Introduction

East Europe consists of countries that were formerly pursuing socialist economic ideologies. With changing economic variables such as increased competition in the international market especially for financial services, these countries have had to adopt capitalist economic policies. Before the 2008/2009 economic meltdown, the Eastern European region was leading in the boom for financial products such as credit facilities and securities.

However, the scenario changed after the meltdown which had adverse effects on the banking sector in the region (Uhde & Heimshoff, 2009). A lot of research has been done on the effects of the last recession on the banking sector in Eastern Europe with the aim of formulating the best strategies to save the region’s banking sector. However, little attention has been given to the opportunities presented by the recession to the banking sector in the region. Pursuing new strategies for addressing the effects of the recession might have long-term benefits. However, this might take longer and the effectiveness of the solutions is not guaranteed since they rely on the changes in economic variables (Uhde & Heimshoff, 2009).

Focusing on the opportunities attributed to the recession can help the banking sector to quickly recover. This justifies the need for academic research on the various opportunities presented by the recession. This paper will discuss the various opportunities in the Eastern European banking sector that are attributed to the recession. It will also compare and contrast the Eastern European banking sector and the US banking sector.

Review of Literature

Despite the adverse effects that the recession had on the Eastern European economy, the banking sector can still exploit the following opportunities and achieve higher growth. First, the banking sector in the Eastern European region is characterized by a credit sector that is yet to be saturated (Dinger & Hagen, 2009). This has two implications in the banking industry. The first implication is that the demand for credit facilities will continue to rise especially in the medium term and in the long-term as the economy recovers from recession (Dinger & Hagen, 2009). The second implication is that the competition in the market is not characterized by intense rivalry.

This means that the commercial banks in the region have the opportunity to increase their revenues by focusing on the credit market segment that is yet to be fully exploited (Dinger & Hagen, 2009). To realize this objective, the banks can consider reforming their business strategies and policies. This will include lowering the lending rates in response to the low purchasing power that is attributed to the effects of the recession. This will encourage borrowing in the short and medium-term. Consequently, the banks will increase their revenues and recover from the financial crisis.

The second opportunity is attributed to the macro-economic variables in the region that are likely to facilitate long-term growth in the Eastern European banking industry. Most central banks in the region have resorted to the use of unconventional policies to restore stability in the region’s banking sector. One of the most important unconventional policies used involved liquidity easing. Liquidity easing is a policy that aims at improving the supply of cash in the economy (Uhde & Heimshoff, 2009).

It was implemented in two ways in the region namely, domestic liquidity easing and foreign exchange easing. The economies in the region used systematic domestic liquidity arrangements in response to the blockage in the conventional systems of money transmission. This involved widening the counterparty access to the central bank liquidity facilities. It also involved relaxing the collateral requirements and extending the maturity dates for the liquidity facilities (Uhde & Heimshoff, 2009). Thus the banks in the region have the opportunity to obtain credit facilities from their respective central banks at lower interest rates. Besides, the extension of the maturity dates for the liquidity facilities will translate to higher returns in the long term. All these give banks in the region an opportunity to increase their revenue.

Foreign exchange liquidity easing involved foreign exchange liquidity injection and cross-central bank currency swop. Cross-central bank currency swop has led to the injection of foreign currency facilities in the region (Dinger & Hagen, 2009). The local banks can use such facilities to create credit facilities thus increasing their revenue. The use of this policy also led to the removal of capital inflow limits and ceilings on banks’ purchase of offshore foreign exchange. The central banks have also reduced the reserve ratio requirements for foreign currency (Dinger & Hagen, 2009). These changes have made the foreign exchange business in the region to be profitable. Besides, the banks have a greater opportunity to obtain credit facilities at reduced interest rates to expand their operations.

The third opportunity attributed to the effects of recession is the drastic reduction in the prices of IT products such as the use of the internet and banking software. In response to the reduced demand for IT products, the firms offering the products have lowered the prices to encourage purchases. The Western economies are particularly targeting the Eastern European region in order to consolidate their market share in the global IT industry.

Thus the banks have the opportunity to use new information technologies to improve their operations at reduced costs (Staikoura, Mamatzaleis, & Koutsomanoli-Filippoki, 2008). The banks can thus introduce new products such as the internet or online banking in order to increase their market share. The overall costs in banking will also reduce due to the reduction in the costs of IT products in the region. In the same way, the efficiency rates will be high in the region’s banking sector (Staikoura, Mamatzaleis, & Koutsomanoli-Filippoki, 2008).

The fourth opportunity is attributed to the effects of foreign banks in the region. The foreign banks especially from the Western economies have brought with their innovations in the banking industry. The innovation in this context relates to the product mix, pricing, and customer services (Staikoura, Mamatzaleis, & Koutsomanoli-Filippoki, 2008). Thus the local banks have the opportunity to learn from them and also improve their operations.

