Introduction

Cosmetics market in Poland holds the promise of growth with a compounded annual growth rate (CAGR) of 3.1% in 2007 (Pitman, 2006). The Polish cosmetics market has so far experienced steady growth. The cosmetics market is highly competitive with competition being based on price, quality, and brand recognition (Case Study). This is a case study analysis of the competitive situation of small and mid-sized cosmetic companies in Poland. The company studied is Dr. Eris. The main questions that will be answered in this case study analysis are – (1) if small and mid-sized cosmetics companies can survive the increased competition from big multinational companies, (2) the strategy Dr. Eris should adopt to sustain its leadership position in facial cosmetics segment, and (3) the process of internationalization of Dr. Eris in the US.

Main Body

Future of small and mid sized cosmetics companies in Poland

The first question that will be dealt with is what does the future hold for Polish small – and medium-sized cosmetics manufacturers? In order to answer this question it is necessary to do a competitive analysis of the cosmetic industry in Poland. For this Michal Porter’s five forces model is used. Here it must be noted that I do not agree to the statement of the Polish manager who states that the small and mid-sized manufacturers have no future in the cosmetics industry.

Strategy to sustain leadership position in facial cosmetics segment

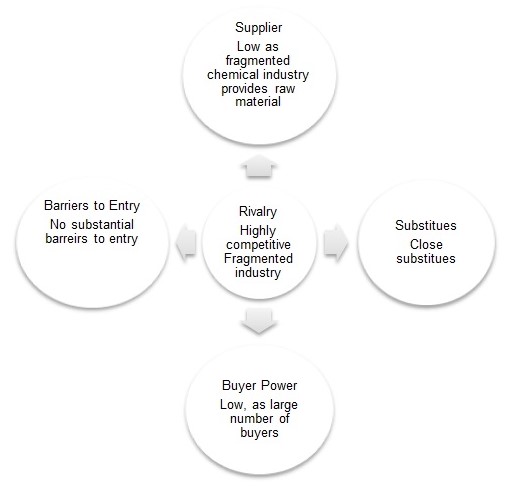

Figure 1 presents the five forces competitive analysis. It shows that the cosmetics industry is highly fragmented with a large number of small and mid-sized cosmetics manufacturers and large multinational companies. This indicates that there exists a lot competitive pressure. As cosmetics are made by one company has a close substitutes made by a second company, therefore the substitutes also present competition. There are no barriers to entry. Therefore, with high profitability and stable growth rate, there are many new entrants in the industry. The suppliers too have low power and mostly the raw material is derived from chemical industry which to is highly fragmented.

The analysis shows that the requirement of industry is low. As the competition increases, there would be a large number of buyers and sellers operating. However as long as there is innovation and use of new technology in making quality products, which are, competitively prices, and the small firms too will retain their market share. The reason being the market value of the industry in 2001 was US$450 million in Poland itself. This shows that the market has the potential of expansion. Further, there is a lot of demand for the products in East European countries.

Internationalization in the US

The number of multinational companies who have entered the Polish market has increased. However, these companies sell their product only in the premium and luxury segment of the market. If we consider exhibit 1 (Case Study, p. 453), we will see that the imports of cosmetics in Poland have remained almost stable with marginal increases, whereas there has been a rather large rise of cosmetics manufactured domestically. Even the export of Polish cosmetics has increased substantially. This shows that the market for Polish small and mid-sized cosmetics companies is increasing as the geographical expanse of the market has increased due to inclusion in EU and their pricing strategy. Therefore, the view of the Polish manager may prove to be wrong.

According to the case study, the facial cream cosmetics market is dominated by Dr. Irene Eris with a market share of 16%. In order to sustain their leadership position, the company must follow a few strategic steps:

- In order to retain its leadership in low cost segment, the company must continue to sell its products in this segment only. This will help the company to avoid competition with more recognized foreign brands that operate in the mid-and premium-prices segment.

- Continuous research and development is the key, which will lead to product innovation. Due to high competition in the industry, product life cycle is low. Innovative products introduced in the market will make the company more sustainable in long run.

- The company must take advantage of the ongoing process of EU expansion, which will provide the opportunity to the company to expand market in rest of Europe.

- Increased brand awareness through promotional and other means is necessary to increase brand recall and loyalty.

For the internationalization process in the US, Dr. Eris took a very niche approach of targeting the Polish community in the US. Their strategy was to use personal contact in order to gain access to the stores in the US. However, the key to the growth process was personal contact, which was used to distribute products in 1000 retail stores in the US. For an initial expansion plan, this is all right. However, for a more grand entrance, the company did not do any brand awareness in the US, which is the key to entering a market in the cosmetics industry. Franchising is the mode of distribution that the company opts. However, the distribution through superstores and malls might provide a greater reach to the company.

Conclusion

Dr. Eris is a healthy cosmetics company with plans to expand into international market. It has expanded in countries within the EU and has also targeted the US market. However, of internationalization, most companies (irrespective of industries0 have targeted the developing countries with rising markets like China, and India. The company must target these markets in order to instil greater international presence and increased revenue.

Works Cited

Case Study. Dr. Eris: Cosmetics from Poland. In M. R. Czinkota, & I. A. Ronakainen, International Marketing (pp. 452-56).

Pitman, S. (2006). Polish cosmetics market set for steady growth. Web.