the performance of an economy is through Gross Domestic Product (GDP). According to Macrotrends (2023a), the GDP of the US has grown steadily for the past five years, from $20,533 billion in 2018 to $25,460 billion in 2022, as demonstrated in Figure 1 below.

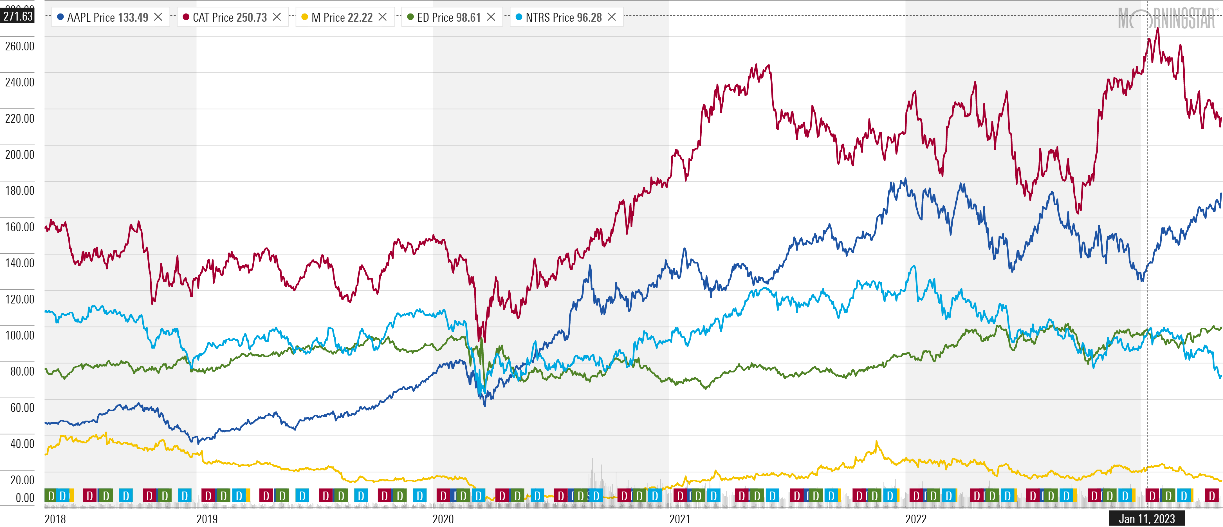

However, the indexes of the US market, including S&P500, NASDAQ, and Dow Jones, demonstrated a significant decline in 2022 in comparison with previous years, as shown in Figure 2 below. The analysis of indexes against GDP growth revealed that the fluctuations in market indexes could not be explained by GDP changes, as despite the GDP growth, all three market indexes decreased. Pound and Subin (2022) claim that outside factors, such as the conflict in Ukraine and the COVID-19 crisis in China, can account for the stock market’s decline.

Market Performance Data Explanations Using Asset Valuation and Macroeconomics

Apple’s stock prices are currently after a significant fall in Q3 and Q4 of 2022 from $173 per share to $124 per share at the end of the year (Morning Star, 2023a). The fall at the end of the year was associated with a significant decline in the company’s speed of income growth. In 2021, the company experienced almost a 65% increase in net income in comparison with 2020, while the net profit growth in 2022 was only slightly above 5%, which negatively affected EPS and P/E growth (Morning Star, 2023a). However, the overall rise of the stock markets in 2023 had a positive impact on Apple’s stock, which allowed Apple to regain its value (Morning Star, 2023a). Currently, Apple’s stocks are traded at around $174 per share.

Caterpillar’s stock is currently trading at $214 per share after falling from $260 per share at the start of the year (Morning Star, 2023b). One of the primary reasons for the decline in share prices is the company’s decreased margins in 2022 due to growing costs associated with high inflation. Previously, the company’s stocks were growing, unlike the overall trends in the financial indexes, which was explained by the growth in the company’s sales. However, a significant rise in share prices led to a decrease in EPS and P/E ratios, which made the stock overvalued (Morning Star, 2023b). As a result, the company’s stocks started to fall at the beginning of 2023.

