Introduction

Canada is a country that lies in the northern side of United States of America. Canada became independent in the year 1867. It has three territories and about ten provinces. The country extends from the Pacific Ocean to the Atlantic. Its geographical area coverage is about 9.98 million per square kilometers. Canada is the second-largest nation in the world in terms of the area per square meters.

It shares a common border with the United States of America. The borderline between the two countries is the longest in the world. Different types of people have lived in Canada. The Aboriginal people were the original inhabitants of the country. In addition, the French colonial masters and the British also lived in Canada in the 15th Century. Canada is one of the richest countries in the world.

It is a first-class country with the 8th highest per capita income in the world. Canada also has the 11th highest standing Human Development Index (HDI) in the world. The country has set good standards in matters of justice and civil rights. The United Nations recognize Canada as a middle power nation.

In addition, it boasts of membership of the G20, G8, G7, NATO, International Covenant on Political and Civil rights, World Trade Organization, Commonwealth Nations, North America Free Trade Agreement, United Nations, Organization for Economic Co-operation and Development, Association of United States, Pacific-Asia Trade Association and Francophone Nations.

Canada enjoys diverse resources like oil, gas, oil, nature resources, and uranium. The location of Canada is also strategic for economic growth in diverse sectors. It is adjacent to the United States of America. Canada is among the leading economies in the World. It operates with an English legal system.

This research paper provides an explanation about the history of Canada’s economic development between 1990 and 2000. The paper discusses the nature of Canada’s economy during this period and forces that were directing its developments. It explores economic theories and models to explain the rationale for the different economic indicators that inform the Canadian economy.

The paper presents the economic growth facts through figures, charts and graphs. It provides essential facts and overall economic conditions of Canada. In addition, the paper discusses the sources of the economic growth data and the formula the country uses for making calculations of its various economic indicators like the GDP.

The paper relates the history of Canada’s economic development between the years 1990 and 2000 to the different economic models and their application in particular contexts. The paper can be adopted by relevant economic agencies for further investigation. This aspect can help in creating new knowledge and ideas on what various nations can do to improve their economies.

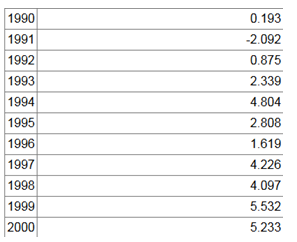

Canada’s economic data between the years 1990-2000

Canada’s nominal Gross Domestic Product stands at approximately 1.75 trillion US dollars. According to the IMF, Canada’s measure of the per capita income is about $51,147. The economic indexes of Canada conform to various scales. The Economic Freedom Score Index of Canada stands at 79.4. This aspect makes it the 6th freest nation in the world. It is the freest economy in Northern America.

Canada recorded stable economic growth throughout the post-war period until the end of the 1970s. The country realized high income per capita output and economic productivity. The rates of unemployment in Canada were relatively low in comparison with major nations like Japan and the United States of America in the 70s.

However, the commencement of the oil crisis in the mid-1970s brought about a period of high inflation rates and global stagnation in economic growth. In addition, the Deep World Recession of 1980-81 also presented economic challenges to Canada.

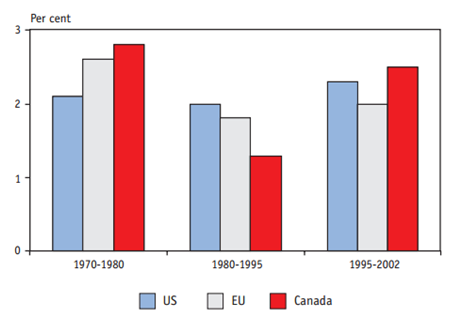

The realization of the economic success of Canada improved between the years 1990 and 2000. The economic growth of Canada during this period surpassed that of the United States and the European Union.

