This essay is devoted to the explanation of discounted cash flow and relative valuation techniques. Both groups of methods are illustrated with examples. While relative valuation techniques are often criticized for inconsistency, this essay tries to explain why these methods are still frequently used both by small investors and financial analysts. Additionally, the essay concludes with specific reference to common mistakes made in the valuation of security due to the irrelevancy of accounting reports.

Discounted cash flow methods

Discounted cash flow (DCF) methods are not new in human history. The ‘philosophy’ behind DCF is very simple and was known from the very earliest times of financial history: the value of assets changes across time. However, it was only in 1930 when DCF techniques were translated on modern financial language and formalized by Irwing Fisher. According to Fisher (1930): “Income is derived from capital goods. But the value of the Income is not derived from the value of the capital goods. On the contrary, the value of the capital is derived from the value of the Income.” Therefore to find out the value of capital now, one must analyze possible changes in the value of Income in the future.

When used for estimating the value of a security, DCF methods do not simply use future cash flows as current ones but consider their ‘discount’ or interest rates when converting them to current. In this way, DCF methods demonstrate two significant benefits. First, they take into account the time value of funds, reflecting the strive of investors to acquire cash as soon as possible. Cash flows discounted with interest rates produce less Income. Therefore current profit is more valuable to an investor than delayed profit. Second, they include risk premium, reflecting extra return offered to investors for the risk of not acquiring future Income at all. There are several well-known groups of DCF techniques — each of them is analyzed below.

Flows to equity approach

The flows to equity approach bases on the notion of free cash flow to equity (FCFE), which indicates how much cash will be available for payout to investors after all expenses, reinvestment, and debt repayment included. Or, expressing in a mathematical way:

FCFE = Net Income – (Capital Expenditures – Depreciation) – (Change in Non-cash Working Capital) + (New Debt Issued – Debt Repayments).

FCFE can be used for determining the value of a company and, therefore, its securities. How exactly? Damodaran (2002) answers this question: “We measure how much cash is available to be paid out to stockholders after meeting reinvestment needs and compare this amount to the amount actually returned to stockholders.” The difference between the actual payouts and hypothetical ones tells us if security is under-or overpriced.

Since we are using a discounted cash flow technique, net Income will be adjusted with the discount rate, and in the case of valuing the project, our formula calculates its net present value (NPV) as follows: NPV = Cash Flow to Levered Equity / Discount rate – Initial Investments + Debt Issued, where Cash Flow to Levered Equity = (Net Income–Debt*rate of return)*(1 – Corporate Tax). Thus, the FTE approach allows us to find the true value of a project; however estimating discount rate can be a problem.

Adjusted present value approach

The second important technique, which becomes particularly useful when time change of debt to equity ratio is essential, is called the adjusted present value approach. Simply it uses the net present value adjusting it with the present value of financial decisions made by the company. This technique can be divided into three steps: estimation of the net present value of a project, calculation of the present value of interest tax savings, and finally estimation of the probability of bankruptcy and its expected cost. The last step is the most complicated one as the cost and probability of bankruptcy cannot be calculated directly (Ehrhard and Daves, 1999).

The weighted average cost of capital approach

WACC approach shows the return a project must earn to return its stock price constant without changing assets. Illustrated by a formula: WACC = Equity/Total capital * cost of equity + Debt/Total capital * cost of debt (1 – tax rate), where Total capital = Equity + Debt (company’s assets are financed only by debt or equity). Expressed in percentage WACC shows the rate of return, which is desirable, i.e., only investments with the rate of return higher than WACC should be made. Or put it another way, WACC shows how much a company should pay to its investors.

The following example serves as an illustration for a better understanding of DCF techniques described before. Suppose we have a company that requires $5 million to invest, expecting to bring Income of $1.6 million annually. Without losing much detail, we suppose that the company’s income will remain the same forever. Additionally, the company’s required return on all (debt + equity) is 10%, and it wants to use debt of an additional $3 million with the rate of return of 8%. The corporate tax rate is at 40%.