Consolidated Edison’s stock is currently trading at $100 per share, which is similar to the same period in 2022 (Morning Star, 2023c). Although the macroeconomic trend caused the company’s share prices to plummet significantly in October 2023, the company’s earnings per share (EPS) increased steadily from $3.85 in 2021 to $4.66 in 2022, allowing it to regain its position from the year before. (Morning Star, 2023c).

Northern Trust is currently trading at $74 per share, demonstrating a steady negative growth since January 2022 (Morning Star, 2023d). The central reason for that is the decrease in share prices, which is the unfavorable performance of the company in terms of profitability. Northern Trust’s EPS decreased from $7.13 in 2021 to $6.14 in 2022, which led to a decreased trust of investors in the company (Morning Star, 2023d). Recent macrocosmic trends that had a positive effect on the prices of stock had no notable influence on Northern Trust’s share price (Morning Star, 2023d).

Macy’s is currently priced at approximately $15 per share, reflecting a consistent downward trend since November 2021 (Morning Star, 2023e). After a fast recovery in 2021 after the COVID-19 pandemic’s effect, the company’s growth slowed down, which led to a decrease in share prices. Macy report that the central reason for the loss in share price is the increase in inflation that pressures the consumers (Escobar, 2023). In Figure 3, the share price trends are shown.

Companies’ Valuation

Key Ratios

Using ratios for company valuations is beneficial. Ratios provide a standardized method for comparing a company’s financial performance to other companies in the same industry or sector. This helps to provide context for the company’s financial standing and allows for a more meaningful comparison of financial performance. The key ratios of the company are provided in Table 1 below:

Table 1. Key financial ratios.

In 2022, Apple was highly overleveraged, with a D/E ratio of 1.953 with an industry average of 0.06. However, Apple’s liquidity was high, with an interest coverage ratio (EBITDA/Interest) of 38.27 with an industry average of 28.35. Caterpillar was also significantly overleveraged, with a D/E ratio of 1.953, far exceeding the industry average of 0.73. With an interest coverage ratio of 25.765 compared to the industry average of 19.48, Caterpillar simultaneously showed high liquidity.

Compared to the industry average of 1.35, Consolidated Edison’s D/E of 0.987 showed a stronger degree of long-term solvency. However, the company’s liquidity suffered, with a Debt/EBITDA ratio of 4.384 with an industry average of 7.18. With a balanced D/E ratio of 1.1, Northern Trust showed a strong leverage position. Finally, Macy’s was significantly overleveraged (D/E = 1.46) in comparison with the industry of 0.7. However, the company’s interest coverage ratio was very high (150.12), while the industry average was 9.36, which demonstrated strong performance in terms of liquidity.

Company Valuations: Intrinsic Value

Net Asset Value (NAT) and price-to-earnings (P/E) multiples were used to valuate the companies. The results of valuations are provided in Table 2 below.

Table 2. Asset valuation.

With a NAV of $3.1 at a share price of about $174 and a P/E ratio of 29.41, the analysis’s findings showed that Apple was the most overvalued of the five companies. At the same time, Macy’s was the least overvalued stock, with an NAV ($14.51) close to the current share price of $14.87 and a P/E ratio of 3.6.

Industry Trends

Five companies operate in different markets, and it is crucial to compare the performance of different companies to the relative industry performance. Apple operates in the consumer electronics industry, and it should be compared to the trends in this industry. Table 3 below demonstrates the revenue growth of the world consumer electronics market in comparison with Apple’s revenues. The results of the comparison demonstrate that Apple outperformed the industry in terms of 5-year revenue growth with 48.5% against 7.4% (Morning Star, 2023a; Statista, 2023). However, in 2022, the company’s revenues grew by 7.9%, while the industry experienced negative growth.

Table 3. Consumer Electronics market comparison (in $ million).

Other companies were not as successful in comparison with the industries in which they operate. For instance, Caterpillar experienced a 16.7% growth in 2022, which was below the overall industry revenue growth of 22.6 % (Morning Star, 2023b; CSI Markets, 2023). Consolidated Edison experienced a 14.5% revenue growth in 2022 in comparison with the 11.66 % revenue growth of the energy industry (Morning Star, 2023c; CSI Markets, 2023).