Thus in the long-term, the local banks will be more efficient and competitive (Staikoura, Mamatzaleis, & Koutsomanoli-Filippoki, 2008). The foreign banks in Eastern Europe were bailed out of the last economic crisis by their parent companies in the Western economies. The local banks have the opportunity to benefit indirectly from this strategy. This is because part of the withdrawals made from the foreign banks is deposited in the local banks. These deposits are used by the local banks to create more money. Consequently, they are able to improve their profitability in the medium term.

Finally, the banking sector in Eastern Europe is on its way to maturity (Dinger & Hagen, 2009). This means that the industry is still operating at under-capacity with more room for growth (Dinger & Hagen, 2009). The banks in the region can take advantage of this opportunity and increase their revenue in several ways. First, they can focus on increasing their branch network to reach out to more clients and increase sales. Second, they can introduce new products as well as differentiate the existing products. This will lead to greater revenue and market share for each bank.

Challenges in the Eastern European Banking Sector

There are four main challenges experienced in the region’s banking industry. First, the entry of foreign banks into the industry has had negative impacts, especially on local banks. The foreign banks have rapidly expanded their operations in the region due to their financial capabilities. Consequently, there is a lot of competition for the market share. This has led to reductions in the prices of various products in the industry and a lot of expenditure on product differentiation. Thus most local banks have become less profitable due to their inability to compete with their foreign counterparts (Staikouras, Mamatzaleis, & Koutsomanoli-Filippoki, 2005)

Second, the global financial crisis greatly reduced the competitiveness for new lending (Staikouras, Mamatzaleis, & Koutsomanoli-Filippoki, 2005). The crisis came at a time when the industry had lent a lot of money to the economy. However, the crisis slowed down economic activities in the region and this made it difficult for the borrowers to service their loans. This has led to a large number of defaulters. Consequently, the banks are reducing lending for fear of losing more cash. This has led to an increase in lending rates in the industry. The commercial banks are also obtaining credit facilities at high rates especially from their respective central banks. This further limits the competitiveness in lending and hence reduces revenue.

Third, the underperformance in the economies in the region has discouraged growth in the banking sector. The region is characterized by high inflation rates and instability in the financial markets (Staikouras, Mamatzaleis, & Koutsomanoli-Filippoki, 2005). This has discouraged investments in the sector as well as lowered the performance of the existing firms. High inflation and instability have particularly made it difficult for the economies in the region to join the eurozone. This means that such economies cannot take advantage of the large market in the eurozone and increase their revenues.

Finally, there is government interference with the operations of the banking industry in the region especially in countries like Russia (Steinherr, 1997). Through the fiscal and monetary policies, the local governments have continued to influence the operations of the industry. This involves influencing the lending rates as well as the level of cash flow in the economy. The central banks are not fully in control of the banking sector and this undermines the performance of the industry by limiting the scope of the central and commercial banks to make vital decisions in the industry (Steinherr, 1997).

Eastern European Banks versus US Banks

In comparing the Eastern European banks and the US banks, two similarities can be identified. First, banks in both regions are finding it difficult to recover the loans they lent to the public before the global financial crisis. This is because the borrowers are either bankrupt or are having low purchasing power. Consequently, the banks in both regions have had to rely on government support in order to remain in business. Secondly, banks in both regions are focusing on efficiency and product differentiation in order to maintain their competitiveness (Staikoura, Mamatzaleis, & Koutsomanoli-Filippoki, 2008). This is because traditional lending is still not attractive since the economies are yet to fully recover from the recession.

There are two main differences between the Eastern European banking industry and the US banking industry. Unlike the Eastern European banking industry, the US banking sector has already attained maturity. Thus the banks in the US are focusing on sustainability rather than growth since the industry is operating at near capacity. The Eastern European banks are focusing on growth since the industry in their economy is operating at less than full capacity (Dinger & Hagen, 2009). Second, the credit market in the US is saturated due to a large number of firms in the industry. Consequently, the cost of credit facilities is low as compared to Eastern Europe in which the market is not saturated.

Summary

The above analysis indicates that the banks in Eastern Europe were adversely affected by the global financial crisis. However, the financial crisis also presented growth opportunities for the banks. The main opportunity includes the use of an unconventional policy framework in response to the financial crisis. The policy has lowered the cost of obtaining credit facilities by the commercial banks as discussed above (Uhde & Heimshoff, 2009). Consequently, the banks have been able to increase their revenue. Other opportunities include a reduction in the cost of IT products and the innovations that have been introduced by foreign banks.

