Introduction

The performance level of any product in the marketplace depends on its reception by the target consumers relative to other competing brands placed in the same market. Marketing encompasses one of the noble activities adopted by any organisation in an effort to create awareness of value for its products and services. A fundamental interpretation of the marketing function in an organisation is that marketing entails the art of selling.

However, selling is only a small fraction of concerns of marketing for a product like the Dilmah Ceylon tea brand since selling is accomplished in an environment dominated by various multinational competing brands such as the Unilever tea.

Marketing products involving stiff competition in terms of both value and volume entails market research, market segmentation, setting of marketing strategies, evaluation of the marketing environment, and positioning (Kotler et al. 2009). This paper considers these aspects of marketing in the discussion of the marketing of the Dilmah Pure Ceylon Tea brand in the Australian market.

Background to Dilmah Ceylon Tea brand

Ceylon (Sri Lanka) is located in the Indian Ocean and historically, the nation is famous for spices, beauty, and tea coupled with gems (Herath 2004). Natural resources coupled with the strategic location of the island made it primary area of interest for foreigners. In particular, foreign inversion by the Europeans was driven by spices coupled with the need to establish a base for control of India (Herath 2004).

The presence of the Europeans in Sri Lanka was particularly important in the development of Ceylon as an agricultural nation. According to Herath (2004, p.1), ‘by 1948, the most important export crops were tea (65%), rubber (13%), and coconut products (19%)’. Despite the size of Ceylon in the mid 1950s and 1960s, the country accounted for 20 per cent of all tea consumed across the globe. As depicted by appendix 1, tea has been an important crop grown in Ceylon between 1965 and 1998.

Although Ceylon tea was consumed in many countries since the commencement of tea exportation from Sri Lanka, the largest exportation to Australia took place between 1960s and 1970s. This exportation accounted for 70 per cent of the total tea consumed (Arambewela 2013).

Nevertheless, as Arambewela (2013, p.506) notes, ‘the Ceylon tea market share started to decline in the early 1980s, both in terms of volume and value, and an overhaul of the Ceylon tea marketing strategy was thus considered necessary to arrest this decline’. One of the adopted strategies involved rebranding Ceylon tea brand, while ensuring that the new brand continued to represent quality perceptions of the Ceylon tea brand amongst its consumers.

The above concern led to the creation of the Dilmah Pure Ceylon tea brand in 1984. During this period, the Australian tea market had many other competing brands at multinational and national levels. According to Arambewela (2013, p.506), these brands included ‘Lipton, Bushells, Lanchoo, Tetleys, Harris, and Twining’.

The brands had managed to establish an immense market share for tea Australia. This aspect made Dilmah Pure Ceylon Tea brand to encounter an immense threat whilst making a new entry in the market. This assertion means that marketing environment for the new brand was not welcoming. Any effort to develop a marketing strategy aimed at winning back the market share for Ceylon Tea brand established in the early 1960 to late 1970s called for scrutiny of the marketing environment for the brand.

Marketing environment for Dilmah Ceylon Tea

Products are offered for sale in a market comprising of substitutes. This assertion means that various factors influence successful placement and the actual sale of products in the marketplace. At an organisational level, such factors emanate either internally within an organisation or externally.

In an attempt to develop a successful marketing plan, it is crucial to conduct a thorough analysis of internal and external factors that affect the performance of a product in the market environment. Competition entails one of the factors, which shape the marketing environment. The figure below shows various factors, which shape competition.

Factors shaping competition in a marketing environment

Source: (Keller 2004, p.71)

A number of factors influence decisions made by the marketing team for any product including the Dilmah Pure Ceylon tea brand. From the PEST EL organisational analysis approach, these factors are political, economic, social, technological, environmental, and legal factors (Gerry, Kevan & Whittington 2005).

For the Dilmah Pure Ceylon tea brand, political environment affects the performance of the product via taxing policies since taxes are levied from the profit margins upon the selling of a product. These taxes are incorporated in setting of price of the tea products sold in Australia.

Since profit margins per item are lower for cheaper products, which may be of equal quantity and quality with Dilmah Pure Ceylon tea brand, cheaper brands are more likely to make higher sales volumes in comparison to Dilmah Pure Ceylon tea brand. The overall effect of this scenario in performance of a brand is more pronounced where the market demand is driven by price concerns.