Source: Organization of Economic Cooperation and Development (OECD) The period between 1990 and 2000 experienced a rise in the material standard of living of Canada to the level of particular countries like Switzerland, Denmark and the Netherlands.

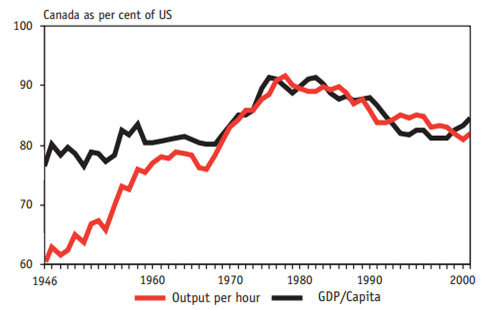

The output per capita and productivity of the nation were also unstable, rising and falling at times during the same period. Canada’s Output per Capita and Productivity features below

In the period between 1990 and 2000, a combination of credible control of inflation and fiscal policies led to the elimination of the risk premium in Canada interest rates relative to those of the United States. This aspect led to an improvement in the climate of investment.

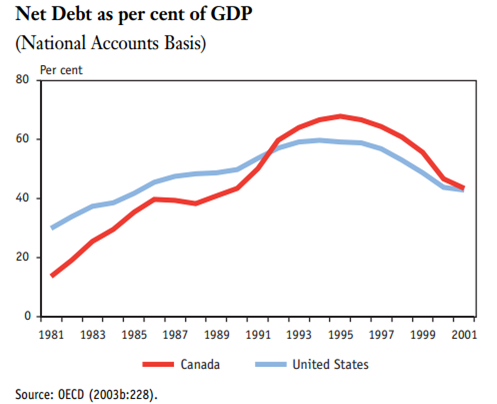

The Canadian government spent a huge sum of money in 1985, leading to a period of economic and political challenges. Canada experienced an accumulation of budget shortages. For instance, the province of Saskatchewan was almost running bankrupt. Around the mid-1990s, there were severe budget cuts in various provinces.

The government also reduced expenditure on different projects by eliminating fund transfers to the provinces at the federal level institutes. Canada’s annual deficit fell below 2% of GDP in 1997.

The supporters of this move argued that the government could have decreased the cost of debt before it became uncontrollable. In contrast, critics felt that the Canadian government was risking the prospects of high quality of education and healthcare through cutting expenditure.

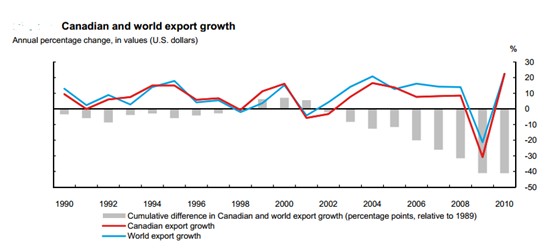

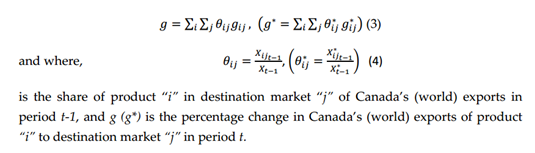

As a result of the decline of Canada’s global market share of goods’ exports, the continuous market share analysis framework led to the decomposition of Canada’s global market share into competitiveness and structural effects over the 1990‐2000 period.

It led to an increase in Canada’s firms’ competitiveness. These challenges led to the persistent strength of the Canadian dollar. It also led to a decrease in productivity of the country’s economy in relation to its main trade competitors.

The economic situation of Canada was not favorable in the early 1994. The economy was facing severe challenges like persistent inflation. The Consumer Price Index also rose during the period. Most Canadians sought protection from the implications of inflation through indexed wage contracts and ventures in the housing and real estate sectors.

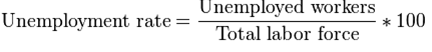

In addition, there were high unemployment rates in this period and low internal spending. The Canadian economy experienced an average GDP growth rate of about 3%. The rate of unemployment was about 12% in 1992.

