- Introduction

- Executive Summary

- Macroeconomic Condition Comparison between Japan and the U.S.

- Financial System Comparison of Japan and the U.S.

- Political and Cultural Environment Comparison between Japan and U.S.

- Legal and Business Issues

- Recommendation and Risk Assessment for Business Investments

- Conclusion

- References

Introduction

Japan and the United states are two of the world’s largest economic powers, and they together account for the world’s 30 percent of the Global Domestic Product, a large position of international trade and a bigger portion of international investment. The economic power of the two countries makes them powerful actors in the international economy.

The economic conditions and the business environment of both Japan and USA have a lot of impact on the rest of the world, and their bilateral economic relations can shape the economic conditions of other countries. The economic relationship between the two countries is a symbiotic one since they are heavily integrated in the flow of goods and services and are the larger markets for each other’s imports and exports.

Both countries are connected via capital flows. The relative importance of Japan and the USA as economic partners has been eroded following the rise of China as a major economic power but from the analysis of trade and other economic data, the bilateral relationship between the two countries is still important (Arnold, 2010).

The economies of the two countries are relatively similar in various aspects like high level of industrialization hence their populations are guaranteed of high standard of living, but their differences emerge from the fact that the economy of USA is almost two times larger than that of Japan based on nominal and the purchasing power parity, and the USA economic growth has been growing at a stronger rate.

The following is the comparison of the two countries based on-key economic indicators.

As a response to the pressures of recession, Japan has eased its restriction on foreign business. There is growing indication by the government to rely on market’s forces, and it has minimally relied on planning for any economic growth. This has highly favored the U.S. companies that are interested in marketing their products in the crucial Japanese market.

Executive Summary

The essay gives an in-depth analysis of Japanese economy and its international business potential. It analyzes the country’s macroeconomic situation, financial system, political and cultural environment, risks assessment and legal and business issues. Some of the above variables are explained in comparison with the U.S.

The two countries pursue different exchange rates; the U.S. pursues floating exchange rates while Japan pursues pegged exchange rates. Consequently, the paper examines the two financial systems that are practiced in two countries; that is, bank based and market based financial system. The inflation figures of the two countries are also given theoretically and statistically.

An analysis of the cultural and political environment is provided and backed up by vivid composition between Japan and the U.S.

The essay also provides an insight into the legal and business issues involved in conducting business in Japan and an analysis of investment risks in Japanese business potential with a recommendation at the end based on the risks. The paper ends with a conclusion on the international and business potential of Japan.

Macroeconomic Condition Comparison between Japan and the U.S.

The governments of the two largest economies have been pursuing two different exchange rates policies namely freely floating exchange rates and pegged exchange rates.

The U.S. has pursued the floating exchange rates by allowing the markets’ rates to shape the direction of the exchange rate value of its currencies while Japan has applied the pegged exchange rate regime that involves heavily intervening in the foreign exchange market that involves buying dollars and selling their currencies so as to sustain a politically defined and below market exchange rate that is pegged to the U.S. dollar.

This is aimed at enhancing the price advantage of their manufactured exports in the U.S. and the European markets (Brady, 2008).

The Japanese macroeconomic and financial markets have a lot of features that are distinct to that of the U.S. Regarding to the financial markets, Japan emphasize on the government intervention on interest and credit rates and any financial disequilibrium that might arise from the financial market.

Business loans from all commercial banks have a lot of influence on the investment and production behavior of Japan due to the high borrowing ratio in Japan. There is, however, no intervention by the government on the cal market or the federal funds market since the interest rate are set by brokerage firms with guidance from the bank of Japan.

External shocks have a large impact on the Japanese economy and the consumer and wholesale prices reflect the current import prices in these circumstances, monetary policy is considered to be the cure for balance of payment (Baumol & Blinder, 2010).

International trade: in comparing Japan and the U.S. in terms of economic performance and disturbance, the degree of dependence of foreign trade is a critical factor to be considered. Japan highly depends on international trade, and hence its imports are susceptible to volatile disturbances of global markets. In this vein, external shocks may result in increased price of imports.

Japan, while comparing with the USA has different characters regarding foreign trade. In Japan, the export and import ratio is higher than that of the USA. Consequently, majorities of the Japanese imports are made up of raw materials, food, oil; the prices of these products are subjected to high variability.