Northern Trust’s revenues grew by 4.5% in 2022, while the industry revenues increased by 11.49 % (Morning Star, 2023d; CSI Markets, 2023). Finally, Macy’s experienced an insignificant growth of revenues in 2022 with less than 1%, while the overall retail industry increased by 24.2 % (Morning Star, 2023e; CSI Markets, 2023). Thus, from the point of view of revenue growth, Apple and Consolidated Edison were attractive investments.

Key Stakeholders

Publicly traded companies have various stakeholders, including shareholders, customers, employees, suppliers, regulators, and communities, who have a direct or indirect interest in the company and its performance. Shareholders expect the company to generate profits and increase the value of their investments (Quiry et al., 2022). Consumers anticipate that the business will offer premium goods and services at competitive prices (Quiry et al., 2022). Workers anticipate a safe workplace, chances for professional advancement, and equitable compensation and benefits (Quiry et al., 2022).

Suppliers anticipate that the business will continue to be financially stable and make its bill payments on schedule (Quiry et al., 2022). Regulators expect the company to operate in compliance with laws and regulations, while communities expect the company to be a good corporate citizen by creating jobs, supporting local charities, and minimizing its impact on the environment (Quiry et al., 2022). Ultimately, all stakeholders expect the company to operate in a responsible and ethical manner while generating sustainable value over the long term.

Portfolio

Assets

The central objective of the XYZ company is to ensure capital growth above the company’s cost of capital. Since the company does not require immediate growth, it can use constant weight asset allocation. The buy-and-hold strategy associated with a constant weight asset allocation model can be acquired only by an investor who does not require fast returns on investment. Therefore, it is recommended to allocate around 70% in equities and 30% in bonds since the company can tolerate moderate risk due to the comparatively low cost of capital.

Two stocks are recommended for inclusion in XYZ’s portfolio, including Apple and Consolidated Edison. Apple’s stock is associated with expected five-year returns of 30.5% with a beta of 1.3 (Morning Star, 2023a). It is recommended that the XYZ company allocate 50% of Apple’s equity. Even though Apple promises high returns, the stock is associated with increased volatility in comparison with the market, which is signified by the beta above 1. Therefore, investment in the stock may be associated with increased risk. In order to mitigate this risk, the XYZ company is recommended to invest 20% in Consolidated Edison’s equity.

ED’s stock is associated with five-year returns of 8.51% in comparison with the industry’s 8.16%. However, the company’s beta is as low as 0.37, which demonstrates a very low level of volatility and associated risk (Morning Star, 2023a). The analysis of expected 5-year returns, along with the companies’ growth rates, revealed that investments in other equities were not recommended for the XYZ company.

There are two bonds that are recommended for inclusion in the portfolio of the XYZ company to mitigate the possible risks of investment in highly volatile stock, such as Apple. In particular, the XYZ company is recommended to invest in bonds of Consolidated Edison and Northern Trust. Both ED and NTRS have very low leverage levels that are close to industry averages. In particular, ED has a D/E ratio of 0.3 in comparison with the industry average of 0.33, while NSTR has a D/E ratio of 0.08 with an industry average of 0.06. The XYZ company is recommended to invest 15% in Northern Trust’s bonds with an expected 5-year return of 4.44% and 15% in Consolidated Edison’s bonds with an expected return of 5.66%. Such allocation of investment in bonds can ensure control for volatility risks.

Securities

The proposed portfolio included two stocks out of five assessed possibilities. One of the reasons why these two stocks were included is because they had the highest average annual growth rate for the past five years. In particular, Apple’s stock had the average annual growth rate of 13.53%, while Consolidated Edison’s stock grew at 4.02%. Table 4 below demonstrates annual net income by year.

Table 4. Net income by year (in million $).