Using the APV technique at first we will find unlevered NPV first: NPV = Income * (1 – Corporate Tax)/Rate of return – Initial Investments=1.6*(1-0.4)/0.1 – 5=1.6*0.6/0.1 – 5=$4.6 million. But our company uses additional financing from debt with an annual interest of 3*0.08=$0.24 million. The tax subsidy from this sum will amount to 0.24*0.4=$0.096 million. Therefore the present value of debt financing decisions will be 0.096/0.08=$1.2. Thus the adjusted NPV will be 4.6 + 1.2= $5.8 million. The real market value of the whole project will be 5+1.2=$6.2 million, and therefore its equity = total value – debt = 6.2 – 3 = $3.2 million.

Under FTE technique the cashflow to levered equity will amount (Income –Debt*rate of return)* (1 – Corporate Tax) = (1.6–3*0.08)*(1–0.4)=(1.6–0.24)*0.6=$0.816 million. Using the debt to equity ratio calculated previously we can find the cost of equity = total cost + debt to equity ratio * (1 – Corporate Tax) (total cost – cost of debt)=0.1 + 3/3.2*(1-0.4)*(0.1-0.08)=0.1+0.937*0.6*0.02=0.1112. Thus the cost of equity is 11.12%. Thus NPV under this approach will be calculated as: NPV = 0.816/0.1112 – 5 + 3=7.33 – 2=$5.33 million.

Finally, WACC can be easily calculated through the formula: WACC = 3.2/6.2*0.1112+(1-0.4)*3/6.2*0.08=0.0573+0.0232=0.0805. Therefore investments in this project will be beneficial under the rate of return higher than 8.05%.

Each of the provided methods has some drawbacks. Under AVP, it is often hard to determine bankruptcy costs and probability. FTE is not helpful in acquiring the required return, and under WACC, debt capacity can alter from reality.

Relative valuation methods

While discounted cash flow valuation methods determine the price of an asset by looking on its expected future cash flows, relative methods determine the price of an asset by comparing it with known prices on other assets claimed to be ‘comparable.’ Usually, relative methods are easier to use then DCF because the former ones do not hold any complex estimation, and use information readily available. Ratios used for relative valuation are numerous. However, we will look into the most widely used: price/earnings (P/E), enterprise multiple, and price/book (P/B).

The price/Earnings ratio simply reflects how much investors are willing to pay per dollar of earnings. It is calculated as market value per share divided by earnings per share. Generally, it is believed that companies with high P/E on their stocks are attractive to investors as earnings are expected to grow in the nearest future. For instance, a company trading $25 per share with earnings over the last year of $2.5 may be more perspective than stocks of another firm at a price of $60 per share and earnings of $8 over the last year, because in the first case P/E=25/2.5=10 and in the second P/E=60/8=7.5, which means that shares of the first company purchased now will bring more earnings in future. Unfortunately, P/E does not seem to be a reliable ratio: “relative P/E-ratio valuation will not be able to handle differences in the expected book return or growth of owners equity” (Skogsvik and Skogsvik, 2001).

Enterprise value (EV) is known to be an alternative to the direct market capitalization measure of a company’s value. EV is sometimes called the takeover value of a company because it includes market capitalization plus debt, minority interests, and preferred shares but excludes total cash and cash equivalents. It is considered that EV is a more accurate representation of a firm’s value, especially if a company has a diverse capital structure.

Still, the most reliable of relative ratios, according to empirical tests of Park and Lee (2003), is the price/book ratio, calculated as stock price/ (total assets – intangible assets and liabilities). Generally, this ratio shows if shares of a company are overpriced or underpriced and how much relative to other companies. For instance, if company A has a market capitalization of $50milion and has assets totaling $15million with debts of 2 million. Then P/B=50/15-2=3.85. Let us assume there is company B with a market cap of $20million, assets of $12 million, and liabilities of $1 million. Its P/B=20/12-1=1.82. It means that A-shares are overpriced in comparison to B, and B shares are underpriced when comparing it with A. Normally, this would mean that B shares are better to buy, and A shares are better to sell. However, P/B is often distorted with other side effects. For instance, the operating performance of B has significantly decreased, and its share prices have fallen down. Or, the CEO of firm A is more popular, and it has fast-growing earnings.