The ratio of these commodities in the U.S. is almost half. A small percentage of Japanese exports are manufactured goods whose global prices are stable. The high dependence on foreign trade makes Japanese economy highly vulnerable to external shocks.

Monetary policy: the fundamental objective of Japanese monetary policy under the fixed rate regime is to maintain the stability of the balance of payment and deficits in the balance of payment was mitigated by a tight monetary policy that could aid in suppressing import demand.

Appreciation of yen has a favorable impact on consumer prices because it will cut the cost of raw materials, but at the same time it will diminish international terms of trade, which can affect domestic consumption.

Inflation in Japan is at its low, and it has averaged 0.6 percent from 2007, there are also formal price controls that only apply to rice, but the prices of other commodities are dictated by producers and regulators.

This is unlike US where inflation has averaged 1.4 percent and price controls are applied to specific regulated sectors like health insurance and other regulated monopolies. The following graph indicates inflation as a key economic indicator.

Financial System Comparison of Japan and the U.S.

The Japanese financial system heavily relies on the main bank system or bank based financial system that is driven by banks and with which the borrowers have a close relations with the financial system. This is dissimilar to the financial system in the United Sates of America that heavily relies on capital markets, i.e. a financial system where the capital markets play a dominating role.

Japan’s financial system received a lot of praise due to its contribution to the countries sustained growth in 1980 but in 1990s it was considered a cause of economic stagnation due to its improper functioning primarily because of the bad loan problem that followed the explosion of the bubble economy.

This is contrary to the reputation of the market based financial system pursued by the U.S. that has been credited for the driving the lasting expansion of the U.S. economy and guiding its thriving markets (Neave, 2002).

Japanese authorities are moving towards the utilization of capital markets since the launch of the Big Bang initiatives. Bank based financial system places a lot of emphasis on stability while the market based financial system emphasizes on efficiency (Baba & Hisada, 2002).

The Japan financial system does not, however, intend to shift towards the U.S. market based financial system due to its unique financial structure like its share of public finance. The U.S. has little government involvement in the financial system, and any limited government intervention was aimed at increasing the importance of markets while in Japan, the government intervenes to increase the influence of banks in the economic system.

From the following data, it can be deduced that the Japanese financial system is prone to instability than the U.S. financial system; this is mainly because Japanese banks and insurance companies have a hold of 40 percent of the market and hence their liabilities are fixed hence volatility in the stock market may result to problems in the stability of the institutions.

In the U.S. only a small proportion of the market equity is in the hand of institutions with liabilities and banks and insurance only account for 9 percent of the market equity.

Concerning corporate governance, effective corporate governance in Japan is provided by the main bank system that intervenes when its client becomes bankrupt and the main bank assumes the responsibility from lenders to ensure the firm is run effectively. This also applies to the U.S. where corporate control is practiced (Allen, 1996).

Political and Cultural Environment Comparison between Japan and U.S.

Japan is a country of constitutional monarchy but with a parliamentary system of government. There is both an emperor and a cabinet. The emperor is the chief of state but does not have powers relating to the running of government. The executive power in Japan is exercised by the cabinet that is made up of the cabinet of state and the prime minister.

There is also the Diet that is a bicameral parliament that consists of the Upper house (House of Councilors) and the lower house (House of Representatives). All members of the Diet are elected via universal suffrage and they designate the prime minster from among its members.

There are two levels of Japanese government namely: National and Prefectural but the national legislative powers are vested on the Diet. The characteristics of the Japanese politics are derived from the rules and institutional constraints that the country had adopted and not defined according to the character of the Japanese people and society.

Compared with the U.S., Japan utilizes various political institutions ands rules like unitary government, Prime Minister System and a selected meritocratic bureaucracy. The electoral system and process in Japan is different from that of the U.S. system and an important feature of the Japanese political economy is the factional politics of the LDP and the stability of LDP government (Wada, 1996).

The process of establishing and operating a business in Japan is a streamlined. The only limited impediment is bureaucracy that is stifling and an entrepreneurial growth that is discouraged by various structural problems that emanate from the government’s interference in the economy.

The economic institutions in Japan are aimed at encouraging industrialization and the growth of the economy while at the same time placing emphasis on the necessity of maintaining stable market economy. This is as opposed to the United States where the economic institutions are less significant in the establishment of stable market share and customer relations.