The two stocks were evaluated to understand their intrinsic value using the following formula (where r is the expected growth rate):

Intrinsic Value = Earnings per Share (EPS) * (1+r) * P/E Ratio

Thus,

Apples Intrinsic Value = 6.11 * (1 + 0.135) * 29.41 = 203.95

Consolidated Edisons Intrinsic Value = 4.67 * (1+0.04) * 14.12 = 68.58

Rates of Return

The suggested portfolio will have the following expected rate of return:

ERR = 30.5% * 0.5 + 8.51% * 0.2 + 43.44% * 0.15 + 5.66% * 0.15 = 18.5%

The suggested portfolio is expected to have a high expected rate of return. However, it is crucial to calculate a benchmark required rate of return based on the capital asset pricing model (CAPM) and dividend growth rate model for NSTR. CAPM is one of the most widespread models for evaluating the expected rate of return. Assuming that the risk-free rate is 3.57% (Y-Charts, 2023), the expected five-year market return is 14.5% (Thune, 2023), and a beta of 1.08 (Morning Star, 2023d), CAPM suggests the following rate of return of NSTR, which was taken as a benchmark

ERR = Riskfree Rate + β * (Market Returns – RiskFree Rate) = 3.57% + 1.08 * (14.5% – 3.57%) = 15.53

Assuming that NSTR has a dividend growth rate of 8% per annum and the company’s dividend yield is 4.93%, the dividend growth model suggests the following cost of equity:

ERR = Dividend Yield + Dividend Growth = 4.93% + 8% = 12.93%

Thus, the suggested portfolio is above the expected rates of return calculated by both models.

Risk-Return Trade-Off

The proposed portfolio consists of a mix of equities and bonds. The equity portion includes investments in Apple and Consolidated Edison, while the bond portion includes investments in Consolidated Edison and Northern Trust. The allocation is as follows:

Equities:

- 50% in Apple

- 20% in Consolidated Edison

Bonds:

- 15% in Northern Trust

- 15% in Consolidated Edison

The expected rate of return for the portfolio is calculated to be 18.5%. However, it is important to compare this expected rate of return with benchmark rates of return to assess the risk/return trade-off.

For Northern Trust (NSTR), two models are used to calculate the benchmark rates of return: The Capital Asset Pricing Model (CAPM) and the Dividend Growth Model.According to the CAPM, the recommended benchmark return for NSTR is 15.53%, based on a risk-free rate of 3.57%, an anticipated five-year market return of 14.5%, and a beta of 1.08 (Morning Star, 2023c). The Dividend Growth Model, on the other hand, suggests a benchmark return of 12.93% for NSTR, assuming a dividend yield of 4.93% and a growth rate of 8%. When compared with the expected return of 18.5% for the portfolio, it becomes clear that the proposed portfolio is expected to outperform both benchmark rates, indicating a potentially higher return on investment.

However, it is essential to acknowledge that this higher expected return comes with increased risk, especially due to the inclusion of Apple stock, which has a higher beta (1.3) and volatility (Morning Star, 2023a). The proposed portfolio aims to mitigate this risk by allocating a smaller portion (20%) to the less volatile Consolidated Edison (beta = 0.37) stock and diversifying further with bond investments. Additionally, the portfolio aims at decreasing the possible risk by investing in bonds of Consolidating Edison, which have a beta of only 0.31, and bonds of Northern Trust, which have a beta of 0.97 (Morning Star, 2023b; 2023c).

The associated risk can be calculated using the portfolio’s beta, which can be calculated using the following formula:

Portfolio Beta = (Weight of Apple * Beta of Apples) + (Weigth of Consolidated Edison * Beta of Consolidated Edisons) + (Weight of Northern Trust * Beta of Northern Bonds) + (Weigth of Consolidated Edison Bonds * Beta of Consolidated Edison Bonds) = 0.5 * 1.3 + 0.2 * 0.37 + 0.15 * 0.97 + 0.15 * 0.31 = 0.916

Executive Summary

Position

Making the proposed investments in the portfolio can position the XYZ company within its industry and the market in several ways. First, by investing 50% of the equity allocation in Apple, XYZ company gains exposure to one of the leading technology companies globally. Apple’s stock is associated with high expected returns, indicating potential growth opportunities. Investing in Apple can position XYZ company as being aligned with technological advancements and innovation within the industry.

Second, including Consolidated Edison in the portfolio, with a 20% equity allocation, offers diversification benefits. Consolidated Edison operates in the utilities sector and is known for its relatively stable business model. Investing in a company with low volatility and moderate returns can provide stability to the portfolio, mitigating the potential risks associated with the higher volatility of Apple’s stock. This diversification strategy can position XYZ company as one that carefully balances risk and return within its investment approach.