However, there was a decline of this rate to about 8% in 1999. The Canadian economy was flourishing again after interventions of monetary policies by the government. Normal recovery of the economy began in the late months of 1991. The implications of innovation and technological transformation led to a decrease in communication costs.

In addition, markets became susceptible to international competition. These factors were the major driving forces of economic growth in Canada.

Sources of data

Various sources of economic growth data in Canada provide insight into the economic status of Canada. Different institutions make documents on their statistics, facts, and reports to help them analyze economic growth and development in various sectors.

The sources of Canada’s economic growth include the Bank of Canada, International Monetary Fund and the Canadian Foundation for Economic Education and the Canadian Association for Business Economics among other institutions.

The Financial Department of Canada provides relevant data on Canada’s historical economic growth. It provides reports on financial status of the country, sustainable development policies, fiscal policies and budget information.

The Bank of Canada is also an essential stakeholder in the provision of statistics relating to economic growth. It is the main bank of the country and provides relevant information relating to financial planning, economic growth and statistics for interpretation and adoption of necessary measures. It also provides information relating to the Toronto Stock Exchange and other essential financial data.

The International Monetary Fund and Canada facilitate economic equity and cooperation of member states. The two encourage exchange rate stability and provide resources to enhance the balance in economic growth and poverty reduction in poor countries of the world. They also provide essential data regarding economic growth over the years to the poor economies.

The Canadian Foundation for Economic Education promotes economic growth of Canadians. It provides relevant education essential in economics. In addition, the institution maintains an essential database for economic growth. It works in collaboration with relevant government agencies and departments.

The Conference Board of Canada is also essential in providing crucial economic growth data about Canada. The Canadian Association of Business Economics is a certified body of professionals who are active in the field of business economics. It is a national association with local subdivisions. Local and national procedures include luncheons, studios and seminars. Therefore, it collates essential data about Canada’s economic growth over the years.

The Fraser Institute also provides useful data on Canada’s economic growth. The Fraser Institute distributes peer-reviewed studies into fundamental economic and public policy matters including fiscal policy, government expenditure, health care, education performance and trade.

Calculation of economic growth data

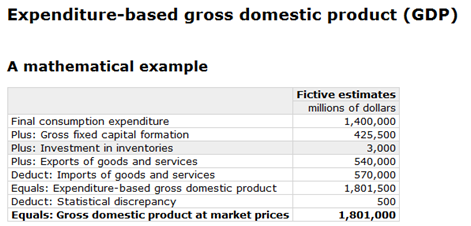

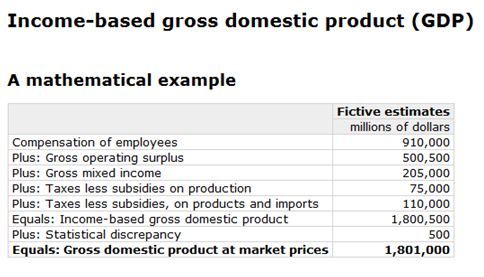

The GDP is the primary measure used for decision making in Canada on matters of economic nature. The calculation of this measure is either through the income or expenditure method or value-added technique.

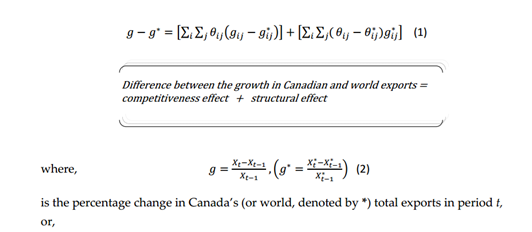

Constant Market Share Analysis

This analysis refers to Canada’s deviation in terms of the country’s and the world’s export growth. Formula

Unemployment Formula

Source: Canada Statistics Economic theories

Different theories that explain the economic growth of Canada between 1900 and 2000 provide an interpretive dimension on the Canadian economy. Economic theories refer to different ideas or systems that illustrate how economies work in the real world. The concepts are valid modulations of truth that explain the functioning of economic phenomena in the world.