From the perspective of economic factors, the selling economic environment for Dilmah Pure Ceylon tea brand is characterised by intensive competition and influx of various imported tea product brands from Sri Lanka and other parts of the world including East Africa, into the Australian market.

The influx of new tea product brands emanates from new importing organisations seeking to acquire part of the Dilmah Pure Ceylon tea brand’s market share in the Australian market.

Social factors act as an immense success factor for the Dilmah Pure Ceylon tea brand. Arambewela (2013, p.506) confirms that the marketing environment of Dilmah Pure Ceylon tea brand is affected by social factors when he states that the ‘advent of tea bags, green tea, and herbal tea products was a direct result of trends towards convenience and healthy lifestyles.

This trend has had a major impact on the marketing of tea in Australia’. In search of convenience, tea consumers also try other alternative products such as coffee. This aspect implies that the Dilmah Pure Ceylon tea brand faces major marketing challenge for ensuring customer loyalty to the product.

Managing a product delivered in the national market calls for the need of embracing technology in management of chain supplies and logistics. The Dilmah Pure Ceylon tea-brand management team handles large size of information relating to purchases, sales, and even the workforce data.

Fhe ever-changing technological developments and challenges of increased costs of learning business underscore yet a major challenge encountered in the Dilmah Pure Ceylon tea brand marketing environment. These challenges are articulated to the needs of keeping software application updated in an effort to ensure competitiveness in terms of effectiveness in handling all product-related information.

Dilmah Pure Ceylon tea brand embraces the use of tea bags as a means of packaging. This aspect creates the concern of environmental impacts of the brand in the manner of disposal of these bags.

Environmental concern for the Dilmah Pure Ceylon tea brand varieties is of great concern to the company especially given that Australia has policy frameworks to guide disposal of products and products’ associated wastes with the best practice being entirely environmentally green. Such legal provisions have the impact of increasing the costs of packaging of tea products. The tea bags used must be biodegradable.

Even though the above factors affecting the operation environment for any product are important, they are incomplete without discussing the competitive force in the market place. From the context of substitutes, the greatest threat for the Dilmah Pure Ceylon tea brand emanates from carbonated beverages coupled with coffee.

The main driver for consumption of these substitutes in comparison to tea mainly entails search for convenience coupled with search for variety (Arambewela 2013). This realisation suggests that the creation of a variety of the Dilmah Pure Ceylon tea brand to suit different consumer needs especially differing levels of convenience may help to reverse the consumption of alternative products in favour of tea.

Australia constitutes an attractive market for various tea brands. Arambewela (2013, p.506) supports this assertion by noting that Australia ‘is among the largest tea-consuming countries in the world, with per capita consumption of around 0.55 kilograms’. Table 1 below shows the extent and the degree of rivalry of competition of tea brands in the Australian market.

Table 1: competitions of tea brands in Australia

Source: (Arambewela 2013, p.506)

From the table above, AB foods coupled with Unilever constitute the major key multinational players in the Australian tea market. The two players account for 56 per cent of the total tea market share. This aspect means that other competing brands including the Dilmah Pure Ceylon tea brand battle to gain dominance for the remaining 44 per cent market share. Arguably, this aspect implies that the competitive market environment for the Dilmah Pure Ceylon tea brand in incredibly fragmented.

In comparison to the competing tea brands, the Dilmah Pure Ceylon tea brand has the advantage of higher brand value in relation to product-sales market volume. This aspect is evident as Arambewela (2013, p.506) notes that in the year 2010, ‘the grocery value of tea was estimated at $294.5 million, while the total volume stood at 11,184 tons’.

This value was accompanied by 2.3 per cent rise in the tea market value nationally and 2.1 per cent rise of tea sales volume. Although market share competition from various rival multinational organisations was immense, Dilmah acquired 14 per cent market share from the paradigms of market value and 12 per cent market share in the context of tea market volume. The aforementioned statistics suggest the existence of room to capitalise on positioning the Dilmah Pure Ceylon tea brand as a high-value quality tea product.

