Executive Summary

Eco Works is a partnership company between 4 people. Eco Works will provide eco-friendly products, as it believes that there is a demand for environmentally friendly products in the current market. People are more aware of saving the environment for future generations. Eco works not only helps the environment but also tries to adopt “Being sustainable does not necessarily mean that you have to pay more.”

The key financial parameters (Sales, Gross Margin, and Net Profit) are provided in figure 1. These are the plans of the company for the nearest five years.

Objectives

- Sales rate ‑ over $ 448 000 by year 6

- Gross margin higher than 63 %

- Net income more than 218 % by year 5

- To become the leader of environmentally friendly office supplies in Australia.

Mission

It is our mission to become the market leader of environmentally friendly office supplies in Australia, particularly Melbourne, with the best price offer and premium quality products.

Keys to Success

- Excellence in fulfilling the promise – best price to customers and supply premium quality product.

- Secure large contracts with corporations and government agencies.

Company Summary

Eco Works is a new company providing eco-friendly products such as paper supplies, stationeries and office supplies. Our business strategy is to become a major vendor of environmentally friendly office supplies. A product catalogue will create a compelling one-stop shopping venue. All products will be priced competitively, often at the same low price as non-eco-friendly products. We are targeting large corporations, Government Organisations and others such as Universities and small businesses, which are looking for eco-friendly office supplies.

The team will consider various ways of approaching the customers. Some of them are:-

- Talking to big organisations bringing samples and pricelist

- Advertising on newspaper and business magazines

- Distributing flyers around universities

The marketing strategy seeks to develop an awareness of Eco Works and its ability to offer a wide selection of eco-friendly office products through the product catalogue. After financial research, we estimated that we would need around $221,140 to start the business.

Company Ownership

Eco Works is a partnership company owned by four principal investors and principal operators. The company will be created as Australia Private Limited based in Melbourne.

Financial Assumptions

Start-up requirement

In order to identify what cost will be involved before starting the business, we decided to use the Establishment Costs Template taken from www.business.vic.gov.au.

After comparing the four big banks, we decided to choose the Business Saver of ANZ to take loans with an interest rate of 8.62% for ten years term. The total banking fees to open this account in the Company Name and other fees are around $1,500. According to the Australian Securities and Investments Commission, the application fee of registration and licenses for a private company, which does not offer share capital, will be $340. Furthermore, we need a professional website so that our customers will be able to browse our products even after office hours; customers could also place an order online. Thus we decided to spend $3000 on this expense and become the customer of the Web Showroom company.

To reduce the start-up cost, we will rent an office for only $10000 per annual, ten years contract with Melbourne Commercial Office Sales & Leasing Company. This office is located at the Exchange Tower in Little Collin street (suite 402). Other spendings are on cleaning service, decorating, equipment, printing and around $200,000 to cover the inventory for the first trading.

Revenue & Cost Projection

According to the Retail Owners Institute, the gross margin per cent trend of the office supplies and stationery stores has a slight increase from 35.8% in 2005 to 38.7% in 2009. This is the evidence we used to estimate and expect that our gross margin will be 39%. Thus, the formula of gross margin (Gross margin% = [sales –variable costs]/sales) help us to identify the % variable costs, which is 61%.

Revenue & cost projection for first-month trading.

Assumptions:

- Traffic: 5 customers per month

- Stationeries: 70% buy 150 stationery products each

- Paper: 90% buy 200 paper products each

- Furniture: 10% buy 100 furniture products each

Worst-case and best-case scenario.

We assumed that in the best-case scenario, we would receive revenue of $34,050. However, the worst case is that our sales will be $22,700.

Revenue projection for the year.

Monthly flow of revenue.

* times 1000

Assumptions:

- 40% of sales during the school holiday season (Jan-Feb and Jun-Jul): 40%x$304,500 = $121,800

- 10% of sales during the Christmas season (Nov-Dec): 10%x$304,500 = $30,450

- Rest (50%) equally divided over six months

- Best case and worst case plus or minus 20%

- We expect that in the school holiday season, the revenue will increase because the universities will supplement more furniture and stationery for the new students’ enrollment.

Sales Forecast

Our monthly sales forecast for the first year is included in the figure below; we need a maximum of 3 months preparing the business, such as the administration system, to be completed as well as to get the website running; therefore, we will not be receiving any sales for that period.

From the fourth month, our company starts to do business and expect to get revenue as stated in the projections. There will be an uneven in sales following the assumptions stated above; an increased sale in June and July and a relative decrease in sales starting August.

Based on our research of an existing company, the Green Office, the market growth rate is 6.77%, so we expect that our revenue will grow to start from year 3 of our trading period. However, because in the first year we have only nine months trading, that three months development worst 28% of the sale and in year two we have a full 12 months trading, the sale should be increased around 34% compared with the first year.

Financial Pro-forma

Profit and Loss

This proforma income statement show all the revenue, expenses and profit we will get in the future. The assumption is that our gross margin should be 39%, so the cost of goods sold will be 61%. The expenses start with our four partners’ salary, which we expect each will get $2500 per month. Other expenses will be rent, advertising, bills and insurance. After minus the interest and tax, even our net profit is not high, it increases stability year by year, be patient. We will be a success.