The main challenges to the region’s banking sector include the poor performance of the region’s economies, competition from foreign banks, and government interference with the operations of the industry. A comparison between Eastern European banks and US banks shows that banks in both regions are focusing on efficiency and product differentiation in order to maintain their competitiveness (Staikoura, Mamatzaleis, & Koutsomanoli-Filippoki, 2008). However, unlike the US banking sector, the Eastern European banking sector is yet to attain maturity.

Conclusions

The following conclusions can be made on the Eastern European banking sector. First, as banks focus on efficiency and product differentiation, expenditure on core activities such as payment processing and branch technology will significantly increase in the medium term (Staikoura, Mamatzaleis, & Koutsomanoli-Filippoki, 2008). This is because the banks believe that they can increase their profits by improving their efficiency.

Second, the banks are likely to partner with IT firms from Western Europe in order to obtain superior banking technologies. This is necessitated by the fact that high efficiency has to be facilitated by superior technology which is readily available in Western Europe. The banks are also likely to consider exporting their services to economies that have already recovered from the recession. This will help them to quickly recover from the recession and become profitable. Finally, each bank will have to reconsider its investment level to ensure that they do not underinvest. This is because they anticipate rapid growth in demand for financial products after economic recovery.

References

Dinger, V., & Hagen, J. (2009). How small are the banking sectors in Central and Eastern European countries. Journal of Finacial Regulations and Compliance, vol.17 (2) , 96-188.

Staikoura, C., Mamatzaleis, E., & Koutsomanoli-Filippoki, A. (2008). Cost efficiency of the banking industry in the South Eastern European region. Journal of International Markets, Institutions and Money, vol. 18 (5) , 483-497.

Staikouras, C., Mamatzaleis, E., & Koutsomanoli-Filippoki, A. (2005). Competition and concentration in the banking sector of the South Eastern European region. Emerging Markets Review, vol. 6 (2) , 192-209.

Steinherr, A. (1997). Banking reforms in Eastern European countries. Oxford Review of Economic Policy, vol. 13 (2) , 106-125.

Uhde, A., & Heimshoff, U. (2009). Consolidation in banking and financial stability in Europe: Emperical evidnece. Journal of Banking and Finance, vol. 33 (7) , 1299-1311.

Illustrations

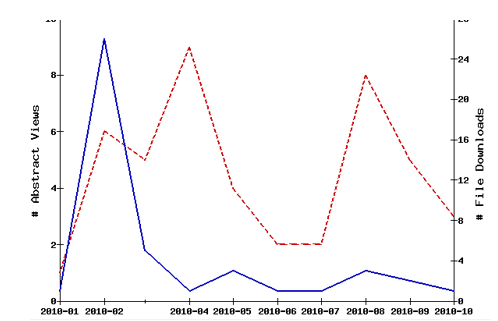

This shows the performance of eastern European banks based on abstract views and file download views. The red line represents the abstract views while the blue line represents the file download views. The figure indicates unstable performance in the region’s banking sector.

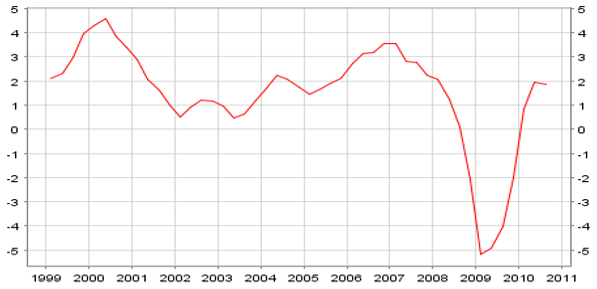

The high inflation rates discourage investments in the region’s banking sector. Inflation reduces the returns on investments especially in the financial markets. This has discouraged foreign firms from investing in the region’s banking and financial markets.

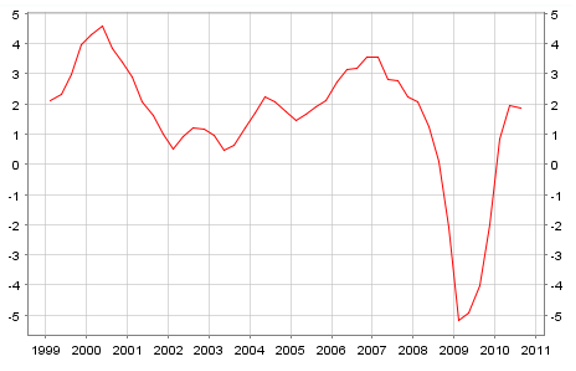

The figure indicates unstable economic growth in Eastern European countries. This has led to slow growth in the regions banking sector. An underperforming economy is characterized by low purchasing power. Consequently, a large percentage of citizens are not able to afford credit facilities. This lowers the revenue for banks and discourages growth of the region’s banking sector.