Certain economic terminologies may be difficult to understand. Scholars resort to the application of theories to explain economic situations. Economic theories illustrate the functioning of simple, abstract representations of the real world in an efficient way. Therefore, the economic growth of Canada during the period between 1900 and 2000 can be derived in theoretical terms in order to justify various economic occurrences.

The theories include the Classical, Keynesian, Neo-Classical, Marxian and Stages. The models constitute the dependency, surplus labor and export-led. The classical theory postulates that increasing production requires the presence of larger amounts of a variable input like labor and a fixed input like land. However, this concept means that the principle of diminishing return can also apply.

The principle states that an increase in the total output can decrease the total outputs available for further production in the long-run. This fact may result in the decrease of the average (per worker) output in linkage with the numbers of workers employed. The principle may be used to justify a fall in the average output in the long-run until it reaches a subsistence level.

The classical theory was relevant to the Canadian economic growth between 1990 and 2000. During this period, Canada brought land, skilled labor and other factors of production together to spur its economic growth. However, exploitation led to decrease of this factor. The application of the law of diminishing returns ultimately led to the stagnation of the economy towards the eve of the 21st Century.

The variables of the theory include a fixed supply of land, law of diminishing returns and the variable of labor and capital. According to the theory, the interaction of these variables can increase production. The production can continue up to a set level beyond which the law of diminishing returns starts to apply. This situation featured in Canada between 1990 and 2000.

The second theory is the Keynesian model. This economic theory emphasizes the importance of rates of real capital investment, saving and the connection between the increase of capital stock and output. The Keynesian model influences development policies.

It encourages governments to align themselves to strategies that promote their variables. It promotes their economic stability and accountability. The variables of the theory include rising income, saving, investment, capital accumulation and aggregate demand. These parameters affect the future status of the economic growth and could have been behind Canada’s prosperity during the 90s.

The third theory is the Marxian analysis. It is a modern capitalist model that explains that economies develop through a process-driven social struggle. The theory advances that social transformation in the society is fundamental in economic growth. It explains that social transformation improves the internal organization of an economy hence introducing a new social order that is free from conflict, classes and scarcity (Yunker, 39).

The theory was applicable to Canada’s economic growth in the period between 1990 and 2000. Canada’s economic growth was as a result of the social re-organization after the post-war period and the recession of 1988. The economy during that period created a new social order with a favorable environment for economic prosperity.

A number of the variables of the Marxian model include labor, class-struggle, surplus-value, immoderation of the proletariat and exploitation (Wenz, 28). These variables bring about a social transformation in the society, which subsequently promotes a new social order. The social order improves the conditions for economic development leading to prosperity and growth. This aspect improved in Canada between 1990 and 2000.

The surplus labor models explain that an increase in the supply of skilled human resource and application of modern technology can be useful in spurring economic growth. These factors emerged in Canada during the 90s as they were the driving forces for its economic growth.

The export-led theory explains that the increase in a number of exports in relation to the imports improves a country’s income. This aspect subsequently promotes the nation’s economic growth through foreign exchange. Canada had plenty of natural resources like oil and gas that were essential in spurring economic growth.

The analysis of Canada’s economic growth between 1990 and 2000 using economic theories reveals that Canada’s economy can be linked to a multiplicity of factors. The models divide the economic growth into three segments. The segments are labor, capital and total factor of productivity. They show a close correlation between the postulations of the theories and the nature of economic growth (Sullivan et al, 34).

What happened to the Canadian economy?

Canada’s economic growth went through a significant transformation during the 1990s. Different factors can explain this phenomenon. It is evident that most Canadians attributed the transformation to the mid-decade. Canadians were living within their limits, paying taxes and relying more on entrepreneurs than bureaucrats.