However, as argued before, the consumption trends of tea products are subject to social factors manifesting themselves in terms of changing lifestyles depending on demographic characteristics of consumers. This assertion implies that while attempting to position the Dilmah Pure Ceylon tea brand appropriately, focus on mechanisms of market segmentation is important to prevent the Dilmah Pure Ceylon tea brand loyal consumers from trying new alternatives to tea in the quest to satisfy their emerging lifestyles.

Market segmentation for Dilmah Ceylon Tea

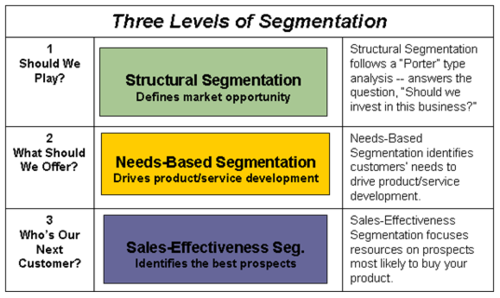

For a firm to succeed in placing its brand strongly, it needs to determine its market segment precisely. Market segmentation encompasses division of consumers into subsets constituted by common needs in terms of consumption of goods and services offered for sale (Yelkur 2007). Figure 2 below shows various ways of segmenting a market

Fig 2: levels of segmentation

Source: (Yelkur 2007, p.107)

After segmentation, appropriate market campaigns are set to target the subsets. For the Dilmah Pure Ceylon tea brand, market segmentation can be accomplished in two main ways, viz. demographic segmentation, and psychographic segmentation. Demographics refer to the characteristics of people such as age, religion, gender/sex, and social class among others (Menon et al. 1999).

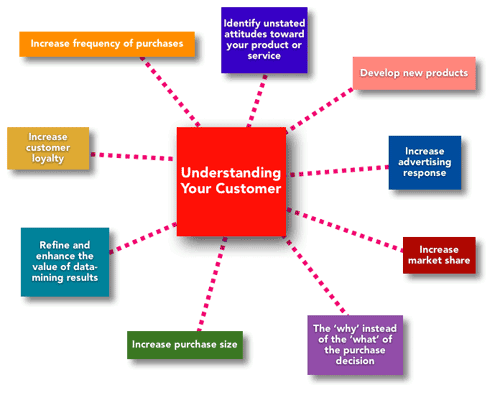

Psychographic segmentation is based on the reason why people buy products and services. According to Xiaoni and Prybutok (2008, p.9), ‘by creating psychographic profiles, marketers are in a position to understand the motivation and conscious drives of a target audience’. In terms of segmentation, psychographics encompass the people’s opinions and interests coupled with opinion variables. Pictures 1 below shows how psychographic segmentation may be accomplished

Picture 1: psychographic segmentation

Source: (Xiaoni & Prybutok 2008, p.9)

From the context of demographic segmentation, through new media, the Dilmah Pure Ceylon tea-brand target group is young people who are highly accessible to social media and Internet-based buying and selling systems. Studies show that people whose age falls between 10 and 45 years highly embrace the Internet (Maktoba, Ian & Sonny 2011).

This aspect means that such people are more likely to use the social media networks such as Facebook, Twitter, and MySpace among others. This group of people forms the main target subsets for marketing campaigns employing the benefits of the social media such as speed and cost-effectiveness in the promotion of brand or brand varieties.

The attitudes and interests of people for different products are dependent on various variables such as preferences. From the paradigms of psychographic segmentation, the target populations are the Australian people and other people from different nations residing in Australia.

These segments are divided into the middle class and working class persons. Offering products for sale at large retail shops such as supermarkets can be the most effective way of reaching out for the middle class and working class as such classes are likely to shop in supermarkets as opposed to small stores (Simon 2007).

While targeting this group of people, it is important to maintain high quality and value-driving forces for sale of the Dilmah Pure Ceylon tea brand varieties, since the middle class and the working class people are highly responsive to quality standards of products and services (Philport & Arbittier 2007). This assertion means that for success in restoring the early 1960s to 1970s dominance of the Ceylon tea in the Australian marketplace, an effective Dilmah Pure Ceylon tea brand positioning strategy is of great importance.

Brand positioning is enhanced through developing unique identifiers of an organisation so that when customers see the identifiers, the images of the products and services offered by the organisation are invoked. Customers not only buy a product or pay for a service, but also they pay for the brand image (Holt & Quelch 2004).