As can be seen, relative methods are often criticized for their inaccuracy. Still, they are widely used not only by small investors because of the simplicity of techniques but also by financial analysts combining them with DCF methods. Damodaran (2001) indicates that relative methods can be helpful in understanding the global picture of the market or one of its sectors, or indicating the presence of mistakes in the portfolio, while DCF tools are more accurate and help to determine local changes, or where those mistakes exactly are.

Of course, despite the method chosen, there is always a probability of making a mistake. While investor or financial analyst relies upon the accounting information available, the accounting reports themselves are often generators of mistakes. Here three most common problems that occurred due to accounting are described.

First, there is always a problem that exists with the calculation of a company’s growth. Since growth can be estimated by computing historical growth rates in dividends, sales, or net profits, such an approach is often too rigid and unable to reflect changes in the company or in the economy. For instance, the increase of competition in a particular business area will most likely slow down terms of growth, and even high-growth companies will not be able to keep with their historical growth rates. At the same time, stock prices of companies showing historically high growth will indicate a continuation of a high growth rate. Therefore, shareholders and investors will acquire lower returns than they would receive from investing in companies, which growth has already stabilized.

Second, estimated required return rates or risk premium could be dimmed through the insufficiency of accounting information. The estimated risk premium is often hard to calculate (Lamdin, 2002) because it has dropped significantly from the rate common to see ten years ago. While even small changes in estimating risk premium may significantly influence a portfolio, Lamdin (2002) indicates that recommended ERP oscillates from 2 to 10 percent, which shows rather wide frames for ERP.

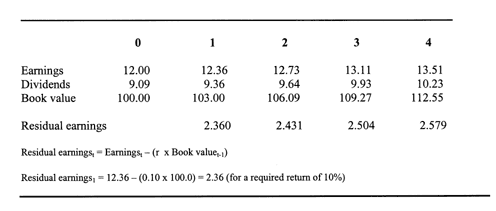

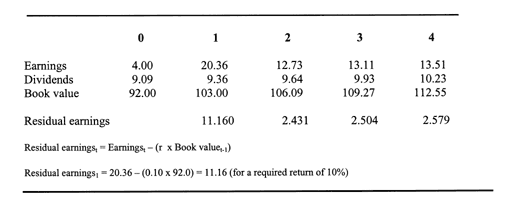

Finally, forecasting dividends is also greatly affected by accounting information. Penman (2003) argues: “GAAP net income and earnings per share misses aspects of a firm’s operations that bear upon the valuation of shares”. Notice from exhibits 1 and 2 how earnings were generated by conservative accounting.

Conclusion

As can be seen, both discounted cash flow and relative valuation methods can be useful when applied with caution to their strengths and limitations. Being useful tools for investors and analysts DCF and relative methods are best used together in combined mode in order to receive the most comprehensive picture on the stock market.

References

- Damodaran, A. (2002). Investment Valuation: Tools and Techniques for Determining the Value of Any Asset. 2nd ed. Chapter 14: “Cash flow to equity discount models”. John Wiley and Sons. Web.

- Damodaran, A. (2001). “Its all Relative: First Principles of Relative Valuation”, Working paper.

- Ehrhard, M.C., Daves, P.R. (1999). “The Adjusted Present Value: The Combined Impact of Growth and the Tax Shield of Debt on the Cost of Capital and Systematic Risk”. Whitepaper published by Odellion Research. Web.

- Fisher, I. (1930). Theory of Interest. The Macmillan Company, New York. Web.

- Lamdin, D.J. (2002). “New estimates of the equity risk premium and why we need them: sharpening estimates of an important financial variable”. Business Economics, Web.

- Park, Y.S., Lee J.-J. (2003). “An empirical study on the relevance of applying relative valuation models to investment strategies in the Japanese stock market.” Japan and the World Economy, vol. 15, issue 3, pages 331-339.

- Penman, S.H. (2003). “Quality Accounting For Equity Analysis”. The Saxes Lectures in Accounting.

- Skogsvik, K. and Skogsvik, S. (2001). “P/E-ratios in Relative Valuation – a Mission Impossible?” Working Paper, Stockholm School of Economics. Web.