Introduction

Economic depression is defined as the sustained and prolonged down-turn in the economy of a country. Depression is considered more extreme and severe than economic recession. Though depression is considered a form of recession only that depression is characterized by its length, the abnormality of economic factors like rising cases of unemployment, decline in credit availability and also shrinking output and highly volatile monetary value.

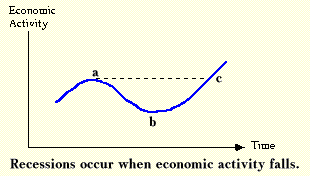

Depression is linked to the following two indicators; decline in the Gross Domestic Product by a margin of more than 10% and secondly a recession period exceeding 2 years. According to Foldvary, recession is derived from the word recede that implies falling back and it lasts for a very short time and depression is understood based on the degree of output fall and the extend of the down-turn (Foldvary 3).

An economic depression happens when there is fall in output below the long-run trend.

The Depression of 1873-1879

This depression was as a result of the bankruptcy of the railroad investment firm of Jay Cooke and company and particularly the restrictive monetary policy of the federal government; this is whereby the gold standard increment could not maintain the pressure for money demands that could enhance the growth of the economy. Deflation is also a factor that led to this depression (Watkins and Allay 1)

The Depression of 1893-1898

This was considered to be the worst form of depression ever witnessed in the US before the 1930. It first emanated from the agricultural crises that affected the southern cotton belt and the Great Plains in 1880s and it later hit the Wall Street and the urban areas in 1893.

This from of depression led to a massive unemployment which is still considered the highest in the US history at 20-25%, the depression resulted in widespread poverty among the Americans of various income levels. The magnitude of the depression was so acute that by 12896, it was made a popular subject of political campaigns (Edwards 1)

The Great Depression of 1929-1933

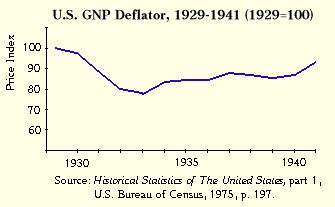

The United States of America experienced the worst, the longest and the most severe economic depression in the year 1929. This depression led to an acute decline in output, extreme unemployment and drastic deflation in the USA and it has been ranked the second calamity to the civil war.

This depression was largely associated to several factors like the reduced consumer demand, great financial panic and misplaced government spending that forced a fall in economic output.

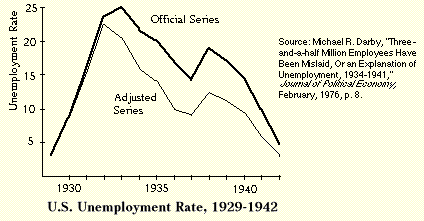

This depression led to the reduction in industrial production by 47% and the subsequent reduction of the Gross Domestic product (GDP) by 30%, it also resulted in the decline in the wholesale price index or otherwise referred as deflation by 33%; also the unemployment rate reached 20% which was considered the highest point at that time (Romer 1).

This depression is just considered severe when compared to the next depression to hit America in the year 1981-82 that resulted in the decline of GDP by 2%. The USA recovery from this depression began in 1933 when the GDP began to improve at 95 per annum (Romer 3).

The 1930 depression saw the increased level of unemployment characterized by a lot of labor force but no work to do and the worst part of depression was in 1933 when the unemployment rate fall below 10%. Recession appeared twice during the great depression, in the august of 1929 and March of 1933 between as indicated by the following graph;

During the great depression, the most hit sector was the banking sector. The following table is an indication of how banks were affected including the number of suspended banks and also indicates the decrease in the number of banks as a result of merger, failure or collapse and voluntary liquidation.

Number of banks and bank suspension

Causes of the Great Depression

The most critical cause of the great depression in the USA was the reduction in spending or otherwise referred as the reduced aggregate demand; this resulted in decline in production since manufacturer noticed an anticipated rise in inventories. This was reflected in other countries due to the factor of gold standard. Other factors that necessitated the great depression are:

The stock market crash: the great depression is associated with the tight US monetary policy that targeted the limitation of stock market speculation; this was due to the mild recession that had been witnessed between 1924 and 1927 that had witnessed the massive rise in the stock prices in 1920 and reached the optimum in 1929 and as an immediate measure, the federal reserve had raised the interest rates in order to stop this spiraling stock prices and this largely affected the construction and the auto mobile industries.