According to Keller (1998, p.27), brand image is a ‘perception of customers when they see a brand and reflected by brand associations in their mind’. This aspect implies that brand positioning refers to the manner in which an organisation wants its customers to think about its products or services. Ceylon tea is not a new brand in Australia (Arambewela 2013); hence, great efforts are required to ensure that the target market segments are aware of the continued quality presence of the Ceylon tea in the Dilmah Pure Ceylon tea brand.

For an organisation to penetrate the target markets effectively, it requires to differentiate its brand from all other brand of the competitors. Brand differentiation refers to the unique symbols or any other means of identifying and distinguishing an organisation from other organisations even though two or more organisations offer similar products or services (Hill & Ettenson 2005). Organisations not only sell products or charge for their services, they also sell their brands.

A number of elements including the brand name, logo sounds, tagline, tastes, and scents among others identify brands. Dilmah should deploy a unique logo in the Australian market in an attempt to make the target market perceive it as uniquely offering tea product varieties. Slogans such as ‘I like Dilmah Pure Ceylon tea brand experience’ can incredibly aid in soliciting for happy thoughts amongst customers whenever they see Dilmah Pure Ceylon tea advert or even get the urge to take tea.

Management of the marketing mix variables for Dilmah Ceylon Tea brand

Marketing mix embraces various choices that organisations make to ensure that their products or services are availed to the market (place) at the right price using the appropriate promotional strategies (Menon et al. 1999). Marketing mix for the Dilmah Pure Ceylon tea brand encompasses four mains aspects, which include place, price, promotion, and the product.

Place

The place of sale of the product is in all supermarkets, hypermarkets chain stores, and even in local stores across Australia. This place is justified by the view that marketing of the Dilmah Pure Ceylon tea targets people of all social economic status. This aspect makes it possible to place the Dilmah Pure Ceylon tea.

Failure to offer the product at all the places where the Dilmah presence is felt is tantamount to breach of a strong brand positioning strategy pursued in the Australian tea market. In a place of sale, brand needs to present good features (Rust, Zeithaml & Lemon 2008). For instance, the brand should be appealing to the target market segments.

Product

The product offered for sale is the Dilmah Pure Ceylon tea and its brand. In Australia, Dilmah presents a collection of product varieties represented by the brand of the Dilmah. Arambewela (2013, p.507) notes that these product varieties range from ‘gourmet black tea, original gardens teas, green tea, decaffeinated tea, real white tea, organic tea, and real chai to a variety of herbal infusions’.

Hence, the success of the Dilmah brand in the new market is a measure of the success of the Dilmah Pure Ceylon tea. Ensuring that customers are connected and maintained requires the creation of a dialogue that is sensible with the customers. Holt and Quelch (2004, p.73) posit, ‘the importance of brand in a business strategy affirms a paradigm of calculating its economic value called brand equity’.

Brand equity entails a long-term investment that Dilmah has to manage effectively since it is the measure of economic value for a company. Without effective management of the brand equity for Dilmah, it is practically impossible to gain optimal profitability for the new Ceylon tea brand, viz. Dilmah Pure Ceylon tea.

Pricing strategy

Price is an important aspect for recapturing the 1960s to 1970s’ market share for the Ceylon tea brand in the Australian tea market. Since some multinational companies have been in a position to acquire some of the Ceylon tea brand’s market share through low pricing strategy, it is important for Dilmah to consider the possibility of deploying low-price strategy to re-penetrate the tea market.

However, Khosla (2010, p.220) warns that while employing this strategy, it is crucial to note that the ‘price of a product involves the examination of customers’ perceptions and rival products and the costs of manufacture’. The price of a product is set such that an organisation is in a position to cover its direct and indirect costs and earn a profit margin.

Price for the products offered by the Dilmah tea product in the Australian market should be set such that the target market population will buy large enough number of products for the company to make a significant profit margin that would make it break even and deliver value to its investors.

Promotional strategy

People share information on the experiences of consuming various products through various forms of media especially the Internet and social media.

Consequently, these platforms form some of the promotional media that the Dilmah should prioritise. In essence, through the social media and the Internet, it is possible to reach a large number of people globally with minimal expenditure of financial resources (Abhamid & McGrath 2005). Customers themselves share promotional information. Point of sale promotion is also an additional cost-effective promotional technique.