Consequently, the financial system in Japan is a reflection of the Japanese society; this is because, the flow of funds is dominated by the transactions based on customer relations as opposed to open market transactions. This is in contrast to open market transaction in the U.S. that characterizes the flow of funds.

The cultural difference between the two countries is dictated by the nature of the societies in either country. Culturally, the value system of Japan emphasizes the tradition of cohesiveness and national goals that are geared towards catching up with the western powers. Japanese also has a tradition of worshiping ancestors while subordinating branch families to integrate the main family in order to achieve national loyalty.

The Japanese society is dominantly middle class and homogeneous whereas the American society is purely heterogeneous due to the immigration factor hence a widening gap of inequalities.

American culture is a composition of various subcultures that are defined by race, ethnic origin, class, religion and geographical location. All these people have common attributes; the Japanese society is not diverse in terms of subcultures due to less immigration.

The family structure in both countries also differs, in Japanese the family is defined by tradition while an American family is free and its roles are not strictly defined. There is equality in American family between the husband and wife while in Japan the husband is considered as the head of the family (Wapner, 1997).

Legal and Business Issues

Foreign investments in Japanese business and companies are subjected to regulation by the foreign exchange and foreign trade law. There are various business entities and structures that are available to business corporations that operate in Japan.

The main business entities are: corporations, limited liability companies, representative office, general and silent partnerships and the registration of foreign corporations. Japan offers three forms of business partnerships namely: General or Voluntary, Limited partnerships and Silent partnerships.

In Japan, foreign exchange and foreign trade demand that various transactions that involve foreign individuals or entities should be filed before the relevant minister via the bank of Japan and all exceptions to the notices and ordinances relating to the act should be provided in full details in the foreign exchange and foreign trade act.

Incase a foreign entity, a Japanese entity, and foreign individuals or a firm that is owned by Japanese or foreign entity invests in a business that is sensitive and likely to raise national-security concerns like military or aerospace, a prior notice has to be filed with the relevant minister though a bank of Japan, and a waiting period for one month should be observed and if the entity in which the investment is made, but it does not involve sensitive business deals; the entity only has to file a report that follows the investment.

Consequently, any business transaction that is more than 100 million Japanese Yen but which does not fall under the above category of inward direct investment a report should be filed as a capital transaction should be filed with the relevant minister though the bank of Japan following transaction consummation.

This report is necessary for transactions like guarantee, loan and sale of receivables between an individual or entity with Japanese address or a transaction that involves foreign currency.

Furthermore, if there is a payment to be made between a resident and foreigner or between two residents but living in different countries and if that payment is Yen 30 million or more than the resident is needed to file a report for payment (Silkenat, Aresty, & Klosek, 2009).

With regards to the exporting of certain goods, permission has to be obtained under the Foreign Exchange and Trade Act and also under the Export Trade Control Order. According to Japanese rules, all parties to a contract have the freedom to choose and agree on all applicable laws that can govern their contract and their selection of all governing laws can be explicit or implicit.

In determining of jurisdiction, it is the theory of characteristic performance that can be applied and this enhances the proximity of Japanese choice of law and the signatories of the Rome convention.

This, however, comes with exceptions and particular about investments in real estate and consumer and employment contracts. Because mergers and share exchange fall under statutory agreements that are guided by the Companies Act, the agreements and other documents have to conform to the relevant requirements under the Japanese law and have to be governed by the Japanese law.

Consequently, all the agreements concerning share acquisition and business transfers of Japanese companies may be governed by laws of any jurisdiction of a selected country but most of them are governed by Japanese laws.

The only problem that raises a lot of concerns among the foreign investors is the overregulated Japanese economy where the national government plays a direct role in negotiations between private companies. In recent times, the Japanese government has permitted legal due diligence particular in real estate transactions (Index of Economic Freedom, 2011).

In the USA, foreign and domestic investments are treated as legally equal but foreign investments are only screened if they are considered to be a threat to national security. Regulations are transparent and individual states impose their own restrictions. The government also imposes few restrictions on the transfers of currency, profit repatriation. Foreign investors are also allowed to own (USA, 2011).