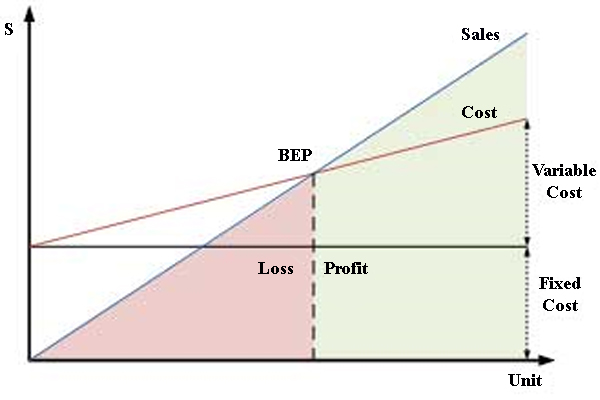

The Break even rate for the market equals 604 units for the entire period of forecast (5 years). The numbers that were taken for the analysis are the maximal values of sales rates, costs, and units sales forecasts. Hence, the actual break-even point is calculated on the basis of the offered forecasts (Point 3.3)

Balance Sheet

Assumption

- We give customers 30 days to pay 50% of the revenue

- Supplier give us 45 days to pay 70% of COGS

- Account payable = 70% the COGS of the last month

- Account receivable = 50% revenue of last month

- Inventory = COGS next month

- Cash = revenue of year – account receivable and 30% inventory

Our accountant of the company with the response from our Sales representative, we decided to give our customers 30 days to pay 50% of the sale after they pay the first half. Thus, the account receivable should be 50% of the last month revenue. Because our suppliers will give us 45 days to pay the credit and 30% will be paid immediately as a deposit, our account payable will be 70% of the inventory, and the inventory is the cost of goods sold for the next month trading. Our cash at the bank should be the revenue minus the account receivable and 30% of the inventory.

Cash Flow Statement

In the first year of our trading, we estimated that our cash flow would be negative due to the large capital investments in the first year relative to the revenue collected. However, due to no requirement of additional capital after the first year, we are able to experience a positive cash flow of $116,502 in the second year of operation.

Financial Decision

Investment & Loan

After researching, at least we need around $221,140 to start the business. Each of the members will contribute $42,785 cash into the business as capital. So we need to get a bank loan of $50,000 from a bank. Compared with four major banks and other financial institutes, we selected the Business Saver from ANZ bank as it gives favourable interest rates. This loan facility offers the flexibility of fixed and variable interest rates, with a choice of repayment options to suit our cash flow requirements. The interest rate is fixed at 8.62% for a duration of 10 years. Thus, the repayment amount of $4,310 is payable to ANZ bank monthly.

Ownership structure

There will be four partners setting up this partnership business. Each of us will have a role in running the business. As you can see from the chart below, Hemant will be working under Operation, Ivon will be handling Sales and Marketing, Rena will be doing administration of the company, and Jenny will be making sure that the Company’s Account is up to date to cover the cost and to generate profit.

With the business knowledge that we acquire from Swinburne University, we will be able to set up and run this business. With the availability of a mentor (our lecturer) will be able to cut costs in getting business consultation both from theory and also experienced businessman.

Ratio Analysis

The current ratio shows us a strong asset, especially cash at the bank account, which can cover our liabilities. But because this ratio ignores the timing of cash received and paid out, even this ratio is good. We are still not sure about the ability to survive the company. The quick acid test ratio is better than the current ratio, but it still has the same disadvantage above. Our company has a high inventory turnover ratio which is an indicator of good inventory management even it also means there is a shortage of inventory.

However, because our company will receive customer’s orders before purchasing the inventory from suppliers, this ratio must be high. For the account receivable and account payable turnover, the higher turnover, the shorter time between sales and collecting; purchase and payment. It is a must if we can try to keep it low so we don’t need to depend too much on the money of people outside the company. The risk ratio is an indicator of the businesses’ vulnerability to risk, which is used to determine the ability of the business to repay loans. This ratio in our company keeps decreasing year by year which is a good sign. The next ratio is the times interest earned, which measures the ability to make contractual interest payments.

Except for the first year negative because of the loss, from the second year, the ratio shows that our company is able to fulfil its interest obligations. The return on asset measures the overall effectiveness of management in generating profits with its available assets, and the return on equity shows the return on the shareholder’s investment. Even these ratios increase slowly. We can feel confident about our successful business.

Exit Strategy

After five years of trading, we will keep on continuing even though we are making losses, as long as we manage to keep our Variable cost paid monthly. However, if it will be hard for us to make sales, we are looking into selling this business to an established businesses like Office Works, where they might be interested in buying our business strategy that also includes good suppliers contact and also a vast selection of products.

On the other hand, if this business is making money, we will maintain our customers by giving longer credit terms and also expanding the business into eco-friendly consultation services as an additional service offered by us. We will be looking at consulting Businesses, Universities and Corporations in deciding what products and how can they make their office green!

Overall Analysis

Through our financial findings and consideration from many aspects, to be successful in this business will be very low due to the Target audience that we are looking at are big organisations where they will be reluctant to do business with us since we are new. Apart from that, getting the cash-in as soon as we can, there will also be a problem since other big corporations might already approach our Target Audience.

However, if the promo strategy is implemented properly, the forecasted sales rates (as well as revenues) are quite real. The financial background of the selected industry is rather favourable for penetrating the market. However, the actual values of the eco market and ecologically safe production can not be overestimated by potential investors. The break-even analysis of the industry and sales level is 604 units for the entire period forecasted. However, the forecasted sales levels are essentially higher in comparison with the analysed values.

References

Gross margin. Web.

Establishment cost template. Web.

Bank fee. Web.

Licences & Register fees. Web.