Incidences of negative profiling of the Dilmah Pure Ceylon tea brand varieties may be spread through the social media and the Internet. This aspect implies that in an effort to build a strong brand in Australia that will overcome the brand positioning challenges in the future, the Internet and the social media form important promotional platforms. Multinational organisations offer cheap tea brands developed from tea produced in Sri Lanka and other places.

Pursuing low pricing strategy to compete effectively with the multinational organisations requires Dilmah to minimise costs. Apart from the limited use of traditional media such as newspapers and magazines coupled audio and audio visuals to alert people about the renewed brand of Ceylon tea in the Australian market, point of sale promotion is also incredible in retaining new and existing customers.

Conclusion

A major critical mechanism of inducing increased consumption of an organisation’s brand entails the development of customer satisfaction and loyalty to the brand through designing of an appropriate product marketing mix. Since this goal is unrealisable without prior knowledge of the marketing environment, this paper first discussed the nature of the marketing environment for Dilmah Pure Ceylon tea before progressing to offer a discussion of the product marketing mix of the Dilmah Ceylon tea brand.

The paper also argued that incorporation of brand in the design of marketing planning for the Dilmah Pure Ceylon tea brand is crucial since brand identifies and distinguishes an organisation from other organisations even though two or more organisations offer similar products or services.

Appendix 1: primary exports for Sri Lanka between 1965 and 1998: percentage composition at current prices, two-year averages

Source: Herath (2004, p.3)

Reference List

Abhamid, N & McGrath, M 2005, ‘The Diffusion of Internet’s Interactivity on E-tail Web Sites: A Customer Relationship Model’, Communications of the International Information Management Association, vol. 2 no.1, pp: 45-70.

Arambewela, R 2013, ‘Dilmah Ceylon Tea: Market development in Australia’, in B Sharp (ed), Marketing: Theory, Evidence, Practice, Oxford University Press, South Melbourne, pp. 506-507.

Gerry, J, Kevan, S & Whittington, R 2005, Exploring corporate strategy: text and cases, Prentice Hall, London.

Herath, K 2004, ‘Tea industry in Sri Lanka and the roles of Dilmah tea’, Delhi Business Review, vol.5 no.1, pp. 1-15.

Hill, S & Ettenson, T 2005, ‘Achieving the Ideal Brand Portfolio’, Slogan Management Review, vol.2 no.1, pp. 85-90.

Holt, A & Quelch, T 2004, ‘How Global Brands Compete’, Harvard Business Review, vol.7 no.3, pp. 68-75.

Keller, L1998, Strategy Brand Management: Building, Measuring, and Managing Brand Equity, Prentice Hall, Upper Saddle River.

Khosla, S 2010, ‘Consumer Psychology: The Essence of Marketing’, International Journal of Educational Administration, vol. 2 no. 2, pp. 220–225.

Kotler, P, Adam, S, Denise, S & Armstrong 2009, Principles of marketing, Prentice Hall, Upper Saddle River.

Maktoba, O, Ian, B & Sonny, N 2011, ‘Internet marketing and customer satisfaction in emerging markets: the case of Chinese online shoppers, Competitiveness Review’, An International Business Journal incorporating Journal of Global Competitiveness, vol.21 no.2, pp.224-237.

Menon, A, Bharadwaj, S, Adidam, P & Edison, S 1999, ‘Antecedents and consequences of marketing strategy making,’ Journal of Marketing, vol. 63 no.2, pp. 18–40.

Philport, J & Arbittier, J 2007, ‘Advertising: Brand communications styles in established media and the Internet’, Journal of Advertising Research, vol.37 no.2, pp. 68-76.

Rust, T, Zeithaml, A & Lemon, N 2008, ‘Customer centred brand management’, Harvard Business Review, vol. 82 no.4, pp. 110-118.

Simon, H 2007, ‘Rational decision making in business organisations’, American Economic Review, vol.3 no. 4, pp. 123-129.

Xiaoni, Z & Prybutok, V 2008, ‘An empirical study of online shopping: a service perspective’, International Journal of Service Technology and Management, vol. 5 no.1, pp. 1-13.

Yelkur, R 2007, ‘Customer satisfaction and service product mix’, Journal of Professional Services Marketing, vol. 21 no.1, pp. 105-115.