The fall in the stock prices in 1929 to extend that could not be justified by the anticipation rate resulted to the loss of investor confidence and subsequent bubble burst in the stock market.

This led to the panic selling on black ‘Thursday’ on October 24, 1929. The previous rise on stock prices had triggered a massive purchase of stock by the investors using loans and hence this price decline forced some investors to liquidate their holdings thus worsening the fall in prices. This crash in the stock market led to the considerable reduction in the consumer aggregate demand especially in the area of durable goods and investments and great fall in output.

Banking panic and monetary contraction: this was experienced in the year 1930; banking panic occurs when “many depositors lose confidence in the solvency of banks and simultaneously demand their deposits be paid to them in cash” (Romer 8); this can lead to those banks that hold deposits as cash reserves to liquidate loans so that they be in position to pay the cash demands. This process of immediate liquidation can force any solvent bank to collapse.

This continued till 1933 when President Franklin Roosevelt proclaimed the ‘bank holiday’ in 1933 that involved the closing of all banks and could only re-open upon being considered solvent by the government inspectors. Economists largely associate this bank panic to the “increased farm debt in 1920” (Romer 8) and government policy that encouraged “small and undiversified banks” (Romer 8).

The gold standard: economists largely associate the 1929-1933 great depression to the Federal Reserve; they accused the federal reserve of causing a big decline in the American money as a measure to preserve the gold standard. The gold standard implied that each country should fix the value of its currency based on the standard of gold.

International lending and trade: the USA had expanded its foreign lending to Germany and the Latin America, this declined in the 1928 and 1929 due to the high interest rates and the flourishing stock market; “this reduction in foreign lending resulted in credit contraction and the reduction in the output of borrower countries” (Romer 8).

Economic impact of the Great War: when the first broke, no one expected that it would be of the magnitude witnessed; no one predicted the length of the war, the economic expenses of the war and the degree of destruction.

The war caused a lot of infrastructural destruction, loss of lives and monetary value in the countries of Europe; this on the other hand precipitated a period of economic boom in the countries of Canada, USA and Latin America since the countries of Europe exhausted their gold reserves to borrow money, other countries also printed extra money. This war interrupted with patterns of domestic and international trade which preceded the economic depression.

Sources of Recovery

The two main ways of curbing the inflation were indentified as the currency devaluation and monetary expansion. Devaluation “allowed countries to expand their money supplies without concern about gold movements and exchange rates” (Romer 8). Another way of curbing the crises was through the imposition of protectionism measure; this led to the launch of various tariffs, the 1988 US presidential seat was won through protectionist ticket.

Economic Impact of Depression

The depression influenced the US economy in a great way; some of them include the following:

Human suffering: for the very short time of the depression, there was drastic increase in the output and the standard of living also a substantial fraction of the labor force could not find employment.

Change on world economy: the great depression brought to the end the international gold standard era.

Increased government involvement in the economy: after the depression, there was an increased government participation in the economy particularly in the financial market; evidence was the establishment of the Securities and Exchange Commission by the USA.

Development of macro-economic policies: most of these policies were aimed at curbing the downturns and the upturns.

Conclusion

Depression is considered one of the worst macroeconomic aspects that can befall a country; the effects of economy are so devastating since its impact can be felt across the world. The US have experienced a lot five depressions of different magnitude and that has equipped it with experience on the various macroeconomic issues that are required to tame any further depression. The US has on the recent past experienced only recessions which are considered mild form of depression.

It is worth mentioning that from the five economic depressions to have hit the US, all the possible remedies have been tried and applied, despite all the efforts it is not clear whether the business cycle that lead to depressions has been removed. Depression an also be considered a natural economic aspect that can be beyond government intervention. This is exemplified by the economic depression of 1907 and 1920 which was eliminated within a year without the government intervening.

Works Cited

Edwards, Rebecca. The depression of 1893. Projects, 2000. Web.

Foldvary, Fred. The Depression of 2008 2nd edition. The Gutenberg Press, 2008. Web.

Romer, Christina. Encyclopedia Britannica. Berkeley, 2003. Web.

Watkins, Thayer and Allay, Tornado. The depression of 1873-1879. University of San Jose State, 2011. Web.