Another factor is the Bank of Canada’s success in the war against inflation. This war led to the culmination of financial recession on the eve of the 1990s. Credit accrued from the significant liberation of trade as a result of the implementation of the United States, Canada, and the North America free trade agreements (FTAs).

Ventures into human and physical capital, success in the financial market, domestic economic competition and the flexibility of labor markets were also significant driving forces in the economic transformation of Canada between 1990 and 2000.

Canadians developed a sense of entrepreneurship during this period. Canada was applying more human capital during this period than any other time. Efficient workplace training and learning to increase the productivity of human capital improved in the Canadian society.

Canada was improving its research and development capacity during this period. This aspect led to an improvement in innovation and production of new products. Research and innovation led to a significant improvement in the economic sector in Canada. For instance, the use of information communication technology was a significant contribution to the economic growth of Canada (Landsburg, 27).

Trade exposure was also an essential factor in the transformation of Canada’s economy during this period. The increase in Canada’s exposure to trade was significant in improving its productivity and economic growth. It led to a gain in Canada’s comparative advantage over other nations.

Canada gained from exploitations in the economies of scale, specialization and global markets. The increase in domestic competition and trade liberation were also driving forces behind Canada’s economic growth between 1990 and 2000 (Graf, 34).

The increase of the tax burden for Canadian citizens was also a defining factor in the country’s economic growth. The increase in the tax burden led to a subsequent increase in directional impacts on the Gross Domestic Product. Tax burdens led to an increase in the fund programs that reduced incentives and inefficient enterprises.

This factor led to the stagnation of economic growth during certain segments of the economy between the years 1990 and 2000. Certain taxes also led to the improvement of public infrastructure and enhancement of human capital. The improvement also led to the growth of the economic environment of Canada (Gliner et al., 23).

The impact of inflation is also a significant factor in the determination of Canada’s economic growth between the years 1990 and 2000. The rise in inflation in any country usually has a negative effect in investment and economic recovery. The reduction in the uncertainty from volatility of inflation has implications on the propensity of investments and economic growth.

In conclusion, the period between the years 1990 and 2000 noted significant changes in the economic growth of Canada. A number of theories and forces explain this growth. The prospects of economic growth of Canada in the future will include continued availability of factors of production, trade, international competition and technological innovations.

The basis of Canada’s economic growth lies in reaping the benefits of international trade, natural resources, technology and innovation and maintaining the social, cultural and political environments. The prospects of the economic improvement of the Canadian economy lie in the country’s capacity to harness available economic opportunities.

The Canadian government should conduct a lot of research in order to improve its economy and boost trade activities with other world nations. It should allocate adequate finances to relevant research agencies to ensure the reliability of the research. The economy of Canada must always be closely monitored to safeguard it against practices that may destabilize it.

The government should also conduct trade with other middle-income economies, especially Asian countries like Singapore and Malaysia. The Canadian government should trade with particular African countries like South Africa to boost its economic potential.

Works Cited

Gliner et al. Research methods in applied settings, New York, USA: John Wiley & Sons, 2009. Print.

Graf, Mitche. Power Marketing, Selling, and Pricing: A business Guide for Wedding and Portrait Photographers, New York, USA: Amherst Media Inc., 2009. Print.

Landsburg, Steven. Fair Play: What Your Child Can Teach You About Economics, Values and the Meaning of Life, New York, USA: Free Press, 2010. Print.

Sullivan et al.Economics: Principles in Action, New Jersey, USA: Pearson Prentice Hall, 2011. Print.

Wenz, Peter. Take Back the Center: Progressive Taxation for a New Progressive Agenda, Massachusetts, USA: Massachusetts Institute of Technology, 2012. Print.

Yunker, James. Economic Justice: The Market Socialist Vision, United States of America: Rowman & Littlefield, Inc, 2010. Print.