Recommendation and Risk Assessment for Business Investments

An effective risk management in any investment and of any portfolio management requires that all parties enter into portfolio performance numbers. Doing business in Japan is expensive, particularly if the costs are not controlled properly. Risks can be political or economic.

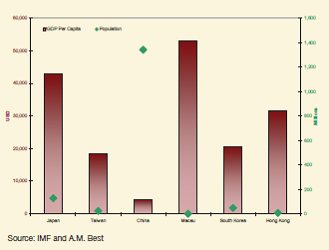

There are very low economic risks; Japan is an industrialized and economically advanced country. Its GDP fell sharply in 2009 due to contraction in exports and domestic demand; the government responded to this crisis by adopting expansionary fiscal policies that led to short term growth in 2010. Growth in Japan can only be constrained by weak global demand. Japan is experiencing economic growth after the earthquake.

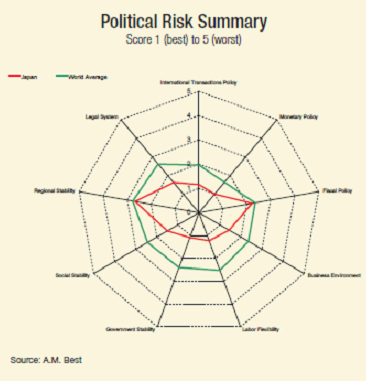

Political risks: there is a low economic risk. Japanese government has experienced a long period of stability, and it is democratic in form and there has been a turnover in leadership, also the legal system is credible with efficient business infrastructure. The mounting deficits of government and increased debts have downgraded the sovereign debt rating of the country.

Financial system risks: there are also low financial risks; this is because the insurance system of the country is under the regulation of the Financial Services Agency. Furthermore, the Japanese regulatory authorities have been aimed at enacting all the banking and security international standards.

The government has also been working towards strengthening the standards of supervision in the times of global financial crisis. These risks are reflected in the following IMF economic outlook.

Recommendations: from the above analysis of the risks environment in Japan, I would strongly recommend that investing in the country can be much profitable due to favorable investment climate.

Conclusion

An in-depth analysis of Japans’ economic situation indicates that its performance based on the various aspects of economic freedom is good but it still experiences a lot of challenges in revitalizing its economy. There is increase in public debt that has threatened private sector investment; there is also a wide disparity in the productivity of various financial sectors.

The financial system of Japan is a modern and well developed one but it is still subjected to political interference, also its taxation is burdensome making its corporate tax regime uncompetitive. The export oriented economy of Japan has heavily benefited from the international trade only that its non-tariff barriers have lingered thus hurting the country’s trade freedom.

The economic stability of Japan is better off when compared to that of the US. The increased spending spree has resulted into fragile businesses and a crushing public debt, government intervention in the economy has eroded economic freedom and the long term competitiveness of the country.

References

Allen, F. (1996). The Future of the Japanese Financial System. University of Pennsylvania. Web.

AMB Country Risk Report. (2011). Japan. AMBEST. Web.

Arnold, R. (2010). Macroeconomics (10th ed). New York, NY: Cengage Learning.

Baba, N., & Hisada, T. (2002). Japan’s Financial System: Its Perspective and the Authorities’ Roles in Redesigning and Administering the System. IMES. Web.

Baumol, W., & Blinder, A. (2010). Macroeconomics: Principles and Policy (11th ed). New York, NY: Cengage Learning.

Brady, K. (2008). Economic performance. HOUSE. Web.

Cooper, W. (2011). US-Japan Economic relations: significance, prospects and policy options. FAS. Web.

ECB Monthly Bulletin. (2005). Comparability of statistics for the Euro area, USA and Japan. ECB. Web.

Index of Economic Freedom. (2011). Japan. Heritage. Web.

Neave, E. (2002). Financial Systems: Principles and Organization. New York, NY: Routledge.

Silkenat, J., Aresty, J., & Klosek, J. (2009). The ABA guide to international business negotiations: a comparison of cross-cultural issues and successful approaches (3rd ed). New York, NY: American Bar Association.

USA. (2011). United States. HERITAGE. Web.

Wada, J. (1996). The Japanese election system: three analytical perspectives. New York, NY: Routledge.

Wapner, S. (1997). Handbook of Japan-United States environment-behavior research: toward a transactional approach. New York, NY: Springer.