Finally, through proposed investments, XYZ company gains exposure to the technology sector through Apple and the utilities sector through Consolidated Edison. This exposure aligns XYZ company with key sectors and industries within the market, allowing it to benefit from the growth and performance of these sectors. It positions XYZ company as having a diversified investment approach that covers different areas of the market.

Benefits

The proposed investment is associated with three central benefits. First, the expected returns of the portfolio are 18.5%, which is above the benchmark values. This implies that the company is expected to have higher income from investment activity. Second, the volatility of the proposed investment is lower than the market’s, which implies that the investment is associated with low risks. Finally, the investment allows the XYZ company to gain exposure to the leaders in various markets, which strengthens its position.

Investment Performance

There are several strategies for evaluating the portfolio’s performance, including Sharpe Ratio, Treynor Ratio, and Jensen’s Alpha. This paper utilizes Treynor’s ratio to evaluate the portfolio’s performance. The Treynor Ratio is a performance measurement ratio that assesses the risk-adjusted return of an investment or portfolio (Kenton, 2020).

The Treynor Ratio allows investors to evaluate how efficiently a portfolio generates returns given the level of systematic risk it assumes. A higher Treynor Ratio indicates better risk-adjusted performance, as it reflects a higher return generated per unit of systematic risk taken (Kenton, 2020). Treynor’s ratio can be calculated using the following formula:

Treynor Ratio = (portfolio Return – Risk – FreeRate) / Portfolio Beta

Treynor Ratio = (18.5% – 3.57%) / 0.916 = 16.3%

The proposed portfolio has a risk-adjusted return of 16.3%, which is above the expected five-year market return of 14.5%. Thus, it may be stated that the recommended portfolio is associated with high performance.

Risk-Return Metrics

Overall, the risk/return trade-off in this proposed portfolio leans towards higher expected returns compared to the benchmark rates of return calculated by the CAPM and Dividend Growth Model. However, higher risks associated with returns were mitigated by adding less volatile stock and bonds, which allowed for a decrease in the overall beta of the portfolio. A higher expected rate of return comes with higher risk, particularly due to the inclusion of Apple stock. However, the risks were mitigated using bonds and stocks of companies with low volatility.

Meeting Objectives

The proposed investment is in accord with the objectives of the XYZ company. The company’s primary aim company is to stay financially profitable with minimal risk to ensure the support of investors. The proposed investment is associated with high growth, which contributes to the company’s income from investing activity. At the same time, the proposed investment is associated with relatively low volatility, which ensures decreased risks.

References

Escobar, S. (2023). Macy’s Warns Consumers Will Be Pressured in 2023. Retail Shares Are Slipping. Barron’s. Web.

CSI Markets. (2023). Industry Revenue Growth Rates. Web.

Kenton, W. (2020). Treynor Ratio: What It Is, What It Shows, Formula to Calculate It. Web.

Macrotrends. (2023a). U.S. GDP 1960-2023. Web.

Macrotrends. (2023b). NASDAQ Composite Index. Web.

Macrotrends. (2023c). S&P 500 Historical Annual Returns. Web.

Macrotrends. (2023d). Dow Jones – 10 Year Daily Chart. Web.

Morning Star. (2023a). Apple Inc. Web.

Morning Star. (2023b). Caterpillar Inc. Web.

Morning Star. (2023c). Consolidated Edison Inc. Web.

Morning Star. (2023d). Northern Trust Inc. Web.

Morning Star. (2023e). Macy’s Inc. Web.

Pound, J., & Subin, S. (2022). Stocks fall to end Wall Street’s worst year since 2008, S&P 500 finishes 2022 down nearly 20%. CNBC. Web.

Quiry, P., Le Fur, Y., & Vernimmen, P. (2022) Corporate Finance: Theory and Practice. Wiley.

Statista. (2023). Consumer Electronics – Worldwide. Web.

Thune, K. (2023). What Is The Average Return Of The Stock Market? Seeking Alpha. Web.

Y-Charts. (2023). 10 Year Treasury Rate. Web.